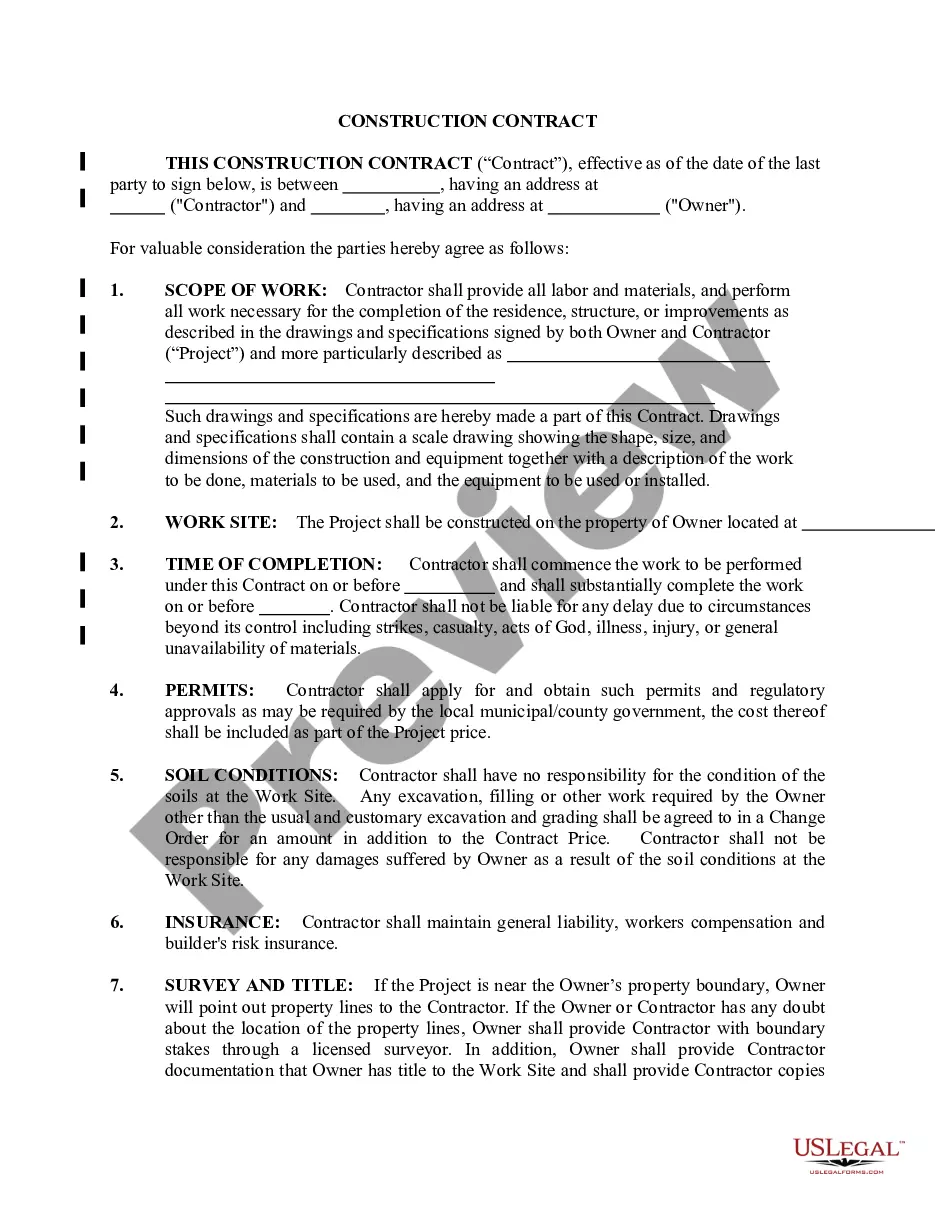

Massachusetts Construction Contract Cost Plus or Fixed Fee

Description

How to fill out Massachusetts Construction Contract Cost Plus Or Fixed Fee?

You are invited to the most important legal document repository, US Legal Forms. Here you can discover any template such as Massachusetts Construction Contract Cost Plus or Fixed Fee forms and download them (as many as you wish/require). Prepare official documents within a few hours, instead of days or even weeks, without needing to break the bank on a legal expert. Obtain your state-specific document in just a few clicks and rest assured knowing it was crafted by our skilled attorneys.

If you’re already a registered client, just sign in to your account and click Download next to the Massachusetts Construction Contract Cost Plus or Fixed Fee you require. Since US Legal Forms is an online service, you will typically have access to your downloaded documents, regardless of the device you’re using. Locate them within the My documents section.

If you do not have an account yet, what are you waiting for? Follow our guidelines outlined below to get started.

Once you’ve completed the Massachusetts Construction Contract Cost Plus or Fixed Fee, send it to your attorney for confirmation. It’s an additional step but a vital one to ensure you’re fully protected. Register for US Legal Forms today and gain access to a vast array of reusable templates.

- If this is a state-specific template, verify its relevance in your state.

- Review the description (if available) to determine if it’s the right template.

- Explore more details with the Preview feature.

- If the document meets your needs, simply click Buy Now.

- To create an account, select a pricing option.

- Utilize a credit card or PayPal to register.

- Download the document in your preferred format (Word or PDF).

- Print the document and fill it in with your/your business’s details.

Form popularity

FAQ

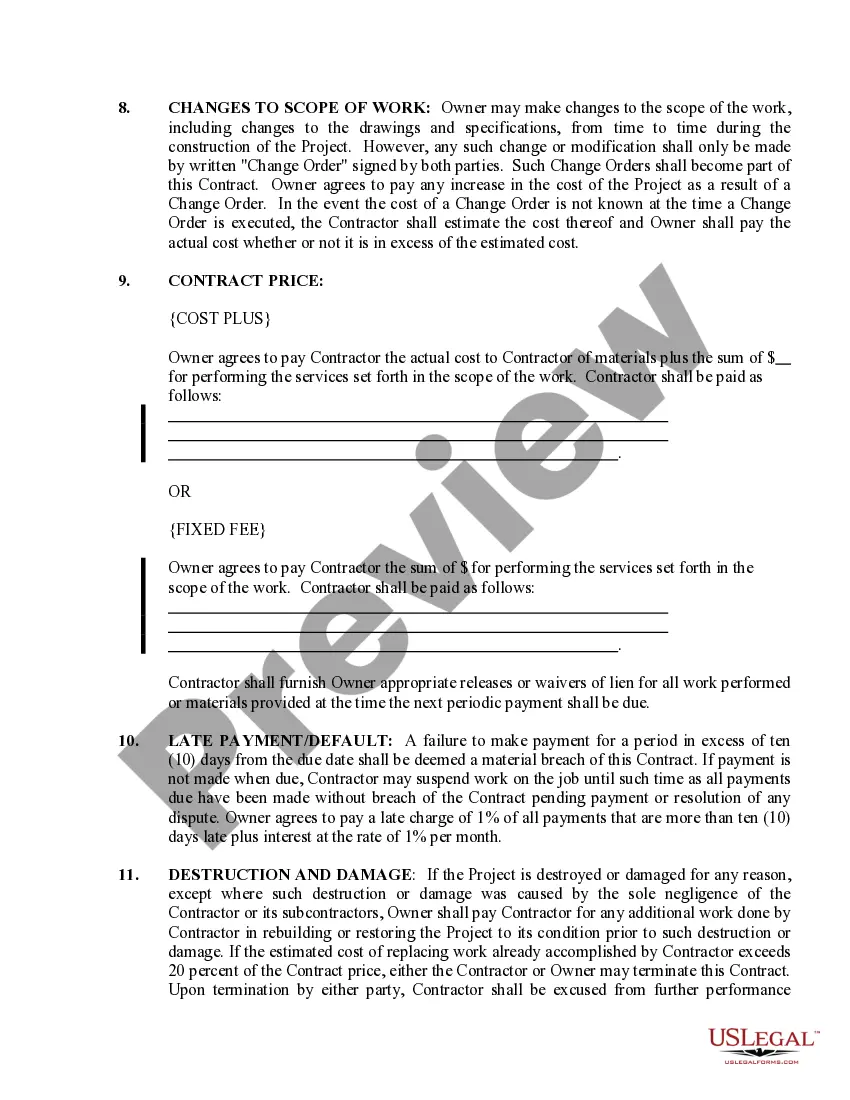

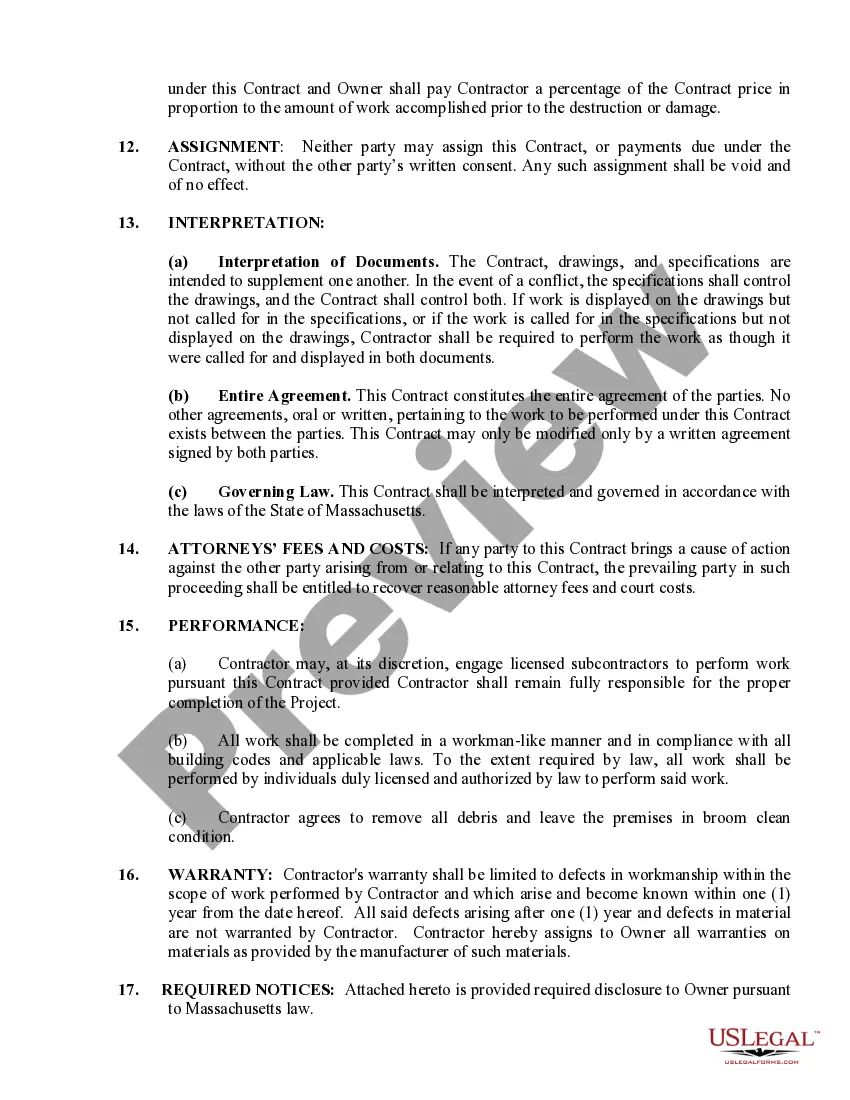

Disadvantages of cost-plus fixed-fee contracts may include: The final, overall cost may not be very clear at the beginning of negotiations. May require additional administration or oversight of the project to ensure that the contractor is factoring in the various cost factors.

A cost-plus contract, also known as a cost-reimbursement contract, is a form of contract wherein the contractor is paid for all of their construction-related expenses. Plus, the contractor is paid a specific agreed-upon amount for profit.

Determine your COGS (cost of goods sold). For example $40 . Find out your gross profit by subtracting the cost from the revenue. Divide profit by COGS. Express it as a percentage: 0.25 100 = 25% . This is how to find markup... or simply use our markup calculator!

A cost-plus contract is an agreement to reimburse a company for expenses incurred plus a specific amount of profit, usually stated as a percentage of the contract's full price.

Cost Plus Contract Disadvantages For the buyer, the major disadvantage of this type of contract is the risk for paying much more than expected on materials. The contractor also has less incentive to be efficient since they will profit either way.

A cost plus percentage of cost contract or CPPC is a cost reimbursement contract containing some element that obligates the non-state entity to pay the contractor an amount, undetermined at the time the contract was made and to be incurred in the future, based on a percentage of future costs.

A Cost-Based Pricing Example Suppose that a company sells a product for $1, and that $1 includes all the costs that go into making and marketing the product. The company may then add a percentage on top of that $1 as the "plus" part of cost-plus pricing. That portion of the price is the company's profit.

In the cost plus a percentage arrangement, the contractor bills the client for his direct costs for labor, materials, and subs, plus a percentage to cover his overhead and profit. Markups might range anywhere from 10% to 25%.