Louisiana Self-Employed Independent Contractor Consideration For Hire Form

Description

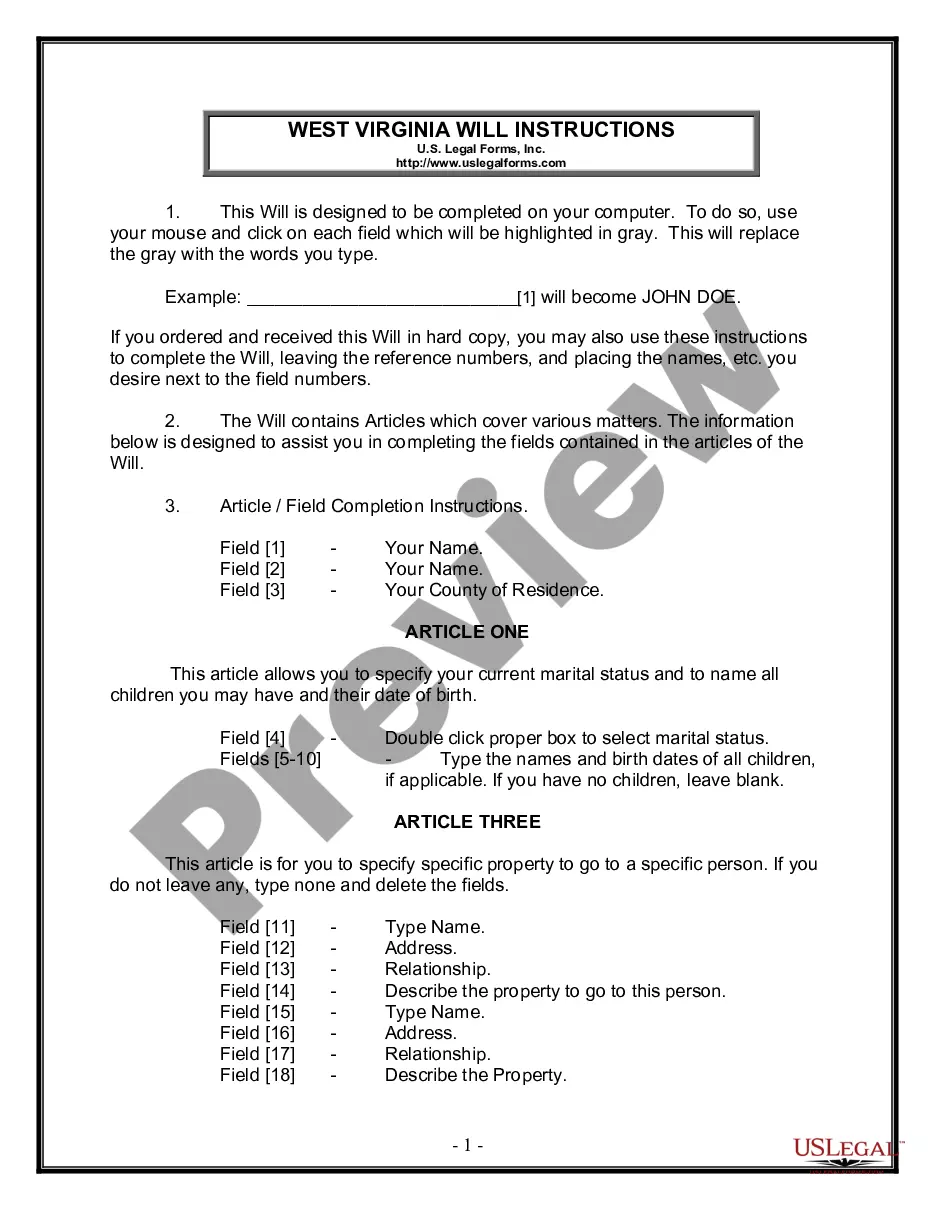

How to fill out Louisiana Self-Employed Independent Contractor Consideration For Hire Form?

US Legal Forms - one of the largest libraries of legal varieties in the States - provides a wide range of legal record layouts it is possible to obtain or print out. While using site, you will get a large number of varieties for organization and personal uses, sorted by groups, states, or keywords and phrases.You can find the most recent models of varieties like the Louisiana Self-Employed Independent Contractor Consideration For Hire Form within minutes.

If you already have a monthly subscription, log in and obtain Louisiana Self-Employed Independent Contractor Consideration For Hire Form in the US Legal Forms local library. The Download key will appear on every kind you perspective. You gain access to all earlier delivered electronically varieties in the My Forms tab of your own bank account.

If you would like use US Legal Forms for the first time, allow me to share simple recommendations to help you get started off:

- Make sure you have chosen the right kind for the area/area. Click the Preview key to examine the form`s content. See the kind outline to actually have selected the proper kind.

- If the kind doesn`t match your demands, use the Research discipline on top of the screen to discover the one that does.

- Should you be pleased with the shape, validate your selection by clicking the Buy now key. Then, choose the costs program you want and give your qualifications to register on an bank account.

- Approach the transaction. Utilize your bank card or PayPal bank account to perform the transaction.

- Pick the formatting and obtain the shape on your gadget.

- Make modifications. Complete, revise and print out and sign the delivered electronically Louisiana Self-Employed Independent Contractor Consideration For Hire Form.

Each and every format you included in your bank account lacks an expiry time and it is the one you have for a long time. So, if you want to obtain or print out an additional backup, just proceed to the My Forms portion and click on around the kind you will need.

Get access to the Louisiana Self-Employed Independent Contractor Consideration For Hire Form with US Legal Forms, the most comprehensive local library of legal record layouts. Use a large number of specialist and condition-distinct layouts that satisfy your business or personal needs and demands.

Form popularity

FAQ

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

How to hire a 1099 employeeCorrectly classify the individual.Check credentials and employment history.Create a contract.Have them fill out the proper forms.Integrate into company.

IRS Tax Form 1099-NEC. As of the 2020 tax year, the IRS Form 1099-NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year. This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting income.

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.

9s and 1099s are tax forms that businesses need when working with independent contractors. Form 9 is what an independent contractor fills out and provides to the employer. Form 1099 has details on the wages an employer pays to an independent contractor. This form is filed with the IRS and state tax authorities.

All 1099 employees pay a 15.3% self-employment tax. There are two parts to this tax: 12.4% goes to Social Security and 2.9% goes to Medicare. It's your responsibility to set aside money to cover these costs as clients aren't required to withhold these taxes from your paycheck.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Companies often hire 1099 employees because they can help complete non-essential tasks quickly and allow businesses to grow and develop more easily. If you're hoping to work with independent contractors, it can be beneficial to understand their major benefits and the most efficient way to hire them.

You will need to fill out a W-9 form if you: Classify yourself as an independent contractor or freelancer. Are not a full-time employee of the business. Will be paid more than $600 for work provided to the business.

Form 1099-NEC & Independent Contractors.