Louisiana Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc.

Description

How to fill out Plan Of Merger Between WIT Capital Group, Inc., WIS Merger Corporation And Soundview Technology Group, Inc.?

It is possible to invest hours online attempting to find the lawful papers web template which fits the state and federal requirements you need. US Legal Forms gives a huge number of lawful types that happen to be examined by specialists. It is simple to download or produce the Louisiana Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc. from our assistance.

If you already have a US Legal Forms profile, you are able to log in and click on the Obtain option. Afterward, you are able to total, revise, produce, or indication the Louisiana Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc.. Each and every lawful papers web template you buy is your own property forever. To have yet another version of the bought form, check out the My Forms tab and click on the related option.

If you work with the US Legal Forms site the first time, keep to the simple recommendations below:

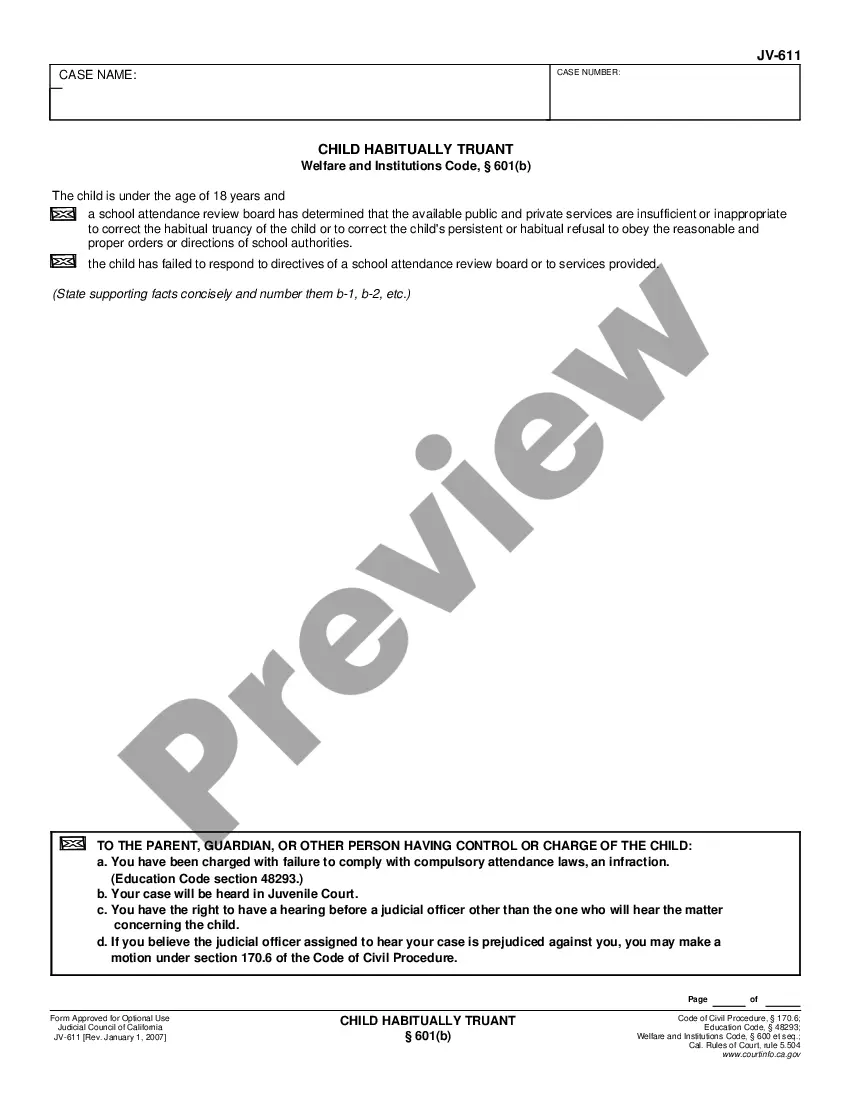

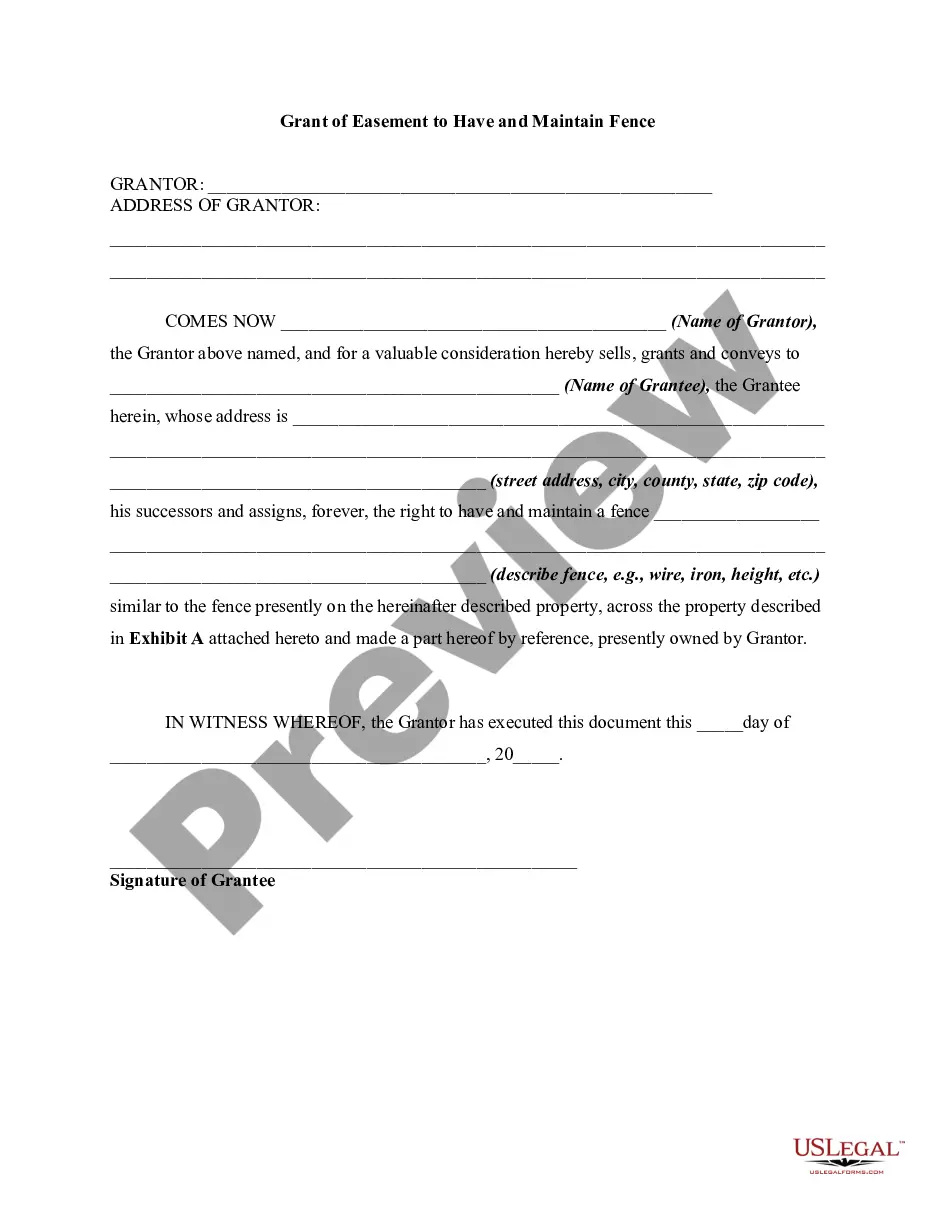

- First, make certain you have selected the best papers web template for your area/area of your choice. Look at the form information to ensure you have picked the correct form. If readily available, utilize the Review option to look through the papers web template too.

- If you want to find yet another variation in the form, utilize the Search area to discover the web template that meets your needs and requirements.

- Once you have identified the web template you need, click Get now to carry on.

- Pick the prices plan you need, key in your credentials, and sign up for an account on US Legal Forms.

- Complete the purchase. You can use your charge card or PayPal profile to cover the lawful form.

- Pick the formatting in the papers and download it to the gadget.

- Make adjustments to the papers if possible. It is possible to total, revise and indication and produce Louisiana Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc..

Obtain and produce a huge number of papers themes while using US Legal Forms site, which offers the most important assortment of lawful types. Use skilled and condition-particular themes to tackle your small business or personal requires.