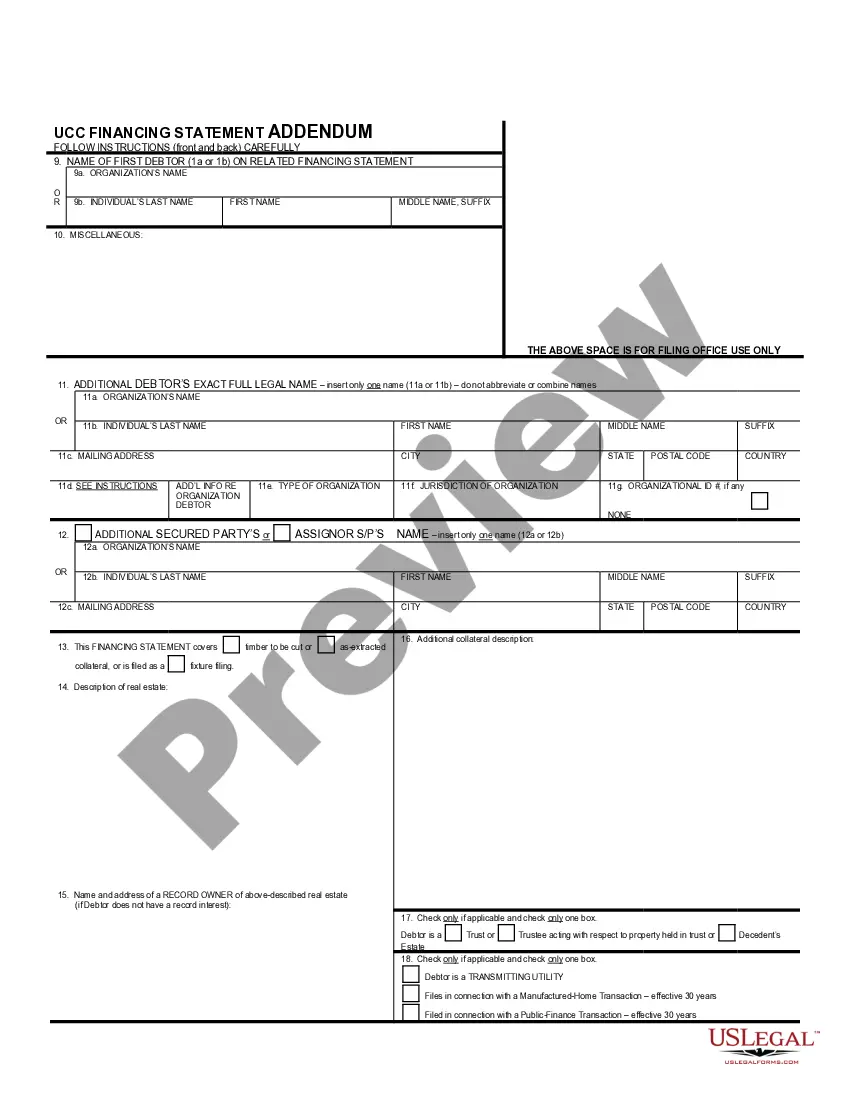

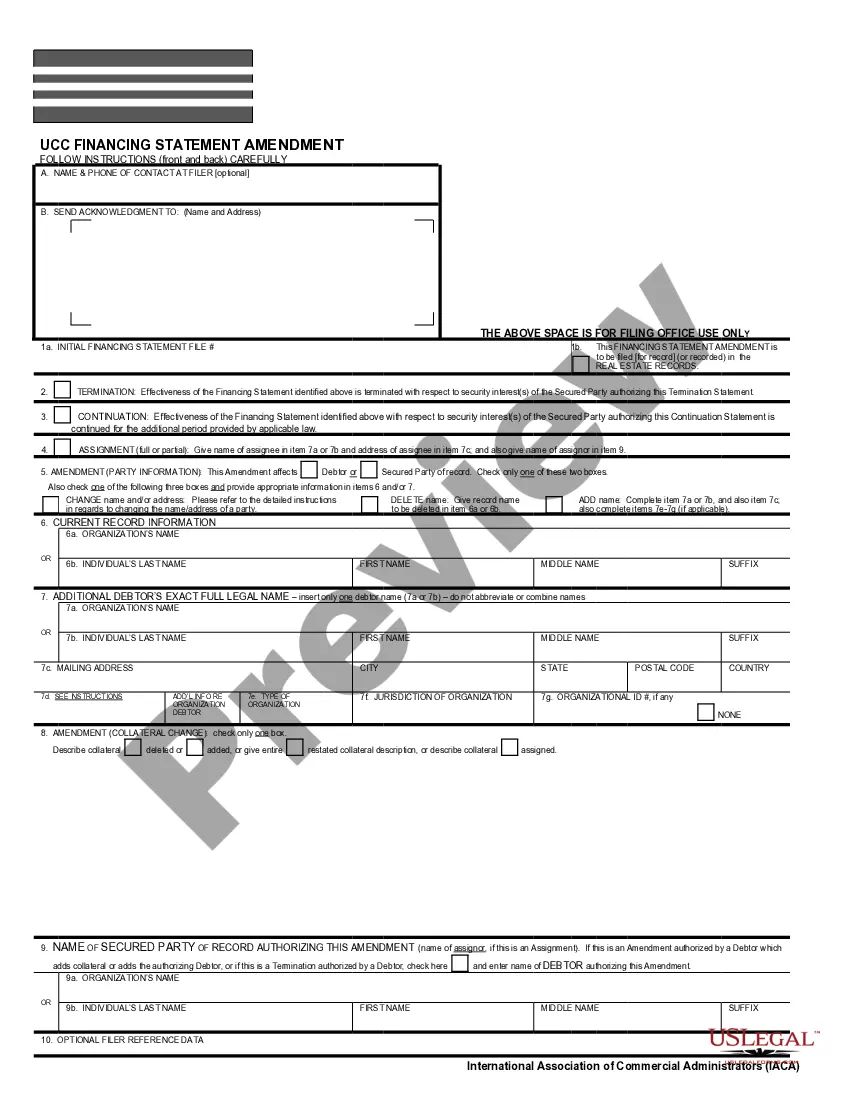

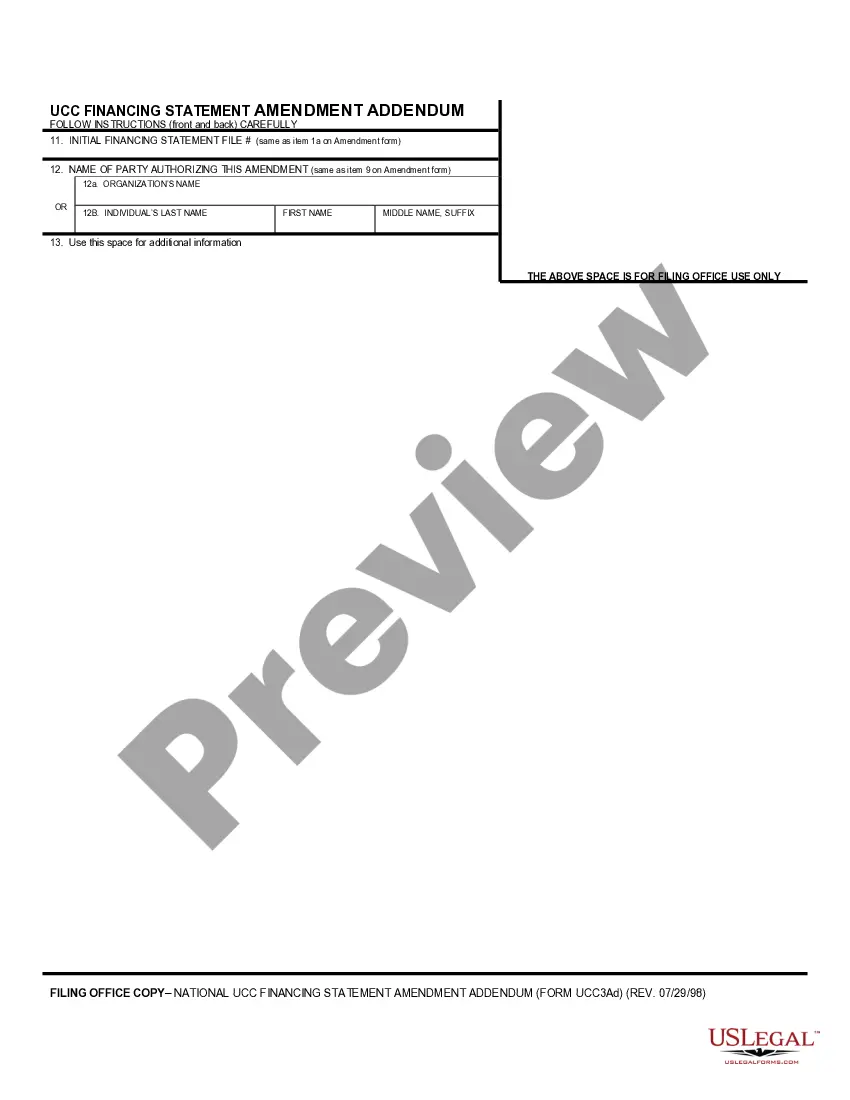

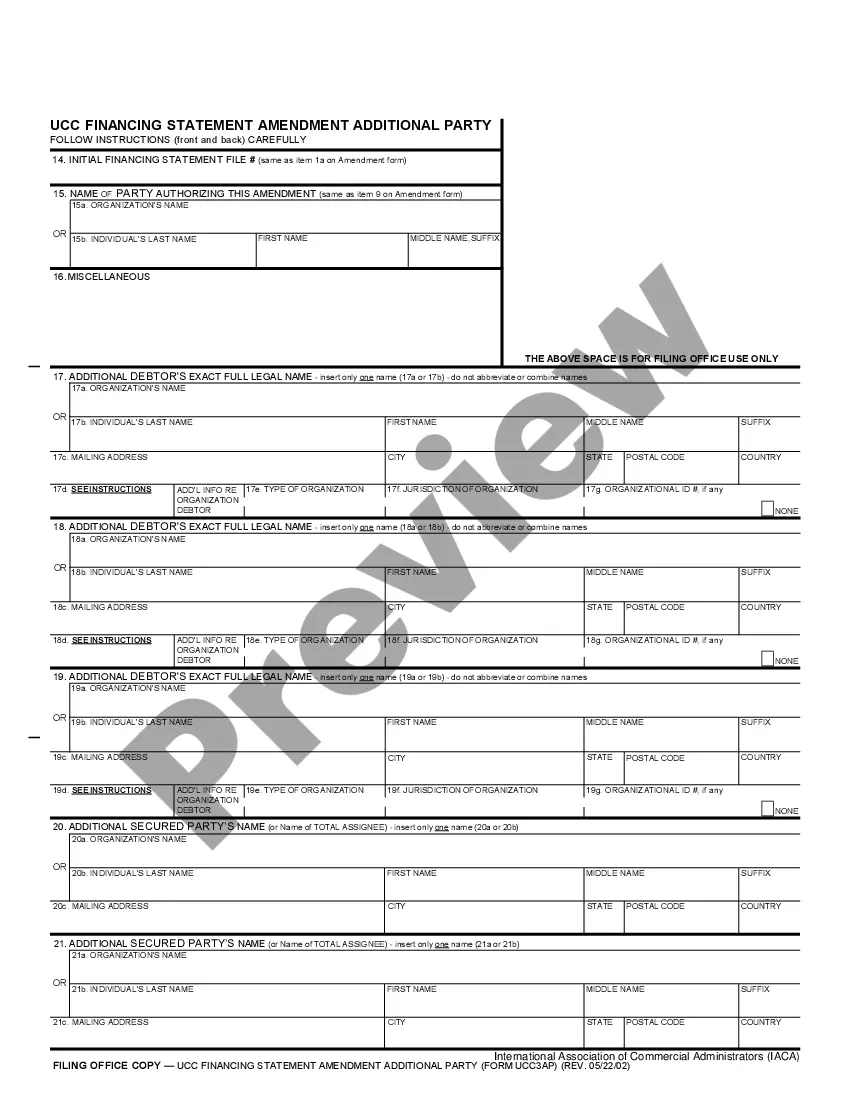

Financing Statement Additional Party form for adding additional Debtors or Secured Parties to Financing Statements (Form UCC1) filed with the Louisiana filing office.

Louisiana UCC1 Financing Statement Additional Party

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana UCC1 Financing Statement Additional Party?

You are invited to the largest legal document library, US Legal Forms.

Here you can locate any template, such as Louisiana UCC1 Financing Statement Additional Party forms and download them as often as you wish or need.

Prepare official paperwork in just a few hours instead of days or even weeks, without needing to spend excessively with a lawyer.

Once you’ve completed the Louisiana UCC1 Financing Statement Additional Party, send it to your attorney for verification. It’s an extra step, but essential for ensuring you’re fully protected. Join US Legal Forms today and gain access to a multitude of reusable templates.

- Obtain the state-specific form with just a couple of clicks and feel assured knowing it was crafted by our certified state attorneys.

- If you’re already a subscribed user, simply Log In to your account and click Download next to the Louisiana UCC1 Financing Statement Additional Party you wish.

- Since US Legal Forms is an online platform, you’ll typically gain access to your saved forms regardless of the device you’re using.

- Find them under the My documents section.

- If you don’t yet have an account, what are you waiting for.

- Follow our instructions below to get started.

- If this is a state-specific template, verify its legality in your residing state.

- Check the description (if available) to ascertain if it matches your needs.

Form popularity

FAQ

What Is a Blanket Lien? A blanket lien, also called a UCC-1 lien, gives a lender a legal claim to all of a borrower's business assets if the borrower defaults on the loan. In the event of a default, the lender can seize all of the business's assets up to the value of the debt, and sell them to repay the debt.

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

An intercreditor agreement is a bit different than a subordination agreement. They both serve to do the same thing, allow two different lenders to split up the collateral of a business so both can be secured in the first lien on their respective collateral.

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.

Make your home refinance possible Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit.

Fffd There is no provision in the Uniform Commercial Code to file a subordination agreement. Not filing a subordination agreement does not harm any other creditor.

It should be noted that UCC financing statements filed now generally do not contain a grant of the security interest and generally are not signed or otherwise authenticated by the Debtor and therefore would not satisfy the requirement of a security agreement.

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.