The Louisiana Pooling and Servicing Agreement (PSA) of Ameriquest Mortgage Securities, Inc. is a legal contract that outlines the terms and conditions for the pooling and servicing of mortgage loans within the state of Louisiana. This agreement is specific to the operations and regulations governing the mortgage-backed securities (MBS) issued by Ameriquest Mortgage Securities, Inc. in Louisiana. As a PSA, it serves as a comprehensive document that details the rights and responsibilities of various parties involved in the securitization process. The key parties include the issuer (Ameriquest Mortgage Securities, Inc.), the trustee, the service, and the investors. The Louisiana Pooling and Servicing Agreement constitutes a critical component of the MBS market, as it defines the rules for loan pooling, cash flow distribution, servicing, reporting, and various other aspects. It ensures compliance with regulatory standards, protects the interests of investors, and establishes mechanisms for resolving potential disputes that may arise during the life of the securities. Some different types of Louisiana Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. may include variations based on the specific mortgage loan products they govern. For instance, there could be distinct pooling and servicing agreements for prime, subprime, or government-backed residential mortgage loans. The agreements may further differ based on the collateral types involved, such as home equity loans or adjustable-rate mortgages. These agreements also address the cash flow mechanisms, payment priorities, prepayment penalties, default provisions, and foreclosure procedures applicable to the mortgage loans pooled within Louisiana. They outline the reporting requirements to the Securities and Exchange Commission (SEC) and other concerned regulatory bodies, ensuring transparency and accountability in the securitization process. By tailoring specific Louisiana Pooling and Servicing Agreements, Ameriquest Mortgage Securities, Inc. can effectively manage the risks associated with mortgage-backed securities and meet the particular demands of investors within the state. These agreements fundamentally shape the functioning of the MBS market, offering legal frameworks that help bring stability and efficiency to the securitization process in Louisiana.

Louisiana Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.

Description

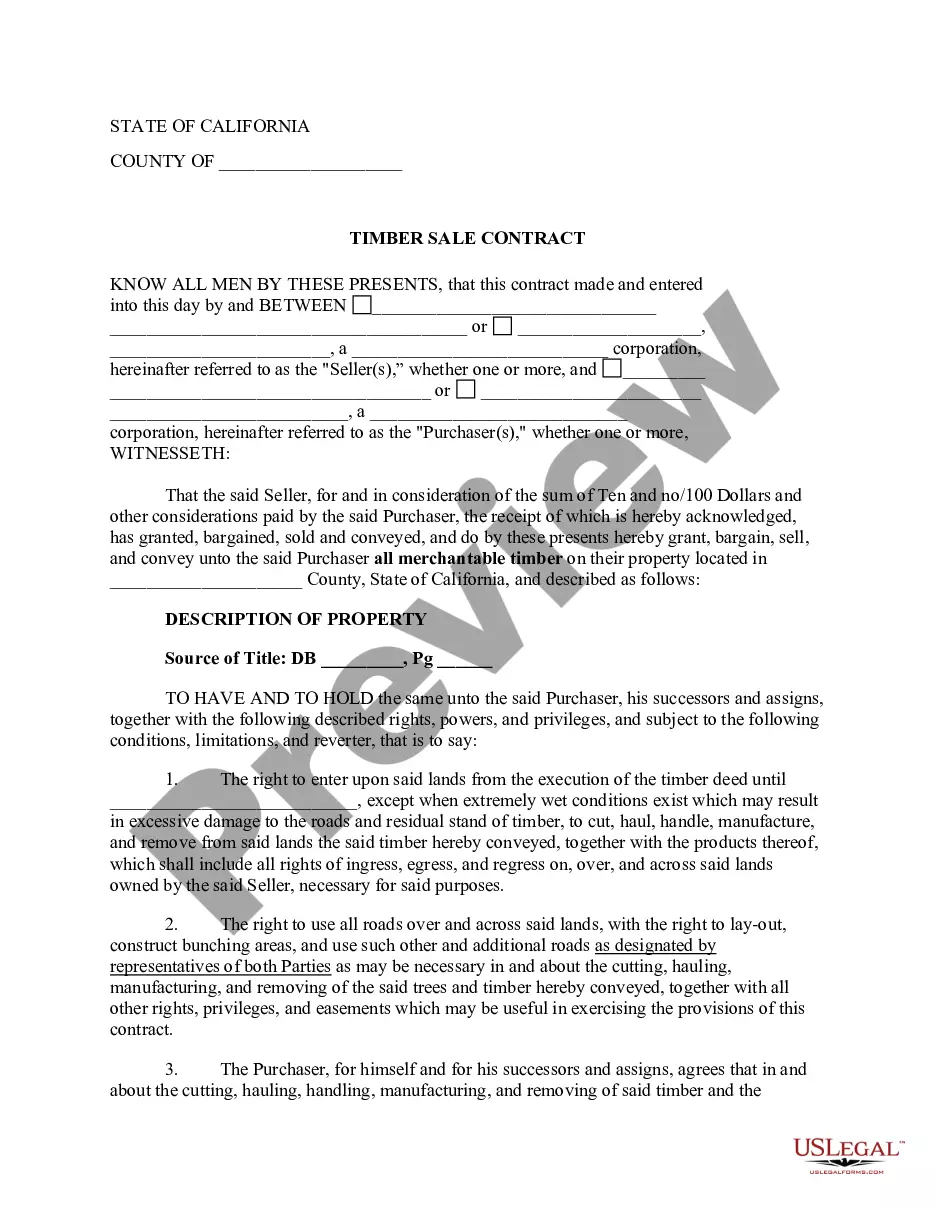

How to fill out Louisiana Pooling And Servicing Agreement Of Ameriquest Mortgage Securities, Inc.?

If you need to total, download, or print lawful papers web templates, use US Legal Forms, the largest selection of lawful kinds, that can be found on the Internet. Take advantage of the site`s simple and convenient search to discover the papers you want. A variety of web templates for organization and individual uses are sorted by types and states, or key phrases. Use US Legal Forms to discover the Louisiana Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. with a number of clicks.

In case you are previously a US Legal Forms customer, log in in your bank account and click on the Obtain button to get the Louisiana Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.. Also you can gain access to kinds you formerly saved within the My Forms tab of your own bank account.

Should you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Ensure you have selected the shape to the right city/country.

- Step 2. Make use of the Preview choice to look over the form`s information. Do not forget about to see the description.

- Step 3. In case you are not satisfied using the develop, use the Lookup area near the top of the monitor to locate other versions of the lawful develop format.

- Step 4. Once you have discovered the shape you want, click the Purchase now button. Select the pricing prepare you favor and add your qualifications to register to have an bank account.

- Step 5. Process the deal. You should use your bank card or PayPal bank account to accomplish the deal.

- Step 6. Pick the file format of the lawful develop and download it in your gadget.

- Step 7. Complete, revise and print or indicator the Louisiana Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc..

Every single lawful papers format you acquire is your own for a long time. You might have acces to every develop you saved within your acccount. Select the My Forms area and choose a develop to print or download again.

Be competitive and download, and print the Louisiana Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. with US Legal Forms. There are thousands of skilled and condition-specific kinds you can utilize for your personal organization or individual needs.