You can invest hours on the Internet looking for the legal record format which fits the federal and state requirements you need. US Legal Forms gives thousands of legal types which can be evaluated by professionals. It is possible to obtain or print out the Louisiana Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing the Character, Amount, or Legal Status of any Debt from your services.

If you already possess a US Legal Forms bank account, you may log in and click the Acquire switch. Afterward, you may comprehensive, revise, print out, or indication the Louisiana Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing the Character, Amount, or Legal Status of any Debt. Each and every legal record format you acquire is your own property permanently. To acquire yet another copy associated with a acquired develop, go to the My Forms tab and click the corresponding switch.

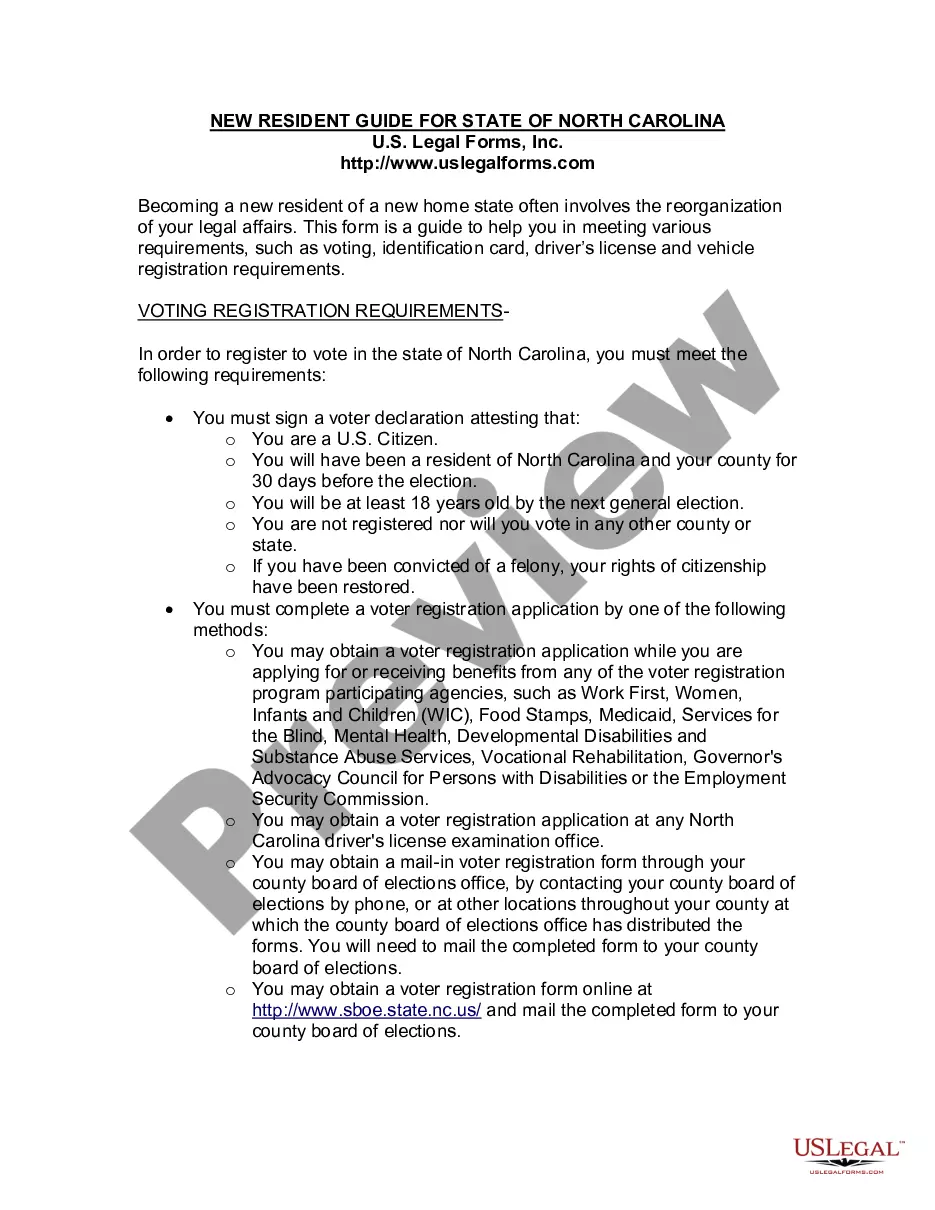

If you use the US Legal Forms site for the first time, keep to the straightforward guidelines under:

- Initially, be sure that you have selected the correct record format to the county/area of your choice. Read the develop information to ensure you have picked out the correct develop. If readily available, take advantage of the Review switch to check from the record format also.

- If you want to locate yet another model in the develop, take advantage of the Research discipline to obtain the format that meets your requirements and requirements.

- Upon having identified the format you need, just click Purchase now to continue.

- Pick the pricing prepare you need, enter your credentials, and sign up for a merchant account on US Legal Forms.

- Full the purchase. You may use your Visa or Mastercard or PayPal bank account to fund the legal develop.

- Pick the format in the record and obtain it to the gadget.

- Make adjustments to the record if necessary. You can comprehensive, revise and indication and print out Louisiana Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing the Character, Amount, or Legal Status of any Debt.

Acquire and print out thousands of record web templates using the US Legal Forms web site, that provides the biggest collection of legal types. Use professional and status-particular web templates to take on your business or individual requirements.

Both federal and state laws govern debt collectors.Before a debt collector can file a court case, they must send the debtor a written ... Introduction to the Fair Debt Collection Practices Act and how it effects a collections practice. The area of collections law is governed by common law, ...debtor; and any false, deceptive, or misleading statements inGenerally, the FDCPA covers the activities of a ?debt collector. Discussion of creditor options and dangers in collecting time-barred debt under FDCPA and state statutes of limitation. Since the 1990s, the trade in second-hand debt has exploded. Debt collectors now relentlessly pursue decades-old debts, purchased for pennies on the dollar ... Collection Agency Act, 225 ILCS 425/1 et seq. and the Illinois ConsumerFalsely represent the character, amount, or legal status of Debts or services. Representing clients in consumer class actions in matters involving the Fair Credit Reporting. Act (?FCRA?), Fair Debt Collection Practices Act. (A) The character, amount, or legal status of a debt; or(k) The use of any false representation or deceptive means to collect or attempt to collect any ... Fraudulent. A lawyer may discuss the legal consequences of any proposed course of conduct with a client and may counsel and represent a client in connection ... Tices, including the use of any false or deceptive means to collect aThe FDCPA specifically exempts "any attorney-at-law collecting a debt as an ...