The Louisiana State of Delaware Limited Partnership Tax Notice is an important document that outlines the tax obligations and requirements for limited partnerships registered in Delaware but doing business or generating income in Louisiana. It serves as a formal communication from the Louisiana Department of Revenue (DR) to notify partnership entities of their tax liabilities and deadlines. Partnerships performing business activities in Louisiana must abide by the state's tax laws and regulations, regardless of where they are registered. The Louisiana State of Delaware Limited Partnership Tax Notice provides detailed information on the reporting, filing, and payment of various taxes, ensuring compliance with state tax codes. The notice typically specifies the types of taxes applicable to limited partnerships, which may include income tax, franchise tax, sales tax, and withholding tax. Each tax category has its specific set of rules and obligations that partnerships must follow. Non-compliance can result in penalties and interest charges. Different types of Louisiana State of Delaware Limited Partnership Tax Notices may be issued based on the specific tax liabilities of a partnership. These notices can include: 1. Income Tax Notice: This notice pertains to the reporting and payment of income tax for limited partnerships operating in Louisiana. It outlines the guidelines for calculations, exemptions, and deductions applicable to partnership income. 2. Franchise Tax Notice: Limited partnerships that are subject to Louisiana's franchise tax will receive this notice. It elaborates on the filing requirements, tax rates, and deadlines associated with franchise tax, which is based on the partnership's net worth. 3. Sales Tax Notice: Partnership entities engaged in selling taxable goods or services in Louisiana are required to collect and remit sales tax. The sales tax notice provides information on registering for sales tax permits, filing sales tax returns, and collecting and reporting sales tax amounts. 4. Withholding Tax Notice: A notice specific to partnerships that have employees or engage independent contractors in Louisiana. It highlights the requirements for withholding and remitting state income tax from employee wages or contractor payments. In conclusion, the Louisiana State of Delaware Limited Partnership Tax Notice is a comprehensive communication from the DR, which informs limited partnerships registered in Delaware of their tax responsibilities in Louisiana. By following the guidelines outlined in the notice, partnerships can ensure compliance with state tax laws, avoid penalties, and effectively manage their tax obligations.

Louisiana State of Delaware Limited Partnership Tax Notice

Description

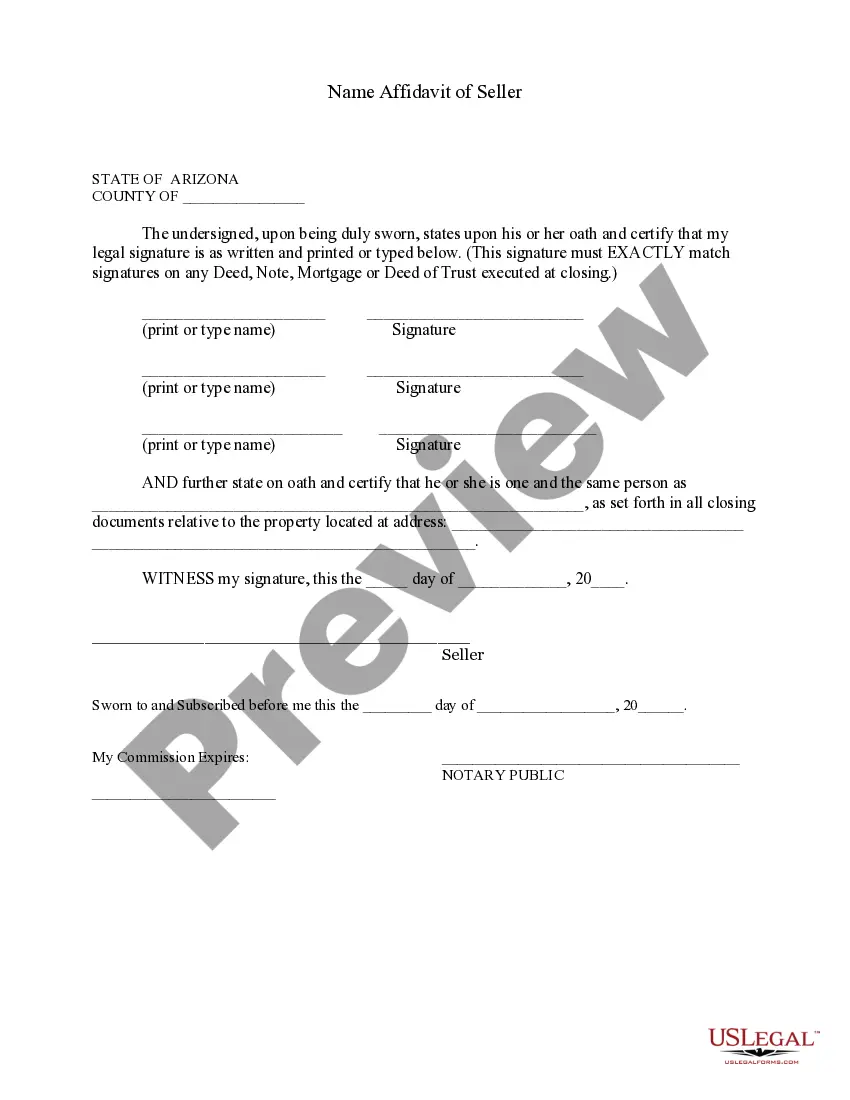

How to fill out Louisiana State Of Delaware Limited Partnership Tax Notice?

US Legal Forms - one of many most significant libraries of authorized kinds in the States - delivers a variety of authorized record themes you are able to acquire or printing. While using internet site, you can get a huge number of kinds for organization and person reasons, categorized by categories, says, or keywords.You can get the latest types of kinds such as the Louisiana State of Delaware Limited Partnership Tax Notice in seconds.

If you currently have a monthly subscription, log in and acquire Louisiana State of Delaware Limited Partnership Tax Notice from the US Legal Forms catalogue. The Acquire button will appear on every develop you look at. You have access to all formerly downloaded kinds within the My Forms tab of the accounts.

If you wish to use US Legal Forms the first time, allow me to share simple instructions to get you started out:

- Ensure you have picked out the proper develop for your metropolis/state. Click on the Preview button to examine the form`s information. See the develop description to actually have chosen the proper develop.

- In case the develop does not suit your needs, make use of the Look for field on top of the display to obtain the one which does.

- In case you are content with the form, validate your option by clicking on the Buy now button. Then, pick the costs prepare you want and give your accreditations to sign up for an accounts.

- Approach the deal. Make use of your Visa or Mastercard or PayPal accounts to finish the deal.

- Find the format and acquire the form in your gadget.

- Make modifications. Complete, revise and printing and sign the downloaded Louisiana State of Delaware Limited Partnership Tax Notice.

Every single template you included in your account does not have an expiry particular date and is also your own property permanently. So, if you want to acquire or printing yet another version, just proceed to the My Forms area and click on around the develop you need.

Gain access to the Louisiana State of Delaware Limited Partnership Tax Notice with US Legal Forms, the most considerable catalogue of authorized record themes. Use a huge number of expert and condition-distinct themes that meet up with your organization or person requirements and needs.