Keywords: Louisiana Assignment of Life Insurance as Collateral, life insurance policies, collateral, lenders, beneficiaries, loan agreements, interest rates, debt repayment, types, absolute assignment, collateral assignment In Louisiana, the Assignment of Life Insurance as Collateral refers to the process wherein a life insurance policy is utilized as collateral by a borrower to secure a loan from a lender. This legal agreement allows the borrower to pledge their life insurance policy as a form of security against the loan amount. In the event of default, the lender can exercise their rights on the policy proceeds to recover the outstanding debt. There are two main types of Assignment of Life Insurance as Collateral in Louisiana: 1. Absolute Assignment: Under this type, the borrower transfers complete ownership of the life insurance policy to the lender. The lender becomes the new policy owner and can exercise all rights associated with the policy, including surrendering, borrowing, or assigning the policy. 2. Collateral Assignment: In this type, the borrower assigns the rights to a specific portion of the life insurance proceeds to the lender as collateral for the loan. The borrower retains the ownership and control over the remaining policy benefits and can make changes to beneficiaries, coverage, or beneficiaries. When using life insurance policies as collateral in Louisiana, both lenders and borrowers need to consider various factors. Lenders assess the cash value and face amount of the policy, the policy's surrender value, the borrower's insurability, and their ability to repay the loan. The terms of the assignment as collateral are outlined in a loan agreement, which often stipulates interest rates, repayment terms, and potential penalties. It is important to note that the Assignment of Life Insurance as Collateral does not automatically transfer the policy's ownership to the lender. The policy's beneficiaries are still entitled to the remaining proceeds after the loan is repaid. Furthermore, the borrower may continue to make premium payments to keep the policy in force during the loan term. In conclusion, the Assignment of Life Insurance as Collateral in Louisiana allows borrowers to leverage their life insurance policies to secure loans from lenders. With two main types, absolute assignment and collateral assignment, borrowers can use the appropriate option based on their needs and preferences. This arrangement provides lenders with an added layer of security while borrowers can access funds at potentially lower interest rates.

Louisiana Assignment of Life Insurance as Collateral

Description

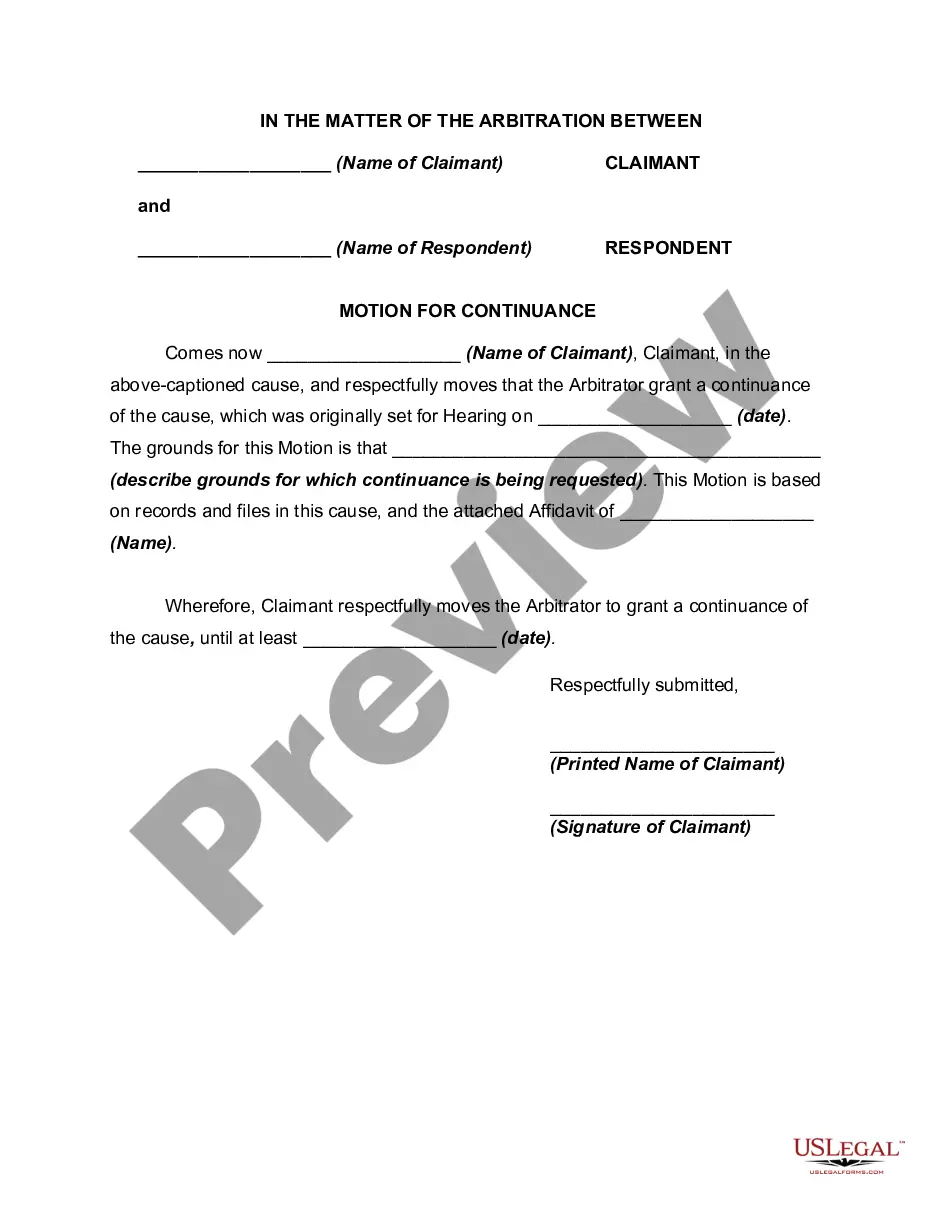

How to fill out Louisiana Assignment Of Life Insurance As Collateral?

US Legal Forms - one of the greatest libraries of lawful kinds in the USA - gives a variety of lawful file web templates you can obtain or print. Using the site, you may get 1000s of kinds for company and individual functions, sorted by groups, says, or key phrases.You can get the most up-to-date models of kinds such as the Louisiana Assignment of Life Insurance as Collateral within minutes.

If you have a registration, log in and obtain Louisiana Assignment of Life Insurance as Collateral from your US Legal Forms collection. The Down load switch can look on each type you look at. You gain access to all formerly acquired kinds in the My Forms tab of your respective account.

In order to use US Legal Forms initially, allow me to share straightforward recommendations to help you started:

- Be sure you have picked out the best type for your metropolis/county. Click the Review switch to examine the form`s articles. Look at the type explanation to ensure that you have selected the proper type.

- In case the type does not suit your needs, utilize the Research area at the top of the monitor to get the one who does.

- When you are content with the form, confirm your choice by visiting the Buy now switch. Then, select the costs program you like and supply your credentials to sign up on an account.

- Process the transaction. Make use of your Visa or Mastercard or PayPal account to perform the transaction.

- Select the formatting and obtain the form in your device.

- Make modifications. Load, edit and print and indicator the acquired Louisiana Assignment of Life Insurance as Collateral.

Each and every design you included with your bank account lacks an expiration date and is the one you have forever. So, if you want to obtain or print another duplicate, just check out the My Forms area and then click about the type you want.

Obtain access to the Louisiana Assignment of Life Insurance as Collateral with US Legal Forms, one of the most considerable collection of lawful file web templates. Use 1000s of skilled and express-specific web templates that meet your company or individual requires and needs.