The Louisiana Plan of Merger between ID Recap, Inc. and Interment, Inc. is a legally binding agreement that outlines the process of merging these two companies into one entity. This merger aims to combine the strengths and resources of both companies in order to enhance operational efficiency, expand market reach, and create synergies for mutual growth. The Louisiana Plan of Merger is a comprehensive document that details all aspects of the merger, including the terms and conditions, rights and obligations of the merging entities, and the proposed structure of the new merged entity. It provides a roadmap for the entire merger process, from the initial negotiations to the final integration of operations. In addition to the general Louisiana Plan of Merger, there may be different types or variations depending on the specific circumstances and objectives of ID Recap, Inc. and Interment, Inc. For example: 1. Vertical Merger Plan: This type of merger involves the combination of companies operating at different stages of the same industry's value chain. If ID Recap, Inc. and Interment, Inc. operate in related but distinct sectors within the dental industry, a vertical merger plan may be implemented to capitalize on complementary capabilities and create a more complete offering for customers. 2. Horizontal Merger Plan: In the case of ID Recap, Inc. and Interment, Inc. being direct competitors in the same market segment, a horizontal merger plan could be considered. This plan would focus on consolidating market share, streamlining operations, and potentially reducing overhead expenses through synergies and economies of scale. 3. Reverse Merger Plan: A reverse merger plan occurs when a smaller entity (ID Recap, Inc.) acquires a larger entity (Interment, Inc.) by integrating it into its corporate structure. This type of merger plan allows ID Recap, Inc. to benefit from Interment, Inc.'s established market presence, brand reputation, and customer base, while potentially also gaining access to additional resources and expertise. Overall, the Louisiana Plan of Merger between ID Recap, Inc. and Interment, Inc. represents a strategic move aimed at achieving growth, competitive advantage, and enhanced value for both companies. It is designed to ensure a smooth transition, address potential challenges, and maximize the synergistic benefits arising from the merger, ultimately creating a stronger and more successful combined entity.

Louisiana Plan of Merger between ID Recap, Inc. and InterDent, Inc.

Description

How to fill out Louisiana Plan Of Merger Between ID Recap, Inc. And InterDent, Inc.?

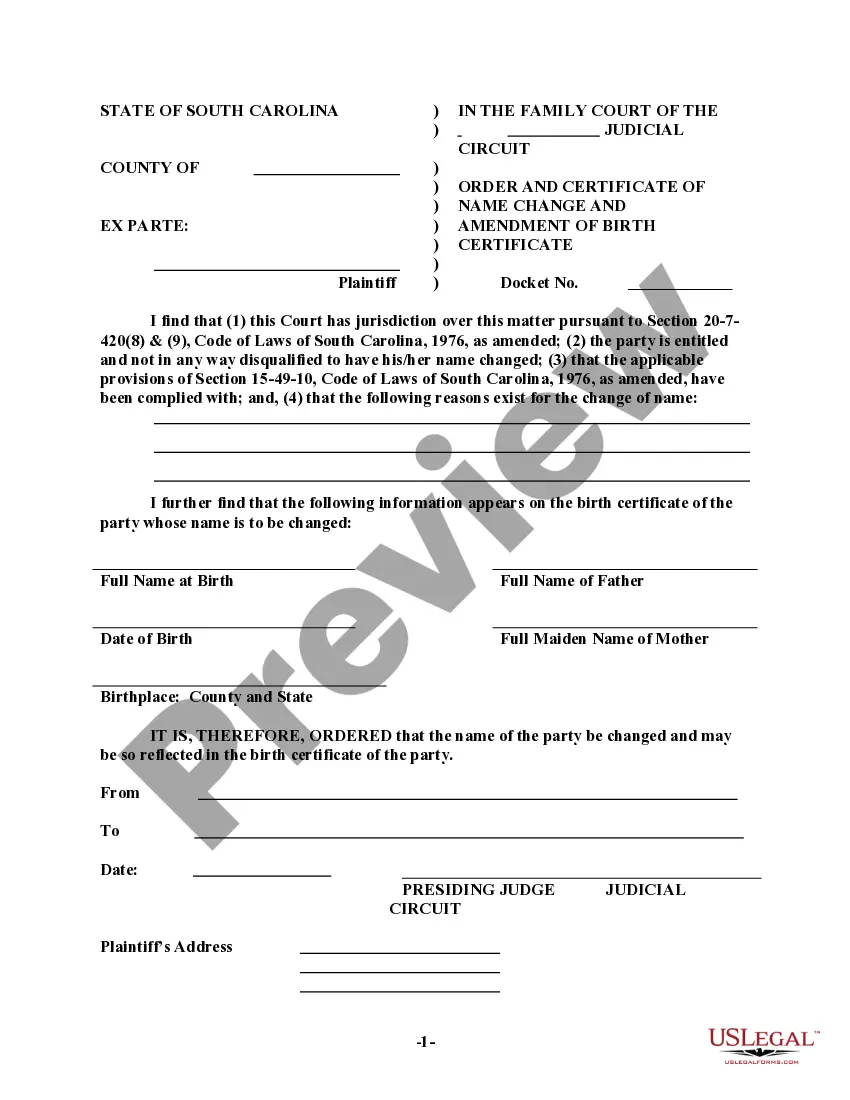

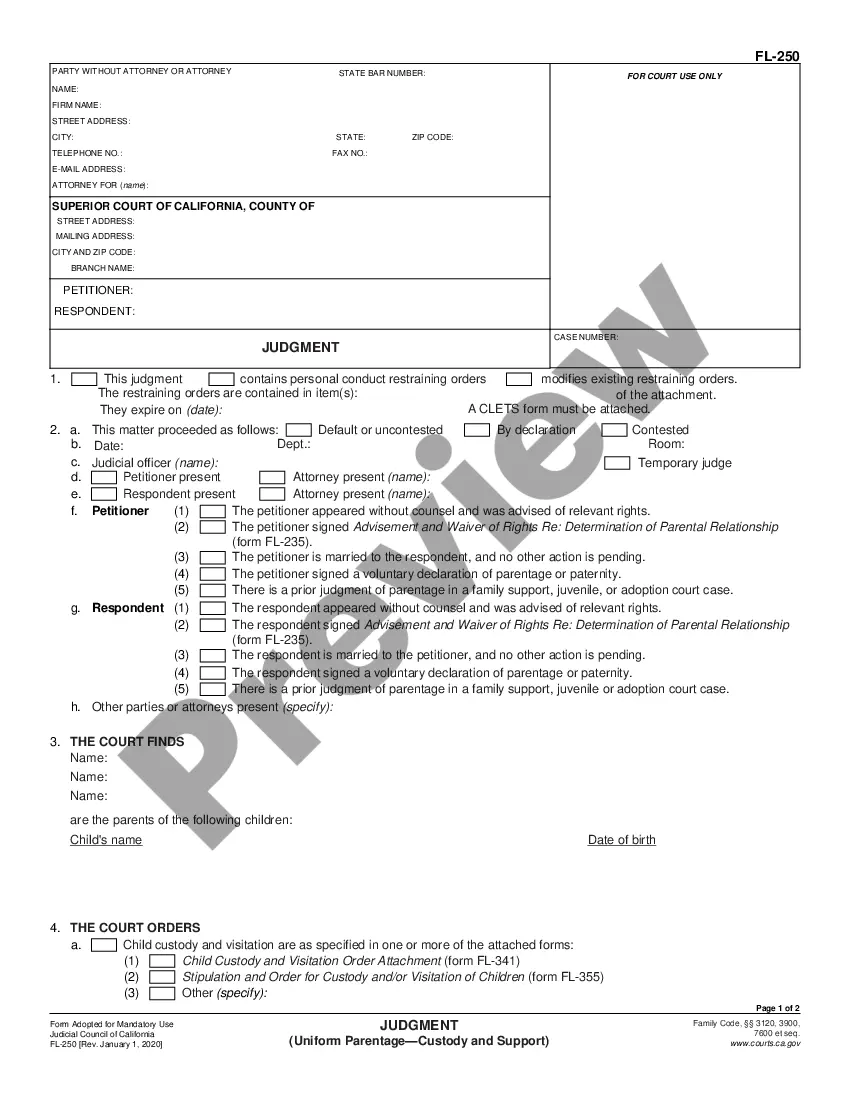

It is possible to commit hours on-line attempting to find the legal record design that fits the federal and state needs you require. US Legal Forms offers a large number of legal types which are evaluated by pros. You can easily down load or produce the Louisiana Plan of Merger between ID Recap, Inc. and InterDent, Inc. from your services.

If you currently have a US Legal Forms accounts, you can log in and click on the Down load key. Afterward, you can full, revise, produce, or sign the Louisiana Plan of Merger between ID Recap, Inc. and InterDent, Inc.. Every single legal record design you get is your own property forever. To have another duplicate associated with a bought form, proceed to the My Forms tab and click on the related key.

If you work with the US Legal Forms site the first time, follow the straightforward instructions under:

- Very first, ensure that you have selected the proper record design for that state/metropolis of your liking. See the form information to make sure you have selected the correct form. If available, take advantage of the Review key to check with the record design as well.

- If you would like find another model of your form, take advantage of the Lookup discipline to get the design that meets your needs and needs.

- After you have found the design you want, click Get now to move forward.

- Choose the rates strategy you want, type your accreditations, and sign up for a merchant account on US Legal Forms.

- Full the deal. You can use your credit card or PayPal accounts to fund the legal form.

- Choose the file format of your record and down load it in your system.

- Make changes in your record if required. It is possible to full, revise and sign and produce Louisiana Plan of Merger between ID Recap, Inc. and InterDent, Inc..

Down load and produce a large number of record web templates using the US Legal Forms web site, which offers the most important selection of legal types. Use skilled and status-distinct web templates to handle your small business or specific requirements.