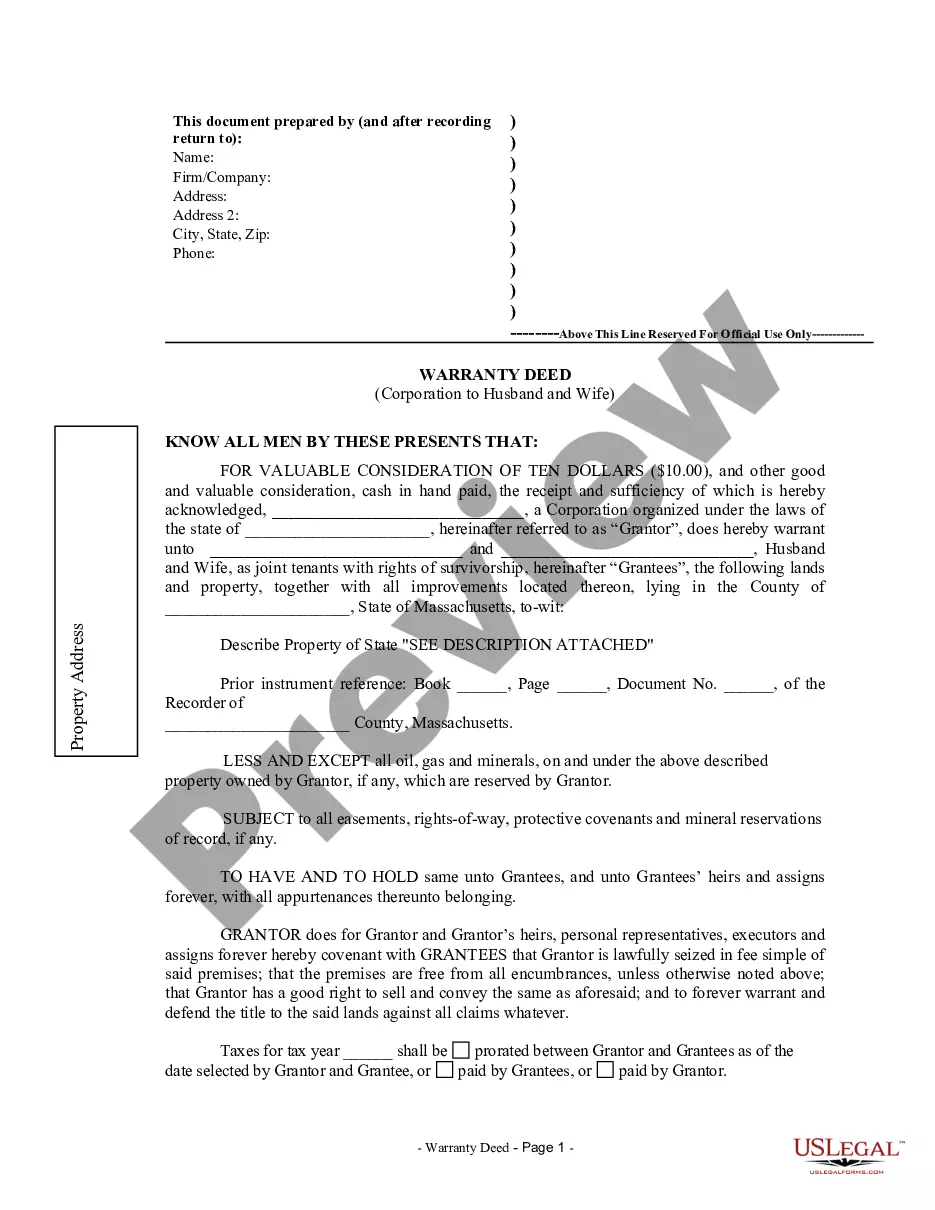

Massachusetts Warranty Deed from Corporation to Husband and Wife

Description

How to fill out Massachusetts Warranty Deed From Corporation To Husband And Wife?

Welcome to the largest legal files library, US Legal Forms. Here you will find any sample including Massachusetts Warranty Deed from Corporation to Husband and Wife forms and download them (as many of them as you want/require). Get ready official documents with a several hours, instead of days or weeks, without spending an arm and a leg with an lawyer or attorney. Get the state-specific example in clicks and be confident understanding that it was drafted by our accredited lawyers.

If you’re already a subscribed consumer, just log in to your account and then click Download next to the Massachusetts Warranty Deed from Corporation to Husband and Wife you require. Because US Legal Forms is web-based, you’ll generally get access to your downloaded files, regardless of the device you’re using. Locate them in the My Forms tab.

If you don't have an account yet, what are you waiting for? Check out our guidelines below to get started:

- If this is a state-specific form, check its validity in the state where you live.

- View the description (if readily available) to learn if it’s the right example.

- See far more content with the Preview feature.

- If the sample fulfills your needs, just click Buy Now.

- To create an account, choose a pricing plan.

- Use a card or PayPal account to subscribe.

- Download the template in the format you need (Word or PDF).

- Print out the file and fill it with your/your business’s information.

When you’ve completed the Massachusetts Warranty Deed from Corporation to Husband and Wife, send it to your attorney for verification. It’s an additional step but an essential one for being sure you’re completely covered. Join US Legal Forms now and get thousands of reusable examples.

Form popularity

FAQ

First, so long as you own the property you purchased, you are obligated to pay its property taxes. One way to get a warranty deed to the property you acquired via a foreclosure where you got a quit claim deed for it is to simply deed the property to yourself or a trust that you created as a grant (warranty) deed.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

A quitclaim deed only transfers the grantor's interests in a piece of real estate.A warranty deed contains a guarantee that the grantor has legal title and rights to the real estate. A quitclaim deed offers little to no protection to the grantee. It offers the least amount of protection out of any other type of deed.

A special warranty deed is a deed to real estate where the seller of the propertyknown as the grantorwarrants only against anything that occurred during their physical ownership. In other words, the grantor doesn't guarantee against any defects in clear title that existed before they took possession of the property.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

Corporate warranty deeds offer the seller's guarantee to the buyer in regards to the validity of the chain of title. Generally, special warranty deeds only protect against problems occurring since the seller purchased the property.

A warranty deed is a higher level of protection produced by the seller upon the real estate closing. It includes a full legal description of the property, and confirms the title is clear and free from all liens, encumbrances, or title defects. Most property sales make use of a warranty deed.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.