Louisiana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds

Description

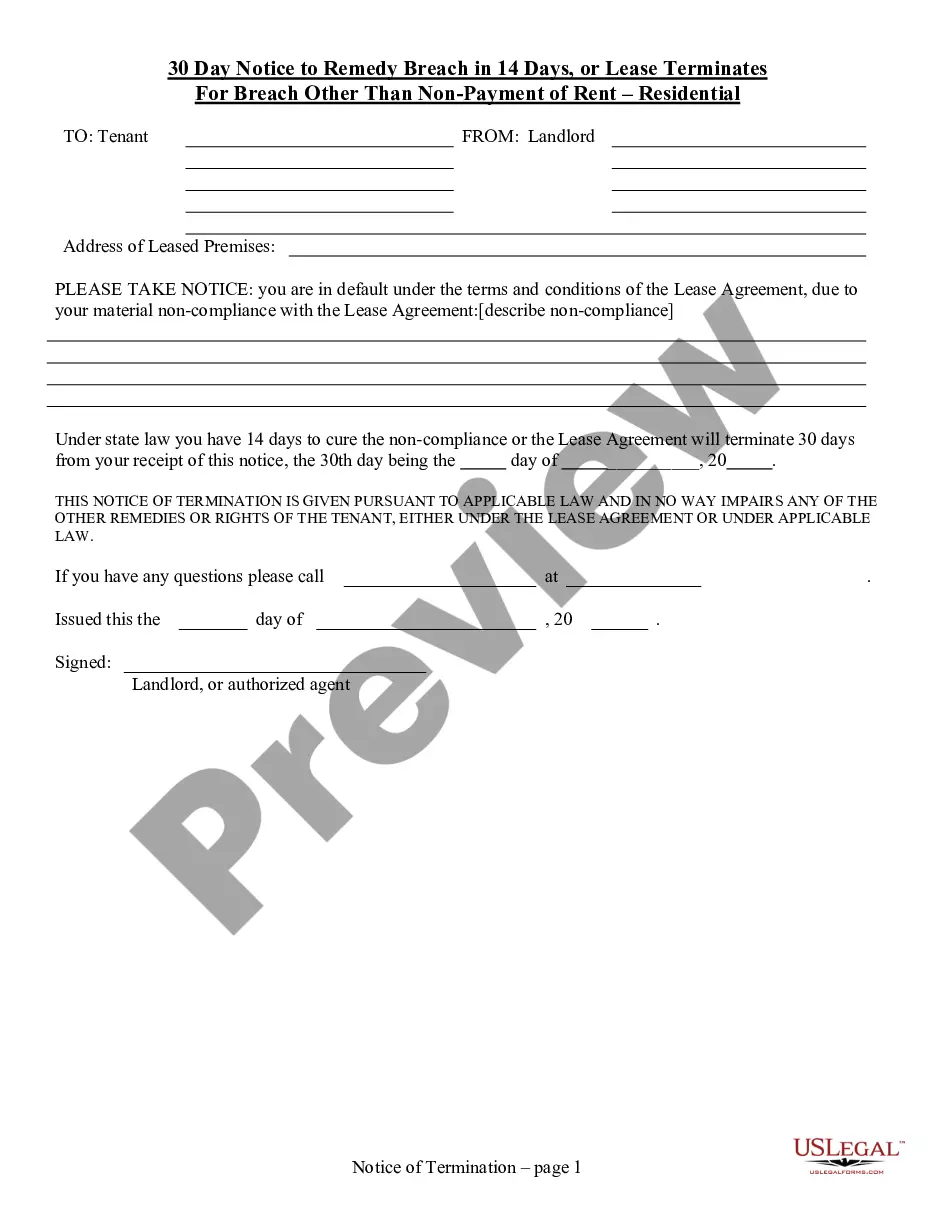

How to fill out Plan Of Reorganization Between Ingenuity Capital Trust And Firsthand Funds?

US Legal Forms - one of the greatest libraries of legal forms in America - provides a wide range of legal document templates it is possible to obtain or produce. Utilizing the site, you can get 1000s of forms for organization and specific functions, categorized by types, says, or search phrases.You can find the most up-to-date variations of forms such as the Louisiana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds within minutes.

If you already have a monthly subscription, log in and obtain Louisiana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds through the US Legal Forms library. The Obtain switch can look on every single type you see. You have access to all in the past saved forms inside the My Forms tab of your account.

In order to use US Legal Forms initially, listed here are basic recommendations to help you began:

- Ensure you have selected the proper type for your personal metropolis/area. Go through the Preview switch to check the form`s information. Look at the type outline to actually have chosen the appropriate type.

- In the event the type does not match your demands, make use of the Look for area near the top of the screen to find the the one that does.

- When you are happy with the shape, verify your option by clicking the Buy now switch. Then, select the pricing prepare you prefer and supply your credentials to register for the account.

- Method the purchase. Utilize your charge card or PayPal account to perform the purchase.

- Select the structure and obtain the shape on your system.

- Make changes. Load, change and produce and sign the saved Louisiana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds.

Every format you added to your money lacks an expiry time and is also the one you have forever. So, if you want to obtain or produce another duplicate, just check out the My Forms section and click on on the type you need.

Obtain access to the Louisiana Plan of Reorganization between Ingenuity Capital Trust and Firsthand Funds with US Legal Forms, probably the most extensive library of legal document templates. Use 1000s of skilled and state-distinct templates that meet your company or specific demands and demands.