Louisiana Loan Modification Agreement - Multistate

Description

How to fill out Loan Modification Agreement - Multistate?

Are you currently within a position that you will need paperwork for both business or specific purposes almost every time? There are a lot of legal record themes accessible on the Internet, but finding types you can rely on isn`t easy. US Legal Forms offers 1000s of type themes, like the Louisiana Loan Modification Agreement - Multistate, which can be composed in order to meet state and federal specifications.

When you are previously familiar with US Legal Forms site and possess your account, simply log in. Next, you are able to down load the Louisiana Loan Modification Agreement - Multistate web template.

Should you not come with an bank account and need to begin using US Legal Forms, abide by these steps:

- Get the type you require and ensure it is to the correct area/state.

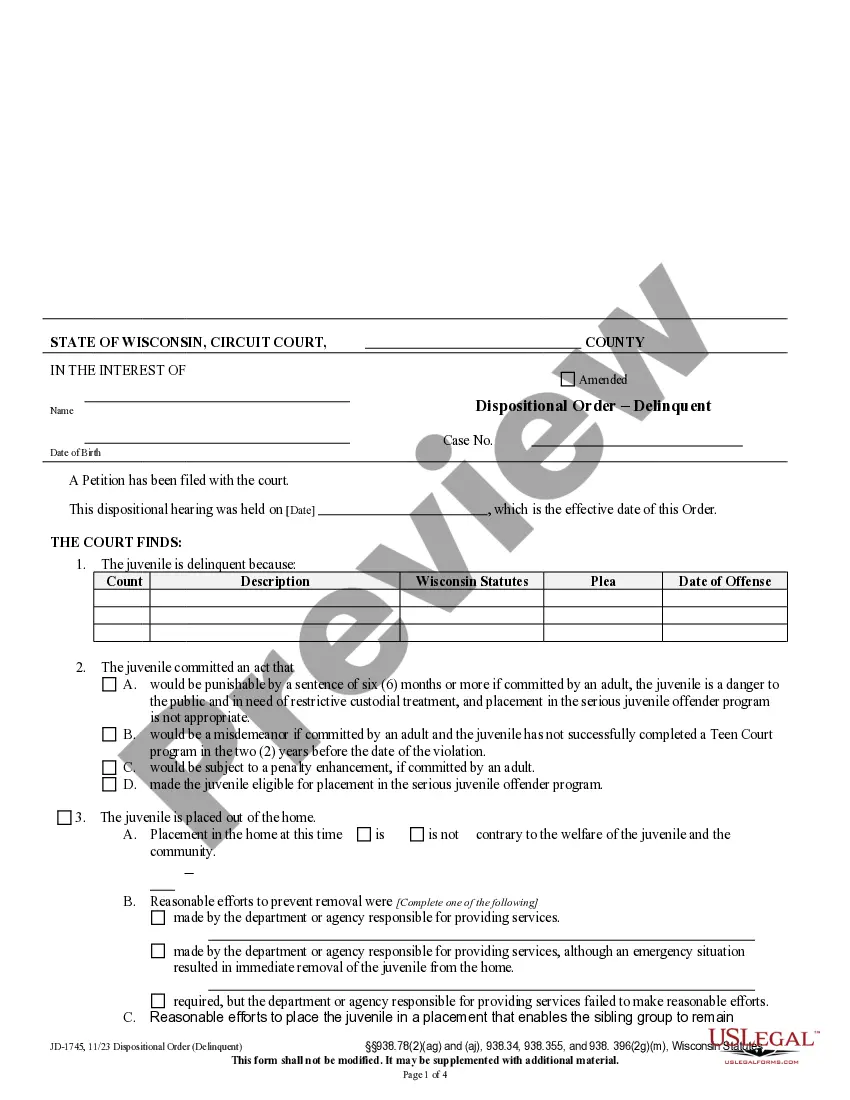

- Utilize the Review switch to examine the form.

- Read the information to actually have chosen the right type.

- When the type isn`t what you are searching for, take advantage of the Look for discipline to find the type that suits you and specifications.

- If you obtain the correct type, simply click Buy now.

- Choose the prices prepare you want, fill out the necessary information to produce your bank account, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Choose a hassle-free file format and down load your version.

Locate every one of the record themes you possess purchased in the My Forms food list. You can obtain a extra version of Louisiana Loan Modification Agreement - Multistate any time, if possible. Just click on the needed type to down load or print the record web template.

Use US Legal Forms, probably the most extensive variety of legal kinds, to save efforts and steer clear of faults. The support offers professionally created legal record themes which you can use for an array of purposes. Create your account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

Generally, you can qualify for a loan modification if you've had an income loss or reduction that caused you to miss your mortgage payments. Or you have to be in imminent danger of falling behind on payments. But you must have sufficient income to make modified payments.

Modifications may involve extending the number of years you have to repay the loan, reducing your interest rate, and/or forbearing or reducing your principal balance.

Conventional loan modification ? For conventional mortgages owned by Fannie or Freddie, you can pursue the Flex Modification program, which can reduce monthly payments by up to 20 percent, extend the loan term up to 40 years and potentially lower the interest rate.

How to Get a Mortgage Modification Gather Initial Paperwork. ... Get in Touch With Your Loan Servicer. ... Complete and Submit a Formal Application. ... Complete Trial Payments. ... Await a Final Mortgage Modification Decision.

Often, a homeowner won't get approved for a loan modification unless there is evidence of one or several missed payments. Those missed payments hurt your credit score. A home loan modification does the same.

Loan Modification: 10 Simple Tips for Success Explain your hardship. Why are you behind? ... Document your income. ... Outline your expenses. ... Gather your Federal Tax Returns. ... Provide proof of insurance. ... Be prepared to interview with a counselor. ... Stay connected. ... Deliver documents as requested.

During meetings with your lender, you can negotiate the interest rate, the term of the loan, late fees, and any good faith payment you are prepared to make. Remember that you may not be able to negotiate the principal or any amount that you still owe from before you applied for the loan modification.

Because these represent mutual agreements, they should be signed by both the borrowers and the plaintiff (who may or may not be the lender or servicer but may be an assignee of the mortgage). There is no doubt that foreclosing plaintiffs understand that they need to sign those mortgage modification agreements.