A Louisiana Trust Indenture and Agreement is a legal document that outlines the terms and conditions for the Naveen Tax Free Unit Trust, Series 1140, between John Naveen and Co., Inc. and Chase Manhattan Bank. This agreement serves as a crucial aspect of the trust, as it sets forth the obligations, rights, and responsibilities of all parties involved. The Louisiana Trust Indenture and Agreement for the Naveen Tax Free Unit Trust, Series 1140, establishes the framework for the trust's operation and administration. It ensures that the trust is managed according to specific guidelines and regulations. This agreement is designed to protect the interests of the trust's beneficiaries and provides them with a legal framework to address any potential challenges or disputes that may arise during the trust's lifespan. Some key elements addressed within the Louisiana Trust Indenture and Agreement may include: 1. Purpose: This section articulates the reason behind creating the trust and specifies its primary objectives. In the case of the Naveen Tax Free Unit Trust, Series 1140, this may include providing tax-free investment opportunities for participants. 2. Parties Involved: The agreement identifies all parties involved in the trust, including John Naveen and Co., Inc. (as the sponsor or creator of the trust), and Chase Manhattan Bank (as the trustee responsible for managing the trust's assets and implementing investment strategies). 3. Trustee's Duties: The Louisiana Trust Indenture and Agreement delineates the responsibilities and obligations of the trustee. This may include maintaining accurate records, managing investments prudently, providing regular reports to participants, and distributing income and principal in accordance with the trust's guidelines. 4. Participants' Rights and Obligations: The agreement outlines the rights and responsibilities of the trust's participants, such as their ability to sell or redeem units, attend meetings, and receive regular updates on the trust's performance. 5. Investment Guidelines: The Louisiana Trust Indenture and Agreement may specify the permissible investment options for the trust, including the types of securities that can be included in the portfolio. It may also outline any limitations or restrictions on investments to ensure the trust's assets are managed in a prudent manner. It's important to note that the Louisiana Trust Indenture and Agreement can vary across different Naveen Tax Free Unit Trusts, Series 1140, depending on the specific investment objectives and dynamics of each trust. Therefore, there may be multiple types of agreements with nuanced differences in their terms and conditions. However, the overarching purpose remains the same — to establish the rights, responsibilities, and operational framework of the trust.

Louisiana Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140

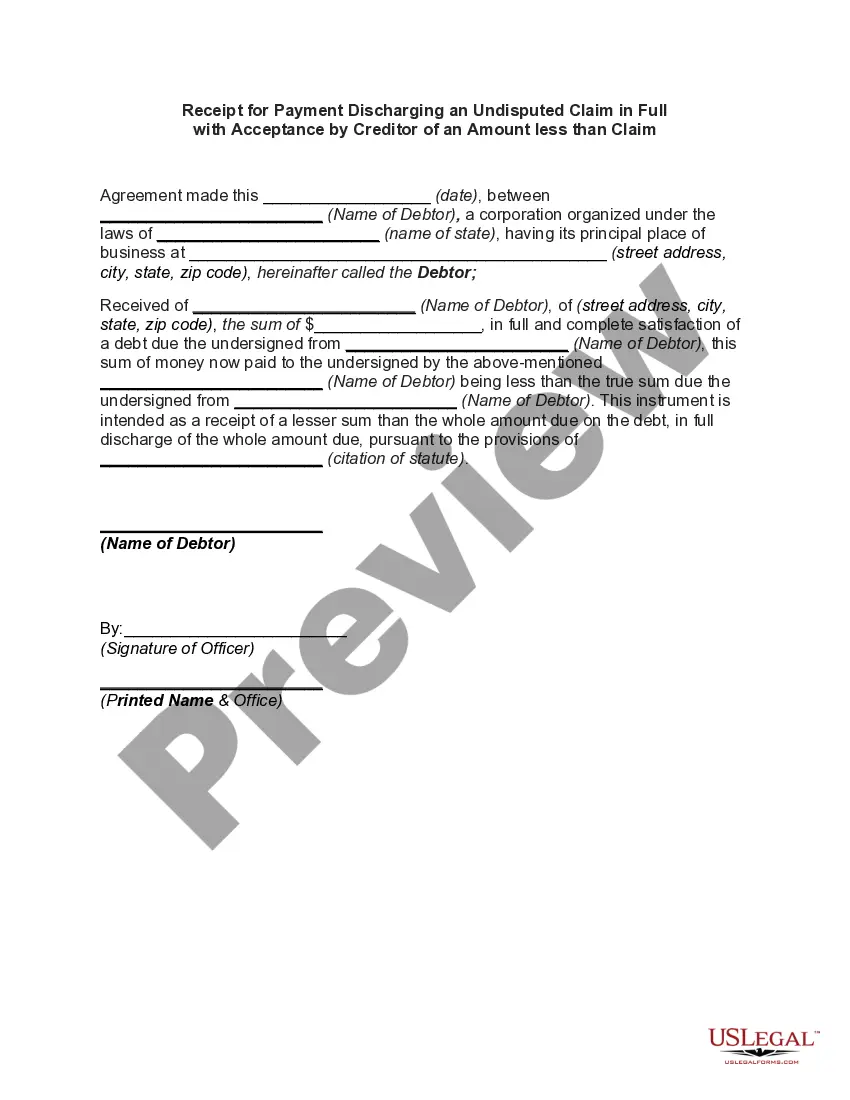

Description

How to fill out Louisiana Trust Indenture And Agreement Between John Nuveen And Co., Inc. And Chase Manhattan Bank Regarding Terms And Conditions For Nuveen Tax Free Unit Trust, Series 1140?

Are you presently in the situation the place you need papers for possibly enterprise or person functions just about every day time? There are plenty of legal document web templates available on the Internet, but discovering ones you can rely on isn`t easy. US Legal Forms delivers a huge number of kind web templates, just like the Louisiana Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140, which are composed in order to meet state and federal needs.

In case you are already informed about US Legal Forms internet site and get a free account, just log in. Following that, you are able to acquire the Louisiana Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140 format.

If you do not come with an profile and want to begin using US Legal Forms, follow these steps:

- Discover the kind you need and make sure it is for that proper town/county.

- Utilize the Review option to examine the shape.

- See the information to ensure that you have selected the appropriate kind.

- In the event the kind isn`t what you`re seeking, take advantage of the Look for discipline to get the kind that fits your needs and needs.

- When you find the proper kind, simply click Acquire now.

- Choose the costs program you would like, fill in the desired information to make your account, and buy your order with your PayPal or charge card.

- Pick a hassle-free document format and acquire your duplicate.

Find all the document web templates you might have purchased in the My Forms food selection. You can obtain a further duplicate of Louisiana Trust Indenture and Agreement between John Nuveen and Co., Inc. and Chase Manhattan Bank regarding terms and conditions for Nuveen Tax Free Unit Trust, Series 1140 anytime, if needed. Just go through the required kind to acquire or produce the document format.

Use US Legal Forms, one of the most comprehensive variety of legal varieties, to save lots of some time and prevent blunders. The support delivers expertly made legal document web templates which can be used for a range of functions. Make a free account on US Legal Forms and initiate creating your daily life easier.