The Louisiana Form of Parent Guaranty is a legal document used to provide financial security for a variety of obligations and liabilities that may arise in a business or contractual relationship. This detailed description will outline the purpose, features, and different types of Louisiana Form of Parent Guaranty, incorporating relevant keywords. The Louisiana Form of Parent Guaranty is primarily used when a parent company guarantees the performance, obligations, or payment of its subsidiary or affiliated company. This legal agreement ensures that the parent company will act as a guarantor, assuming responsibility for fulfilling any contractual obligations or liabilities in the event that the subsidiary or affiliate fails to do so. Keywords: Louisiana Form of Parent Guaranty, legal document, financial security, obligations, liabilities, business relationship, contractual relationship, parent company, subsidiary, affiliated company, guarantees, performance, payment, contractual obligations, contractual liabilities, guarantor, legal agreement. Different Types of Louisiana Form of Parent Guaranty: 1. Full Guaranty: In a Full Guaranty, the parent company unconditionally guarantees the subsidiary or affiliated company's obligations and liabilities, assuming full responsibility without any limitations or exceptions. This type of guaranty offers maximum financial security to the beneficiary. Keywords: Full Guaranty, unconditional guarantee, maximum financial security. 2. Limited Guaranty: A Limited Guaranty imposes certain limitations and conditions on the parent company's guarantee. These limitations can include a cap or limit on the amount guaranteed, specific obligations covered by the guaranty, or a time limitation on the duration of the guaranty. Keywords: Limited Guaranty, limitations, conditions, cap, limit, specific obligations, time limitation. 3. Continuous Guaranty: A Continuous Guaranty remains in effect until it is revoked or terminated by the guarantor or by agreement between the parties involved. This type of guaranty provides ongoing financial support and assurance to the beneficiary, covering both existing and future obligations or liabilities. Keywords: Continuous Guaranty, ongoing, revoked, terminated, financial support, assurance, existing obligations, future obligations, liabilities. 4. Specific Performance Guaranty: A Specific Performance Guaranty is used when the beneficiary requires the parent company to guarantee the performance of specific obligations or contractual terms by the subsidiary or affiliated company. This type of guaranty focuses on ensuring the timely and satisfactory completion of predetermined obligations. Keywords: Specific Performance Guaranty, specific obligations, contractual terms, performance guarantee, timely completion, satisfactory completion. 5. Payment Guaranty: A Payment Guaranty places the parent company as the guarantor for the subsidiary or affiliated company's payment obligations. This type of guaranty ensures that the beneficiary will receive the full payment amount owed under the terms of the underlying contract. Keywords: Payment Guaranty, payment obligations, full payment amount, underlying contract, guarantee. In conclusion, the Louisiana Form of Parent Guaranty is a legal document that provides financial security for obligations and liabilities in business or contractual relationships. It encompasses various types such as Full Guaranty, Limited Guaranty, Continuous Guaranty, Specific Performance Guaranty, and Payment Guaranty. Each type offers different levels of financial protection and serves specific purposes based on the needs and requirements of the parties involved.

Louisiana Form of Parent Guaranty

Description

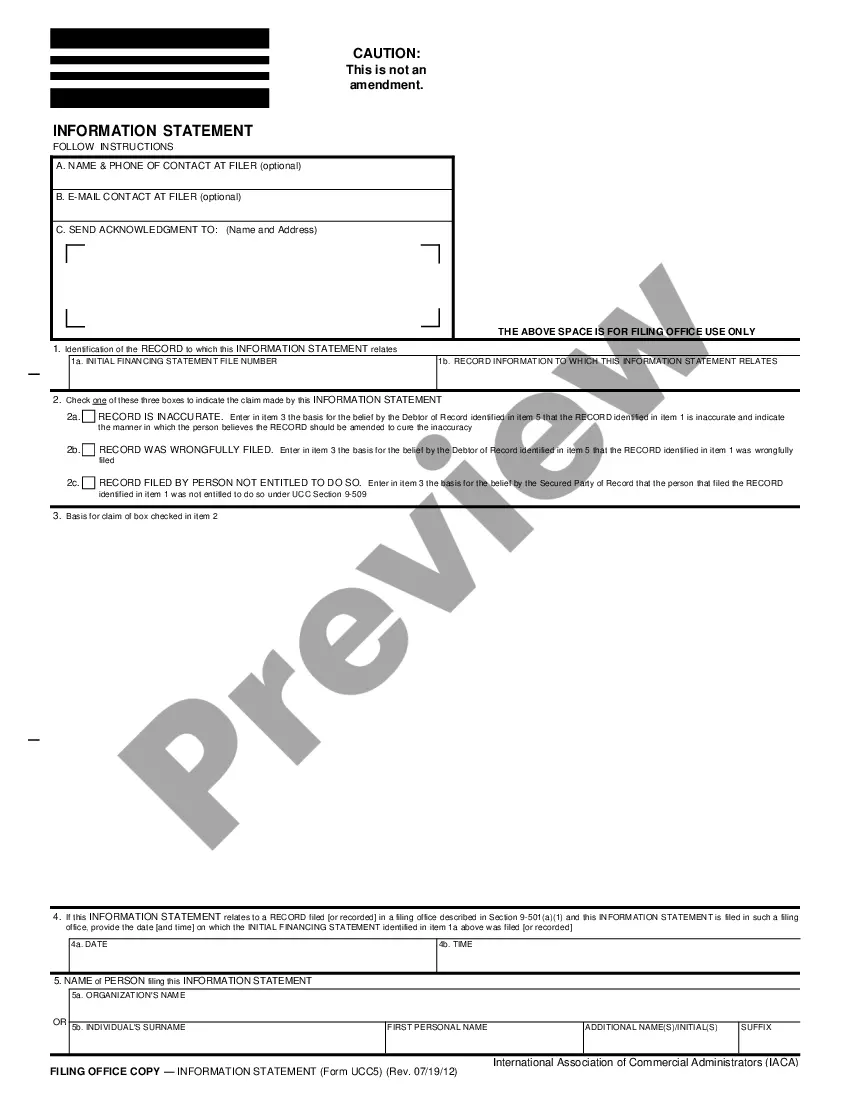

How to fill out Form Of Parent Guaranty?

US Legal Forms - one of several biggest libraries of authorized varieties in America - delivers a wide array of authorized document themes you are able to download or produce. Using the website, you can find 1000s of varieties for company and individual uses, categorized by groups, claims, or key phrases.You will find the newest variations of varieties like the Louisiana Form of Parent Guaranty in seconds.

If you have a registration, log in and download Louisiana Form of Parent Guaranty in the US Legal Forms collection. The Download option can look on each form you see. You have access to all previously delivered electronically varieties within the My Forms tab of the profile.

If you would like use US Legal Forms the very first time, here are straightforward instructions to help you started off:

- Be sure to have selected the best form for your personal area/region. Select the Preview option to analyze the form`s content. Read the form explanation to ensure that you have chosen the right form.

- If the form doesn`t match your demands, use the Look for discipline towards the top of the screen to discover the the one that does.

- When you are pleased with the form, affirm your selection by clicking on the Buy now option. Then, select the costs prepare you favor and offer your references to sign up for an profile.

- Process the purchase. Use your charge card or PayPal profile to complete the purchase.

- Find the structure and download the form on your own system.

- Make modifications. Fill up, change and produce and sign the delivered electronically Louisiana Form of Parent Guaranty.

Each web template you put into your account does not have an expiry time and is the one you have permanently. So, if you wish to download or produce yet another copy, just visit the My Forms area and click in the form you want.

Get access to the Louisiana Form of Parent Guaranty with US Legal Forms, one of the most comprehensive collection of authorized document themes. Use 1000s of professional and condition-certain themes that satisfy your small business or individual requires and demands.

Form popularity

FAQ

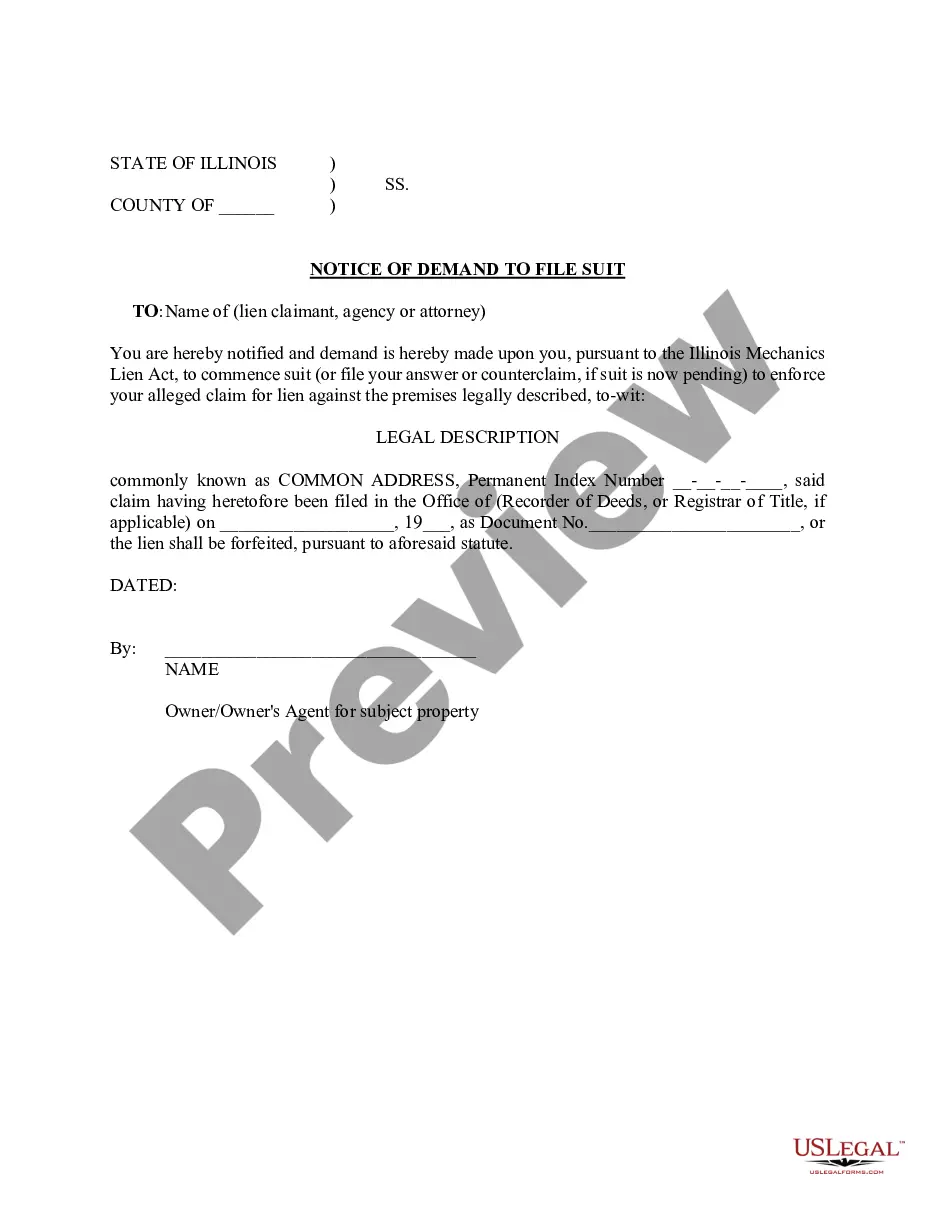

A form of guaranty whereby a parent, as guarantor, assumes the responsibility for the payment or performance of an action or obligation of its subsidiary by agreeing to compensate the beneficiary in the event of such non-payment or performance.

Unlike a personal check that can bounce, both a cashier's check and a money order offer a more guaranteed form of payment ? although the two are not identical.

Payment guarantee - What is a payment guarantee? A payment guarantee provides the beneficiary with financial security should the applicant fail to make payment for the goods or services supplied.

The Guarantee Agreement Form Using a guarantee agreement form formalizes your agreement by setting out the terms under which you will provide financial backing for the repayment of a loan or debt. This assures that a lease or mortgage will be paid or credit card charges paid off.

Definition. The form of payment guarantee controls how the payment of a sales document item is guaranteed. In Risk Management for Receivables you can use both credit management as well as the following forms of payment guarantee: Financial documentary payments (for example, letters of credits or documentary collection) ...

Traditionally, a distinction is made between: Real guarantees relating to assets having an intrinsic value. Personal guarantees involving a debt obligation for one or more people. Moral guarantees that do not provide the lender with any real legal security.

A Guaranty Agreement is a contract that outlines your role in the process. It supports the obligation of a borrower to a lender; in the primary contract the borrower agrees to provide the lender with something of value, like money or goods and services.