This form is used by Claimant as notice of ownership and claim of title to additional interest of the mineral estate in lands, by having engaged in, conducted, and exercised the acts of ownership, which entitle Claimant to ownership of the additional mineral interest by limitations, under the laws of the state in which the Lands are located.

Louisiana Notice of Claimed Ownership of Mineral Interest, by Limitations

Description

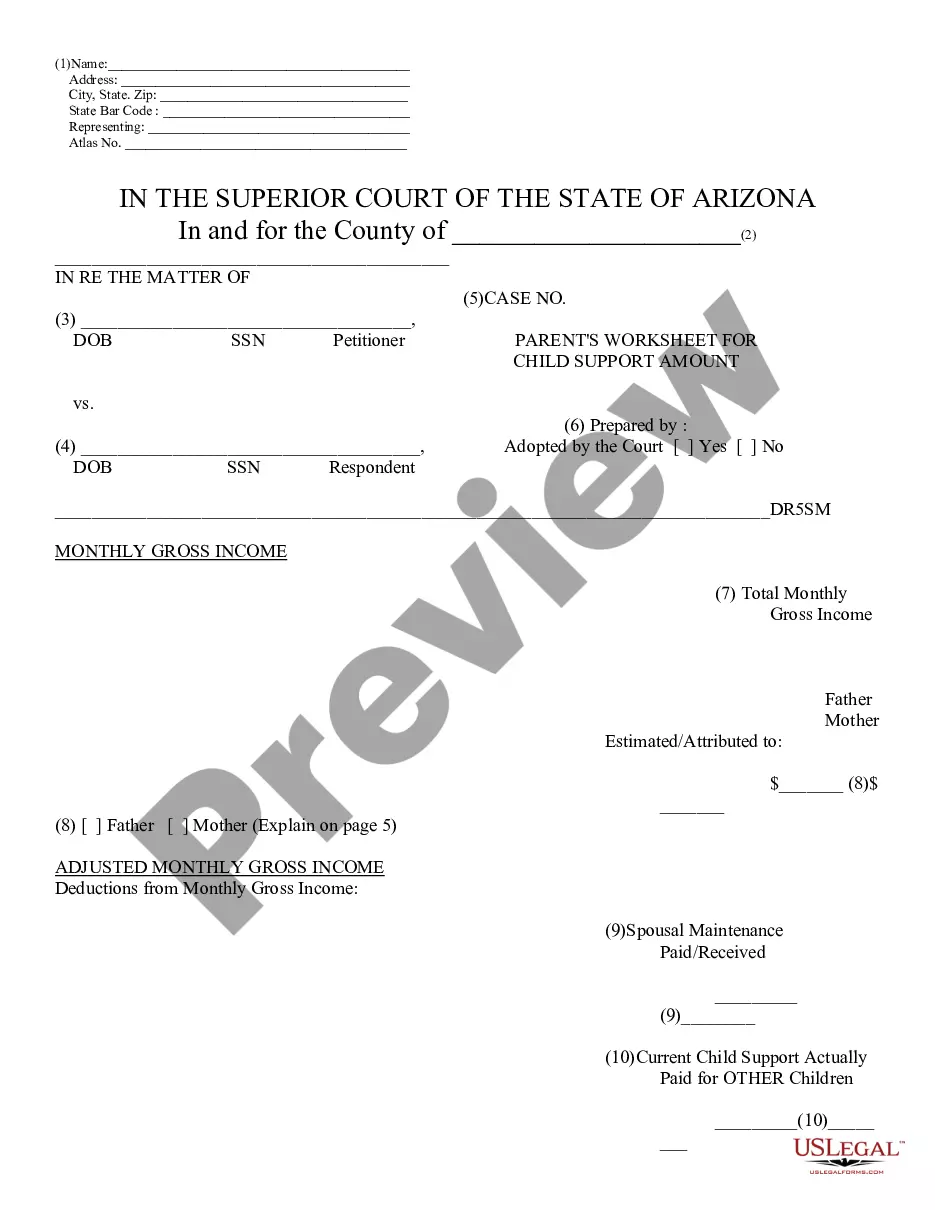

How to fill out Notice Of Claimed Ownership Of Mineral Interest, By Limitations?

You are able to devote hours on the Internet trying to find the legitimate record format that fits the state and federal requirements you want. US Legal Forms provides thousands of legitimate types which are analyzed by experts. It is possible to acquire or produce the Louisiana Notice of Claimed Ownership of Mineral Interest, by Limitations from the support.

If you have a US Legal Forms bank account, you are able to log in and then click the Acquire switch. Next, you are able to complete, change, produce, or indicator the Louisiana Notice of Claimed Ownership of Mineral Interest, by Limitations. Every legitimate record format you buy is yours for a long time. To get yet another backup of the bought develop, visit the My Forms tab and then click the related switch.

If you work with the US Legal Forms website the very first time, follow the simple directions beneath:

- Initially, make certain you have selected the proper record format for the area/town that you pick. Look at the develop description to make sure you have selected the right develop. If readily available, utilize the Preview switch to look through the record format at the same time.

- If you wish to find yet another model in the develop, utilize the Research discipline to get the format that meets your requirements and requirements.

- Once you have located the format you desire, just click Get now to continue.

- Select the pricing plan you desire, type in your accreditations, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You can use your credit card or PayPal bank account to purchase the legitimate develop.

- Select the format in the record and acquire it for your product.

- Make alterations for your record if required. You are able to complete, change and indicator and produce Louisiana Notice of Claimed Ownership of Mineral Interest, by Limitations.

Acquire and produce thousands of record layouts utilizing the US Legal Forms Internet site, which offers the greatest selection of legitimate types. Use professional and express-specific layouts to handle your organization or person requirements.

Form popularity

FAQ

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

What Are Mineral Rights? Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

However, since mineral rights are a severed portion of the land rights themselves (they're separated from the land's "surface rights" and sold separately by deed, just like the land itself), they are usually considered real property.

By statute and case law, mineral properties are taxable as real property and are subject to the same laws and appraisal methodology as all real property in the state.

In Louisiana for example, if you sell land, you may retain ownership of the minerals beneath it for a period of 10 years and one day at which time you must transfer such mineral rights to the current owner of that tract of land, but only if that owner has retained the land for the same period of time.

Selling means that you can receive a large cash payment upfront, regardless of minerals found on your land. A company who leases your land may deplete the mineral supply substantially before returning the land back to you. Selling reduces overall risk of handling mineral rights.

Mineral rights are a form of real property, and they are governed by the same principles of marital property law as other real estate. If the mineral rights were owned before marriage, they are separate property.