The Louisiana Polaris 401(k) Retirement Savings Plan Trust Agreement is a legally binding document that outlines the establishment and operation of a trust between Polaris Industries, Inc. and Fidelity Management Trust Co. It serves as a comprehensive guide for managing the retirement savings plan offered by Polaris Industries, ensuring that the funds are securely held and managed by a trusted entity. The primary purpose of this trust agreement is to provide a framework for administering the retirement savings plan and safeguarding the interests of the plan participants. It outlines the roles and responsibilities of both Polaris Industries, Inc. and Fidelity Management Trust Co., ensuring that each party abides by the terms and conditions laid out in the agreement. This trust agreement covers various aspects related to the establishment and operation of the trust, including: 1. Trustee Responsibilities: The trust agreement defines the responsibilities and duties of Fidelity Management Trust Co., acting as the trustee. This includes overseeing the investment options, asset allocation, and the management of plan expenses. 2. Contributions and Vesting: The agreement outlines the rules and regulations regarding employee contributions to the retirement savings plan and the corresponding vesting schedule. It specifies the contribution limits, employer matching contributions (if applicable), and the conditions under which vesting occurs. 3. Investment Options: The trust agreement provides details about the investment options available to plan participants. It may specify a range of investment funds, including mutual funds, index funds, and target-date funds. The agreement may also outline any restrictions or limitations on investment choices. 4. Participant Rights and Responsibilities: The agreement lays out the rights and responsibilities of plan participants. This includes information on eligibility requirements, enrollment procedures, and the process for making investment elections. It may also cover rules regarding loans, withdrawals, and the distribution of funds upon retirement or termination of employment. 5. Reporting and Disclosure: The trust agreement includes provisions for regular reporting, ensuring transparency and accountability in the management of the retirement savings plan. It specifies the frequency and content of participant statements, as well as the provision of annual reports and other required disclosures. It is important to note that while this description outlines the general features of a Louisiana Polaris 401(k) Retirement Savings Plan Trust Agreement, there may be variations or additional provisions specific to different types of plans offered by Polaris Industries, Inc. and Fidelity Management Trust Co. The exact terms and conditions may vary depending on the specific agreement in place between the two parties.

Louisiana Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust

Description

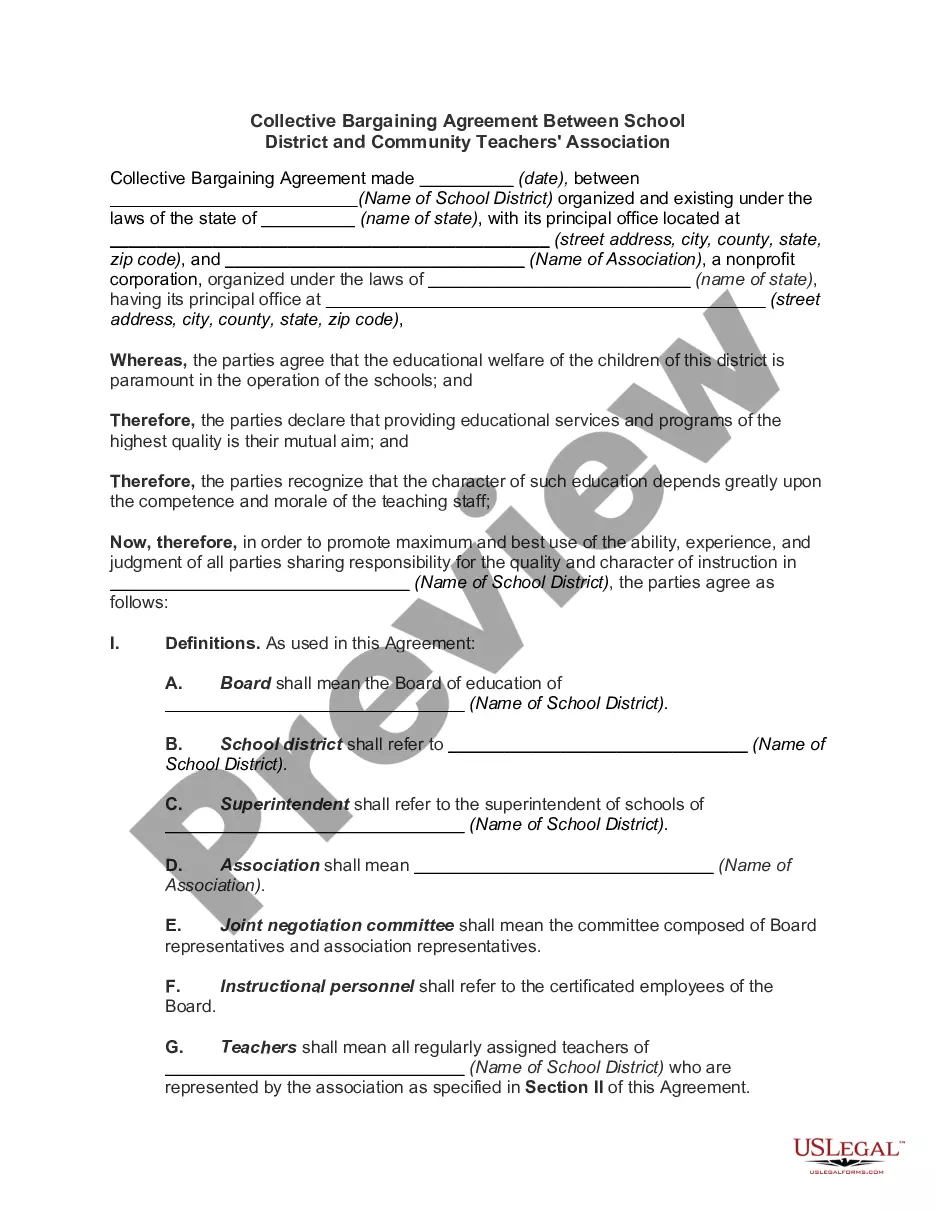

How to fill out Louisiana Polaris 401(k) Retirement Savings Plan Trust Agreement Between Polaris Industries, Inc. And Fidelity Management Trust Co. Regarding Establishment Of Trust?

Finding the right legitimate file template could be a have difficulties. Obviously, there are tons of themes available online, but how can you discover the legitimate kind you will need? Make use of the US Legal Forms site. The assistance delivers thousands of themes, for example the Louisiana Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust, that can be used for company and personal demands. All the varieties are checked out by pros and fulfill federal and state specifications.

In case you are previously listed, log in for your accounts and then click the Obtain option to obtain the Louisiana Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust. Utilize your accounts to check from the legitimate varieties you possess purchased previously. Visit the My Forms tab of your own accounts and acquire another backup of your file you will need.

In case you are a fresh end user of US Legal Forms, listed here are simple instructions that you should follow:

- First, be sure you have selected the appropriate kind to your town/region. You are able to look through the form making use of the Review option and read the form explanation to guarantee this is basically the best for you.

- In case the kind is not going to fulfill your requirements, take advantage of the Seach area to find the proper kind.

- When you are sure that the form is proper, go through the Buy now option to obtain the kind.

- Opt for the prices plan you want and type in the necessary info. Build your accounts and buy an order making use of your PayPal accounts or charge card.

- Select the data file file format and down load the legitimate file template for your product.

- Total, revise and printing and indication the attained Louisiana Polaris 401(k) Retirement Savings Plan Trust Agreement between Polaris Industries, Inc. and Fidelity Management Trust Co. regarding establishment of trust.

US Legal Forms will be the largest collection of legitimate varieties that you will find various file themes. Make use of the service to down load professionally-made files that follow state specifications.