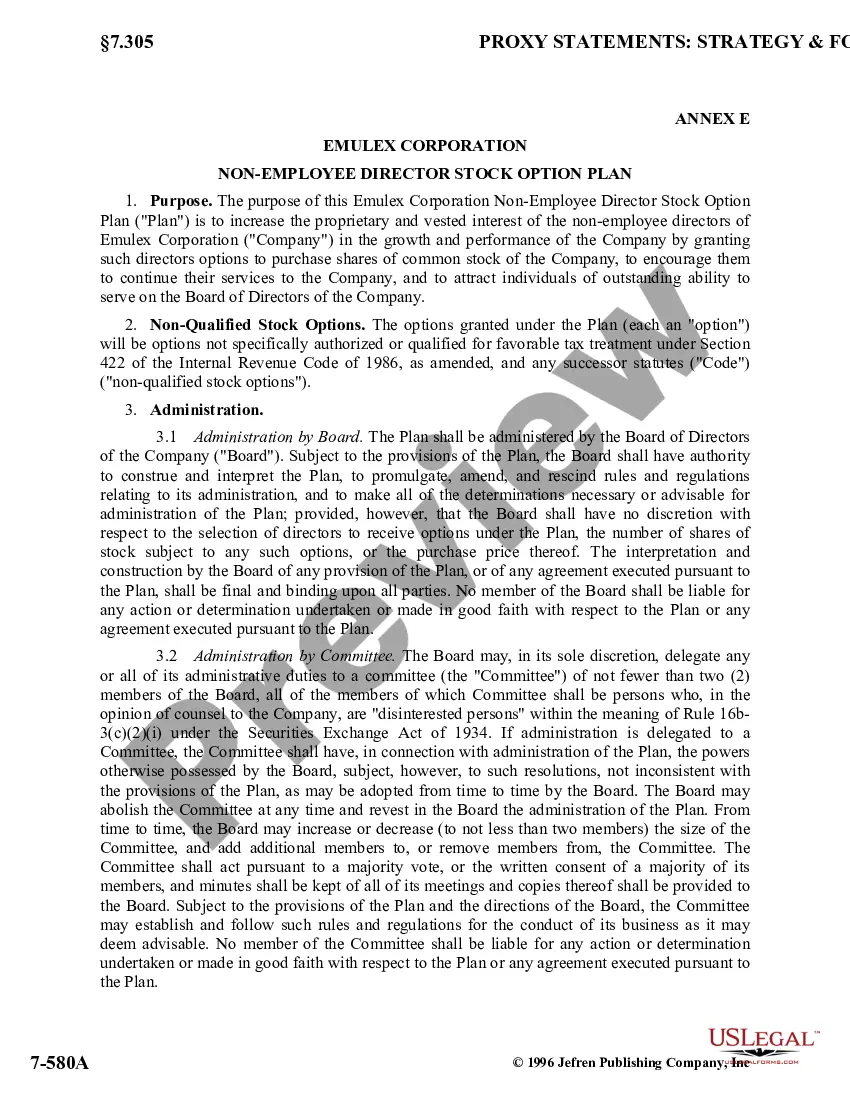

The Louisiana Employee Stock Option Plan (ESOP) of Emblem Corp. is an employee benefit program that provides eligible employees in Louisiana with the opportunity to purchase company shares at a predetermined price. This plan is designed to incentivize and retain talented employees, allowing them to own a stake in the company's success. The Louisiana ESOP allows employees to acquire stock options, which are financial instruments that grant the right to buy Emblem Corp. shares in the future. These stock options are typically provided as part of a compensation package or as a performance-based reward. By participating in the ESOP, employees have the potential to benefit from the growth and profitability of the company. Emblem Corp. may offer different types of stock options under the Louisiana ESOP, including: 1. Non-Qualified Stock Options (Nests): These options are offered to employees and do not qualify for special tax treatment. Nests provide flexibility in terms of exercise price and timing, allowing employees to purchase shares at a predetermined price within a specified period. 2. Incentive Stock Options (SOS): SOS are granted to employees with specific tax advantages. To qualify for favorable tax treatment, SOS must meet certain regulatory requirements, such as holding periods and limitations on the number of shares. 3. Restricted Stock Units (RSS): RSS are another type of stock-based compensation often offered by Emblem Corp. RSS represent a promise to deliver company shares at a future date, subject to certain vesting conditions. Once the RSS vest, employees can convert them into actual company shares. 4. Performance-Based Stock Options: Emblem Corp. may also offer performance-based stock options, which are tied to predefined performance goals or milestones. Employees must meet these goals to receive the stock options, providing an additional incentive to drive the company's success. Participating in the Louisiana ESOP can provide employees with several advantages. Firstly, it aligns their interests with the company's overall success, as they become shareholders. Secondly, it can act as a long-term retention tool, as employees may prefer to stay with the company to exercise their stock options. Finally, if the company's stock value appreciates over time, employees who exercised their stock options may realize significant financial gains. It's important for employees to carefully review the terms and conditions of the Louisiana ESOP, including exercise windows, vesting schedules, and tax implications. Seeking guidance from financial advisors or accounting professionals can ensure employees make informed decisions when it comes to exercising their stock options.

Louisiana Employee Stock Option Plan of Emulex Corp.

Description

How to fill out Louisiana Employee Stock Option Plan Of Emulex Corp.?

Choosing the right legitimate document template can be quite a battle. Of course, there are plenty of themes available on the Internet, but how will you obtain the legitimate kind you need? Take advantage of the US Legal Forms web site. The services delivers a huge number of themes, like the Louisiana Employee Stock Option Plan of Emulex Corp., that can be used for organization and private needs. All of the varieties are inspected by specialists and fulfill state and federal requirements.

Should you be currently signed up, log in in your accounts and click on the Acquire button to obtain the Louisiana Employee Stock Option Plan of Emulex Corp.. Make use of accounts to check from the legitimate varieties you possess purchased formerly. Proceed to the My Forms tab of your own accounts and have one more backup in the document you need.

Should you be a new end user of US Legal Forms, allow me to share simple instructions that you can comply with:

- Very first, be sure you have chosen the appropriate kind for your personal metropolis/region. You can check out the shape using the Preview button and read the shape description to guarantee it will be the best for you.

- If the kind will not fulfill your expectations, make use of the Seach discipline to get the appropriate kind.

- Once you are sure that the shape is suitable, click on the Acquire now button to obtain the kind.

- Pick the costs program you want and enter the essential info. Create your accounts and pay for your order making use of your PayPal accounts or Visa or Mastercard.

- Select the data file formatting and down load the legitimate document template in your product.

- Full, revise and print and indication the obtained Louisiana Employee Stock Option Plan of Emulex Corp..

US Legal Forms will be the biggest collection of legitimate varieties for which you can find various document themes. Take advantage of the service to down load appropriately-produced files that comply with express requirements.

Form popularity

FAQ

The difference between an ESOP and a stock option is that while ESOP allows owners of tightly held businesses to sell to an ESOP and reinvest the revenues tax-free, as long as the ESOP controls at least 30% of the business, as well as certain requirements, are met.

Procedure to Issue ESOP A draft needs to be prepared of the ESOP ing to the companies,2013 and Rules. A board meeting notice along with the draft resolution that is to be passed in the board meeting is to be made. The notice of the board meeting is to be sent seven days before the meeting to all the directors.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

ESOP installations typically close within four to six months, which is usually less time than it takes to sell a business to a third party but more time than it takes to get a bank loan. But the ESOP process needs to begin long before the installation.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. ESOPs are most commonly used to facilitate succession planning, allowing a company owner to sell his or her. shares and transition flexibly out of the business.

Ten Steps to a Successful ESOP Step 1Get sound adviceStep 4Understand ESOP benefits and potential pitfallsStep 5Compare your change of ownership alternativesStep 6Collect & provide information for feasibility studyStep 7Receive & review proposed ESOP structure & valuation5 more rows

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.

The Company loans the proceeds to the ESOP Trust who, in turn, purchases the stock from the selling shareholder. There are two loans that take place during the transaction process: (1) the outside bank loan between the sponsoring company and the bank and (2) the inside loan between the company and the ESOP Trust.