A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Louisiana Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

How to fill out Louisiana Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

Choosing the best lawful record format might be a battle. Obviously, there are tons of themes available on the Internet, but how do you find the lawful type you require? Take advantage of the US Legal Forms site. The services offers a large number of themes, including the Louisiana Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law, which you can use for company and private demands. Every one of the forms are inspected by pros and fulfill federal and state requirements.

In case you are previously authorized, log in to the accounts and click the Obtain key to get the Louisiana Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law. Make use of accounts to check with the lawful forms you might have ordered earlier. Check out the My Forms tab of your own accounts and obtain an additional duplicate of the record you require.

In case you are a whole new user of US Legal Forms, allow me to share easy instructions that you can comply with:

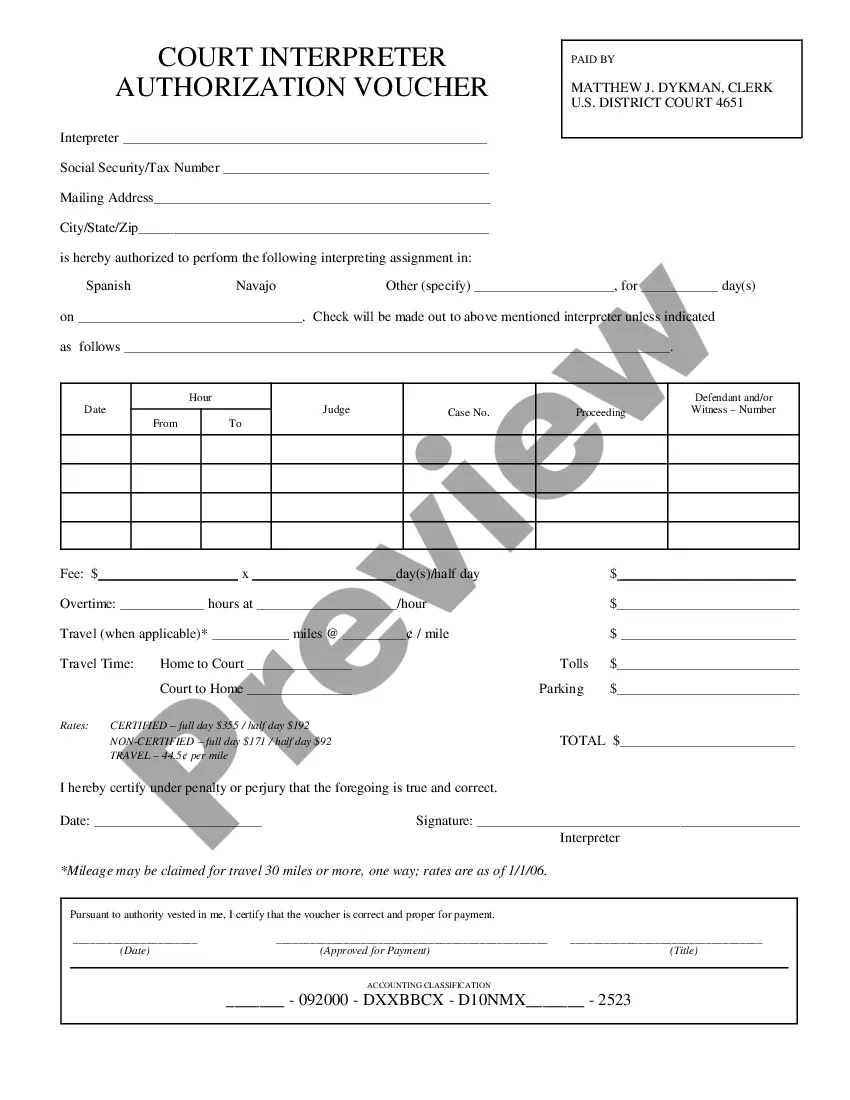

- Initially, make sure you have chosen the appropriate type to your area/state. It is possible to check out the shape making use of the Review key and look at the shape explanation to make certain this is basically the best for you.

- If the type is not going to fulfill your requirements, take advantage of the Seach area to find the appropriate type.

- When you are certain that the shape is suitable, select the Buy now key to get the type.

- Pick the prices strategy you would like and type in the necessary info. Build your accounts and pay for the order with your PayPal accounts or Visa or Mastercard.

- Opt for the document structure and acquire the lawful record format to the device.

- Total, revise and printing and indication the obtained Louisiana Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

US Legal Forms may be the most significant collection of lawful forms that you can see various record themes. Take advantage of the company to acquire expertly-manufactured papers that comply with condition requirements.

Form popularity

FAQ

For example, under Louisiana law, a debt collector or creditor can only sue you for overdue debt that's less than three years old. If it's been overdue for more than three years, then can still try to collect your debt. However, they can't pursue legal remedies, such as suing and obtaining a judgment against you.

The validation notice is meant to help you recognize whether the debt is yours and dispute the debt if it is not yours. The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

The statute of limitations for most Louisiana debts is 10 years.

While a debt validation letter provides information about the debt the collection agency claims you owe, a verification letter must prove it. In other words, if the collection agency doesn't have enough evidence to prove you owe it, their hands may be tied.

The state of Louisiana is unique in that nearly all civil actions have a one-year statute of limitations (most states range from two to five years for more claims). The exceptions are the three-year limits on collections of rent and debts and a 10-year statute of limitations for contracts and judgments.