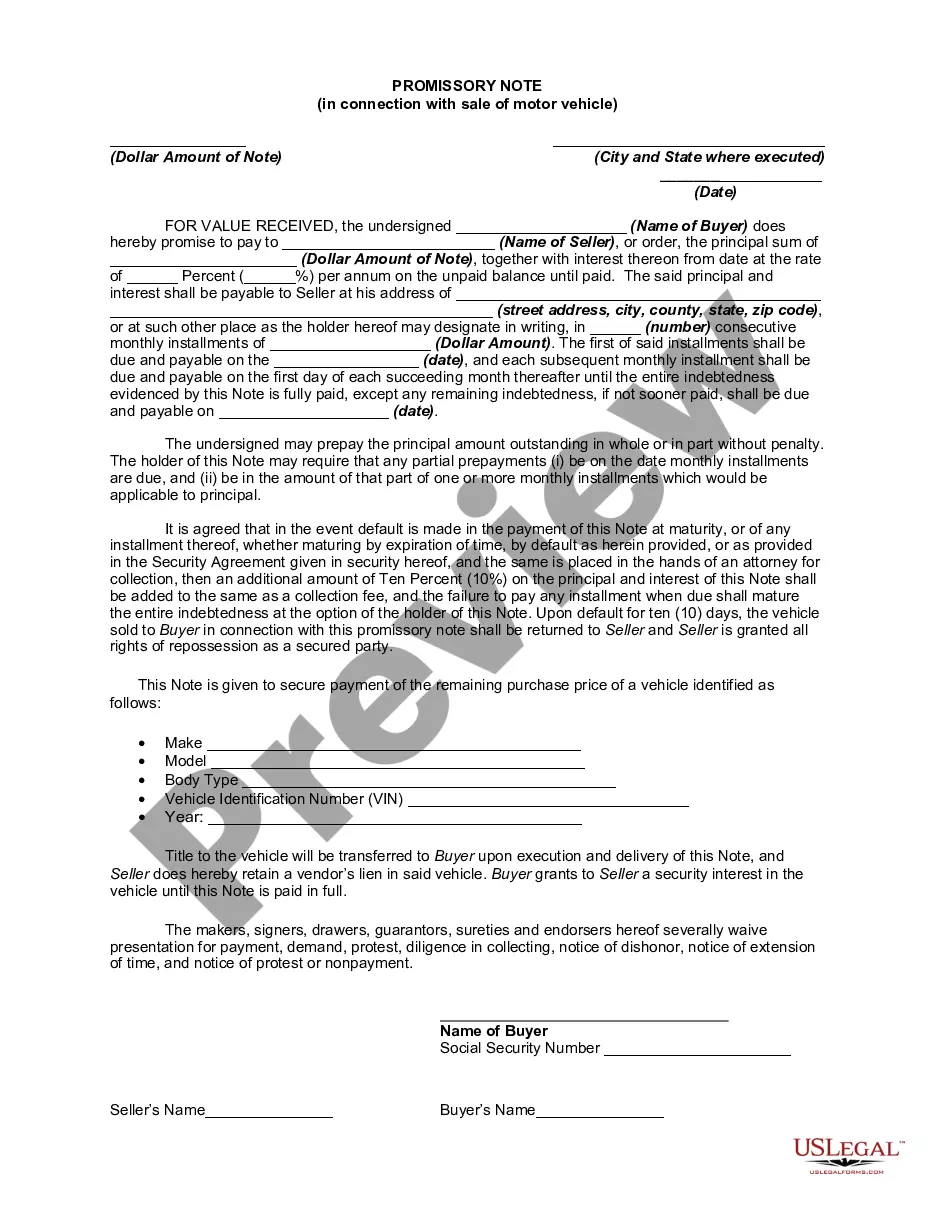

This note may be used in connection with a purchase of a motor vehicle in Massachusetts and reserves a vendor's lien in favor of the Seller.

Massachusetts Promissory Note - Loan in connection with sale of motor vehicle, car, or auto

Description Printable Promissory Note Pdf

How to fill out Sample Promissory Note Pdf?

Welcome to the most significant legal documents library, US Legal Forms. Here you will find any example including Massachusetts Promissory Note - Loan in connection with sale of motor vehicle, car, or auto forms and save them (as many of them as you wish/need to have). Prepare official documents with a few hours, instead of days or weeks, without having to spend an arm and a leg with an legal professional. Get your state-specific form in a few clicks and feel assured understanding that it was drafted by our qualified legal professionals.

If you’re already a subscribed customer, just log in to your account and click Download near the Massachusetts Promissory Note - Loan in connection with sale of motor vehicle, car, or auto you need. Because US Legal Forms is web-based, you’ll generally get access to your downloaded files, regardless of the device you’re using. Locate them inside the My Forms tab.

If you don't have an account yet, what are you waiting for? Check out our instructions below to begin:

- If this is a state-specific document, check its validity in the state where you live.

- See the description (if available) to understand if it’s the proper template.

- See much more content with the Preview function.

- If the example meets all your needs, just click Buy Now.

- To create your account, pick a pricing plan.

- Use a credit card or PayPal account to join.

- Save the document in the format you want (Word or PDF).

- Print out the file and fill it with your/your business’s details.

When you’ve filled out the Massachusetts Promissory Note - Loan in connection with sale of motor vehicle, car, or auto, send out it to your lawyer for confirmation. It’s an extra step but a necessary one for making confident you’re totally covered. Sign up for US Legal Forms now and access a large number of reusable examples.

Example Of Promissory Note Form popularity

Simple Promissory Note Sample Pdf Other Form Names

Sample Of Promissory Note For Loan FAQ

Date of sale. Cost of vehicle purchase. Your full name and address. Buyer's full name and address. Vehicle's year, make, model, identification number and mileage. Acknowledgement of any liens held on the vehicle.

In Massachusetts, there is no legal obligation to have a bill of sale notarized. The purpose of a bill of sale is to act as proof of ownership. While most transactions in Massachusetts don't require a bill of sale, it's still important to have one as a personal record.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Promissory notes are not attached to one person or business. If you have a customer's note, you can legally sell it or you can exchange it with someone else. That person is then entitled to collect on the debt. Whoever holds the note but it's only valid if certain conditions are met.

200b200bThe promissory note should contain: The car's VIN number, model, make and year of manufacture. The statement that the borrower promises to pay the lender a specific amount, how much each payment will be, the annual interest rate and when the loan will be completely repaid.

To transfer a promissory note, it must be negotiable and/or have a provision that allows and explains transfer. In addition, it must comply with state statutes governing promissory notes and assignments thereof. Create a Promissory Note Transfer Agreement.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Debt Classification A promissory note is a type of written contract a lender uses for secured debts where the lender has collateral to seize in the event of default. It is more likely your car loan is a promissory note if you have a schedule of payments and a fixed interest rate spelled out on your loan document.