Louisiana Investment Agreement

Description

How to fill out Investment Agreement?

Are you currently inside a position that you will need files for sometimes organization or individual purposes just about every working day? There are a variety of authorized file templates available on the Internet, but getting versions you can rely on isn`t effortless. US Legal Forms provides thousands of kind templates, much like the Louisiana Investment Agreement, which can be published to fulfill state and federal demands.

In case you are already knowledgeable about US Legal Forms site and also have an account, merely log in. After that, you are able to down load the Louisiana Investment Agreement format.

Unless you provide an bank account and would like to begin to use US Legal Forms, abide by these steps:

- Discover the kind you will need and make sure it is to the right metropolis/region.

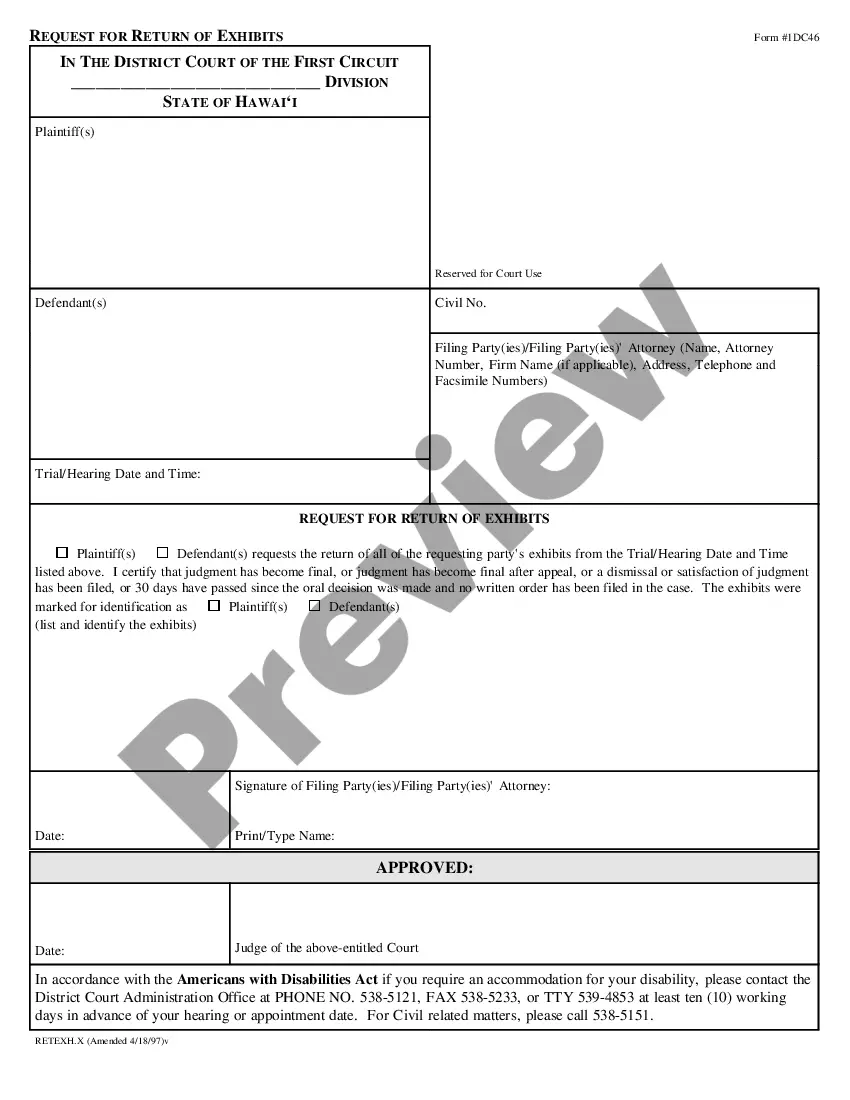

- Make use of the Preview option to examine the form.

- Look at the explanation to ensure that you have chosen the correct kind.

- In case the kind isn`t what you are seeking, utilize the Lookup discipline to discover the kind that meets your requirements and demands.

- Whenever you discover the right kind, click on Purchase now.

- Choose the prices program you would like, fill in the desired info to create your account, and buy the transaction utilizing your PayPal or Visa or Mastercard.

- Decide on a hassle-free paper file format and down load your backup.

Locate all of the file templates you might have bought in the My Forms food list. You can obtain a further backup of Louisiana Investment Agreement at any time, if necessary. Just click on the necessary kind to down load or print out the file format.

Use US Legal Forms, the most extensive selection of authorized varieties, in order to save efforts and avoid blunders. The services provides expertly manufactured authorized file templates that can be used for a range of purposes. Produce an account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

Form 565 is used by LLCs classified as corporations for federal tax purposes, whereas Form 568 is for LLCs classified as partnerships or disregarded entities. Determining your LLC's federal tax classification is essential to determine which form to use.

Louisiana Revised Statute 1.1(F)(4) requires the electronic filing of all composite partnership returns. If tax credits are claimed on the composite return: ALL nonresident partners must be included on the return and on Schedule of Included Partner's Share of Income and Tax.

The state of Louisiana mandates the filing of Form 1099 only if there is state tax withholding. Remember, all 1099s are required to be submitted electronically.

All nonresident partners who were partners at any time during the taxable year and who do not have a valid agreement on file with LDR must be included in the Louisiana Composite Partnership Return (See LAC 61:I. 1401).

Individuals who are domiciled, reside, or have a permanent residence in Louisiana are required to file a Louisiana individual income tax return and report all of their income and pay Louisiana income tax on that income, if applicable.

Who must file. Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return must file a Louisiana Individual Income Tax Return.

Composite returns required to be made for an entity treated as a partnership for state income tax purposes and which is made on the basis of the calendar year shall be made and filed with the secretary at Baton Rouge, Louisiana, on or before the fifteenth day of May, following the close of the calendar year.

Who Must File? All corporations and entities taxed as corporations for federal income tax purposes deriving income from Louisiana sources, whether or not they have any net income, must file an income tax return.