Louisiana Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard

Description

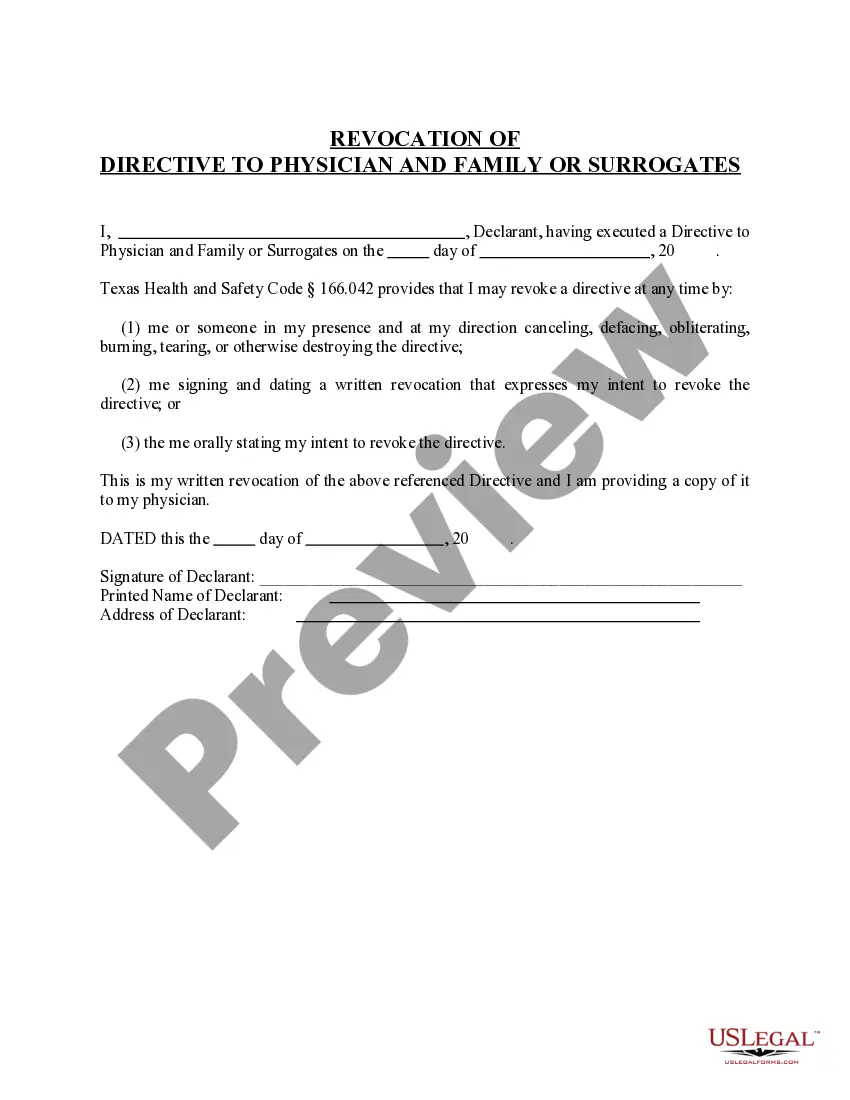

How to fill out Louisiana Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

Are you presently in a position in which you need papers for either enterprise or personal functions almost every working day? There are tons of legal file layouts available on the net, but finding ones you can trust is not simple. US Legal Forms gives 1000s of kind layouts, just like the Louisiana Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard, that are created to meet state and federal requirements.

In case you are already acquainted with US Legal Forms website and possess an account, simply log in. Following that, it is possible to obtain the Louisiana Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard template.

Should you not provide an accounts and want to start using US Legal Forms, follow these steps:

- Obtain the kind you require and make sure it is to the right town/state.

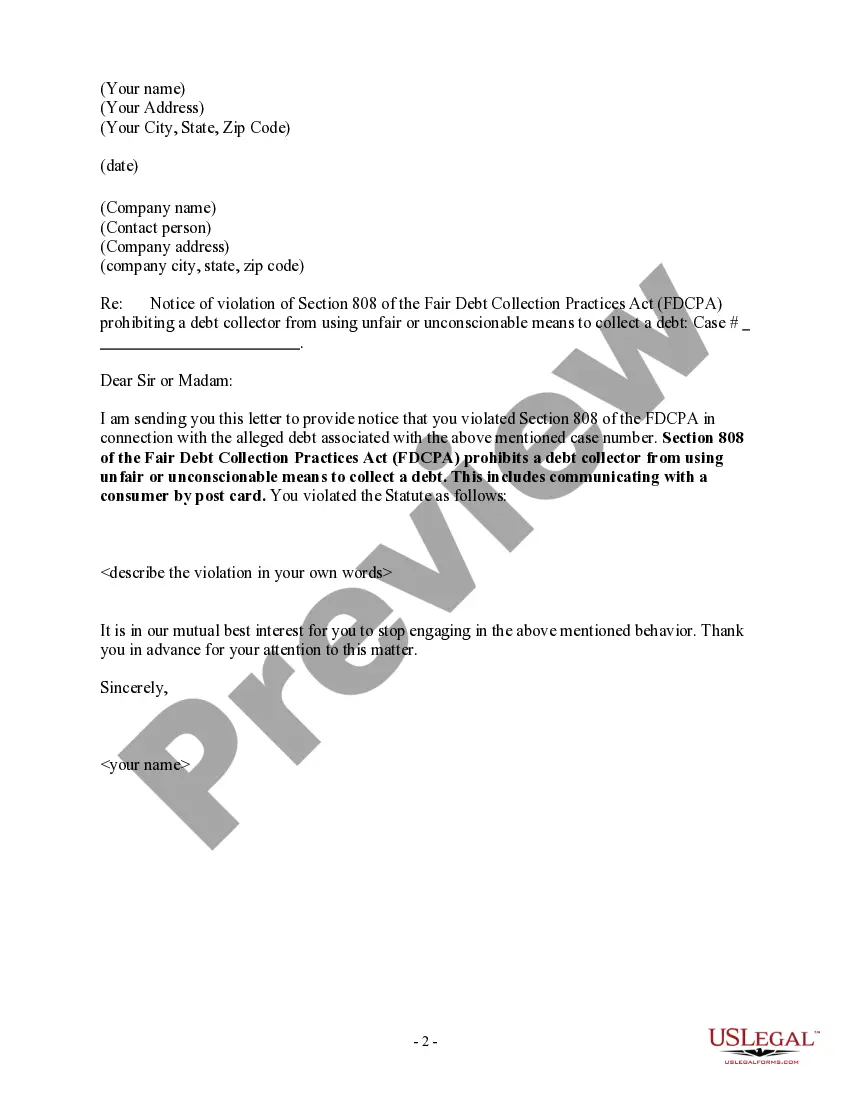

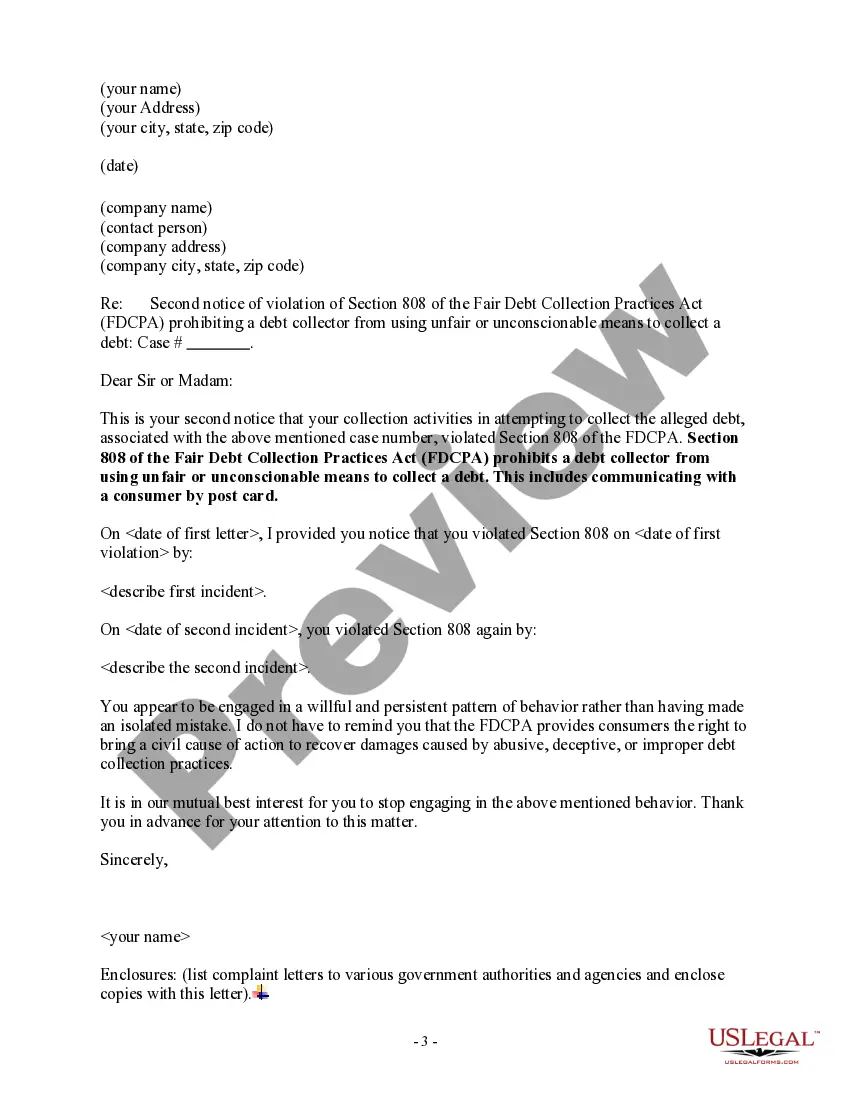

- Make use of the Preview switch to review the form.

- See the outline to actually have chosen the proper kind.

- If the kind is not what you`re trying to find, take advantage of the Search area to find the kind that meets your requirements and requirements.

- If you obtain the right kind, simply click Acquire now.

- Pick the pricing program you want, complete the specified details to make your account, and pay for your order using your PayPal or Visa or Mastercard.

- Decide on a convenient data file formatting and obtain your backup.

Get every one of the file layouts you have purchased in the My Forms menus. You can aquire a extra backup of Louisiana Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard anytime, if required. Just click on the needed kind to obtain or printing the file template.

Use US Legal Forms, one of the most considerable assortment of legal varieties, to save efforts and prevent faults. The service gives professionally created legal file layouts that can be used for a variety of functions. Make an account on US Legal Forms and start creating your daily life easier.

Form popularity

FAQ

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L. Kraninger, took effect Tuesday, Nov.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Although debt collectors can leave a message on your machine, they cannot necessarily do it legally. The FDCPA exists in order to protect your privacy and prohibits debt collectors from disclosing your information to third parties. Third parties include your family, friends, boss, or anyone other than your spouse.

If you continue to ignore communicating with the debt collector, they will likely file a collections lawsuit against you in court. If you are served with a lawsuit and ignore this court filing, the debt collection company will then be able to get a default judgment against you.

The law makes it illegal for debt collectors to harass debtors in other ways, including threats of bodily harm or arrest. They also cannot lie or use profane or obscene language. Additionally, debt collectors cannot threaten to sue a debtor unless they truly intend to take that debtor to court.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

You may ask a debt collector to contact you only by mail, or through your attorney, or set other limitations. Make sure you send your request in writing, send it by certified mail with a return receipt, and keep a copy of the letter and receipt.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L.