The Louisiana Incentive and Nonqualified Share Option Plan is a compensation program implemented by companies operating in the state of Louisiana. These plans serve as attractive tools to incentivize employees and provide them with the opportunity to purchase company shares at a later date, often at a discounted price. The main goal of the Louisiana Incentive and Nonqualified Share Option Plan is to retain, reward, and motivate talented employees by aligning their interests with the success and growth of the company. It allows eligible participants to acquire company shares, becoming shareholders and giving them the potential to profit from any future increase in the company's stock price. There are typically two types of share option plans that fall under the Louisiana Incentive and Nonqualified Share Option Plan: 1. Incentive Share Option Plan: This type of plan provides employees with tax advantages as the gains realized upon exercising the option are taxed at a lower rate compared to nonqualified options. To qualify for the incentives, certain guidelines set by the state of Louisiana must be met, ensuring employees are granted shares in a fair and equitable manner. 2. Nonqualified Share Option Plan: Unlike the incentive plan, nonqualified options do not offer the same tax advantages to employees. However, these plans are usually more flexible and can be tailored to fit the specific needs of the company and its employees. Nonqualified options are often granted to a broader range of employees, including executives and directors, as their tax implications are not subject to the same restrictions as the incentive plans. Both types of plans are designed to align employee interests with the company's long-term success, fostering a sense of ownership and dedication. Employees are granted the right to purchase company shares, typically at a predetermined exercise price, which can be lower than the market price at the time of the grant. This creates an opportunity for employees to benefit from any future increase in the company's stock value. In conclusion, the Louisiana Incentive and Nonqualified Share Option Plan offers companies a powerful tool to attract, motivate, and retain talented employees. By providing employees with the opportunity to become shareholders, these plans align their interests with the company's success, driving performance and fostering a sense of ownership among the workforce. The two main types, the Incentive Share Option Plan and the Nonqualified Share Option Plan, cater to different employee groups and offer various taxation benefits, ensuring flexibility and customization based on the unique needs of each company.

Louisiana Incentive and Nonqualified Share Option Plan

Description

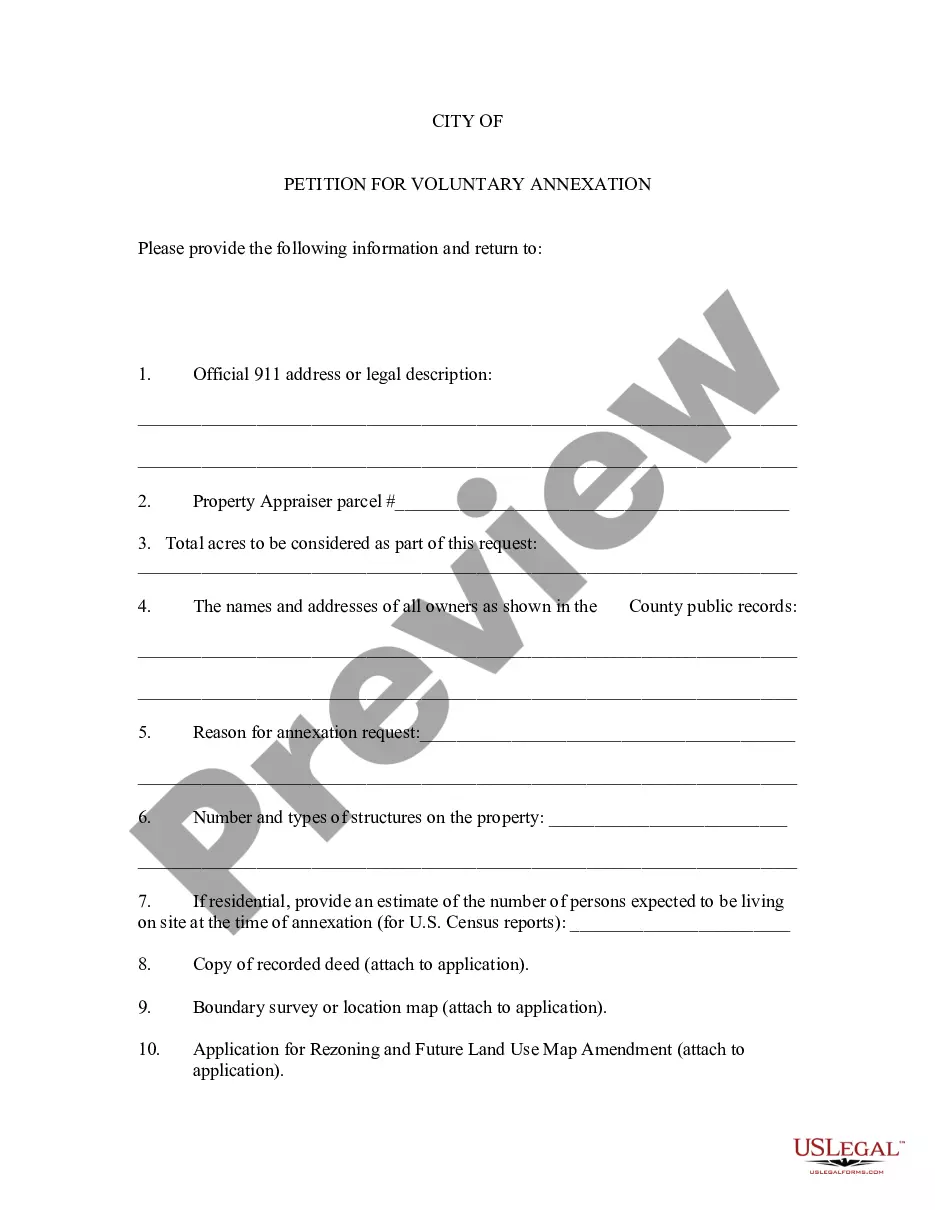

How to fill out Louisiana Incentive And Nonqualified Share Option Plan?

Finding the right legitimate record format can be quite a struggle. Needless to say, there are a variety of templates available online, but how can you discover the legitimate type you will need? Utilize the US Legal Forms web site. The service provides thousands of templates, such as the Louisiana Incentive and Nonqualified Share Option Plan, which can be used for business and private demands. Every one of the kinds are checked out by pros and satisfy state and federal requirements.

When you are presently registered, log in to your account and click the Acquire key to get the Louisiana Incentive and Nonqualified Share Option Plan. Use your account to search through the legitimate kinds you may have purchased previously. Go to the My Forms tab of your respective account and have one more backup in the record you will need.

When you are a whole new customer of US Legal Forms, listed below are basic instructions that you should comply with:

- Very first, be sure you have selected the proper type for the metropolis/county. You can look through the form utilizing the Review key and browse the form information to guarantee this is the best for you.

- When the type will not satisfy your preferences, use the Seach field to obtain the proper type.

- Once you are certain the form would work, click on the Buy now key to get the type.

- Choose the costs program you want and enter the essential details. Build your account and purchase your order utilizing your PayPal account or charge card.

- Choose the submit structure and acquire the legitimate record format to your device.

- Total, change and print out and signal the received Louisiana Incentive and Nonqualified Share Option Plan.

US Legal Forms will be the greatest collection of legitimate kinds in which you can find various record templates. Utilize the service to acquire appropriately-manufactured files that comply with express requirements.