Louisiana Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation

Description

How to fill out Underwriting Agreement Between Advanta Equipment Receivable Series LLC And Advanta Bank Corporation?

Choosing the best legal document template can be quite a have a problem. Of course, there are a lot of web templates available online, but how would you find the legal kind you want? Take advantage of the US Legal Forms internet site. The service delivers 1000s of web templates, including the Louisiana Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation, which can be used for enterprise and private requires. Each of the kinds are examined by specialists and fulfill federal and state specifications.

Should you be already registered, log in in your bank account and click on the Download switch to find the Louisiana Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation. Utilize your bank account to check throughout the legal kinds you have bought in the past. Visit the My Forms tab of the bank account and get an additional backup of the document you want.

Should you be a fresh end user of US Legal Forms, allow me to share straightforward directions that you can stick to:

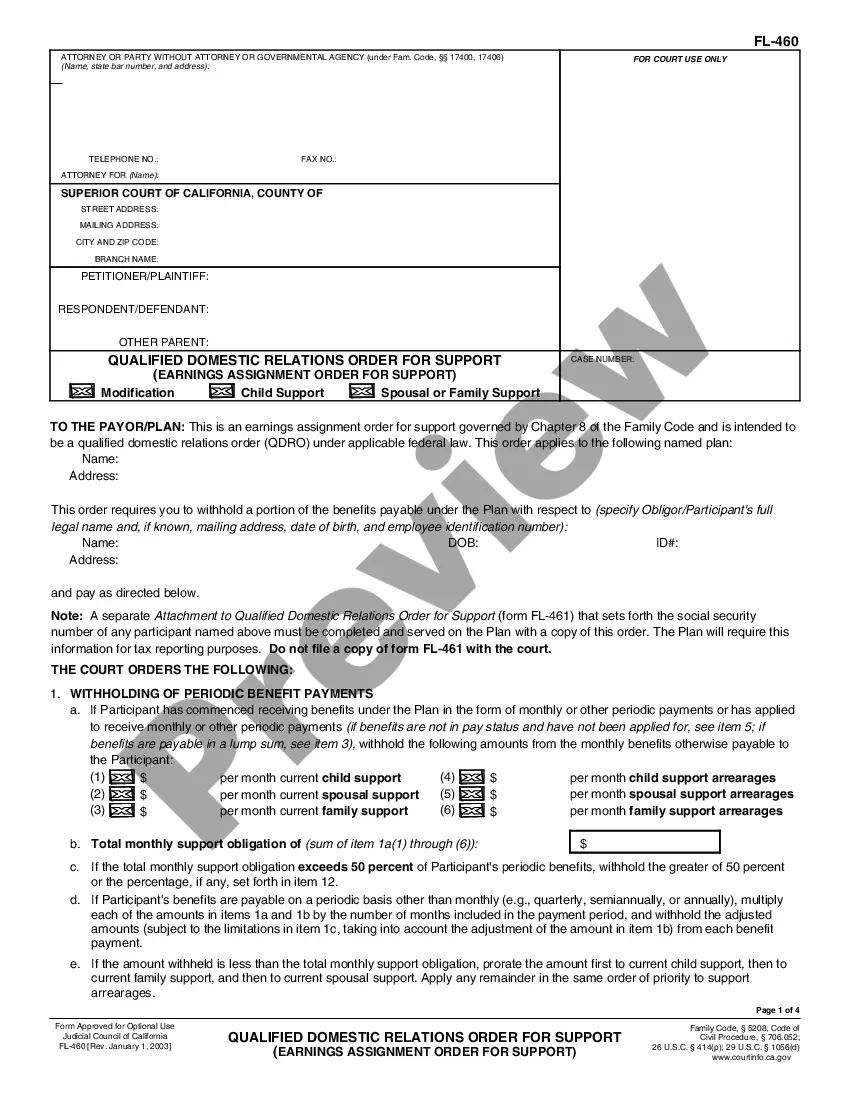

- First, make sure you have selected the appropriate kind to your metropolis/state. You can look over the form utilizing the Preview switch and study the form explanation to ensure it will be the right one for you.

- In the event the kind will not fulfill your preferences, use the Seach area to obtain the proper kind.

- When you are sure that the form would work, click the Acquire now switch to find the kind.

- Select the prices strategy you need and enter the required information. Make your bank account and pay for an order using your PayPal bank account or bank card.

- Select the data file formatting and down load the legal document template in your system.

- Comprehensive, revise and produce and indication the received Louisiana Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation.

US Legal Forms is the largest library of legal kinds that you will find various document web templates. Take advantage of the service to down load professionally-created files that stick to state specifications.