Louisiana Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit)

Description

How to fill out Affidavit As To Heirship Of (Name Of Person), Deceased (With Corroborating Affidavit)?

US Legal Forms - among the biggest libraries of lawful types in the States - delivers an array of lawful file templates you may obtain or produce. Using the website, you can get thousands of types for organization and specific reasons, sorted by types, says, or key phrases.You can get the most up-to-date types of types just like the Louisiana Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) in seconds.

If you have a membership, log in and obtain Louisiana Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) from the US Legal Forms catalogue. The Obtain switch can look on every kind you view. You have accessibility to all previously downloaded types from the My Forms tab of your own profile.

If you would like use US Legal Forms the very first time, listed below are easy guidelines to help you began:

- Ensure you have picked the correct kind to your metropolis/region. Click on the Review switch to review the form`s content. Look at the kind outline to ensure that you have selected the proper kind.

- When the kind doesn`t suit your specifications, take advantage of the Lookup industry on top of the display to find the the one that does.

- When you are pleased with the form, confirm your decision by simply clicking the Acquire now switch. Then, opt for the costs program you favor and give your references to sign up for the profile.

- Method the financial transaction. Use your Visa or Mastercard or PayPal profile to perform the financial transaction.

- Choose the formatting and obtain the form on the gadget.

- Make adjustments. Fill up, edit and produce and indicator the downloaded Louisiana Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit).

Each and every format you included in your bank account does not have an expiry day and it is the one you have eternally. So, in order to obtain or produce an additional copy, just visit the My Forms area and then click in the kind you need.

Gain access to the Louisiana Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) with US Legal Forms, the most comprehensive catalogue of lawful file templates. Use thousands of expert and condition-particular templates that satisfy your company or specific requires and specifications.

Form popularity

FAQ

In Louisiana, probate law is called succession law. The terms succession and estate are often used interchangeably to refer to the property that the dece- dent owned at death. This chapter outline discusses Louisiana succession law and procedures for intestate and testate successions.

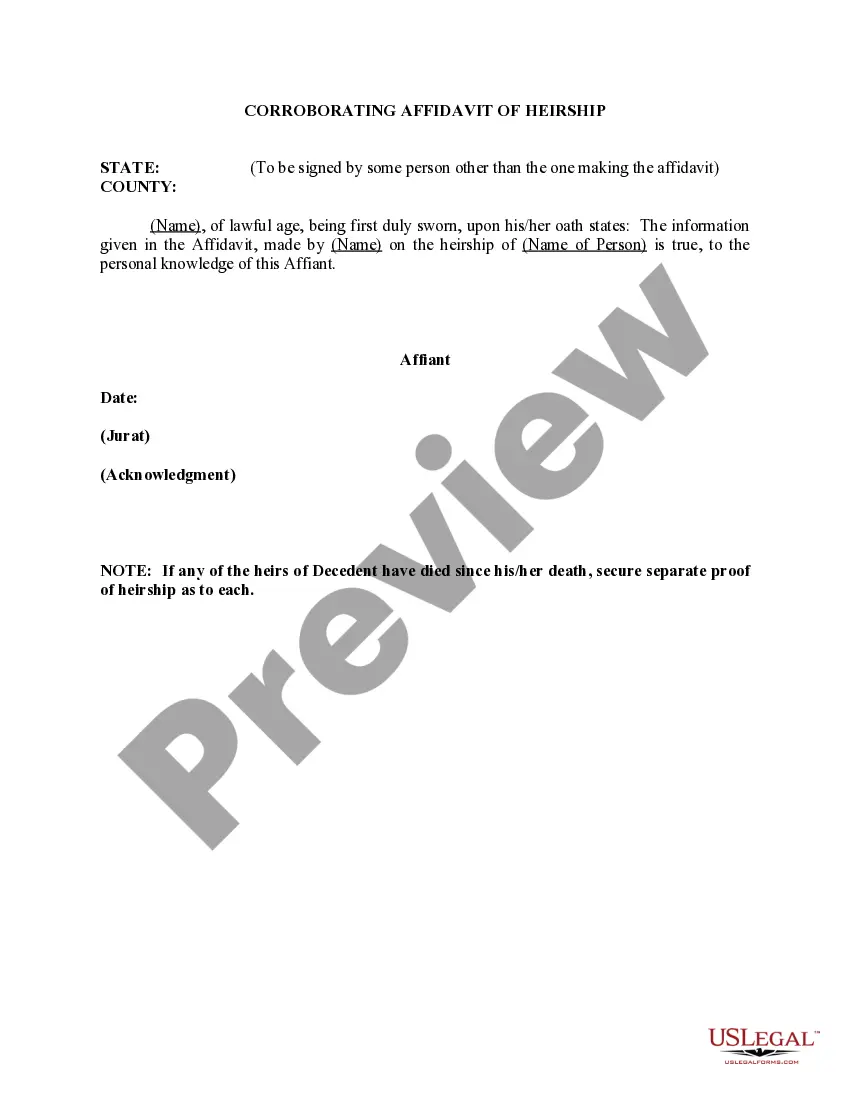

If one of the heirs is a surviving spouse and he/she wishes to transfer the vehicle to a new owner, this affidavit of heirship must be completed by him/her as well as all other heirs, but only the surviving spouse is required to execute a notarized bill of sale or act of donation.

To create the Small Succession Affidavit, you'll need the following information: The parish where you'll file the document. A filled-out and signed affidavit. The date the person died and where they were living at that time. Confirm that the person died without a will.

Understanding the Succession Process The original Last Will & Testament, if one existed. The name of the executor named in the testament. A list of heirs. An accounting of assets. Debts owed by the decedent. Bills, bank statements, and receipts that arrive after death.

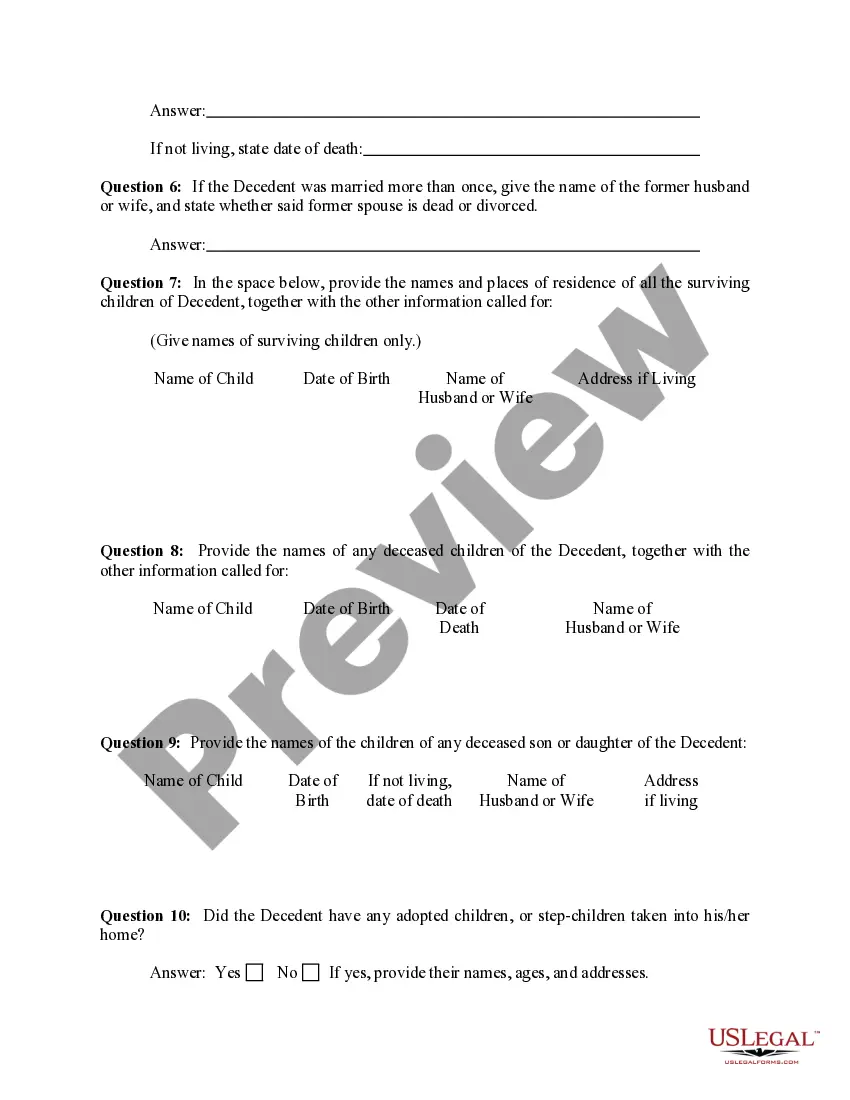

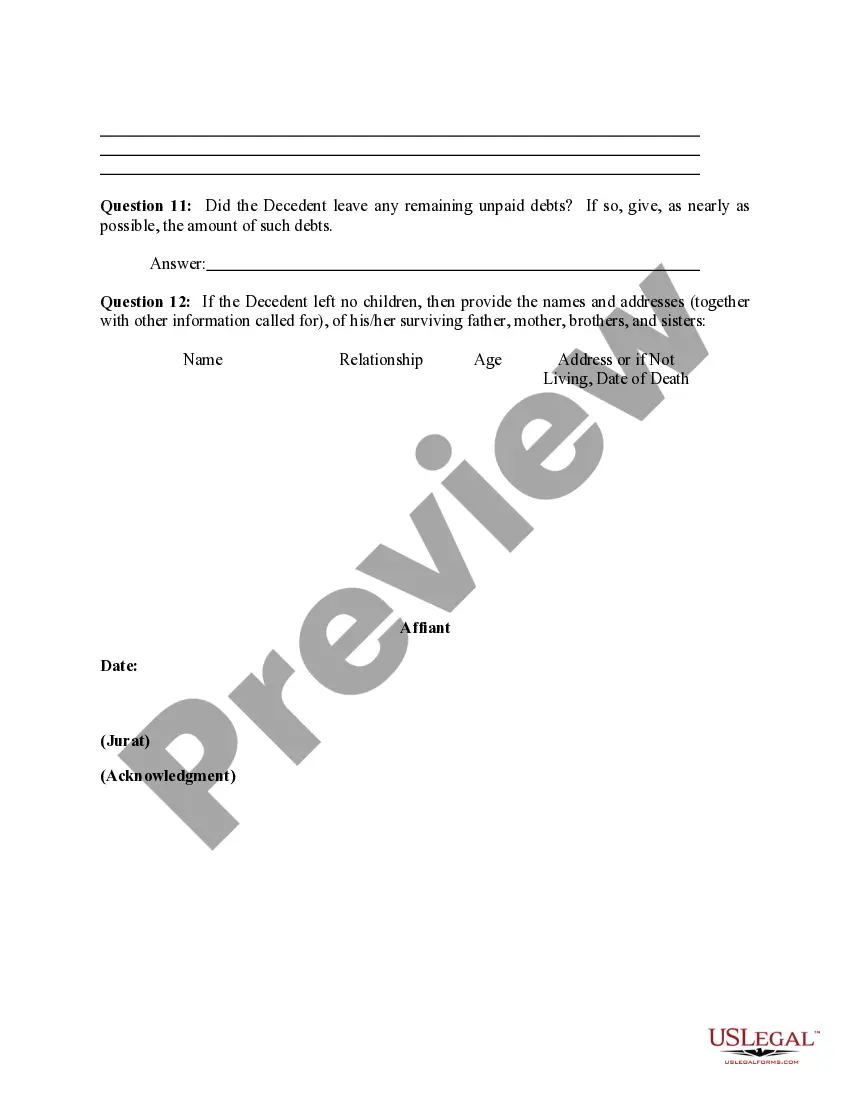

Statutory requirements for the content of the affidavit include the decedent's date of death and his address of primary residence at the time of death; a statement that the decedent died intestate; the martial status at the time of death and the surviving spouse's last-known residence, if applicable.

The purpose of succession is to give clear or marketable title to the deceased person's assets. After the succession process is complete, the individuals or organizations that end up with the assets can sell them, take out loans against them, and otherwise freely deal with the assets.

This document will set out the facts of the decedent's death, his marriage or marriages, divorces, and any children born either of the marriage or adopted, and a general description of the type of assets in the succession and the debts that were left by the succession. It should also name the list of potential heirs.

For simple successions, court costs can range from $300.00 to $600.00 depending on the parish where the succession will be filed. When an administration is needed for an estate, court costs will be higher depending on the filings necessary to complete the administration and can range from $1,500.00 up to $3,000.00.