The Louisiana Assignment of Overriding Royalty Interest — Short Form is a legal document used in Louisiana to transfer the rights to receive overriding royalty interest (ORRIS) from one party to another. ORRIS is a percentage share of the oil and gas production revenues that is separate from the working or leasehold interest in the petroleum property. This assignment document is crucial for both the assignor, the party transferring the ORRIS, and the assignee, the party receiving the ORRIS. It details the terms and conditions of the transfer, ensuring the transaction is legally binding and protecting the rights of both parties involved. Keywords: Louisiana, Assignment of Overriding Royalty Interest, Short Form, transfer, rights, receiving, overriding royalty interest, ORRIS, oil and gas production, revenue, working interest, leasehold interest, petroleum property, terms and conditions, legally binding, parties, document. Different types of the Louisiana Assignment of Overriding Royalty Interest — Short Form may include variations based on specific circumstances or additional clauses. These adaptations could serve different purposes, such as adding specific conditions, addressing tax implications, or accommodating multiple assignors or assignees. Keywords: adaptations, specific circumstances, additional clauses, variations, specific conditions, tax implications, multiple assignors, multiple assignees. It is important to consult legal professionals to ensure the specific requirements and provisions of the Louisiana Assignment of Overriding Royalty Interest — Short Form are met according to state laws.

Louisiana Assignment of Overriding Royalty Interest - Short Form

Description

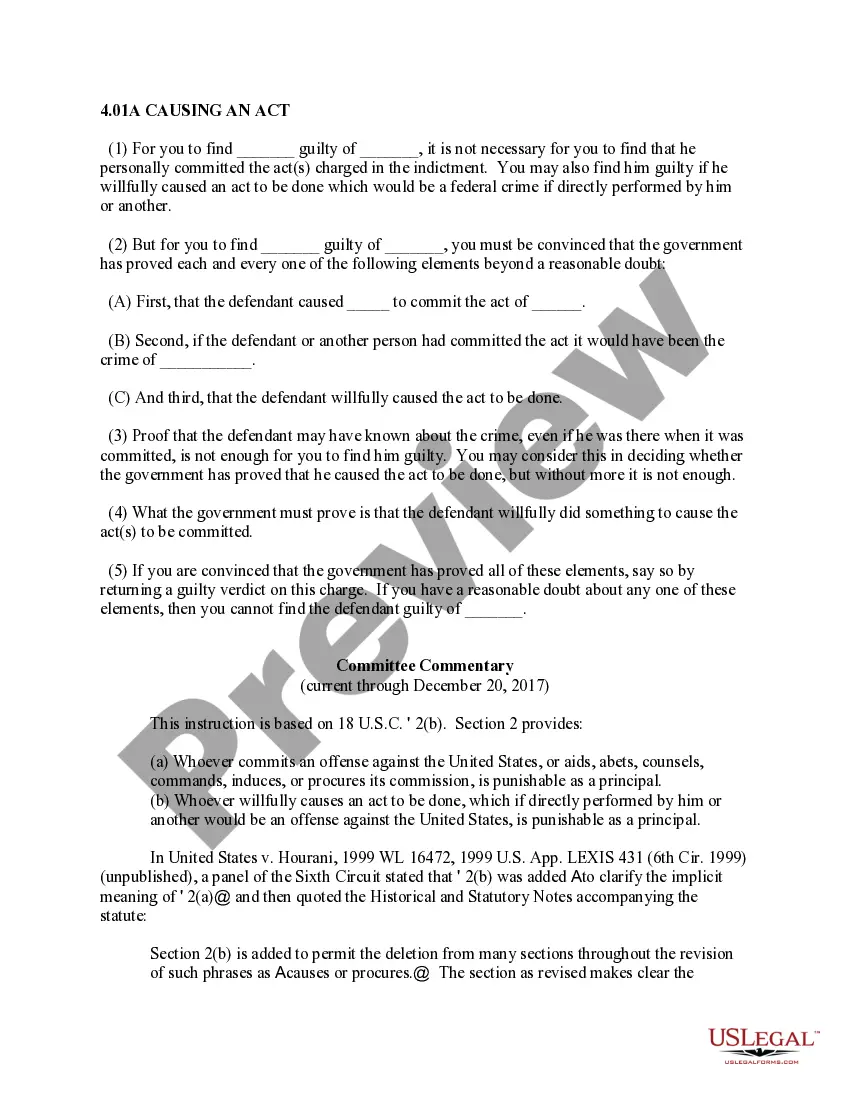

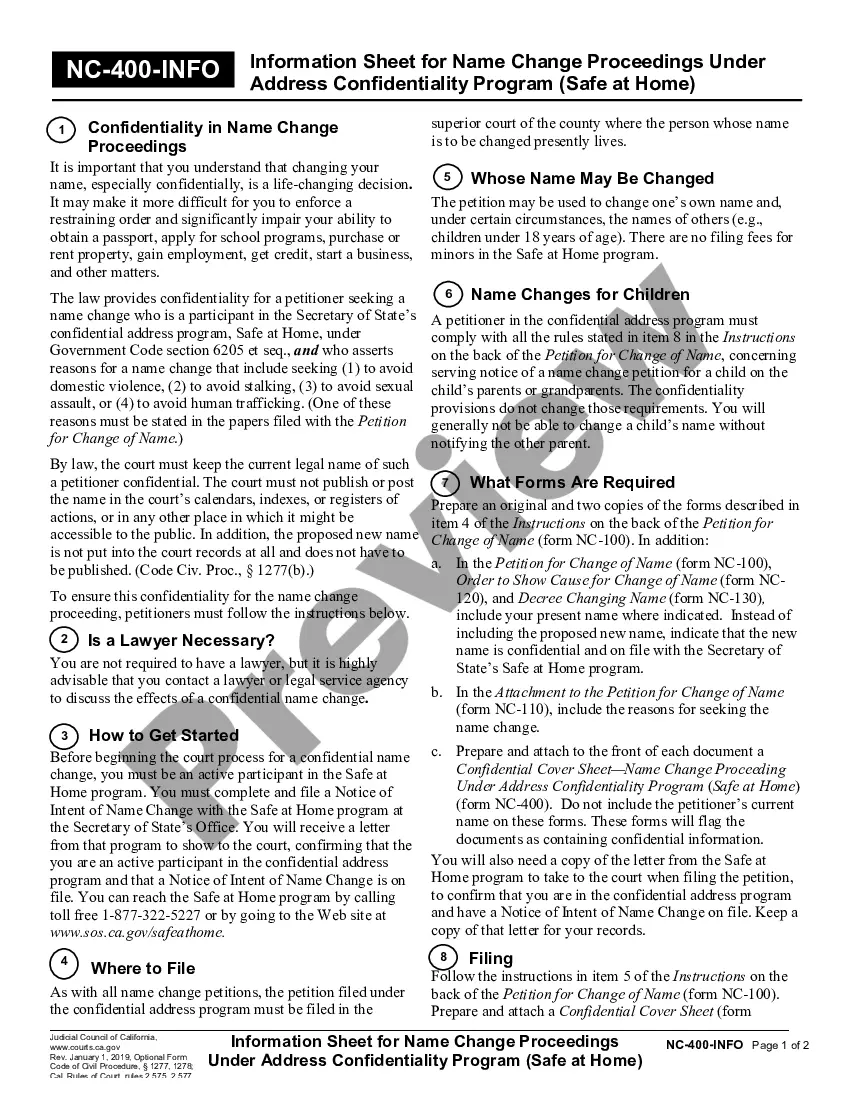

How to fill out Louisiana Assignment Of Overriding Royalty Interest - Short Form?

Discovering the right lawful record web template could be a have difficulties. Obviously, there are plenty of web templates available on the Internet, but how can you obtain the lawful kind you will need? Take advantage of the US Legal Forms website. The services provides a huge number of web templates, like the Louisiana Assignment of Overriding Royalty Interest - Short Form, which you can use for company and private demands. Every one of the kinds are checked out by specialists and meet up with state and federal needs.

If you are presently listed, log in to the profile and then click the Down load switch to have the Louisiana Assignment of Overriding Royalty Interest - Short Form. Make use of your profile to search with the lawful kinds you have bought previously. Visit the My Forms tab of your own profile and obtain yet another copy of the record you will need.

If you are a new consumer of US Legal Forms, allow me to share simple guidelines that you can stick to:

- Initially, make sure you have chosen the correct kind for the city/region. You are able to check out the shape making use of the Preview switch and study the shape description to ensure this is the best for you.

- If the kind does not meet up with your preferences, utilize the Seach field to discover the correct kind.

- Once you are positive that the shape is proper, click on the Acquire now switch to have the kind.

- Select the prices program you want and type in the required information. Design your profile and buy the order with your PayPal profile or bank card.

- Pick the submit structure and download the lawful record web template to the gadget.

- Comprehensive, change and print and indication the obtained Louisiana Assignment of Overriding Royalty Interest - Short Form.

US Legal Forms is definitely the most significant catalogue of lawful kinds for which you can find different record web templates. Take advantage of the company to download expertly-manufactured papers that stick to state needs.

Form popularity

FAQ

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

An overriding royalty interest (ORRI) is an interest carved out of a working interest. Overriding Royalty Interest (ORRI) (US) | Practical Law - Westlaw westlaw.com ? document ? Overridin... westlaw.com ? document ? Overridin...

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production. Transferring Oil and Gas Lease Interests Bureau of Land Management (.gov) ? Assignments Handout_6 Bureau of Land Management (.gov) ? Assignments Handout_6 PDF

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750. What is Overriding Royalty Interest and How to Value it? pheasantenergy.com ? overriding-royalty-in... pheasantenergy.com ? overriding-royalty-in...

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.