Massachusetts Landscape Contract for Contractor

Description

How to fill out Massachusetts Landscape Contract For Contractor?

Greetings to the most extensive repository of legal documents, US Legal Forms. Here you can discover any template such as Massachusetts Landscape Agreement for Contractor documents and download them (as numerous as you wish/require). Prepare formal documents within a few hours, instead of days or weeks, without having to fork out a fortune on a lawyer. Obtain your state-specific template in a few clicks and feel assured knowing it was created by our state-certified attorneys.

If you’re already a registered user, simply Log In to your account and then click Download next to the Massachusetts Landscape Agreement for Contractor you desire. Because US Legal Forms is internet-based, you’ll always have access to your saved documents, regardless of the device you’re using. View them within the My documents section.

If you haven't created an account yet, what are you waiting for? Follow our instructions below to begin.

- If this is a state-specific form, check its validity in your state.

- Read the description (if available) to ensure it’s the correct template.

- Examine additional information using the Preview feature.

- If the template satisfies your requirements, simply click Buy Now.

- To create an account, choose a pricing option.

- Utilize a credit card or PayPal account to subscribe.

- Download the document in the format you need (Word or PDF).

- Print the document and complete it with your or your business’s details.

Form popularity

FAQ

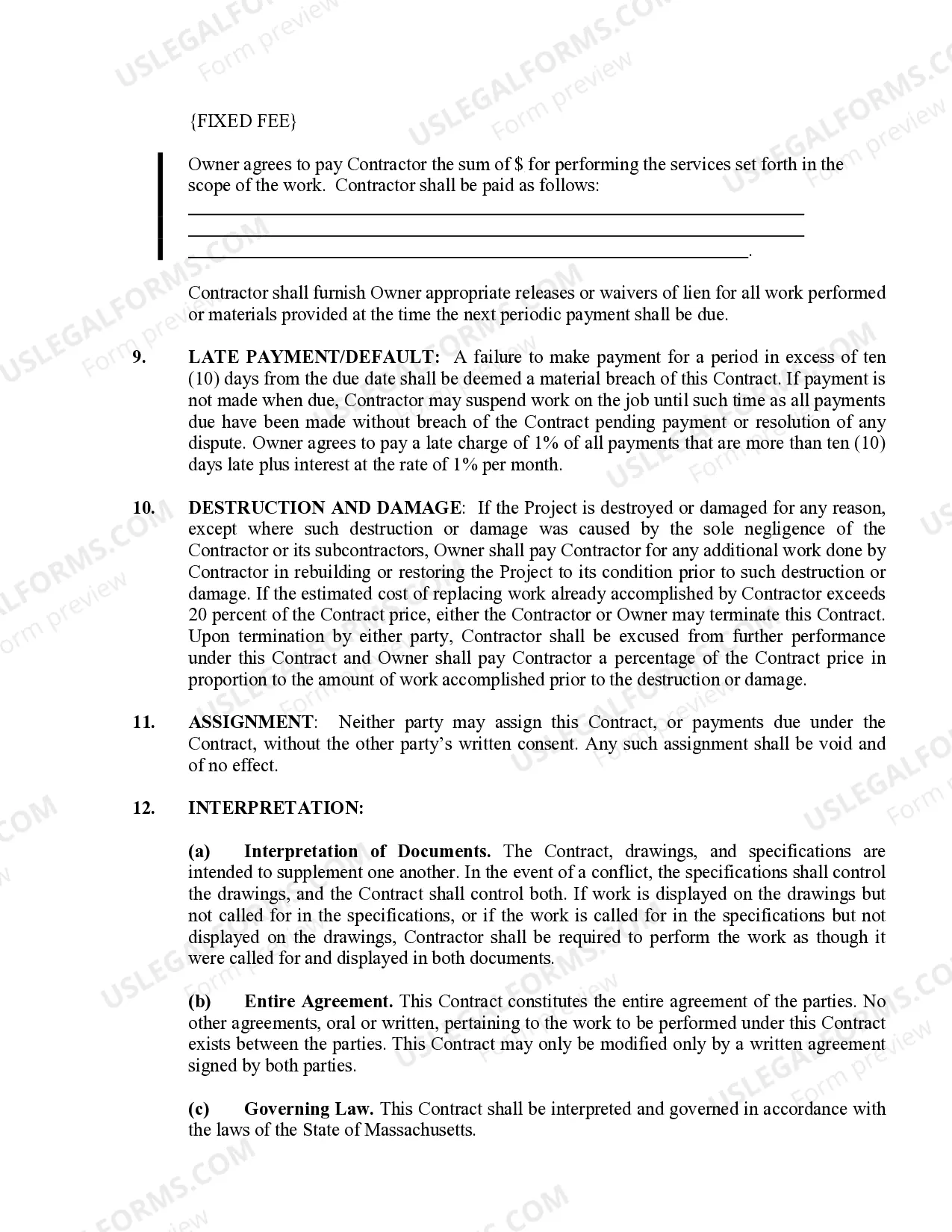

Services in Massachusetts are generally not taxable. But watch out if the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products. Tangible products are taxable in Massachusetts , with a few exceptions.

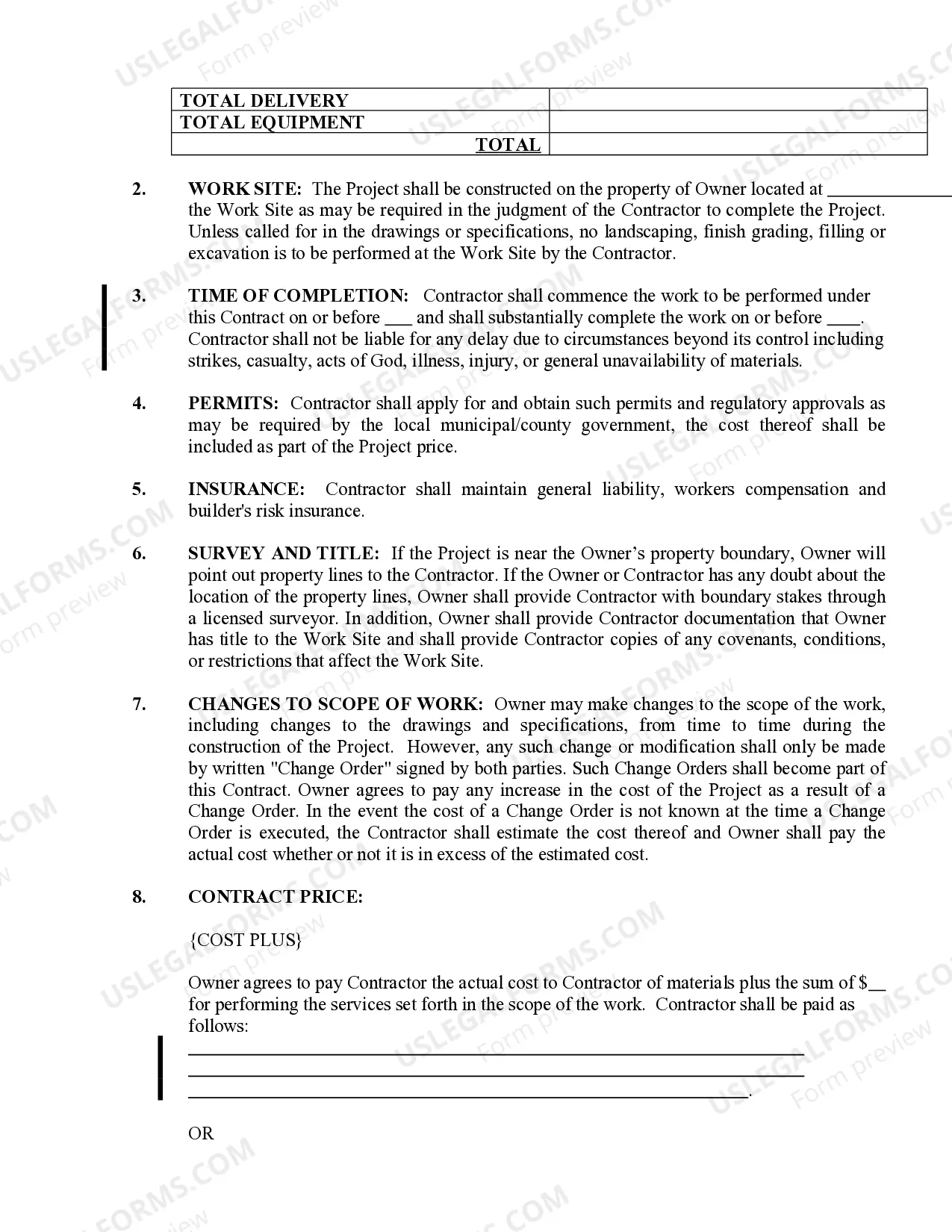

You shouldn't pay more than 10 percent of the estimated contract price upfront, according to the Contractors State License Board.

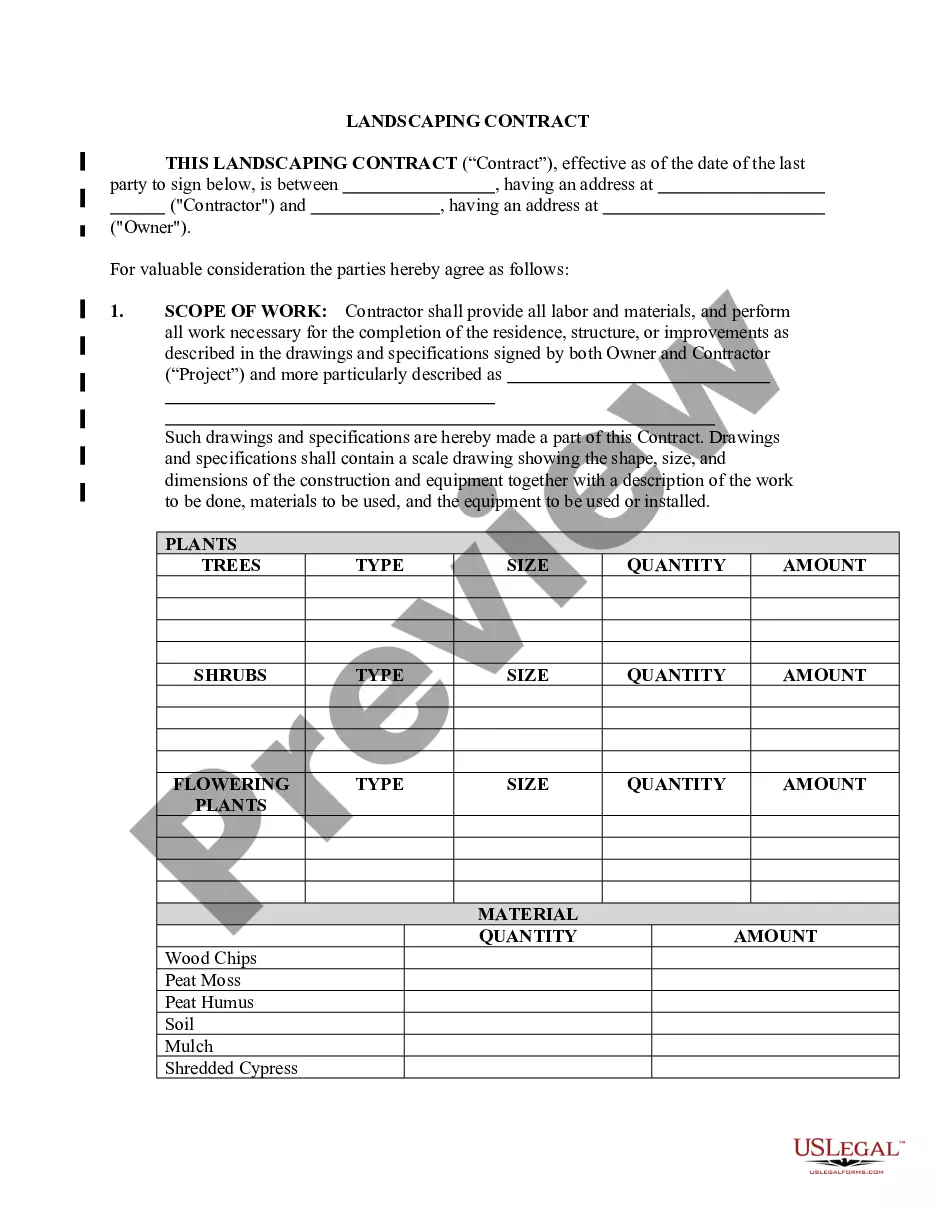

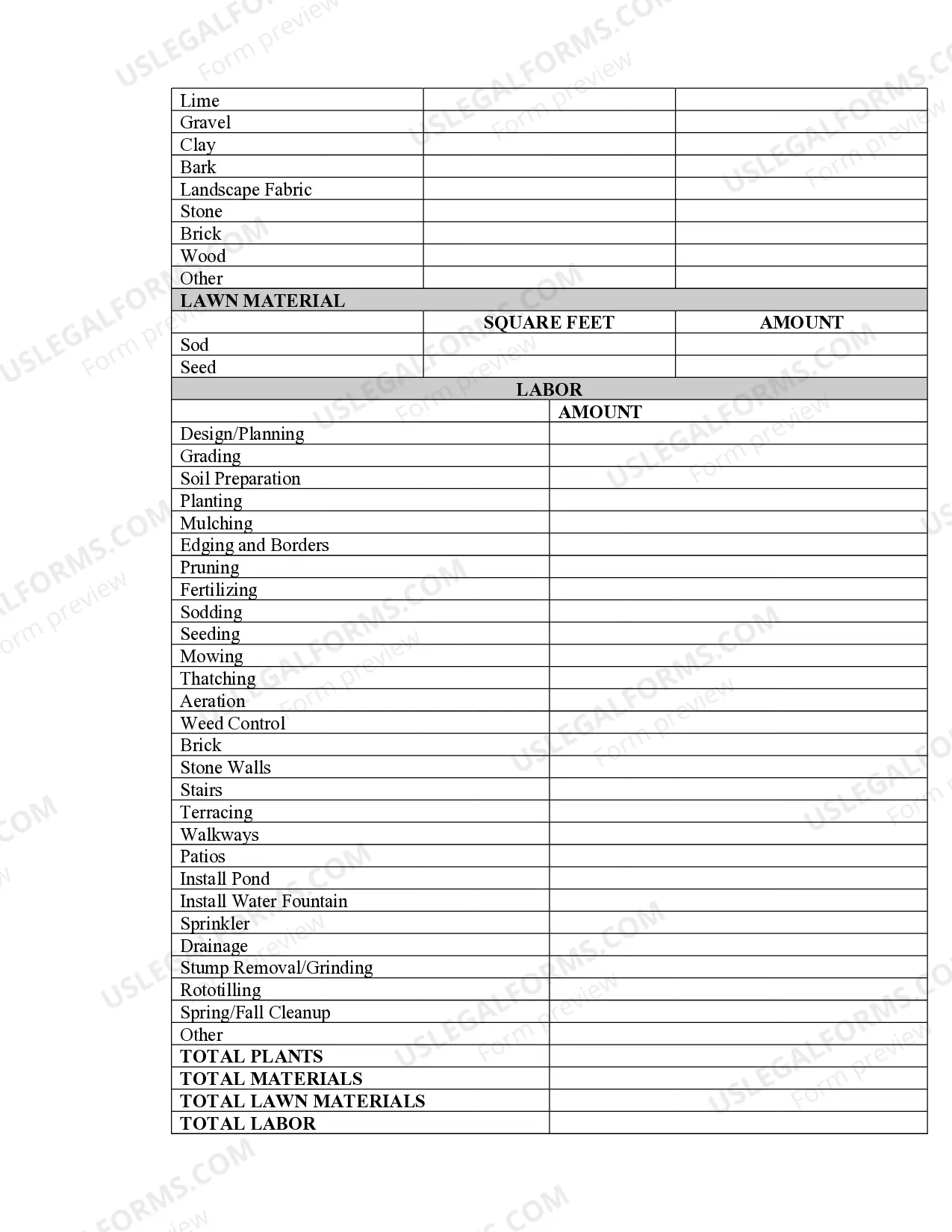

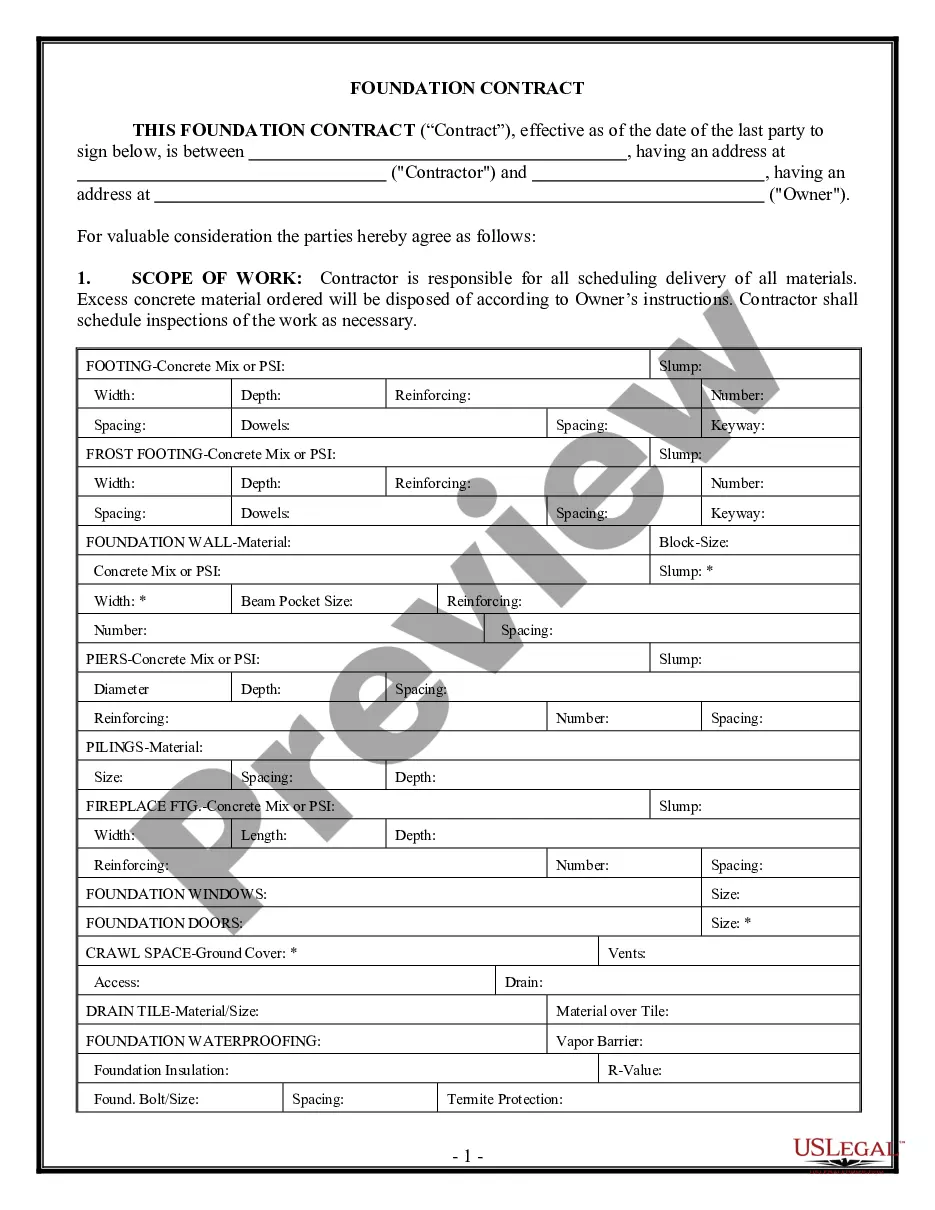

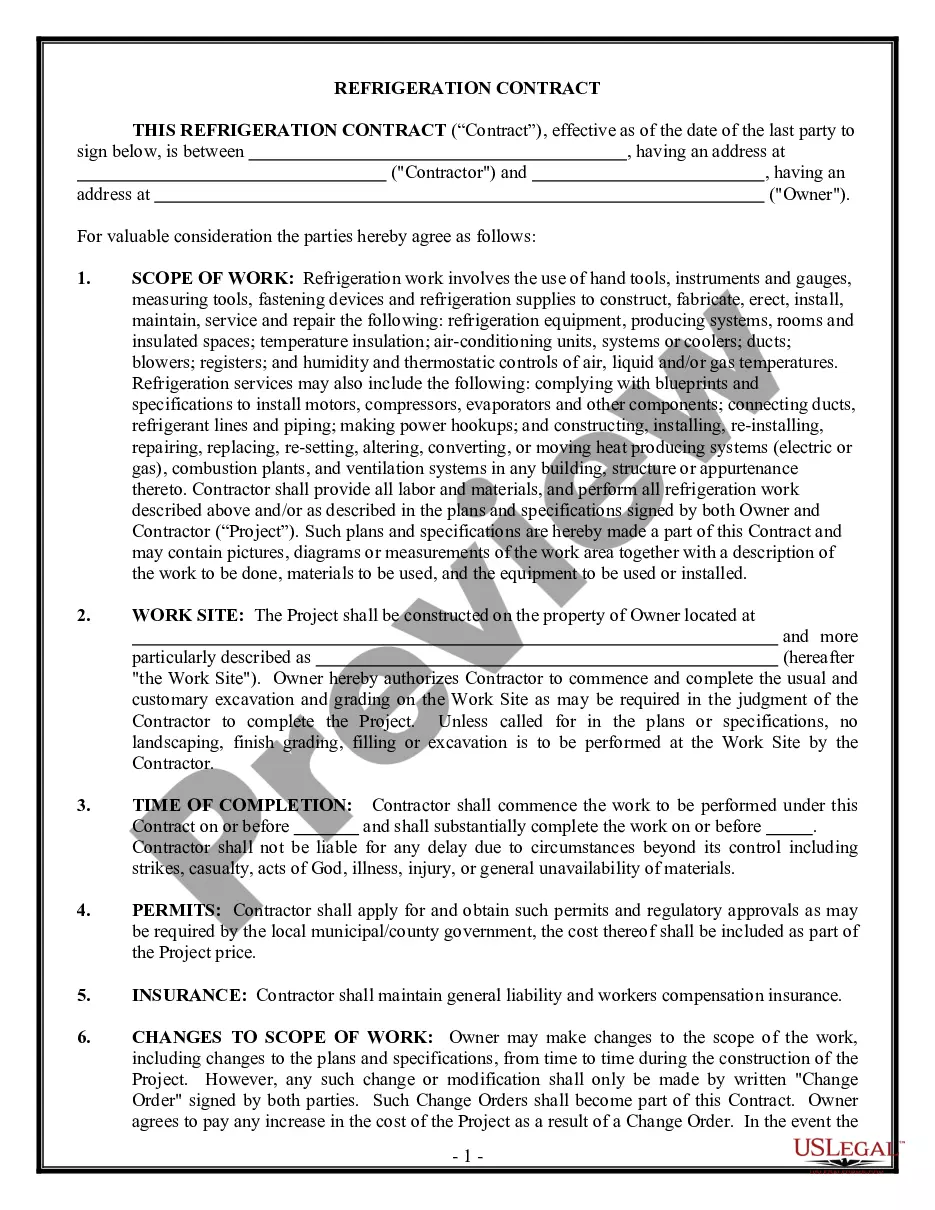

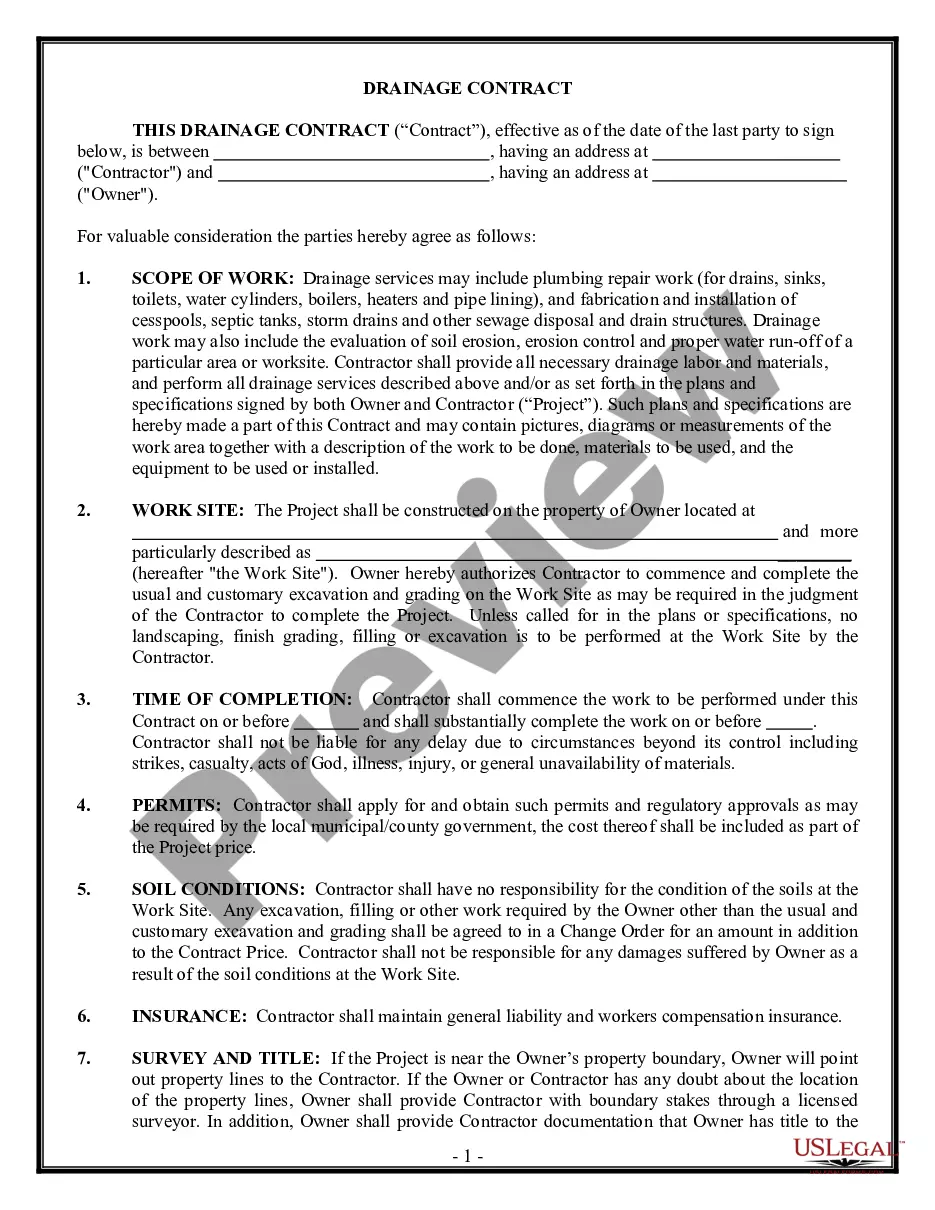

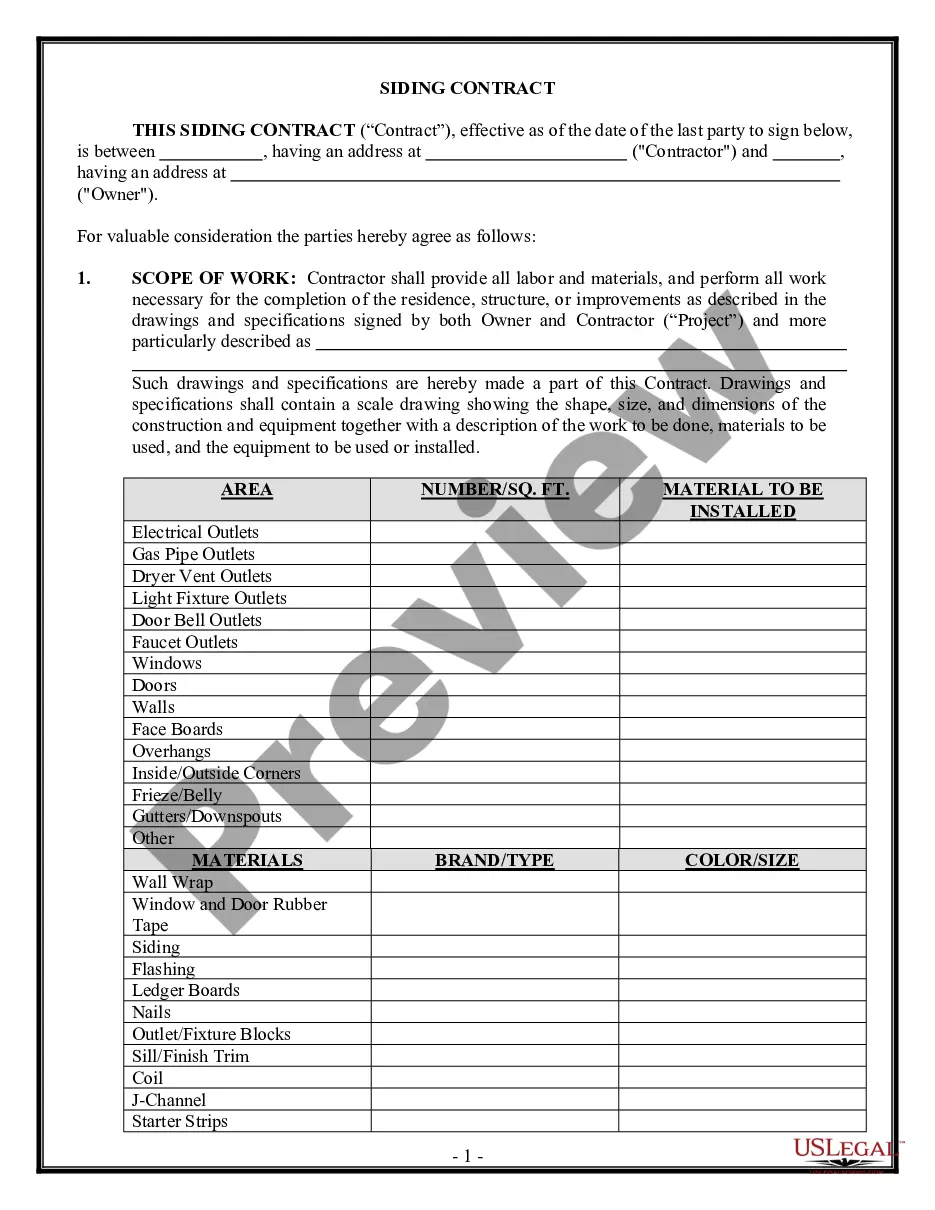

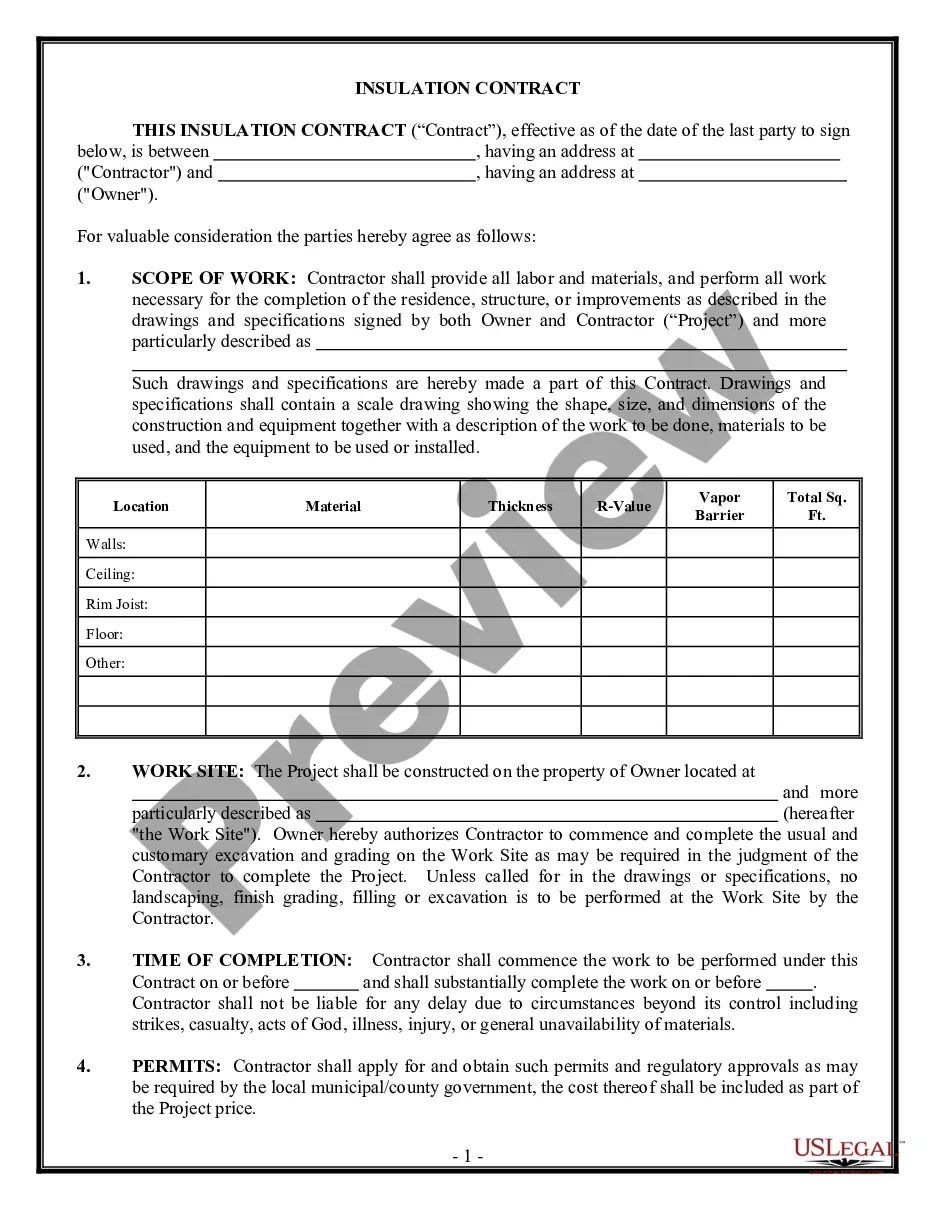

Landscaping contracts should include a detailed description of the project and what exactly you will be doing. Put in writing the basic services that will be performed and also additional ones, those that will be provided for an added cost if desired.

Payment Schedule In Your ContractBefore any work begins, a contractor will ask a homeowner to secure the job with a down payment. It shouldn't be more than 10-20 percent of the total cost of the job. Homeowners should never pay a contractor more than 10-20% before they've even stepped foot in their home.

If the contractor requests a large sum of money before work has begun, Mozen says you should ask specifically what types of work or materials those payments are covering.Contractors sometimes have other motives, other than purchasing materials, when they ask for large amounts of money in advance, Fowler says.

A: It's not uncommon for contractors to ask for a down payment up front to secure your spot on their schedule or purchase some of the job materials in advance. Asking for more than half of the project cost up front, though, is a big red flag.I recommend tying payments to progress made during the job.

Massachusetts law prohibits a contractor requiring an initial deposit of over 33% of the total contract price unless special materials are ordered. Any contractor demanding over a 33% deposit should raise a huge red flag .

Massachusetts imposes a five percent sales tax on retail sales of tangible personal property in Massachusetts by any vendor.As consumers of tangible personal property, construction contractors pay sales tax to their suppliers on their purchases. See Ace Heating, 371 Mass.

Are services subject to sales tax in Massachusetts? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In Massachusetts, specified services are taxable.