Louisiana Terms for Private Placement of Series Seed Preferred Stock When it comes to the private placement of Series Seed Preferred Stock in Louisiana, there are specific terms and conditions that govern these transactions. Louisiana, like many other jurisdictions, has regulations in place to protect both investors and businesses engaging in private placement offerings. Private placement refers to the sale of securities directly to private investors rather than through public markets. Series Seed Preferred Stock is a type of equity investment that grants shareholders certain rights and privileges, such as priority in receiving dividends and liquidation preferences. In Louisiana, certain terms apply to regulate these offerings: 1. Louisiana Blue Sky Laws: Louisiana has its own laws, often referred to as "Blue Sky Laws," which require businesses to comply with state-specific regulations regarding private placements. These laws aim to prevent fraudulent activities and ensure fair dealings in the securities' industry. 2. Accredited Investors: Private placement offerings of Series Seed Preferred Stock in Louisiana typically target accredited investors. These are high-net-worth individuals or institutions that meet specific criteria outlined by the Securities and Exchange Commission (SEC). By selling exclusively to accredited investors, businesses can avoid the extensive disclosure requirements imposed by public offerings. 3. Limited Number of Investors: To qualify as a private placement in Louisiana, the number of investors should be limited. Typically, offerings are limited to 35 non-accredited investors and an unlimited number of accredited investors. This ensures that the private placement remains exempt from certain registration and reporting requirements. 4. Disclosure Requirements: Although private placements are subject to fewer disclosure requirements than public offerings, Louisiana still mandates businesses to disclose certain key information to investors. This includes details about the company, its management, financials, risk factors, and the terms of the Series Seed Preferred Stock being offered. 5. Investment Limitations: The Louisiana Office of Financial Institutions imposes investment limitations to protect investors. These limitations may include specific investment thresholds, such as a minimum investment amount, to prevent unsophisticated investors from risking too much capital on high-risk securities. It is important to note that specific terms for private placement of Series Seed Preferred Stock in Louisiana may vary, depending on the nature of the business, the investors involved, and compliance with federal securities laws. These terms ensure transparency and fairness in private placement offerings, benefitting both businesses seeking capital and investors looking for potential returns. Different types of Louisiana Terms for Private Placement of Series Seed Preferred Stock may include variations in liquidation preferences, anti-dilution protections, conversion rights, voting rights, and participation rights. These terms will be negotiated between the issuing company and the investors, considering factors such as the company's valuation, growth prospects, and investor preferences. In conclusion, the private placement of Series Seed Preferred Stock in Louisiana is governed by specific terms designed to protect investors and businesses. Complying with Louisiana Blue Sky Laws, targeting accredited investors, limiting the number of investors, and providing adequate disclosures are crucial steps in ensuring a successful private placement. By understanding these terms, businesses can navigate the regulatory landscape and secure the capital needed for growth and expansion.

Louisiana Terms for Private Placement of Series Seed Preferred Stock

Description

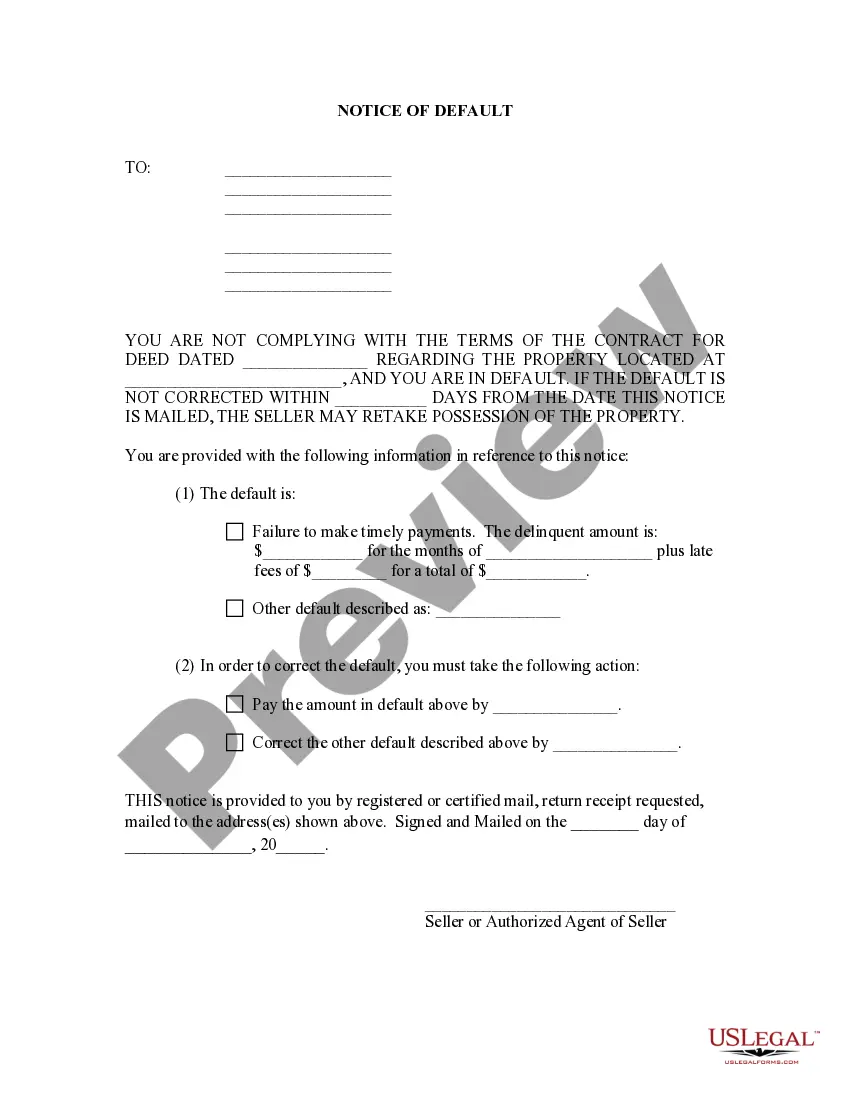

How to fill out Louisiana Terms For Private Placement Of Series Seed Preferred Stock?

Choosing the right lawful record design can be a battle. Naturally, there are a lot of web templates available on the net, but how will you obtain the lawful develop you will need? Take advantage of the US Legal Forms internet site. The service offers 1000s of web templates, for example the Louisiana Terms for Private Placement of Series Seed Preferred Stock, that can be used for organization and personal demands. Each of the varieties are examined by experts and satisfy state and federal needs.

Should you be already listed, log in to your bank account and then click the Acquire key to find the Louisiana Terms for Private Placement of Series Seed Preferred Stock. Make use of your bank account to look through the lawful varieties you possess acquired in the past. Visit the My Forms tab of the bank account and have one more backup from the record you will need.

Should you be a brand new customer of US Legal Forms, listed here are straightforward directions that you can adhere to:

- Initially, make certain you have chosen the correct develop to your city/state. You may examine the form utilizing the Review key and read the form description to make certain this is the best for you.

- When the develop fails to satisfy your preferences, take advantage of the Seach industry to discover the right develop.

- Once you are positive that the form is proper, click on the Buy now key to find the develop.

- Select the costs plan you desire and enter in the required information. Build your bank account and pay for the transaction using your PayPal bank account or bank card.

- Pick the data file format and acquire the lawful record design to your gadget.

- Comprehensive, edit and printing and indicator the attained Louisiana Terms for Private Placement of Series Seed Preferred Stock.

US Legal Forms is the most significant catalogue of lawful varieties that you can discover numerous record web templates. Take advantage of the service to acquire expertly-made documents that adhere to condition needs.

Form popularity

FAQ

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

The following are among the key sections of a PPM: Summary of Offering Terms. ... Risk Factors. ... Estimated Use of Proceeds/Expenses Disclosures. ... Description of the Securities. ... Business & Management Section. ... Other Offering Documents.

The Private Placement Memorandum (PPM) itself doesn't represent the actual ?offering.? Instead, it serves as a disclosure document that comprehensively describes the offering, encompassing its structure, strategies, regulation, financing, use of funds, business plan, services, risks, and management.

A privately owned business can issue restricted preferred shares through a private placement. By this means, the company avoids going public and does not have to register the shares with the Securities and Exchange Commission.

Use this as a basic checklist for what must be in a PPM: Notice of Offering. Executive Summary. Description of the Investment. Investment objectives and Criteria. Terms of Offer. Investment Structure. Financial Information. Use of Funds.

What Is a Private Placement? A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than publicly on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

Outline of a PPM Introduction. ... Summary of Offering Terms. ... Risk Factors. ... Description of the Company and the Management. ... Use of Proceeds. ... Description of Securities. ... Subscription Procedures. ... Exhibits.