This is a "Right of First Refusal and Co-Sale Agreement." It is entered into by the corporation and the purchasers of preferred stock. It gives the company and the purchasers of preferred stock certain rights of refusal and options upon the transfer of stock.

Louisiana Right of First Refusal and Co-Sale Agreement

Description

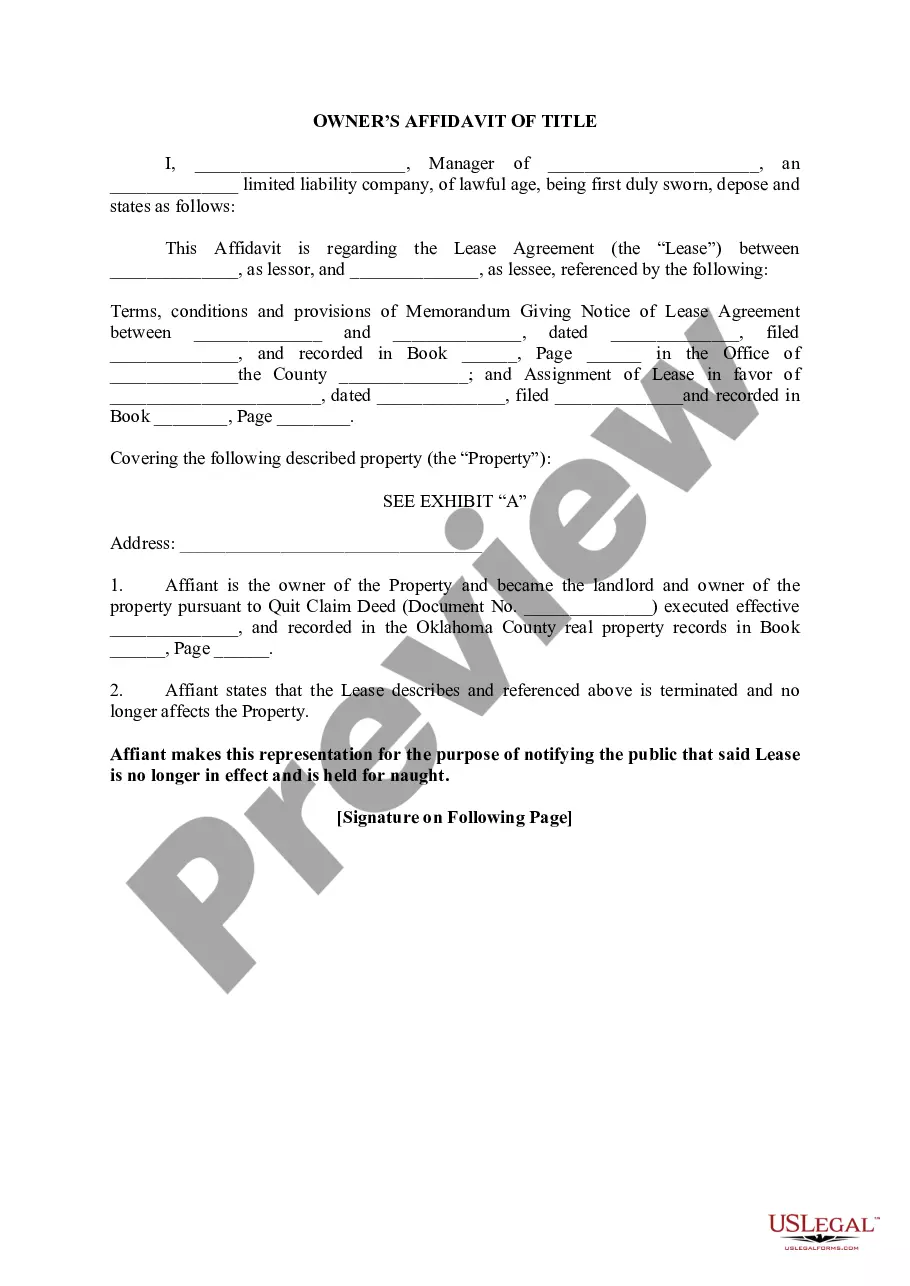

How to fill out Right Of First Refusal And Co-Sale Agreement?

Finding the right lawful file template might be a struggle. Needless to say, there are tons of web templates available online, but how would you obtain the lawful type you want? Utilize the US Legal Forms website. The services provides a large number of web templates, like the Louisiana Right of First Refusal and Co-Sale Agreement, which you can use for business and private needs. All of the forms are checked out by experts and satisfy federal and state needs.

Should you be currently authorized, log in for your bank account and click on the Acquire button to get the Louisiana Right of First Refusal and Co-Sale Agreement. Make use of bank account to check through the lawful forms you may have acquired previously. Go to the My Forms tab of the bank account and obtain an additional version of your file you want.

Should you be a new consumer of US Legal Forms, allow me to share straightforward guidelines so that you can stick to:

- Initial, be sure you have chosen the right type to your area/region. It is possible to check out the form using the Review button and study the form description to ensure it is the best for you.

- In case the type is not going to satisfy your needs, utilize the Seach discipline to discover the proper type.

- Once you are sure that the form is suitable, click on the Buy now button to get the type.

- Choose the prices plan you would like and enter in the needed information and facts. Make your bank account and purchase the transaction with your PayPal bank account or credit card.

- Select the document formatting and acquire the lawful file template for your product.

- Comprehensive, revise and print out and indication the obtained Louisiana Right of First Refusal and Co-Sale Agreement.

US Legal Forms may be the largest library of lawful forms that you can see different file web templates. Utilize the company to acquire skillfully-produced files that stick to express needs.

Form popularity

FAQ

Basically, an ROFR clause obligates a seller to contact the rights holder with an option to purchase the property before they can accept an alternate third-party offer on the piece of real property.

2625. A party may agree that he will not sell a certain thing without first offering it to a certain person. The right given to the latter in such a case is a right of first refusal that may be enforced by specific performance.

2625. A party may agree that he will not sell a certain thing without first offering it to a certain person. The right given to the latter in such a case is a right of first refusal that may be enforced by specific performance.

A right of first refusal is a fairly common clause in some business contracts that essentially gives a party the first crack at making an offer in a particular transaction. In real estate terms, the phrase ?right of first refusal? operates similarly.

A right of first refusal is a contractual right giving its holder the option to transact with the other contracting party before others can. The ROFR assures the holder that they will not lose their rights to an asset if others express interest.

A ROFR is essentially an option to buy a property before it's sold to another buyer. The seller and the holder can choose to agree on a price and other terms in the ROFR or negotiate later. The option could end at a specific date in the future, and the owner doesn't have to sell if the terms aren't already established.

In some cases, a right of first refusal may give the holder the right to purchase the property at a specified ?bargain? price. Such provisions may be held unenforceable, especially if it is apparent that the specified price is significantly less than fair market value.