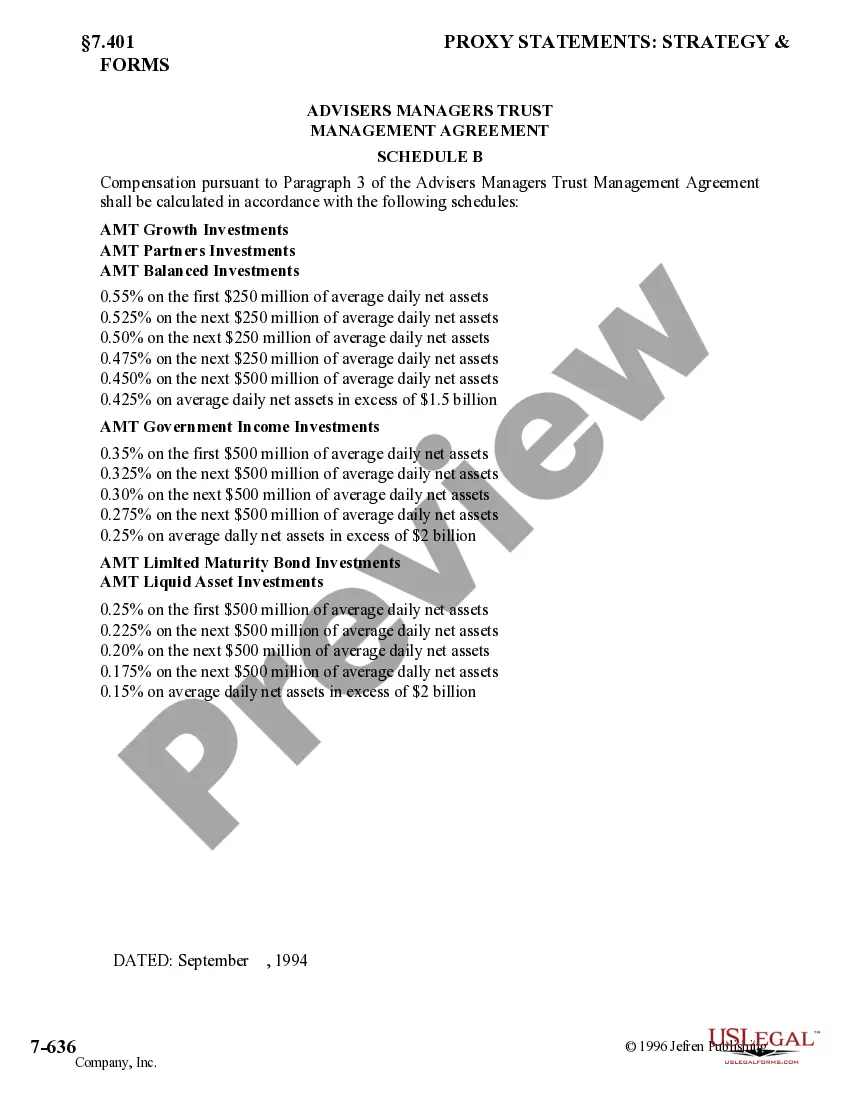

The Louisiana Management Agreement between Advisers Managers Trust and Berger and Berman Management Inc. is a legally binding contract that outlines the terms and conditions regarding the relationship between these two entities in managing investments and assets within the state of Louisiana. This agreement governs the responsibilities, obligations, and rights of both parties involved. Keywords: Louisiana, Management Agreement, Advisers Managers Trust, Berger and Berman Management Inc. 1. Purpose: The Louisiana Management Agreement between Advisers Managers Trust and Berger and Berman Management Inc. establishes a framework for collaboration and cooperation in managing investments and assets in the state of Louisiana. The primary objective of this agreement is to ensure efficient and effective investment management while safeguarding the interests of both parties and their clients. 2. Parties Involved: This agreement involves two main parties: Advisers Managers Trust (AMT) and Berger and Berman Management Inc. (BMI). AMT acts as the principal investment adviser, while BMI serves as the designated manager. Both entities are responsible for executing their roles in accordance with applicable laws, regulations, and industry best practices. 3. Scope of Agreement: The Louisiana Management Agreement covers various aspects of investment management, including portfolio management, risk assessment, decision-making, reporting, and compliance with relevant regulations. It outlines the specific assets, portfolios, or funds managed within the state of Louisiana and identifies the investment objectives and guidelines to be followed. 4. Responsibilities of AMT: As the principal investment adviser, AMT is responsible for providing advice and recommendations on investment strategies, asset allocation, and securities selection. They are expected to exercise prudent judgment and fulfill their fiduciary duty towards the clients' best interests. AMT must also ensure compliance with all applicable laws and regulations. 5. Responsibilities of BMI: BMI, as the designated manager, is responsible for executing the investment decisions made by AMT. They have the authority to buy, sell, and hold securities and assets on behalf of the clients. BMI must exercise due diligence, maintain accurate records, provide prompt reports to AMT, and act in accordance with the agreed-upon investment objectives. 6. Reporting and Communication: The Louisiana Management Agreement stipulates the reporting requirements and frequency of communication between the parties. AMT must receive regular reports from BMI, including portfolio performance, transactions, and compliance updates. Additionally, both parties should maintain open lines of communication to address any concerns, changes in investment strategy, or significant developments. 7. Termination and Amendments: The agreement outlines the conditions under which either party may terminate the agreement and the applicable notice period. It also specifies the process for making amendments or modifications to the agreement, including obtaining written consent from all parties involved. Different Types of Louisiana Management Agreement between Advisers Managers Trust and Berger and Berman Management Inc. (if applicable): — Limited Liability Company (LLC) Management Agreement: This type of agreement is specifically tailored for managing investments within a limited liability company structure, providing additional provisions unique to LCS, such as profit distribution and governance. — Pension Fund Management Agreement: This agreement focuses on the management of pension fund investments, catering to the specific needs and requirements of pension plans and trustees. — Private Equity Management Agreement: For managing private equity investments, this agreement incorporates specific provisions related to equity ownership, deal structuring, and exit strategies. It is important to note that the specific types of Louisiana Management Agreement between Advisers Managers Trust and Berger and Berman Management Inc. may vary based on the nature of the investments being managed and any additional legal or regulatory considerations.

Louisiana Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.

Description

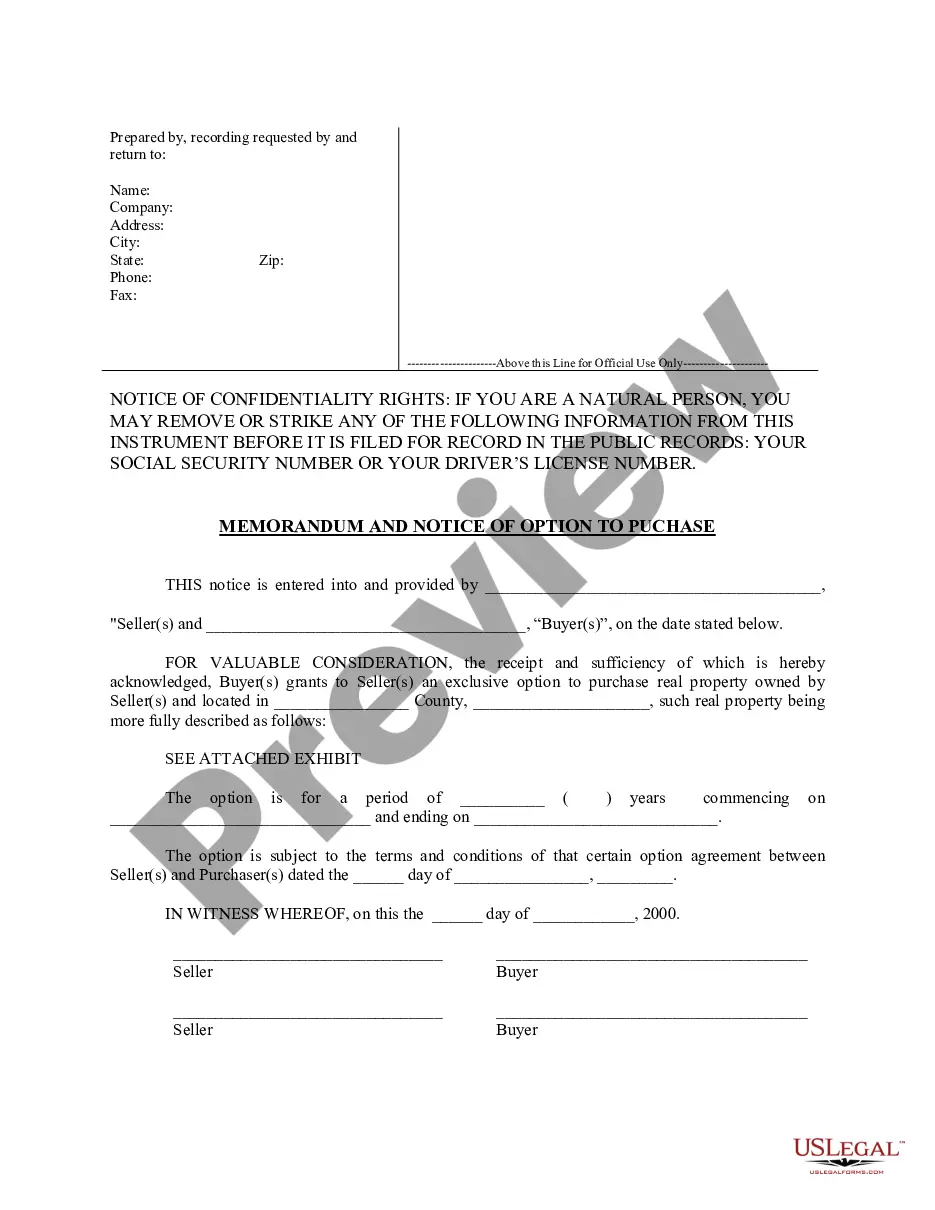

How to fill out Louisiana Management Agreement Between Advisers Managers Trust And Neuberger And Berman Management Inc.?

It is possible to devote hours on the Internet trying to find the legal document format that fits the state and federal needs you require. US Legal Forms gives a large number of legal forms that happen to be reviewed by experts. It is simple to obtain or print out the Louisiana Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc. from our services.

If you have a US Legal Forms bank account, it is possible to log in and click the Acquire option. Next, it is possible to complete, change, print out, or indication the Louisiana Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc.. Each legal document format you purchase is yours eternally. To acquire yet another copy of the purchased develop, proceed to the My Forms tab and click the corresponding option.

If you work with the US Legal Forms web site the very first time, adhere to the straightforward recommendations listed below:

- Initially, make sure that you have selected the best document format to the region/metropolis of your choosing. See the develop information to make sure you have selected the appropriate develop. If available, make use of the Review option to search throughout the document format also.

- In order to find yet another variation from the develop, make use of the Search field to obtain the format that fits your needs and needs.

- After you have discovered the format you need, just click Get now to continue.

- Choose the rates program you need, type in your qualifications, and sign up for a free account on US Legal Forms.

- Full the transaction. You can use your credit card or PayPal bank account to purchase the legal develop.

- Choose the format from the document and obtain it to your device.

- Make changes to your document if necessary. It is possible to complete, change and indication and print out Louisiana Management Agreement between Advisers Managers Trust and Neuberger and Berman Management Inc..

Acquire and print out a large number of document web templates using the US Legal Forms site, that offers the greatest selection of legal forms. Use professional and condition-particular web templates to tackle your business or person requirements.

Form popularity

FAQ

Management Contracting is a form of construction procurement where the Client for a project employs different Subcontractors directly. The Client has a Main Contractor in place that is responsible for managing the Subcontractors, but is not in contract with them in the same way as with traditional procurement.

The common standard term for a management contract is typically between one and five years, but this can vary depending on the specific needs and goals of the parties involved.

The management contract should outline the scope of the work expected, the timeline for its completion, the compensation the manager will receive for their services, and when they expect to be paid.

Some of the most useful types of contracts in project management are fixed priced contracts, cost reimbursement contracts and time and materials contracts. Other types of contracts are implied contracts, unit price contracts, unilateral contracts, express contracts and bilateral contracts.

A management agreement is a legal contract through which a company enables another company to have control of another business's operations. Business owners often sign these written agreements directly with the management company.