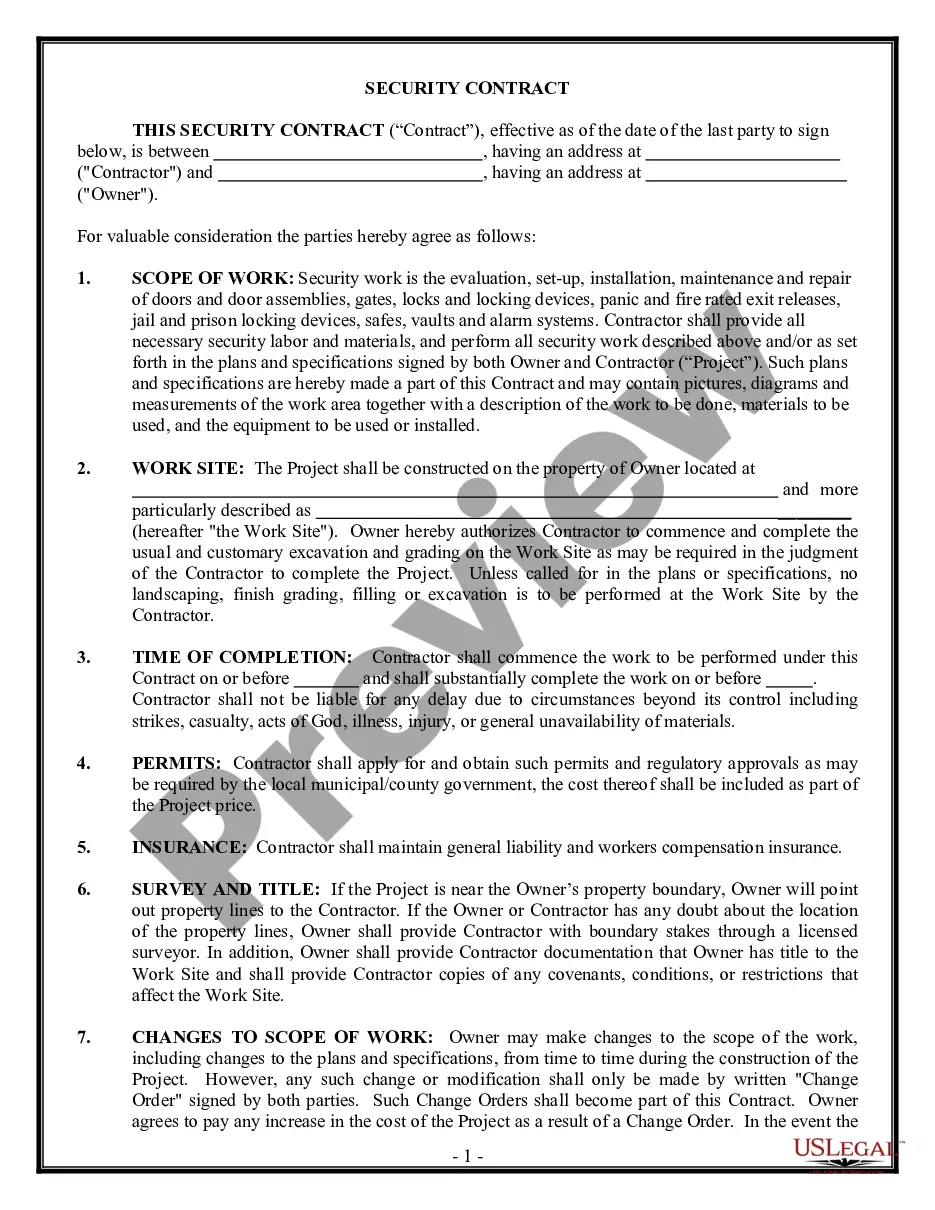

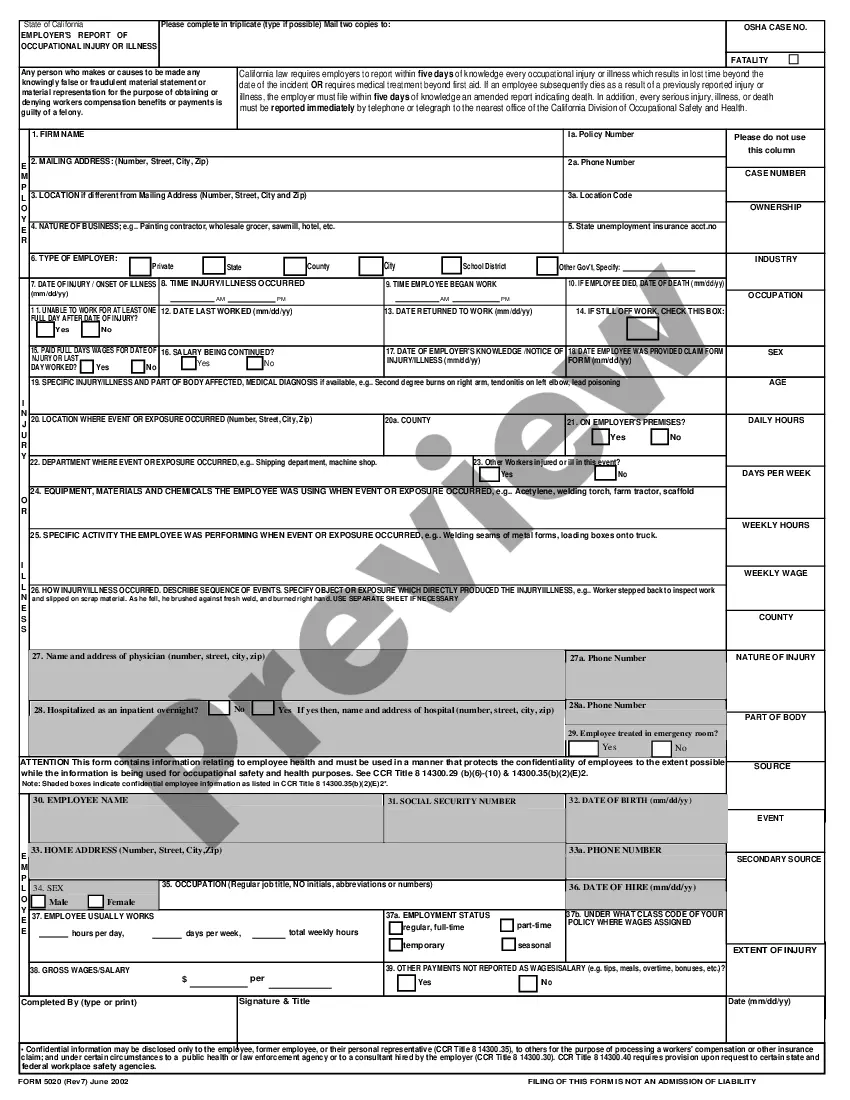

The Louisiana Quick start Loan and Security Agreement is a legal document between Silicon Valley Bank and print, Inc., designed to provide financial assistance to print in the form of a loan while ensuring the bank's security interests are protected. This agreement outlines the terms and conditions of the loan, including repayment terms, interest rates, collateral requirements, and obligations of both parties involved. Keywords: Louisiana, Quick start Loan, Security Agreement, Silicon Valley Bank, print Inc., financial assistance, loan, repayment terms, interest rates, collateral requirements, obligations. There are several types of Louisiana Quick start Loan and Security Agreements that can be customized to suit the specific needs of the borrowing company. These may include: 1. Traditional Quick start Loan: This type of loan agreement offers conventional financing options to print, allowing them to secure the necessary funds for their business needs, such as expanding their operations, purchasing new equipment, or funding marketing initiatives. 2. Line of Credit Agreement: This agreement establishes a predetermined credit limit for print, which they can draw upon as needed. This provides them with flexible access to funds, managing their cash flow efficiently while only paying interest on what they use. 3. Term Loan Agreement: In this type of agreement, a lump sum loan amount is provided to print, which is repaid over a specified period in regular installments. This could be an ideal choice for print if they have a well-defined project or investment plan, as it offers predictable repayment terms. 4. Asset-Based Loan Agreement: This type of agreement is secured by specific collateral, such as print's accounts receivable or inventory. It allows print to leverage their existing assets to secure funding, potentially offering more favorable terms compared to unsecured loans. 5. Revolving Credit Facility: This agreement establishes a revolving line of credit, enabling print to borrow, repay, and reborrow funds as needed. This type of loan agreement provides print with ongoing access to capital, offering greater flexibility in managing their working capital requirements. Each specific Louisiana Quick start Loan and Security Agreement between Silicon Valley Bank and print, Inc. will vary depending on the unique circumstances and financial needs of print.

Louisiana Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc.

Description

How to fill out Louisiana Quickstart Loan And Security Agreement Between Silicon Valley Bank And IPrint, Inc.?

It is possible to spend time online attempting to find the lawful document web template which fits the federal and state requirements you want. US Legal Forms offers 1000s of lawful forms which are examined by professionals. It is simple to acquire or printing the Louisiana Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc. from the assistance.

If you already possess a US Legal Forms accounts, you can log in and then click the Download switch. Afterward, you can total, modify, printing, or indication the Louisiana Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc.. Each lawful document web template you acquire is the one you have forever. To acquire one more backup of any bought type, check out the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms web site the very first time, keep to the easy directions below:

- Initially, be sure that you have selected the proper document web template for the area/metropolis of your choice. See the type information to make sure you have picked out the correct type. If accessible, utilize the Review switch to check through the document web template as well.

- If you wish to get one more edition of the type, utilize the Research area to find the web template that meets your needs and requirements.

- Once you have discovered the web template you desire, just click Purchase now to move forward.

- Pick the prices plan you desire, enter your accreditations, and sign up for a merchant account on US Legal Forms.

- Full the purchase. You can use your credit card or PayPal accounts to cover the lawful type.

- Pick the file format of the document and acquire it for your system.

- Make modifications for your document if necessary. It is possible to total, modify and indication and printing Louisiana Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc..

Download and printing 1000s of document layouts while using US Legal Forms Internet site, which offers the biggest variety of lawful forms. Use skilled and state-distinct layouts to take on your business or personal demands.

Form popularity

FAQ

The Federal Reserve took steps following the collapse of SVB to improve confidence in the banking system and prevent future banking failures, including its Bank Term Funding Program. First Citizens Bank struck a deal with the FDIC to buy SVB's deposits and loans, in addition to certain other assets.

What should be included in a loan agreement? The amount of money to be loaned. The timeframe in which the money is to be repaid. The agreed method of repayment. What the ramifications are of late or non-payment. The amount of interest (if any) to be repaid. Details of any security required to protect the lender.

Here's a simple guide for lending friendly loan agreement format: You should start by writing ?Loan Agreement? at the top of the document. Write the full legal names and addresses of the parties involved (the lender and borrower) in the agreement. Clearly state the details of the loan:

10 essential loan agreement provisions Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.