In Louisiana, a revocable trust agreement is a legally binding document that allows individuals, particularly married couples, known as settlers, to establish a trust for managing their assets during their lifetime and distributing them after their demise. This type of trust provides flexibility and control to the settlers while offering numerous benefits such as probate avoidance, privacy, and potential tax advantages. By creating a revocable trust agreement, the settlers can ensure seamless asset management, avoid court interference, and provide for the smooth transfer of their assets to their beneficiaries. When the settlers are husband and wife, there are different types of revocable trust agreements available in Louisiana: 1. Joint Revocable Trust Agreement (or "Joint Living Trust"): This type of trust allows both spouses to establish a single trust to hold their combined assets. As contractors, they can manage, control, and modify the trust during their joint lifetimes. After the demise of the first spouse, the surviving spouse continues to have full control over the trust's assets. Upon the death of both spouses, the trust's assets are distributed according to the provisions set forth in the trust agreement. 2. Individual Revocable Trust Agreements (or "Separate Trusts" within a Marital Property Regime): Louisiana operates under a unique legal framework called the "community property regime." Under this regime, each spouse can establish their own separate revocable trust agreement, which allows them to maintain control over their individual assets while considering the community property aspects. In these separate trusts, each spouse defines their specific beneficiaries, distribution terms, and other provisions. However, there may be provisions for sharing, dividing, or passing assets between the two trusts if desired by the spouses. 3. Testamentary Trust: Although not exclusively designed for married couples, a testamentary trust is another type of revocable trust agreement relevant for them. This trust is created through the settlers' last will and testament and comes into effect upon their death. A married couple can establish individual testamentary trusts within their respective wills, dictating how their assets will be managed and distributed after both spouses pass away. It is essential for Louisiana couples to carefully consider their unique circumstances and goals when choosing the most appropriate type of revocable trust agreement. Seeking legal advice from an experienced attorney specializing in estate planning and trust law is highly recommended navigating the complexities and ensure the trust agreement aligns with their specific needs.

Louisiana Revocable Trust Agreement when Settlors Are Husband and Wife

Description

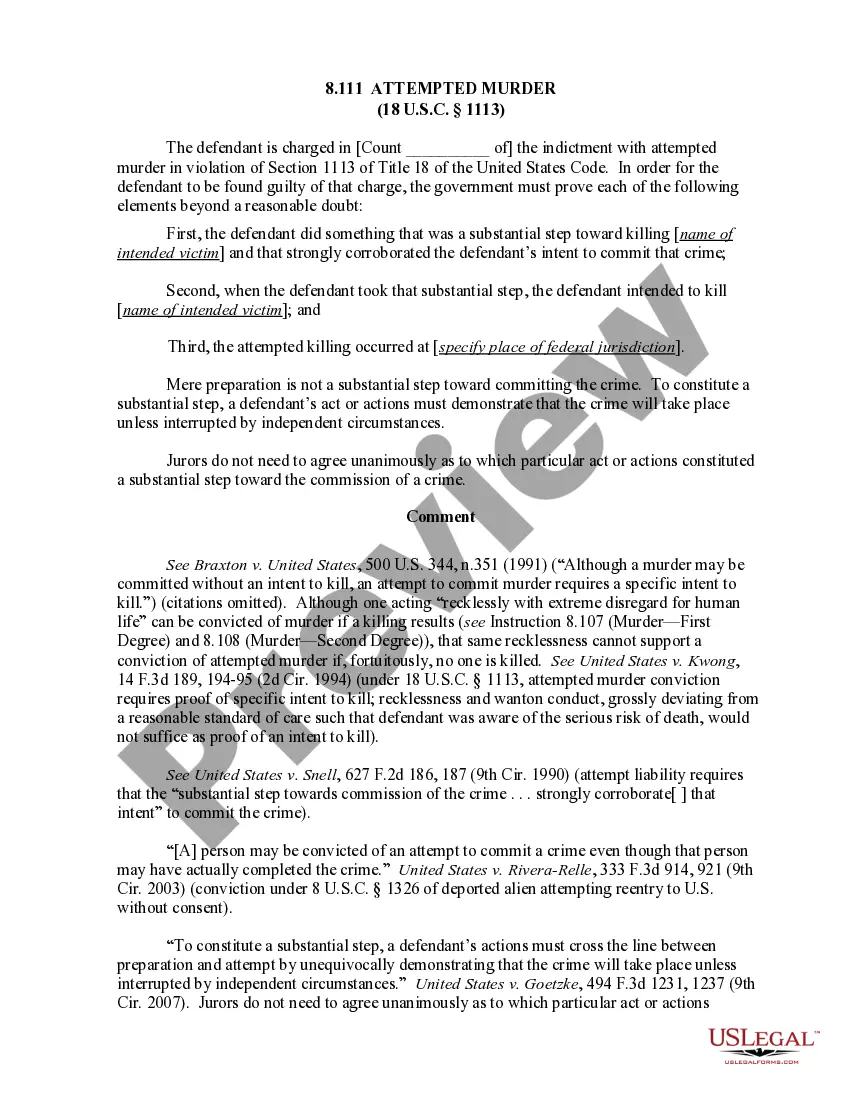

How to fill out Louisiana Revocable Trust Agreement When Settlors Are Husband And Wife?

Are you in a place in which you need paperwork for sometimes enterprise or person purposes virtually every working day? There are tons of legitimate file web templates available on the net, but locating types you can rely on is not effortless. US Legal Forms offers a large number of type web templates, like the Louisiana Revocable Trust Agreement when Settlors Are Husband and Wife, which are written to satisfy federal and state requirements.

When you are already acquainted with US Legal Forms website and have your account, basically log in. Following that, you are able to download the Louisiana Revocable Trust Agreement when Settlors Are Husband and Wife template.

Should you not provide an account and wish to start using US Legal Forms, follow these steps:

- Discover the type you require and ensure it is for the correct city/region.

- Utilize the Review button to examine the form.

- Browse the outline to actually have chosen the proper type.

- In the event the type is not what you`re looking for, use the Lookup area to find the type that suits you and requirements.

- When you get the correct type, click Buy now.

- Opt for the pricing prepare you desire, complete the necessary details to create your account, and purchase your order using your PayPal or charge card.

- Decide on a convenient file structure and download your copy.

Get every one of the file web templates you have purchased in the My Forms food list. You may get a extra copy of Louisiana Revocable Trust Agreement when Settlors Are Husband and Wife any time, if required. Just click the necessary type to download or printing the file template.

Use US Legal Forms, the most comprehensive assortment of legitimate forms, to save efforts and stay away from errors. The assistance offers appropriately created legitimate file web templates that can be used for a selection of purposes. Generate your account on US Legal Forms and begin producing your lifestyle easier.