Louisiana Self-Employed Travel Agent Employment Contract

Description

How to fill out Louisiana Self-Employed Travel Agent Employment Contract?

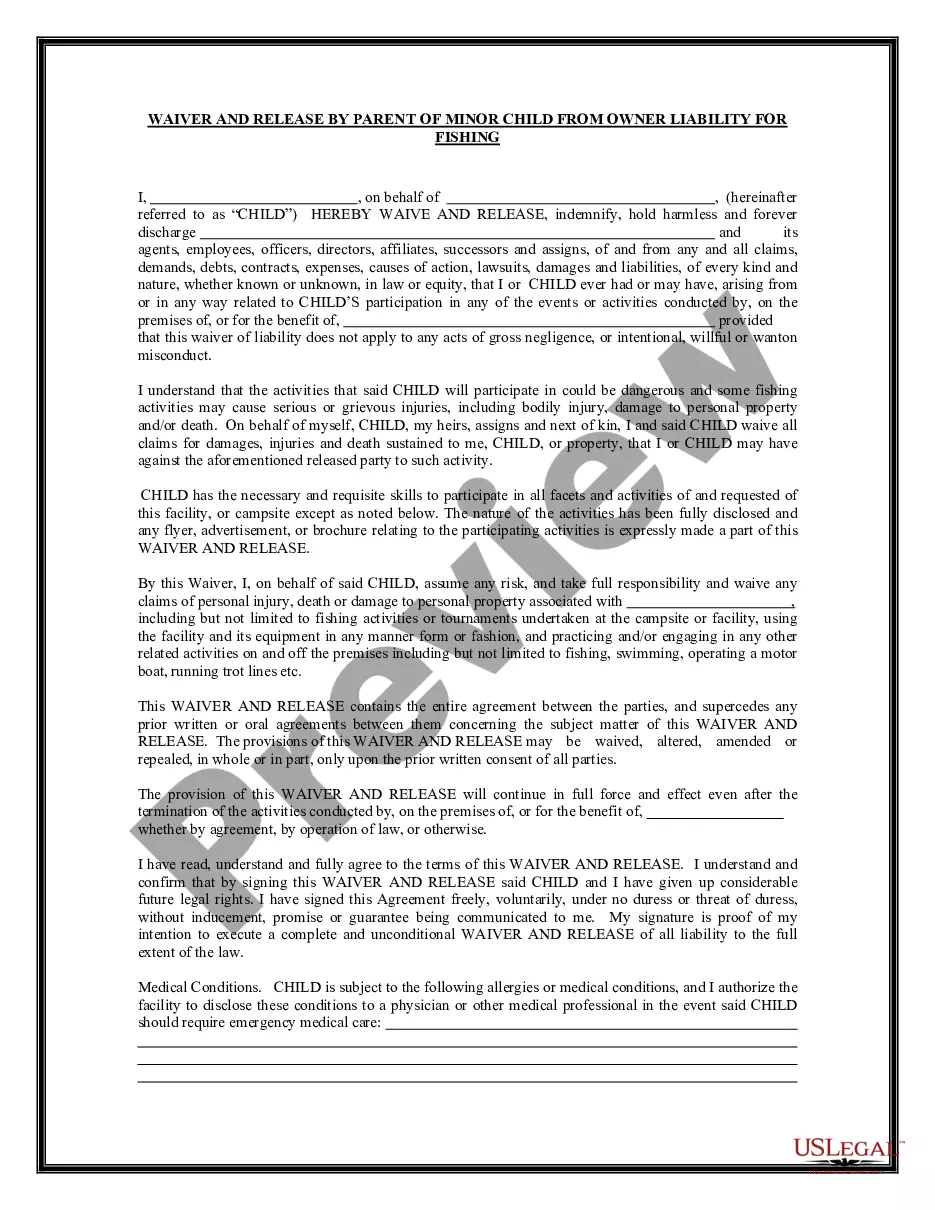

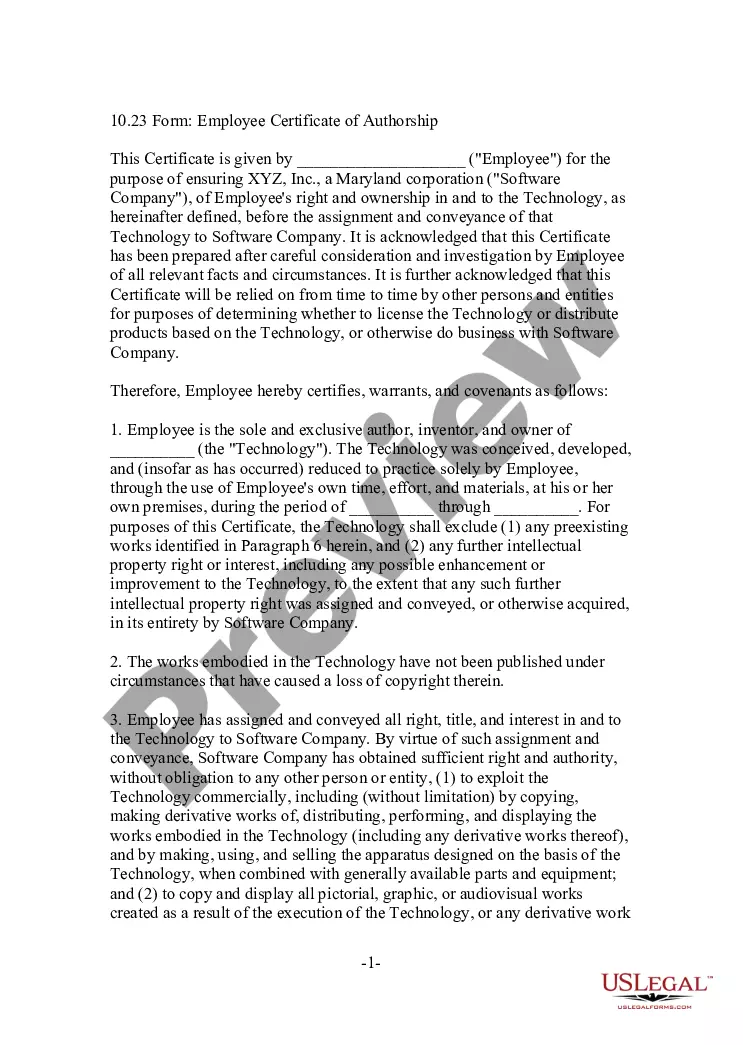

Choosing the right authorized document web template might be a struggle. Obviously, there are plenty of layouts available online, but how would you find the authorized kind you require? Make use of the US Legal Forms internet site. The support delivers a huge number of layouts, including the Louisiana Self-Employed Travel Agent Employment Contract, that you can use for business and personal demands. Each of the varieties are checked by experts and meet up with state and federal demands.

If you are previously authorized, log in for your account and then click the Acquire option to get the Louisiana Self-Employed Travel Agent Employment Contract. Utilize your account to check throughout the authorized varieties you may have purchased previously. Go to the My Forms tab of your own account and get an additional backup from the document you require.

If you are a new user of US Legal Forms, listed below are straightforward directions that you should adhere to:

- First, ensure you have chosen the appropriate kind to your metropolis/region. It is possible to check out the form while using Preview option and browse the form information to make certain it will be the right one for you.

- In case the kind is not going to meet up with your needs, make use of the Seach discipline to find the proper kind.

- When you are certain that the form is acceptable, click the Acquire now option to get the kind.

- Pick the costs strategy you want and enter in the required info. Design your account and buy the order making use of your PayPal account or credit card.

- Select the data file format and download the authorized document web template for your device.

- Comprehensive, change and print and signal the attained Louisiana Self-Employed Travel Agent Employment Contract.

US Legal Forms will be the most significant catalogue of authorized varieties in which you can discover numerous document layouts. Make use of the service to download expertly-created files that adhere to express demands.

Form popularity

FAQ

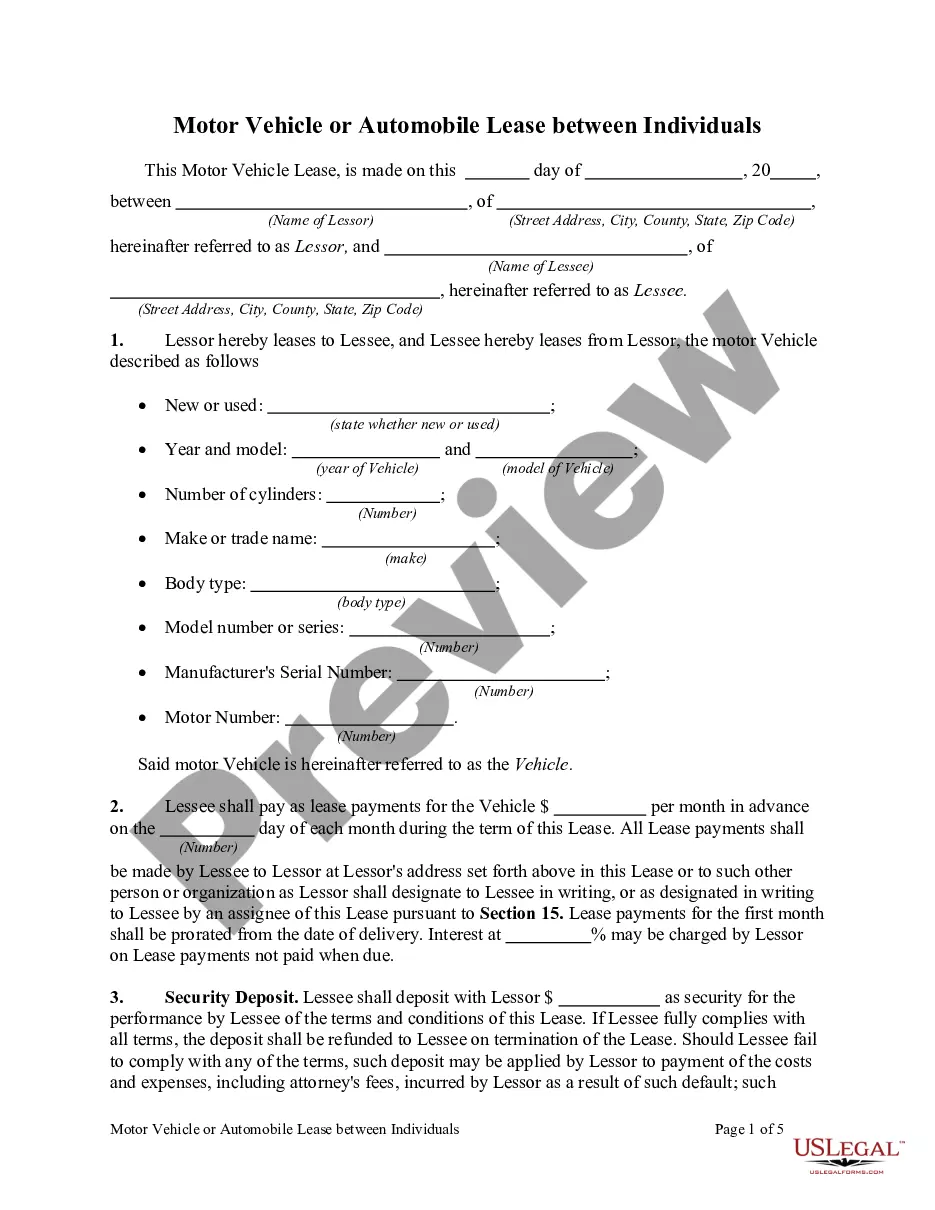

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Make sure you really qualify as an independent contractor. Choose a business name (and register it, if necessary). Get a tax registration certificate (and a vocational license, if required for your profession). Pay estimated taxes (advance payments of your income and self-employment taxes).

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Employees with a 1099 status are self-employed independent contractors. They are paid according to the terms and conditions stated in the contract and receive a 1099 form on which to report their income on their tax return.

If you have a 1099-NEC that is not self-employment income subject to self-employment taxes, you need to enter the income in Box 3 of a 1099-MISC instead of Box 1 of the 1099-NEC. If your income is not self-employment income, you do not need to use Schedule C to report business income.

Contractors (sometimes called consultants) are self-employed people engaged for a specific task at an agreed price and with a specific goal in mind, often over a set period of time. They set their own hours of work and are paid a fee for completing each set assignment.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

More info

iPhone, iPad, etc.