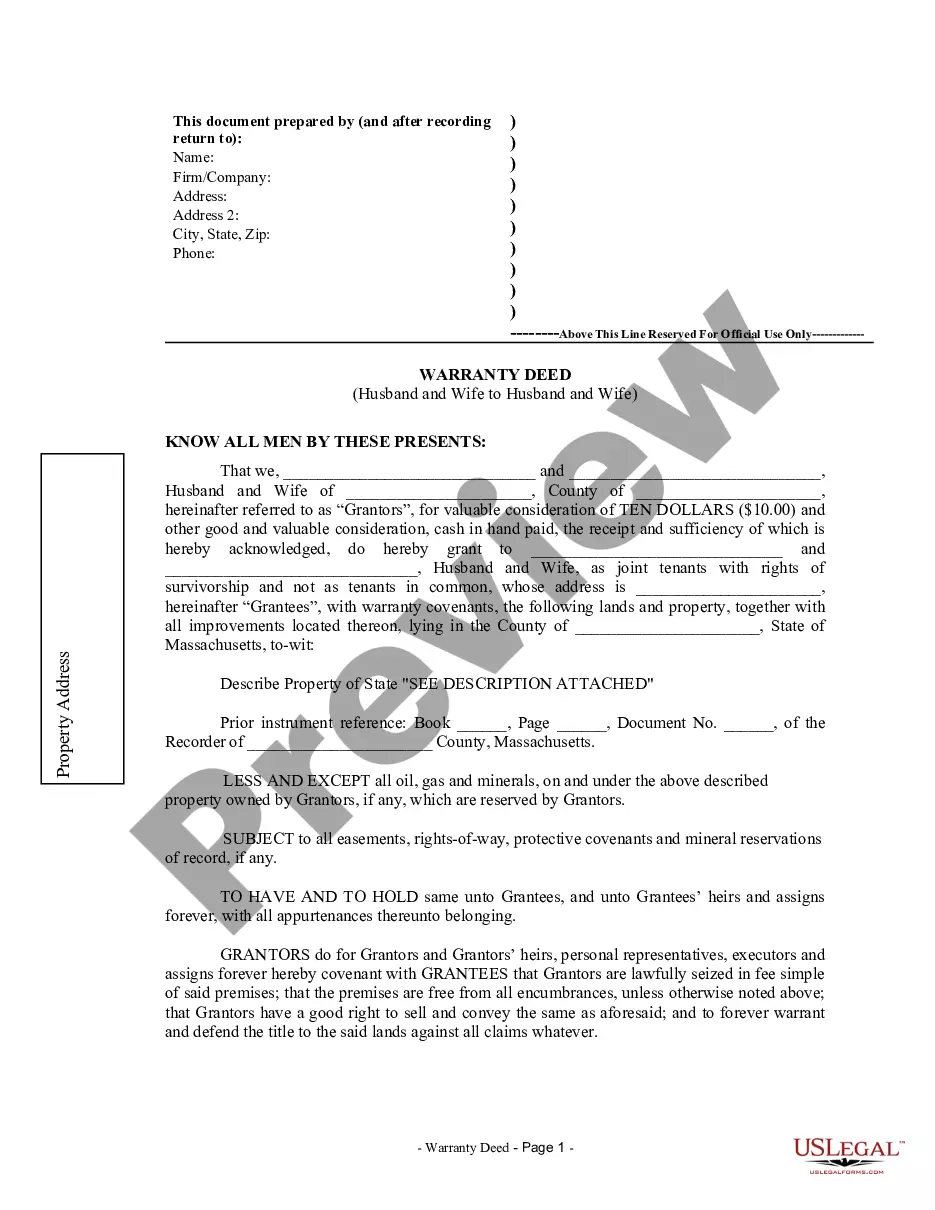

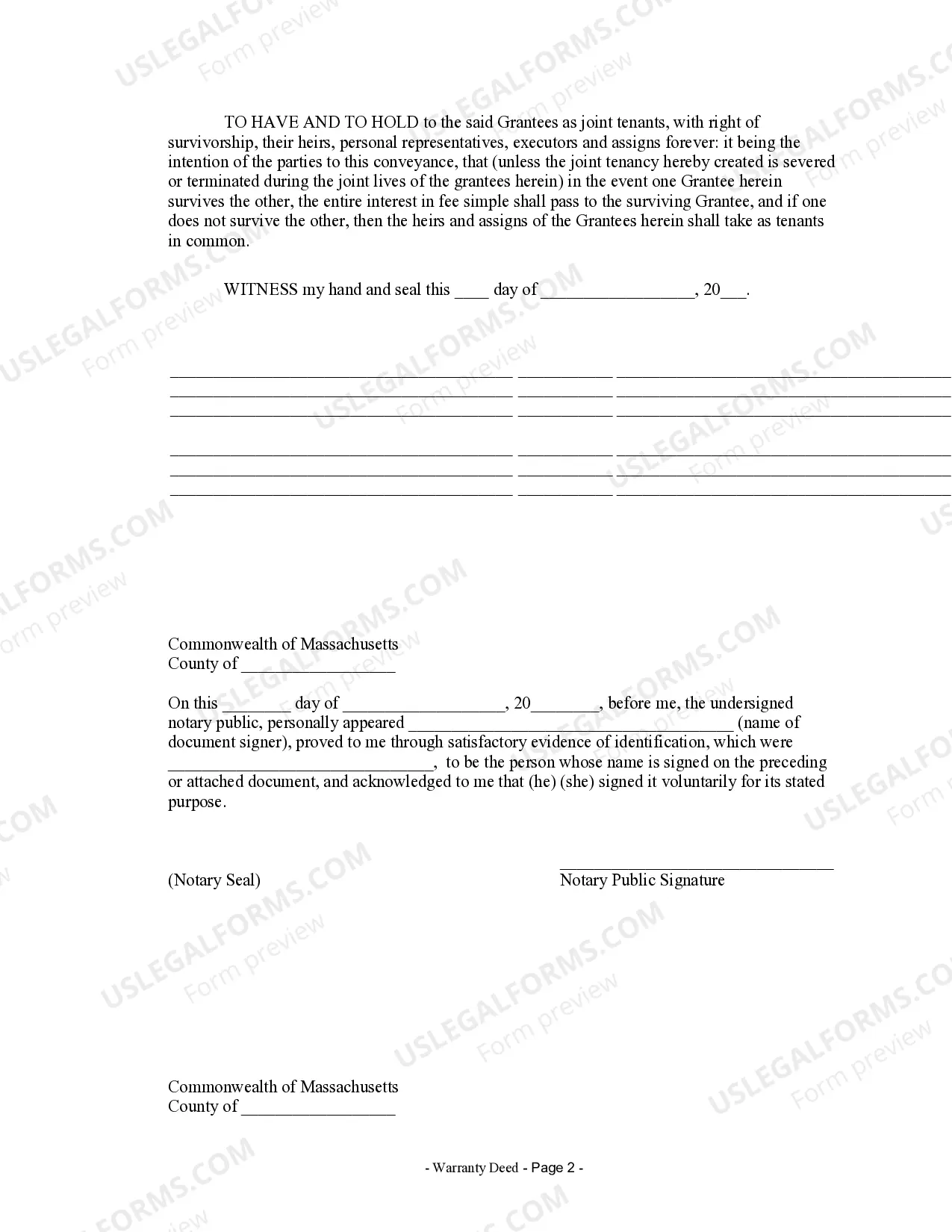

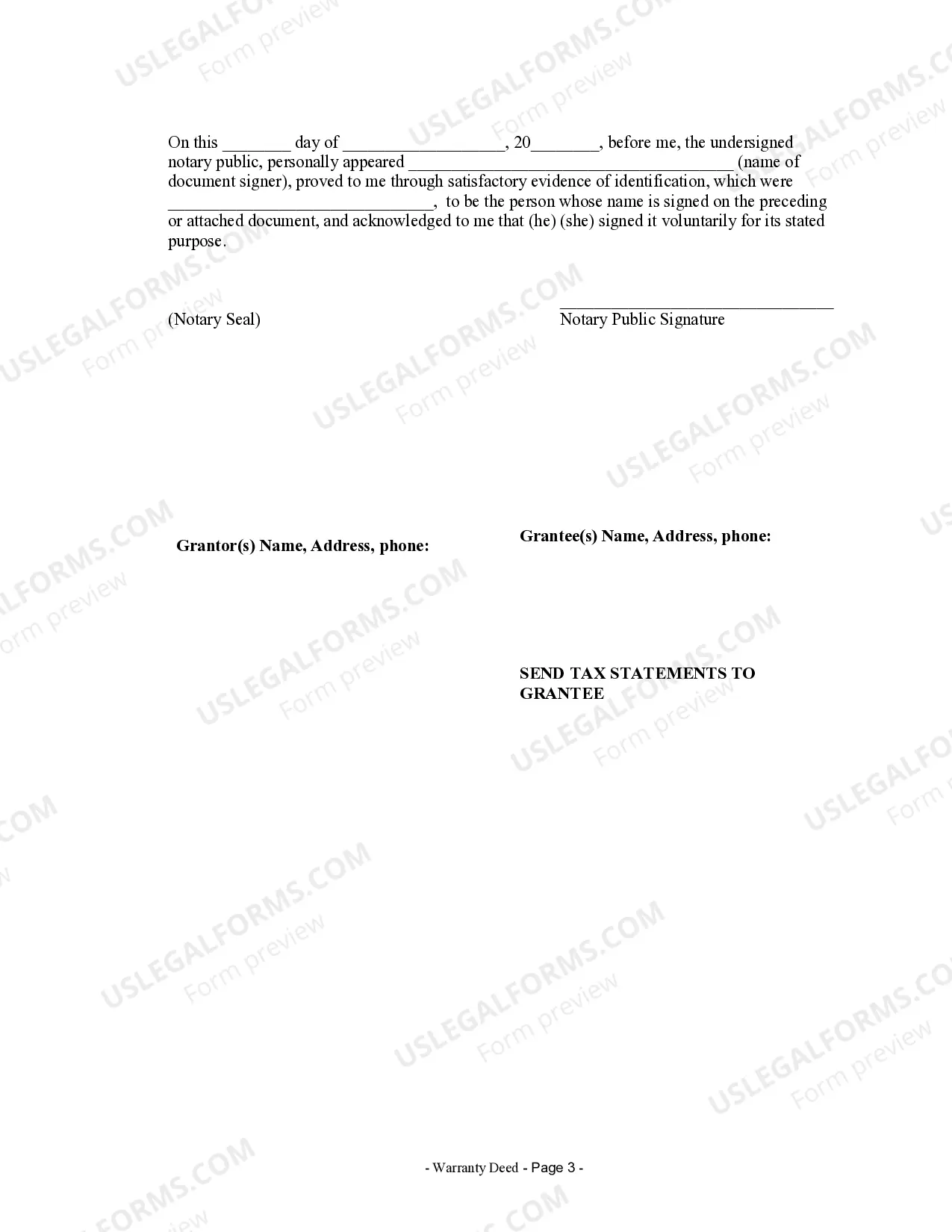

Massachusetts Warranty Deed from Husband and Wife to Husband and Wife

Description

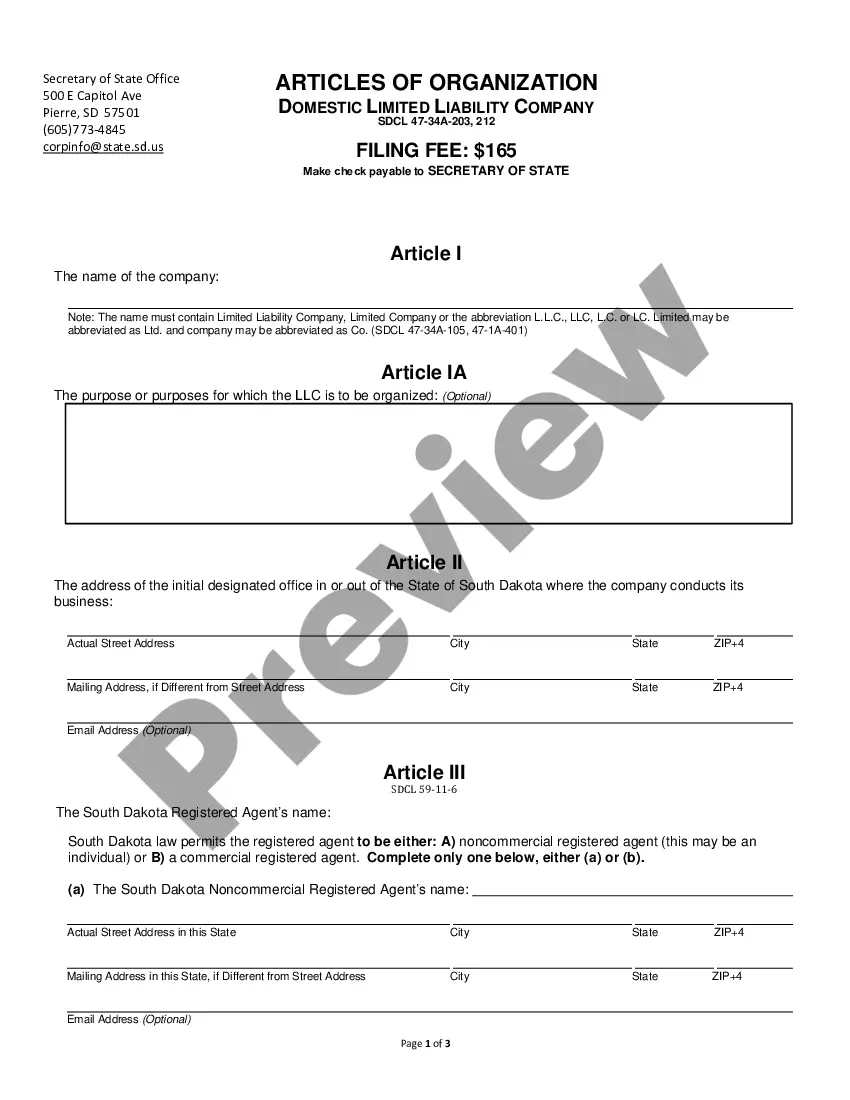

How to fill out Massachusetts Warranty Deed From Husband And Wife To Husband And Wife?

You are welcome to the largest legal files library, US Legal Forms. Right here you will find any template such as Massachusetts Warranty Deed from Husband and Wife to Husband and Wife templates and save them (as many of them as you want/need to have). Make official files within a few hours, instead of days or even weeks, without spending an arm and a leg with an lawyer. Get your state-specific form in clicks and be confident with the knowledge that it was drafted by our accredited lawyers.

If you’re already a subscribed customer, just log in to your account and click Download near the Massachusetts Warranty Deed from Husband and Wife to Husband and Wife you need. Due to the fact US Legal Forms is web-based, you’ll generally get access to your saved files, no matter what device you’re utilizing. Find them within the My Forms tab.

If you don't come with an account yet, what exactly are you awaiting? Check our guidelines below to start:

- If this is a state-specific sample, check its validity in the state where you live.

- See the description (if available) to learn if it’s the right example.

- See far more content with the Preview function.

- If the example matches all your needs, click Buy Now.

- To make an account, pick a pricing plan.

- Use a card or PayPal account to join.

- Save the document in the format you want (Word or PDF).

- Print out the document and complete it with your/your business’s details.

After you’ve filled out the Massachusetts Warranty Deed from Husband and Wife to Husband and Wife, give it to your lawyer for verification. It’s an additional step but a necessary one for making confident you’re completely covered. Sign up for US Legal Forms now and access a mass amount of reusable samples.

Form popularity

FAQ

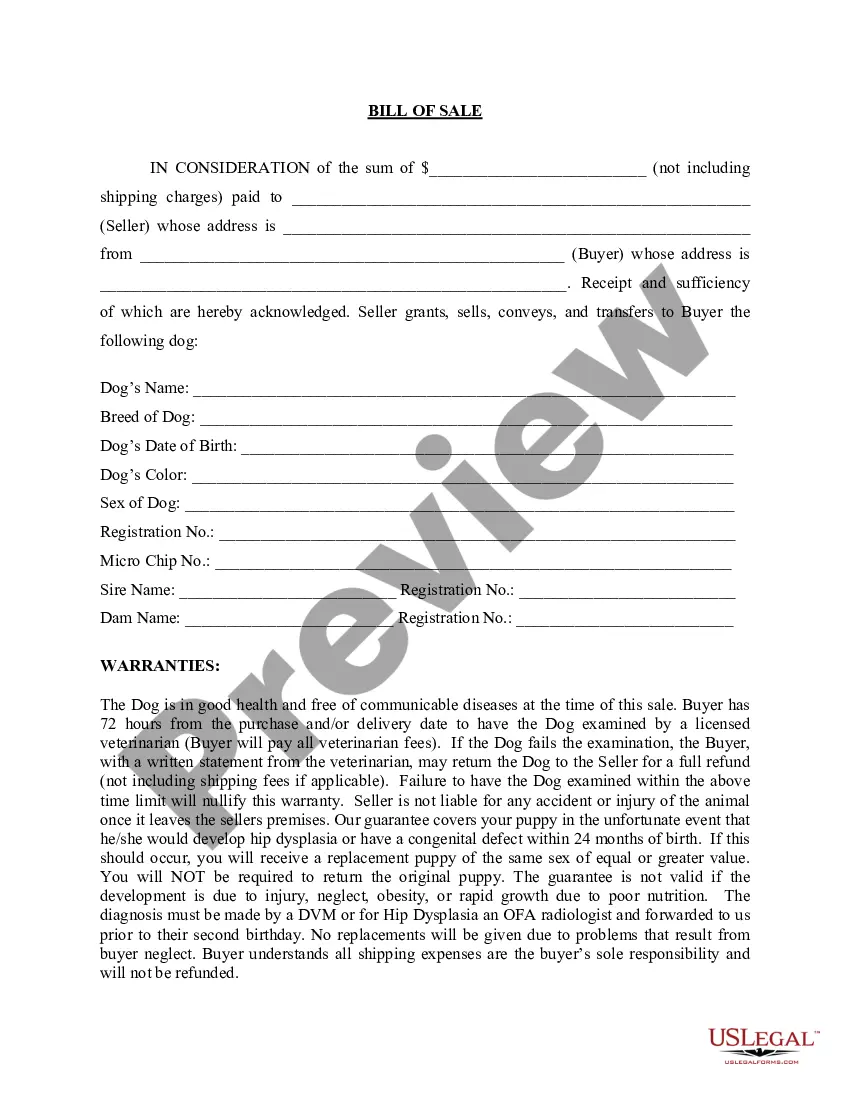

Contact an attorney to prepare a quitclaim deed. Choose the way you want to hold the title. Sign the quitclaim deed as directed by your attorney. File the deed with the county's register of deeds so it can be recorded on public record.

A In order to make your partner a joint owner you will need to add his name at the Land Registry, for which there is a fee of £280 (assuming you transfer half the house to him). You won't, however, have to pay capital gains tax, as gifts between civil partners (and spouses) are tax free.

If you live in a common-law state, you can keep your spouse's name off the title the document that says who owns the property.You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

When it comes to reasons why you shouldn't add your new spouse to the Deed, the answer is simple divorce and equitable distribution. If you choose not to put your spouse on the Deed and the two of you divorce, the entire value of the home is not subject to equitable distribution.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.