Louisiana Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

How to fill out Louisiana Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

Are you currently in a position in which you require papers for either company or personal reasons almost every day time? There are a variety of lawful document web templates available on the net, but getting types you can depend on is not straightforward. US Legal Forms gives thousands of develop web templates, much like the Louisiana Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself, that are published to satisfy state and federal needs.

If you are currently knowledgeable about US Legal Forms website and also have your account, simply log in. Next, it is possible to download the Louisiana Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself format.

Unless you come with an account and wish to begin to use US Legal Forms, abide by these steps:

- Find the develop you want and make sure it is for that proper area/region.

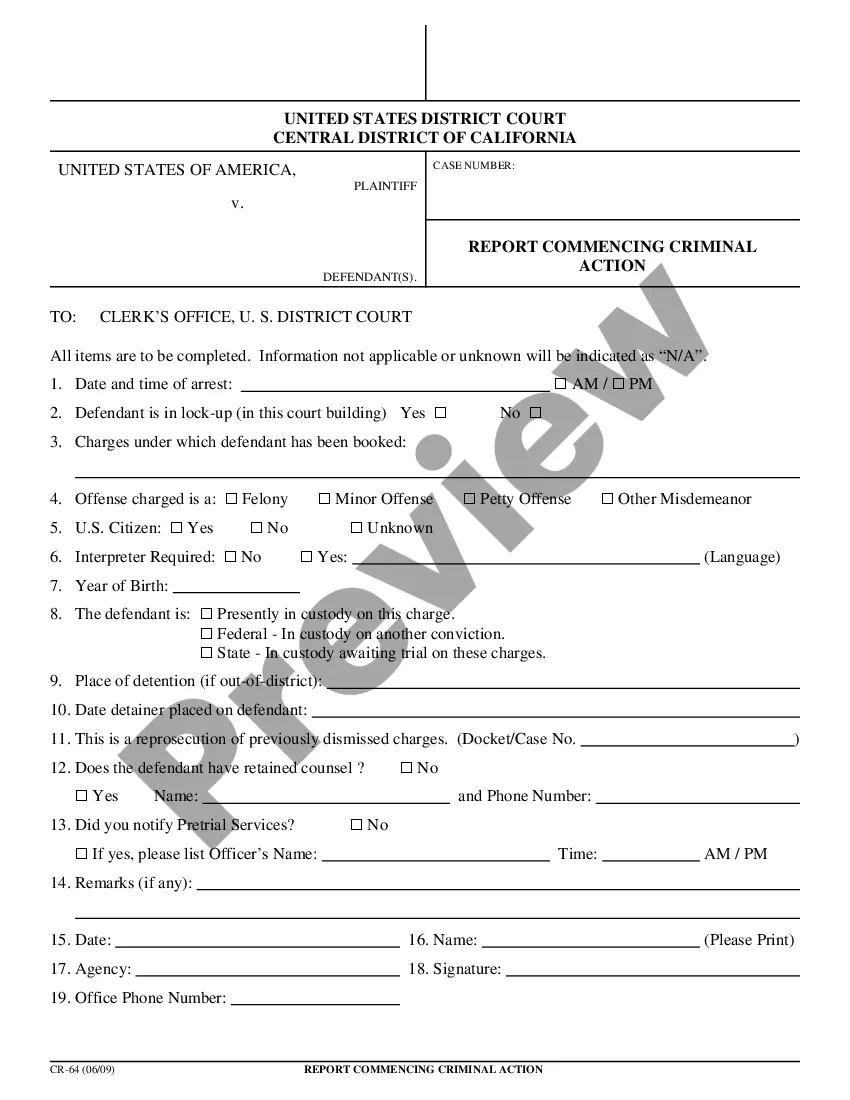

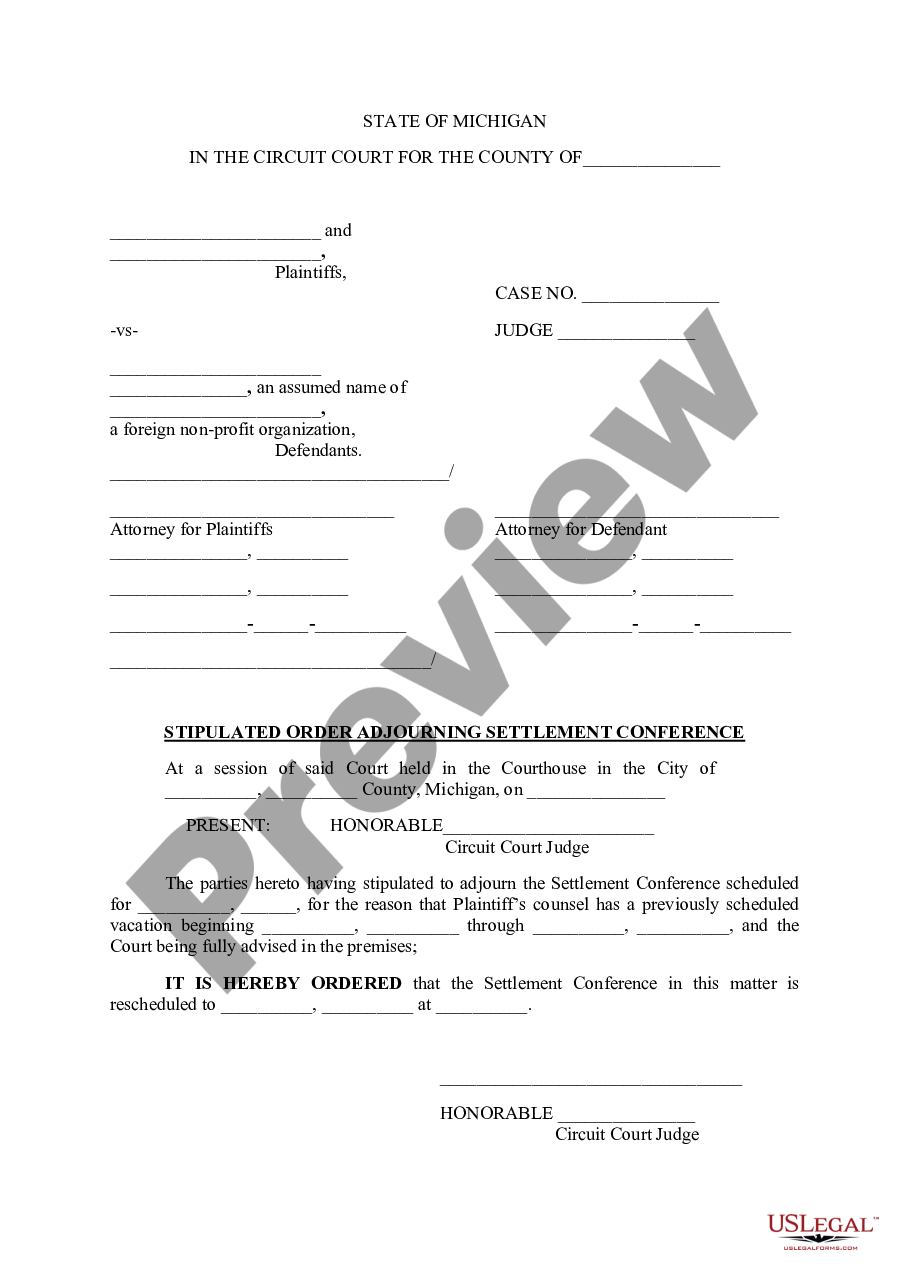

- Utilize the Review key to examine the form.

- Read the explanation to actually have chosen the right develop.

- When the develop is not what you`re looking for, take advantage of the Look for field to get the develop that meets your needs and needs.

- Whenever you get the proper develop, click on Purchase now.

- Select the costs program you would like, fill in the desired information to generate your bank account, and pay for an order making use of your PayPal or bank card.

- Select a practical document file format and download your duplicate.

Locate all the document web templates you possess purchased in the My Forms food selection. You can get a extra duplicate of Louisiana Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself at any time, if possible. Just click the needed develop to download or printing the document format.

Use US Legal Forms, by far the most comprehensive selection of lawful kinds, to save time and prevent mistakes. The assistance gives expertly produced lawful document web templates which can be used for a range of reasons. Produce your account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Debts that may not be covered are those that are not incurred voluntarily, such as income taxes, parking and speeding tickets, and domestic support obligations like child support and alimony, or spousal support.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16-Sept-2020

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

As a rule of thumb, a creditor relinquishes its right to file suit and collect a debt that it is owed after this time period has expired. In Louisiana, the statute of limitations for contracts whether oral or written is 10 years.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

The FDCPA broadly prohibits a debt collector from using 'any false, deceptive, or misleading representation or means in connection with the collection of any debt. ' 15 U.S.C. § 1692e. The statute enumerates several examples of such practices, 15 U.S.C.