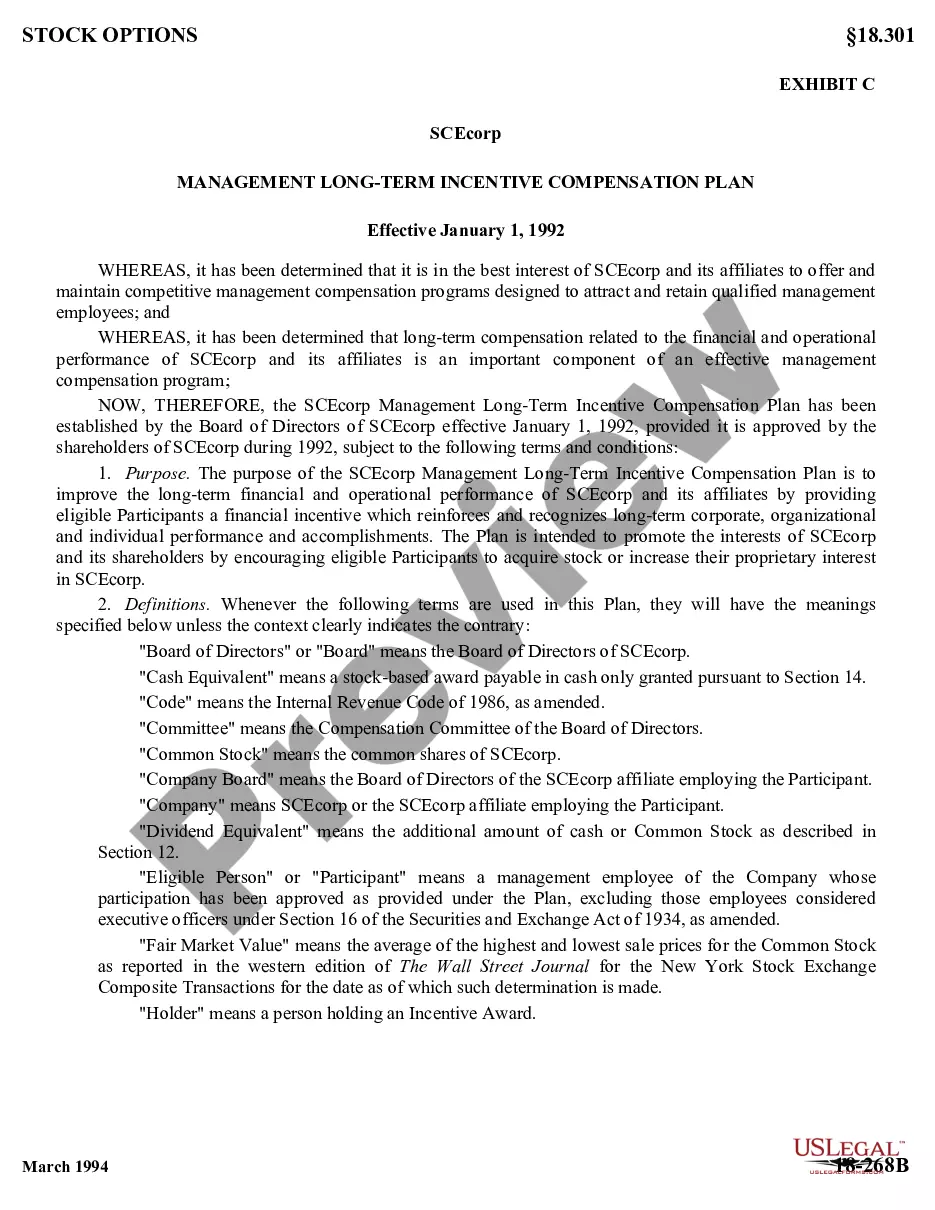

Louisiana Amendment to the Articles of Incorporation to Eliminate Par Value: A Detailed Description and Types The Louisiana Amendment to the articles of incorporation to eliminate par value is a legal process that allows a corporation in the state of Louisiana to modify its existing articles of incorporation to eliminate the par value of its shares. This amendment provides corporations with more flexibility in determining the value of their shares and can have various implications for shareholders and potential investors. To initiate the Louisiana Amendment to the articles of incorporation to eliminate par value, the corporation must follow specific procedures outlined by the Louisiana Secretary of State and comply with the relevant state laws and regulations. This process typically involves submitting a formal amendment document that clearly states the intention to eliminate par value and includes the necessary information such as the name of the corporation, its identification number, and the specific changes to be made. Upon approval of the amendment, the corporation's articles of incorporation will reflect the elimination of par value. This means that the corporation no longer assigns a minimum value to its shares and has more flexibility in determining their worth. The removal of the par value can benefit the corporation and its shareholders in several ways. One of the advantages of eliminating par value is that it simplifies the process of issuing shares. Previously, corporations had to assign a minimum value to their shares, which could pose challenges in scenarios where the market value of the shares exceeded the par value. Without a par value, the corporation can issue shares at a price deemed suitable by the board of directors, considering factors such as market conditions and the company's financial position. Moreover, the elimination of par value can potentially attract investors and facilitate capital raising. Investors may find it more appealing to acquire shares that do not have a contractual minimum value, as it allows for more flexibility in terms of future returns and potential appreciation. Without par value, corporations can adjust their share prices based on market demand and investors' willingness to invest, potentially increasing financing opportunities. It is important to note that there may be different types of Louisiana Amendments to the articles of incorporation to eliminate par value, depending on the specific changes a corporation wishes to make. For example, a corporation may choose to eliminate the par value for all existing and future shares or only for a specific class of shares. Additionally, corporations may include specific provisions or conditions related to the elimination of par value, such as shareholder voting requirements or limitations on further modifications. In conclusion, the Louisiana Amendment to the articles of incorporation to eliminate par value is a significant step for corporations looking to enhance flexibility in determining the worth of their shares. By removing the minimum value requirement, corporations can simplify share issuance procedures, attract potential investors, and potentially increase capital-raising opportunities. Implementing this amendment requires adherence to the relevant state laws and regulations, and different variations of the amendment may exist depending on the specific changes a corporation seeks to make.

Louisiana Amendment to the articles of incorporation to eliminate par value

Description

How to fill out Amendment To The Articles Of Incorporation To Eliminate Par Value?

Discovering the right lawful record web template can be quite a battle. Naturally, there are tons of layouts accessible on the Internet, but how do you get the lawful develop you will need? Take advantage of the US Legal Forms internet site. The support provides 1000s of layouts, including the Louisiana Amendment to the articles of incorporation to eliminate par value, that can be used for organization and personal requires. Each of the forms are examined by pros and meet up with state and federal demands.

Should you be previously registered, log in to your bank account and click the Down load option to have the Louisiana Amendment to the articles of incorporation to eliminate par value. Utilize your bank account to look with the lawful forms you possess purchased previously. Go to the My Forms tab of your own bank account and acquire one more duplicate in the record you will need.

Should you be a new user of US Legal Forms, allow me to share easy recommendations for you to follow:

- Initial, make certain you have selected the proper develop to your metropolis/area. You may check out the form while using Review option and look at the form outline to make certain this is basically the right one for you.

- In the event the develop does not meet up with your preferences, make use of the Seach industry to get the correct develop.

- When you are sure that the form is acceptable, select the Get now option to have the develop.

- Choose the prices prepare you need and enter the needed details. Design your bank account and buy the transaction using your PayPal bank account or bank card.

- Pick the document structure and acquire the lawful record web template to your device.

- Total, change and produce and signal the acquired Louisiana Amendment to the articles of incorporation to eliminate par value.

US Legal Forms will be the greatest local library of lawful forms that you can see different record layouts. Take advantage of the company to acquire professionally-manufactured files that follow condition demands.

Form popularity

FAQ

All courts shall be open, and every person shall have an adequate remedy by due process of law and justice, administered without denial, partiality, or unreasonable delay, for injury to him in his person, property, reputation, or other rights.

Article I, Section 13 of the Constitution of Louisiana, in ance with the state's obligation under the Sixth and Fourteenth Amendments of the United States Constitution, provides that at "each stage of the proceedings, every person is entitled to assistance of counsel of his choice, or appointed by the court if he ...

No person shall be denied the equal protection of the laws. No law shall discriminate against a person because of race or religious ideas, beliefs, or affiliations.

CONST 7 18. Section 18. (A) Assessments. Property subject to ad valorem taxation shall be listed on the assessment rolls at its assessed valuation, which, except as provided in Paragraphs (C) and (G), shall be a percentage of its fair market value.

No conveyance, lease, royalty agreement, or unitization agreement involving minerals or mineral rights owned by the state shall be confected without prior public notice or public bidding as shall be provided by law.

Articles of Incorporation refers to the highest governing document in a corporation. It is also known known as the corporate charter. The Articles of Incorporation generally include the purpose of the corporation, the type and number of shares, and the process of electing a board of directors.

Section 21. In addition to the homestead exemption provided for in Section 20 of this Article, the following property and no other shall be exempt from ad valorem taxation: (A) Public lands and other public property used for public purposes.

No sale of property for taxes shall be set aside for any cause, except on proof of payment of the taxes prior to the date of the sale, unless the proceeding to annul is instituted within six months after service of notice of sale. A notice of sale shall not be served until the final day for redemption has ended.