Louisiana Release of Mortgage / Deed of Trust - Full Release

Description

How to fill out Release Of Mortgage / Deed Of Trust - Full Release?

Choosing the right authorized papers template could be a struggle. Of course, there are tons of templates available on the net, but how would you discover the authorized develop you want? Make use of the US Legal Forms website. The support provides a huge number of templates, such as the Louisiana Release of Mortgage / Deed of Trust - Full Release, which can be used for business and private requires. Each of the varieties are examined by professionals and satisfy state and federal specifications.

When you are presently authorized, log in to your accounts and then click the Obtain button to find the Louisiana Release of Mortgage / Deed of Trust - Full Release. Use your accounts to look with the authorized varieties you may have acquired formerly. Check out the My Forms tab of your respective accounts and obtain one more duplicate of the papers you want.

When you are a fresh consumer of US Legal Forms, allow me to share easy instructions that you should adhere to:

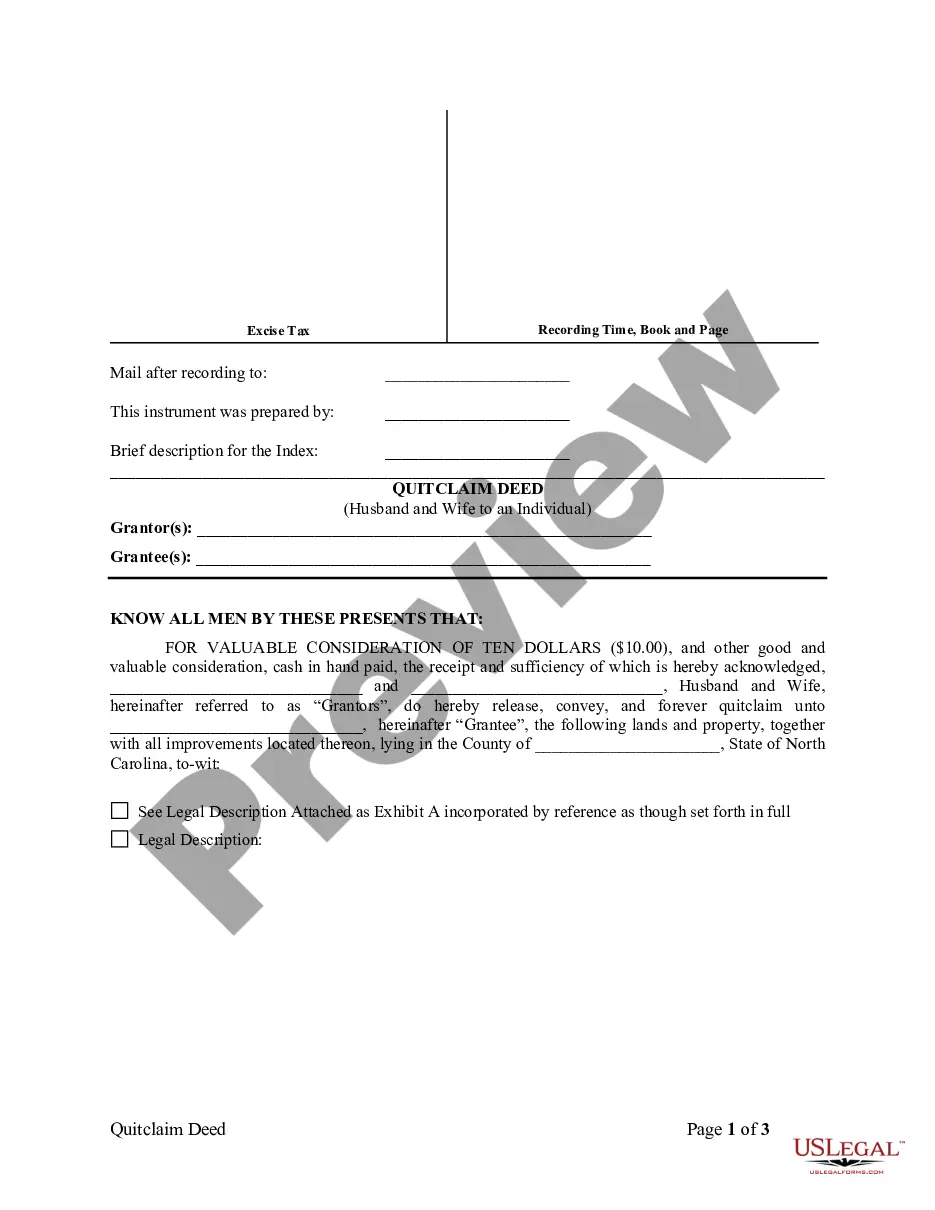

- Initially, ensure you have selected the appropriate develop for your town/county. It is possible to check out the shape making use of the Review button and study the shape outline to ensure this is the best for you.

- In case the develop will not satisfy your needs, utilize the Seach area to discover the correct develop.

- Once you are positive that the shape is proper, click the Acquire now button to find the develop.

- Choose the rates strategy you desire and enter the necessary information and facts. Make your accounts and pay for an order utilizing your PayPal accounts or bank card.

- Opt for the document formatting and down load the authorized papers template to your system.

- Comprehensive, modify and printing and indicator the acquired Louisiana Release of Mortgage / Deed of Trust - Full Release.

US Legal Forms is definitely the largest collection of authorized varieties where you can find various papers templates. Make use of the service to down load appropriately-manufactured papers that adhere to state specifications.

Form popularity

FAQ

Getting a mortgage after a Protected Trust Deed is possible. It may not occur immediately, but it certainly is possible. However, it will not be possible to obtain a re-mortgage on a home that is still in the Trust Deed, without the Trustee's permission, until they have discharged their interest.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

This release of mortgage is recorded or filed and gives notice to the world that the lien is no more. On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.

Benefits of a Mortgage Release While it may seem like throwing in the towel, a mortgage release isn't nearly as bad as a foreclosure. Knowing when to walk away can save you tons in the long run. Not to mention that mortgage releases aren't completely devoid of benefits.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

A release of mortgage, commonly known as a discharge of mortgage, is a legal document issued by the lender acknowledging that the mortgage debt is settled. It effectively releases the property from the lien, allowing homeowners clear ownership.

Print. You Release a Mortgage or Charge when the property charged has been released from the charge or no longer forms part of the company's property. You Satisfy a Mortgage or Charge when the debt of the charge has been paid or satisfied in full or part.