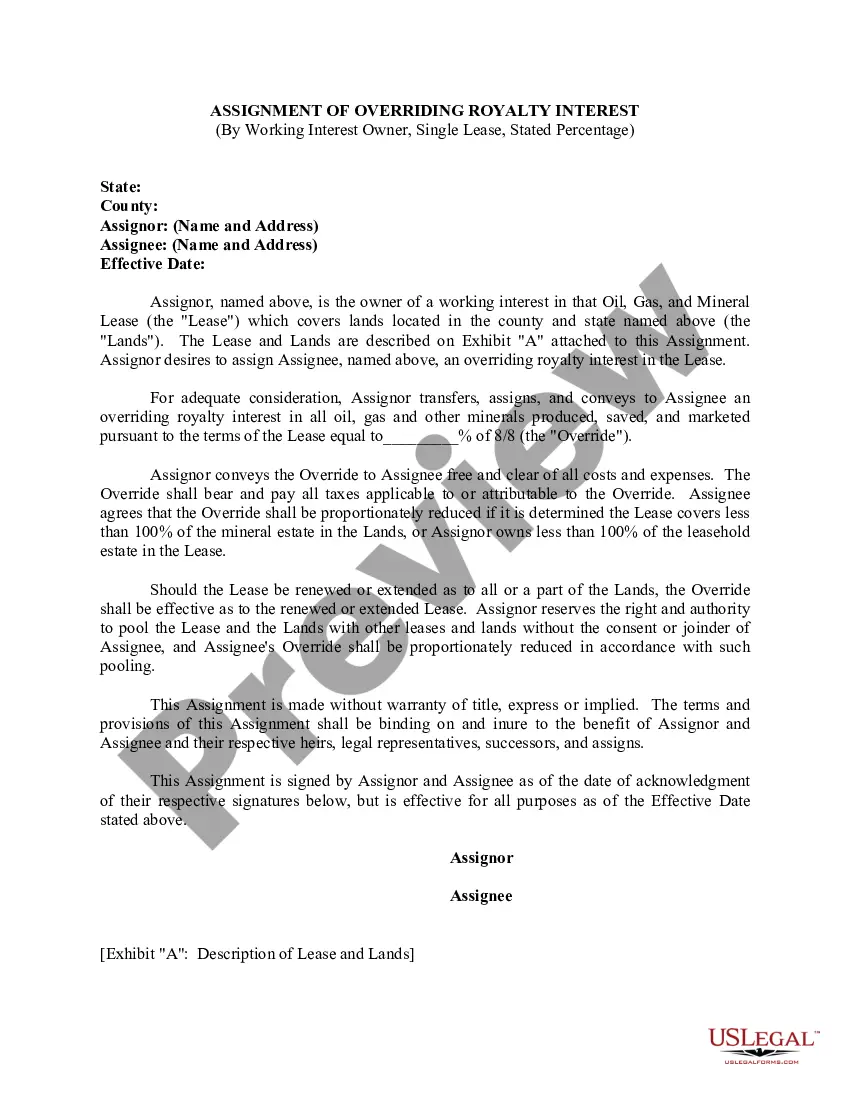

In Louisiana, an Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage is a legal document that transfers the rights to receive overriding royalty interests from the working interest owner to another party. This type of assignment is common in the oil and gas industry and is used to allocate the percentage of royalties owed to the working interest owner under a single lease agreement. The Assignment of Overriding Royalty Interest allows the working interest owner to assign a portion or full percentage of their royalty interest to another party. The assignee, who can be an individual or a company, will then become entitled to receive a portion of the royalties generated from the production of oil or gas on the leased property. This assignment is made effective by executing a written agreement that outlines the terms and conditions of the transfer. It is important to note that there may be variations in the types of Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage in Louisiana. Some common variations include: 1. Percentage Assignment: In this type of assignment, the working interest owner transfers a specified percentage of their overriding royalty interest to the assignee. The assignee will then receive the corresponding percentage of the royalties generated from the lease. 2. Partial Assignment: A partial assignment occurs when the working interest owner transfers only a portion of their overriding royalty interest to the assignee. This allows the working interest owner to retain some control and benefit from the remaining percentage of royalties. 3. Full Assignment: A full assignment involves the complete transfer of the overriding royalty interest in the working interest owner to the assignee. The assignee assumes all rights and responsibilities associated with the royalty interest, including the right to receive the full amount of royalties generated from the lease. 4. Temporary Assignment: In certain cases, a working interest owner may choose to temporarily assign their overriding royalty interest for a specified period. This temporary assignment allows the assignee to receive the royalties for a limited duration, after which the rights revert to the working interest owner. The Louisiana Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage provides a mechanism for working interest owners to transfer their royalty interests while maintaining control over the remaining interest or for assignees to acquire the right to receive a percentage of the royalties generated from the lease. It is crucial for all parties involved to carefully review the terms of the assignment agreement and consult legal professionals with expertise in Louisiana oil and gas law to ensure compliance with relevant regulations and to protect their interests.

Louisiana Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage

Description

How to fill out Louisiana Assignment Of Overriding Royalty Interest By Working Interest Owner, Single Lease, Stated Percentage?

US Legal Forms - one of many most significant libraries of legitimate varieties in the United States - gives an array of legitimate papers themes you may down load or printing. While using web site, you may get a huge number of varieties for business and personal purposes, sorted by types, claims, or keywords and phrases.You will discover the most up-to-date models of varieties like the Louisiana Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage in seconds.

If you currently have a membership, log in and down load Louisiana Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage from your US Legal Forms local library. The Acquire option can look on every type you see. You have accessibility to all previously delivered electronically varieties inside the My Forms tab of your accounts.

If you want to use US Legal Forms for the first time, allow me to share easy instructions to help you started out:

- Be sure you have picked the right type for your personal town/region. Select the Review option to review the form`s information. Read the type information to actually have selected the correct type.

- In the event the type doesn`t satisfy your demands, utilize the Lookup industry near the top of the monitor to discover the one who does.

- If you are satisfied with the shape, verify your choice by clicking on the Purchase now option. Then, opt for the prices program you favor and give your credentials to register on an accounts.

- Procedure the transaction. Make use of bank card or PayPal accounts to accomplish the transaction.

- Pick the structure and down load the shape on the product.

- Make adjustments. Fill out, revise and printing and indication the delivered electronically Louisiana Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage.

Each web template you included in your bank account lacks an expiration particular date and is your own property eternally. So, in order to down load or printing another backup, just check out the My Forms portion and then click around the type you require.

Gain access to the Louisiana Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage with US Legal Forms, the most substantial local library of legitimate papers themes. Use a huge number of professional and condition-particular themes that fulfill your business or personal demands and demands.

Form popularity

FAQ

An Overriding Royalty Interest IORRI), commonly referred to as an override, is a fractional, undivided interest granting the right to receive proceeds from the sale of oil and gas. It is not an interest in the minerals themselves, but rather in the proceeds of the sale of oil and gas.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

Overriding Royalty Interest (ORRI) ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

What Is Working Interest? Working interest is a term for a type of investment in oil and gas drilling operations in which the investor is directly liable for a portion of the ongoing costs associated with exploration, drilling, and production.

Several factors determine the value of an overriding royalty interest in a working lease. They include: Location ? A mineral interest in high producing shale basins will be more valuable. Producing Wells ? Producing wells are valued higher than non-producing wells.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.