Louisiana Complaint Regarding Insurer's Failure to Pay Claim: A Detailed Description If you reside in Louisiana and have encountered an issue where your insurance claim has been denied or left unpaid by your insurer, you have the option to file a complaint with the appropriate authorities. This complaint serves as a legal recourse to address your grievances and seek resolution for the insurer's failure to fulfill their obligations. There are several types of complaints that individuals in Louisiana can file against insurers for failure to pay claims, including: 1. Unfair Claims Settlement Practices Complaint: This type of complaint is filed when an insurance company engages in unfair practices during the handling of a claim. It may involve the insurer's deliberate delay, low-ball offers, denial without proper justification, excessive requests for documentation, or failure to provide reasonable explanations for claim denials. Unfair claims settlement practices are regulated under Louisiana Revised Statutes, particularly Title 22, Section 1961. 2. Bad Faith Complaint: A bad faith complaint is filed when an insurance company knowingly and intentionally denies or delays payment of a claim without any reasonable basis. It alleges that the insurer did not act in good faith and fair dealing, which is a breach of their duty owed to policyholders. Breach of contract laws, as well as other applicable statutes and regulations, govern bad faith claims in Louisiana. 3. Breach of Contract Complaint: If an insurer has failed to honor the terms and conditions agreed upon in the insurance policy contract, a breach of contract complaint can be filed. This complaint asserts that the insurer has violated their contractual obligations by refusing to pay a valid claim or failing to provide proper compensation for losses covered by the policy. When filing a complaint, it is crucial to gather evidence that supports your claim, such as copies of relevant documents (insurance policy, correspondence with the insurer, claim forms, receipts, etc.), photographs, witness statements, and any other information that demonstrates the insurer's failure to pay the claim. To initiate the complaint process, you must submit a written complaint to the Louisiana Department of Insurance (LD) detailing the facts of the case, relevant dates, names of involved parties, policy information, and a clear explanation of why you believe the insurer has failed to pay the claim. Be sure to include any supporting documentation as well. It is advisable to consult with an attorney specializing in insurance law to ensure you navigate the complaint process effectively. They can provide guidance, review your case, and assist in preparing a comprehensive complaint that covers all necessary details and legal requirements. Remember that each type of complaint mentioned above has its unique legal considerations and potential remedies. Seeking legal advice will help you understand the specific steps required to pursue your complaint and increase the likelihood of achieving a favorable outcome.

Louisiana Complaint regarding Insurer's Failure to Pay Claim

Description

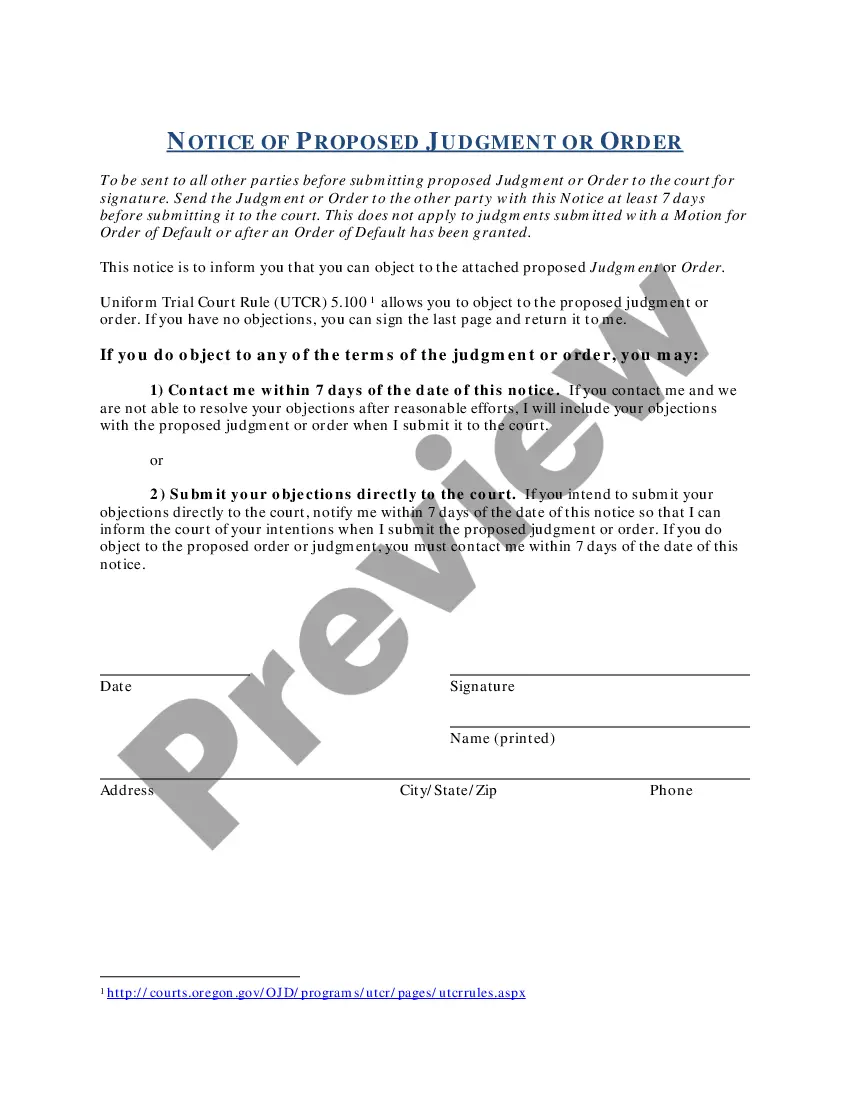

How to fill out Louisiana Complaint Regarding Insurer's Failure To Pay Claim?

Discovering the right legitimate file design can be a battle. Of course, there are tons of layouts accessible on the Internet, but how will you discover the legitimate develop you want? Make use of the US Legal Forms internet site. The support gives thousands of layouts, including the Louisiana Complaint regarding Insurer's Failure to Pay Claim, which you can use for company and personal demands. Each of the varieties are examined by pros and fulfill federal and state specifications.

When you are previously listed, log in for your profile and then click the Download key to obtain the Louisiana Complaint regarding Insurer's Failure to Pay Claim. Make use of profile to check through the legitimate varieties you possess ordered formerly. Check out the My Forms tab of the profile and acquire an additional copy of your file you want.

When you are a fresh consumer of US Legal Forms, allow me to share straightforward directions that you can adhere to:

- Initial, make certain you have chosen the appropriate develop for your personal town/state. You can look over the form utilizing the Preview key and look at the form explanation to guarantee it is the right one for you.

- In case the develop fails to fulfill your expectations, utilize the Seach area to find the correct develop.

- Once you are sure that the form is proper, select the Get now key to obtain the develop.

- Pick the prices program you would like and enter the necessary information and facts. Design your profile and buy your order using your PayPal profile or bank card.

- Choose the file structure and acquire the legitimate file design for your system.

- Total, edit and print out and sign the attained Louisiana Complaint regarding Insurer's Failure to Pay Claim.

US Legal Forms is definitely the most significant collection of legitimate varieties in which you can see numerous file layouts. Make use of the service to acquire professionally-manufactured paperwork that adhere to state specifications.

Form popularity

FAQ

Be honest and straightforward Write to the point, and in clear language. Do not include subjective opinions, except to the effect that your expectations were higher - for example, that you would have expected a better service from such a prominent company, or the product to be free of faults.

Information To Include in Your Letter Give the basics. Tell your story. Tell the company how you want to resolve the problem. Be reasonable. File your complaint. Your Address. Your City, State, Zip Code. [Your email address, if sending by email] Date.

Insurance companies have 30 days to settle claims in Louisiana after they have received satisfactory proof of loss. They are also required to start the process of investigating a claim 14 days after receiving this proof of loss.

How to write an effective complaint letter Be clear and concise. ... State exactly what you want done and how long you're willing to wait for a response. ... Don't write an angry, sarcastic, or threatening letter. ... Include copies of relevant documents, like receipts, work orders, and warranties.

State what you feel should be done about the problem and how long you are willing to wait to get the problem resolved. Make sure that you are reasonable in requesting a specific action. Include copies of any documents regarding your problem, such as receipts, warranties, repair orders, contracts and so forth.

While this jurisdiction has been somewhat eroded by subsequent federal laws and jurisprudence, insurance remains a business primarily regulated by the states. Louisiana's commissioner of insurance is a constitutional office that was created in 1960.

As a regulator, the LDI enforces the laws that provide a fair and stable marketplace with transparent rules so one insurer does not have an unfair competitive advantage over other insurers. The LDI also works to make certain that insurers comply with all the laws in place to protect policyholders.

To write a complaint letter, you can start with the sender's address followed by the date, the receiver's address, the subject, salutation, body of the letter, complimentary closing, signature and name in block letters. Body of the Letter explaining the reason for your letter and the complaint.