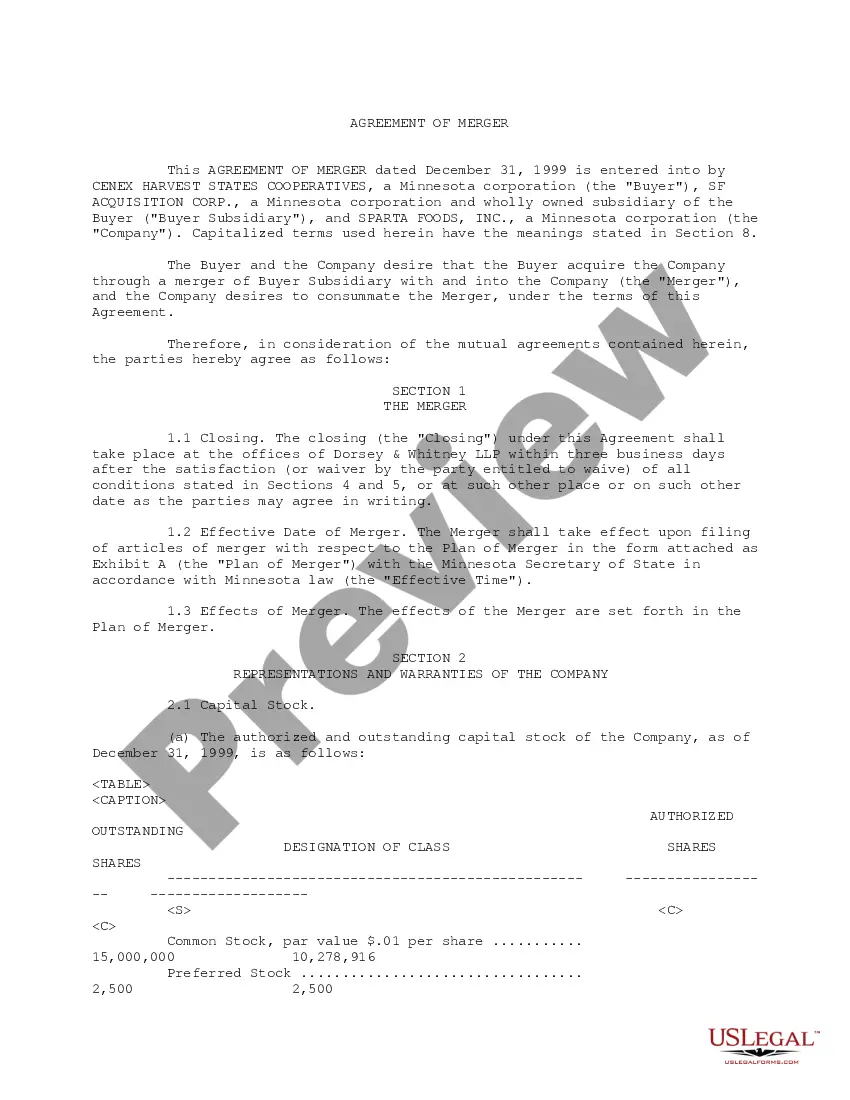

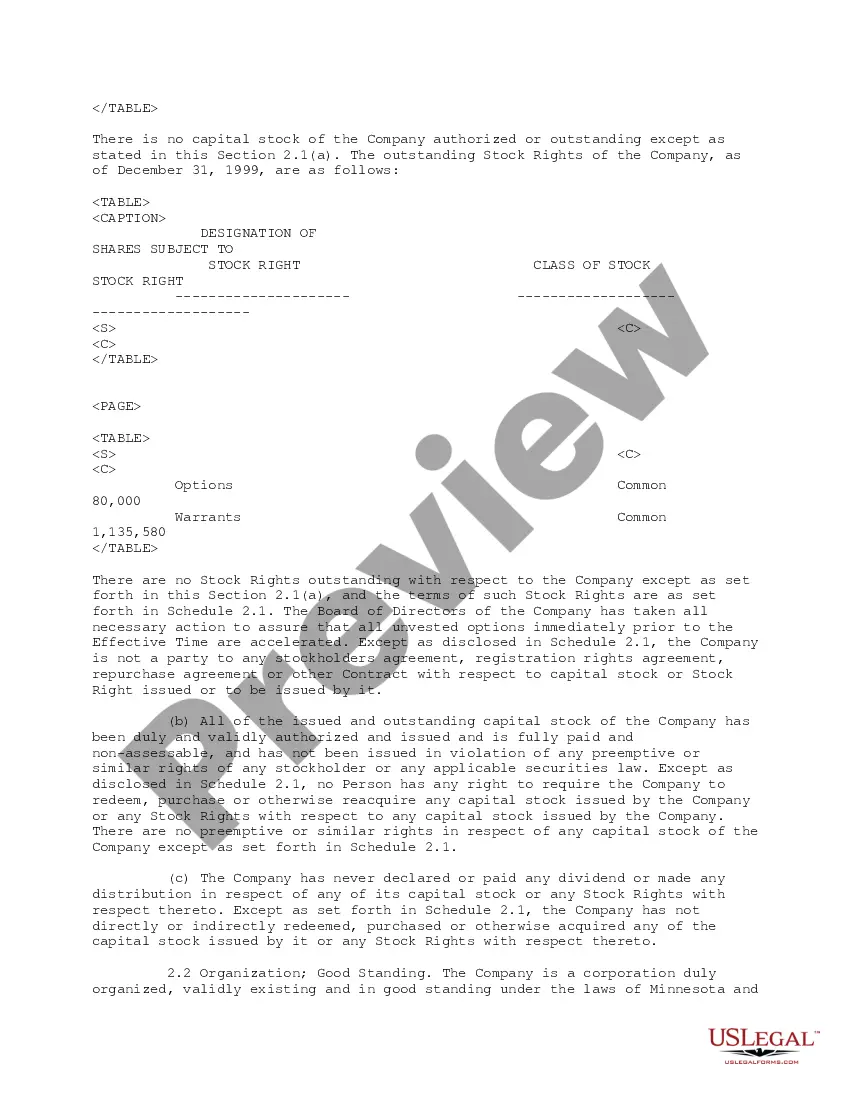

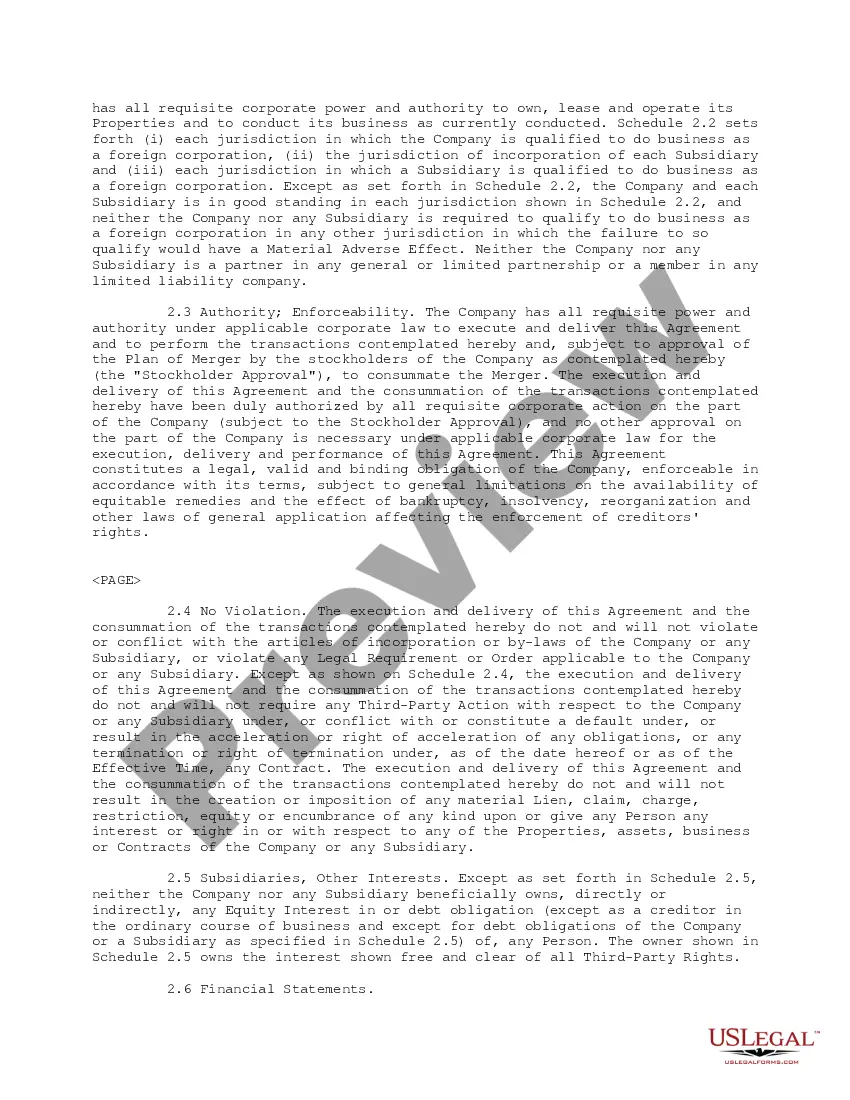

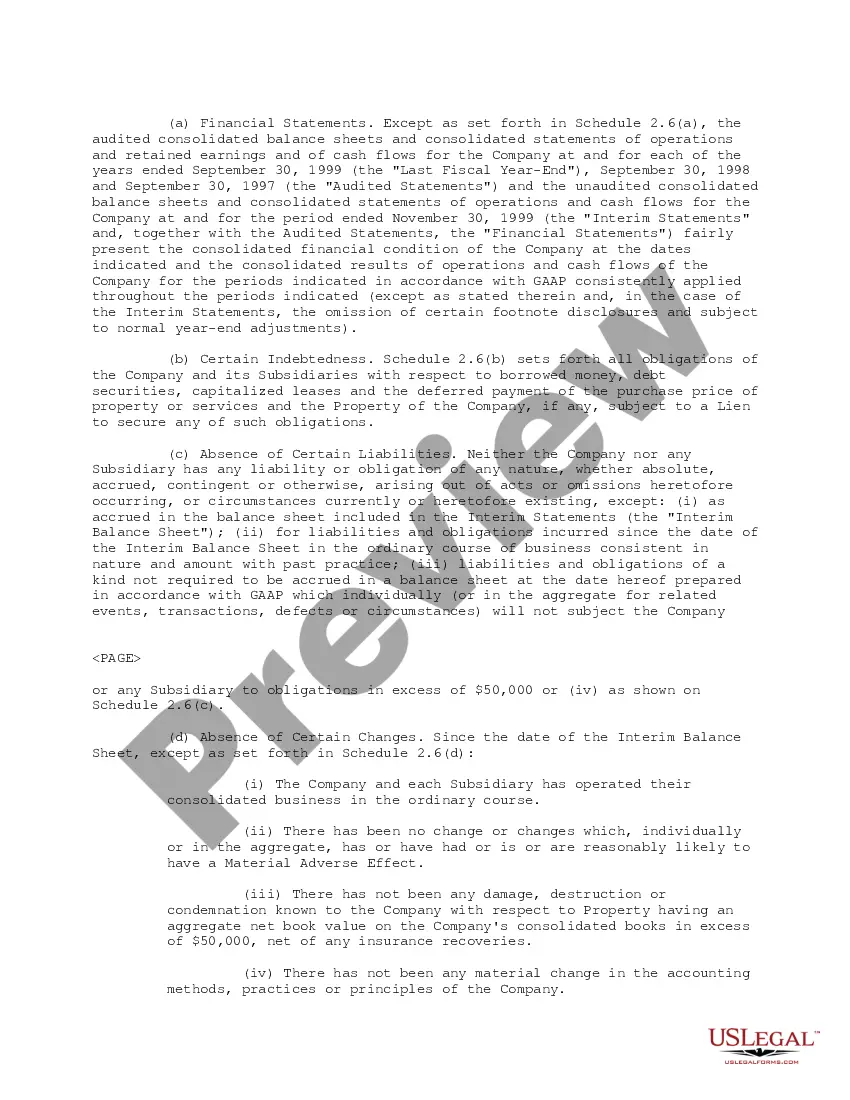

Louisiana Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.

Description

How to fill out Merger Agreement Between Cenex Harvest States Cooperative, SF Acquisition Corporation And Sparta Foods, Inc.?

You may invest hrs online searching for the lawful papers format which fits the federal and state requirements you want. US Legal Forms offers a large number of lawful types which are analyzed by experts. You can actually down load or produce the Louisiana Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc. from our service.

If you have a US Legal Forms bank account, you are able to log in and click the Obtain option. Next, you are able to total, modify, produce, or signal the Louisiana Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.. Every lawful papers format you get is your own property for a long time. To get one more duplicate associated with a acquired kind, visit the My Forms tab and click the related option.

If you are using the US Legal Forms website the very first time, keep to the basic instructions beneath:

- Very first, make sure that you have selected the proper papers format to the area/metropolis of your choosing. Browse the kind information to ensure you have picked the proper kind. If available, take advantage of the Preview option to appear through the papers format also.

- If you want to locate one more edition of the kind, take advantage of the Research area to find the format that fits your needs and requirements.

- Upon having identified the format you would like, click on Purchase now to proceed.

- Choose the rates plan you would like, type in your qualifications, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You should use your Visa or Mastercard or PayPal bank account to pay for the lawful kind.

- Choose the file format of the papers and down load it to your gadget.

- Make modifications to your papers if necessary. You may total, modify and signal and produce Louisiana Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc..

Obtain and produce a large number of papers themes while using US Legal Forms web site, that provides the largest variety of lawful types. Use expert and state-specific themes to deal with your business or person demands.