Louisiana Plan of complete liquidation and dissolution

Description

How to fill out Plan Of Complete Liquidation And Dissolution?

Are you presently within a placement the place you require paperwork for both enterprise or individual uses just about every day? There are a variety of lawful papers themes available on the net, but getting versions you can rely is not simple. US Legal Forms gives a huge number of form themes, just like the Louisiana Plan of complete liquidation and dissolution, that happen to be composed to meet state and federal demands.

Should you be previously informed about US Legal Forms web site and also have a merchant account, simply log in. Next, it is possible to download the Louisiana Plan of complete liquidation and dissolution template.

Should you not provide an account and want to start using US Legal Forms, follow these steps:

- Discover the form you need and make sure it is for that proper area/area.

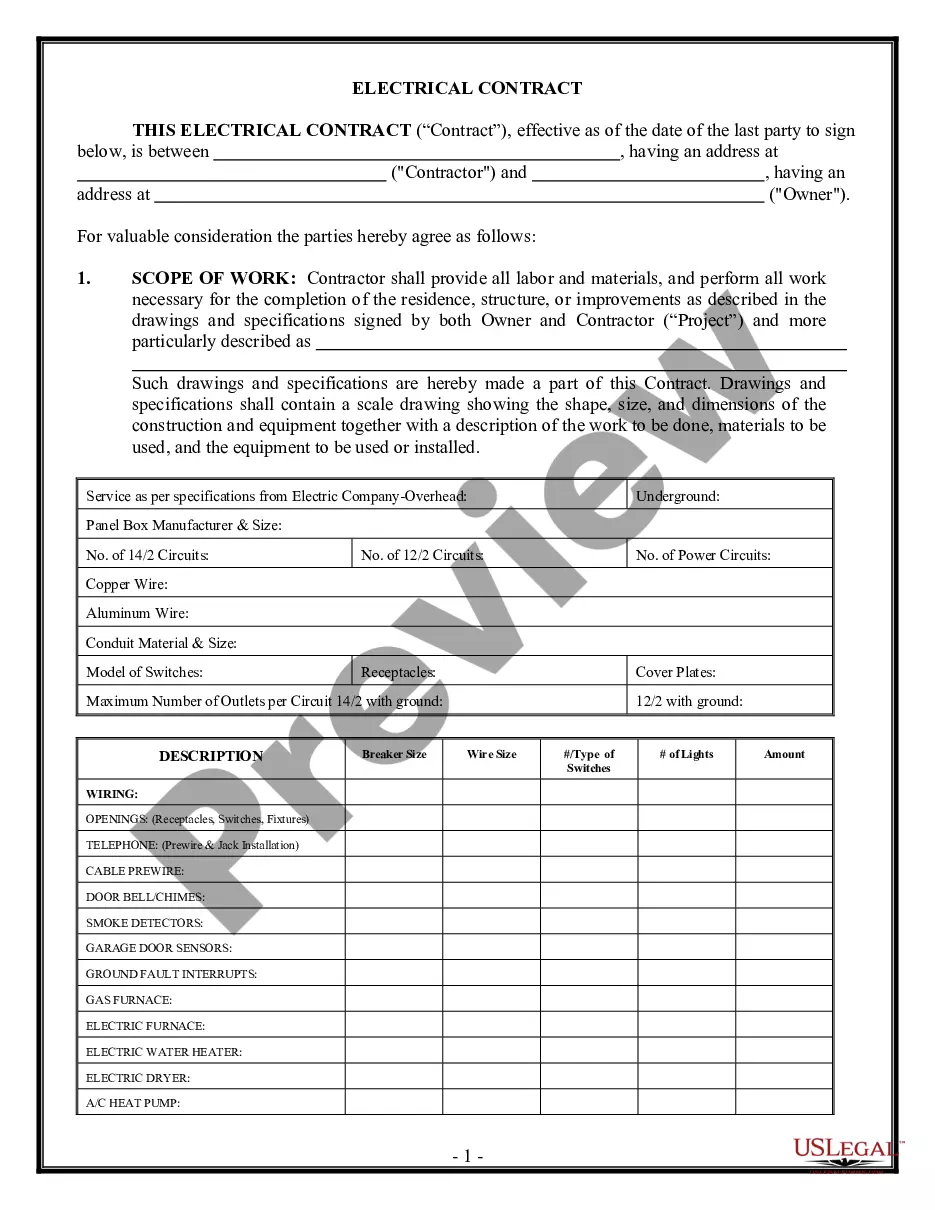

- Use the Review switch to check the form.

- Read the outline to ensure that you have selected the right form.

- In the event the form is not what you are looking for, make use of the Search discipline to get the form that fits your needs and demands.

- Once you obtain the proper form, just click Acquire now.

- Choose the costs plan you need, fill in the necessary information and facts to generate your account, and purchase your order utilizing your PayPal or credit card.

- Select a handy paper formatting and download your copy.

Locate all of the papers themes you possess bought in the My Forms food list. You can get a additional copy of Louisiana Plan of complete liquidation and dissolution anytime, if necessary. Just select the necessary form to download or print out the papers template.

Use US Legal Forms, one of the most extensive selection of lawful forms, to conserve some time and prevent mistakes. The assistance gives appropriately created lawful papers themes which can be used for a range of uses. Make a merchant account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

You must pay all of your debts before you can distribute company assets to the members when closing an LLC. The members are personally liable to the creditors of the company, so you must be sure the creditors are paid before taking the remaining assets.

To terminate with the Secretary of State, the LLC has to be active with good standing. There is no fee to file this certificate. No official tax clearance is required to dissolve your LLC. The filing of a dissolution for a Georgia LLC typically takes 7 to 10 business days.

To comply with corporation formalities, the board of directors should draft and approve the resolution to dissolve. Shareholders then vote on the director-approved resolution. Both actions should be documented and placed in the corporate record book.

You can get an LLC in Louisiana in 3-5 business days if you file online (or 2-3 weeks if you file by mail). If you need your Louisiana LLC faster, you can pay for expedited processing.

A corporation can choose to dissolve by two different methods: by filing a notarized affidavit of dissolution with the Louisiana Secretary of State, or by filing an application to dissolve, referred to as a long form dissolution.

To revive a Louisiana LLC, you'll need to file the Louisiana reinstatement application with the Louisiana Secretary of State. You'll also have to fix the issues that led to your Lousiana LLC's dissolution.

Most documents filed with the Louisiana Secretary of State are processed in approximately one week. You may expedite for an additional $30, which usually means approximately 24-hour processing to receive your Certificate of Dissolution.