Louisiana Farm Hand Services Contract - Self-Employed

Description

How to fill out Louisiana Farm Hand Services Contract - Self-Employed?

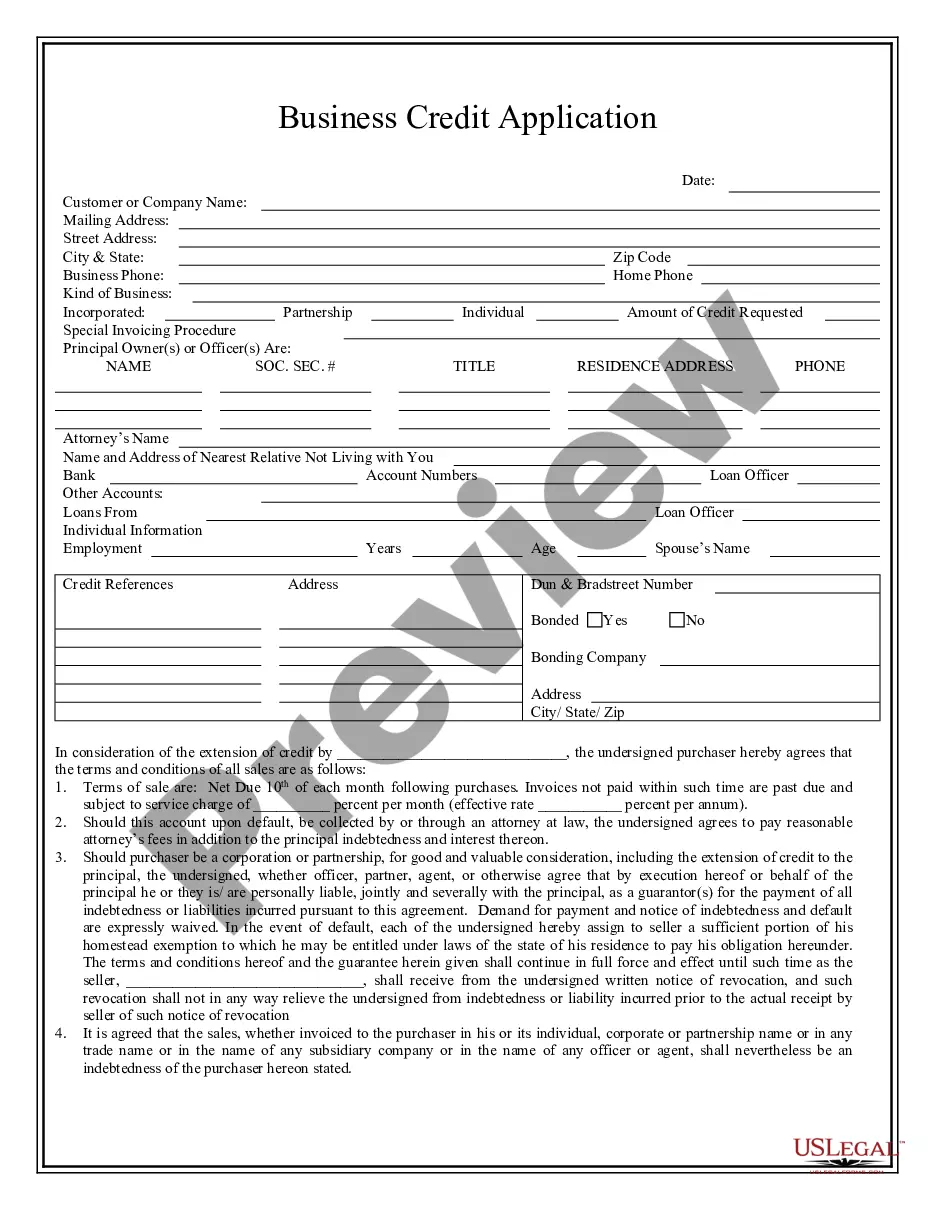

Have you been within a position where you need to have paperwork for both organization or personal purposes virtually every day time? There are tons of legal record themes available on the Internet, but getting kinds you can depend on is not easy. US Legal Forms gives thousands of type themes, like the Louisiana Farm Hand Services Contract - Self-Employed, that happen to be written to meet federal and state requirements.

When you are previously knowledgeable about US Legal Forms web site and have an account, simply log in. After that, you are able to download the Louisiana Farm Hand Services Contract - Self-Employed template.

Unless you offer an profile and want to start using US Legal Forms, follow these steps:

- Obtain the type you require and make sure it is to the proper town/area.

- Utilize the Preview button to examine the shape.

- Look at the outline to actually have selected the appropriate type.

- In case the type is not what you are seeking, make use of the Lookup industry to find the type that meets your needs and requirements.

- When you discover the proper type, click on Get now.

- Pick the prices program you desire, submit the desired details to generate your account, and pay money for the order using your PayPal or charge card.

- Choose a hassle-free paper file format and download your backup.

Locate every one of the record themes you may have purchased in the My Forms menu. You may get a further backup of Louisiana Farm Hand Services Contract - Self-Employed whenever, if necessary. Just click on the necessary type to download or printing the record template.

Use US Legal Forms, by far the most considerable variety of legal forms, to conserve some time and prevent blunders. The assistance gives appropriately made legal record themes which can be used for a variety of purposes. Create an account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

An employee is on a company's payroll and receives wages and benefits in exchange for following the organization's guidelines and remaining loyal. A contractor is an independent worker who has autonomy and flexibility but does not receive benefits such as health insurance and paid time off.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

If you have a 1099-NEC that is not self-employment income subject to self-employment taxes, you need to enter the income in Box 3 of a 1099-MISC instead of Box 1 of the 1099-NEC. If your income is not self-employment income, you do not need to use Schedule C to report business income.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Contract employees, also called independent contractors, contract workers, freelancers or work-for-hire staffers, are individuals hired for a specific project or a certain timeframe for a set fee. Often, contract employees are hired due to their expertise in a particular area, like writing or illustration.

Employees with a 1099 status are self-employed independent contractors. They are paid according to the terms and conditions stated in the contract and receive a 1099 form on which to report their income on their tax return.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.