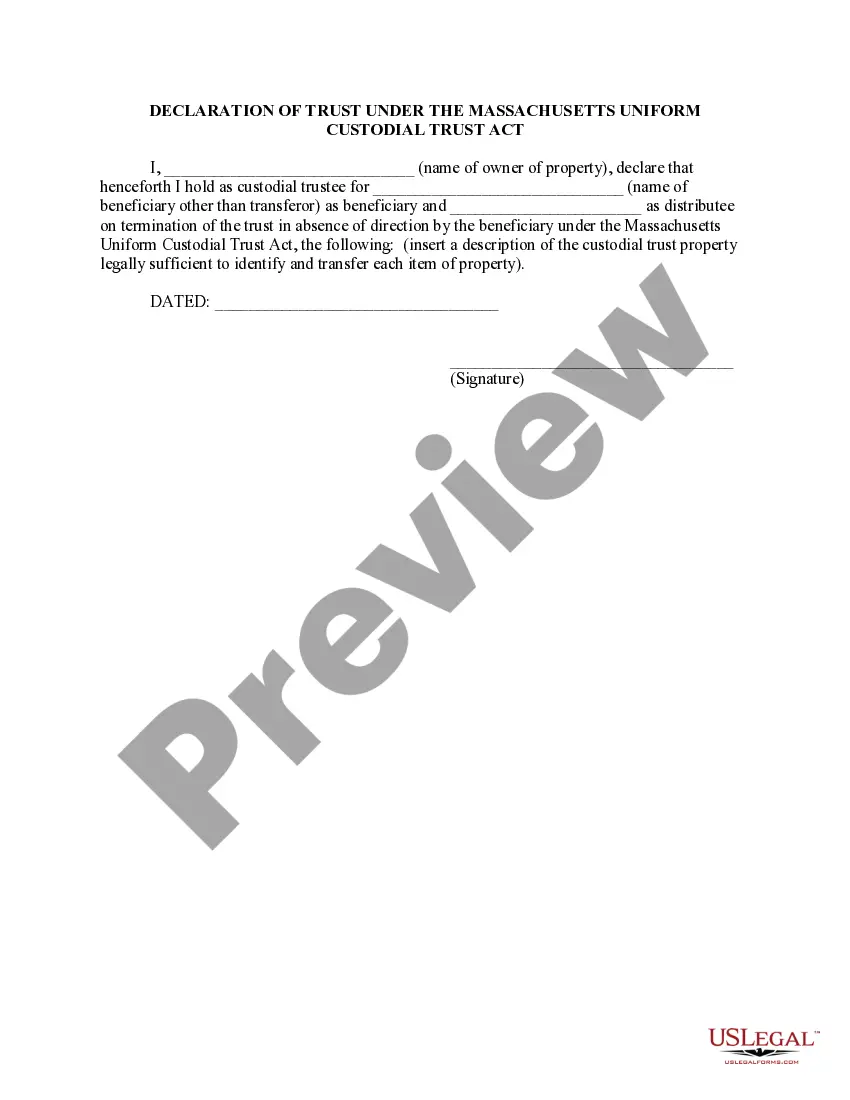

Declaration of Trust Under the Massachusetts Uniform Custodial Trust Code

Description

How to fill out Declaration Of Trust Under The Massachusetts Uniform Custodial Trust Code?

Welcome to the most significant legal documents library, US Legal Forms. Here you can find any sample including Declaration of Trust Under the Massachusetts Uniform Custodial Trust Code forms and download them (as many of them as you want/need to have). Make official documents in just a few hours, rather than days or even weeks, without spending an arm and a leg on an legal professional. Get the state-specific form in a couple of clicks and be assured knowing that it was drafted by our accredited legal professionals.

If you’re already a subscribed consumer, just log in to your account and then click Download near the Declaration of Trust Under the Massachusetts Uniform Custodial Trust Code you need. Because US Legal Forms is online solution, you’ll always have access to your downloaded forms, no matter what device you’re using. Find them in the My Forms tab.

If you don't have an account yet, what are you waiting for? Check our guidelines listed below to begin:

- If this is a state-specific sample, check out its validity in your state.

- View the description (if available) to learn if it’s the right template.

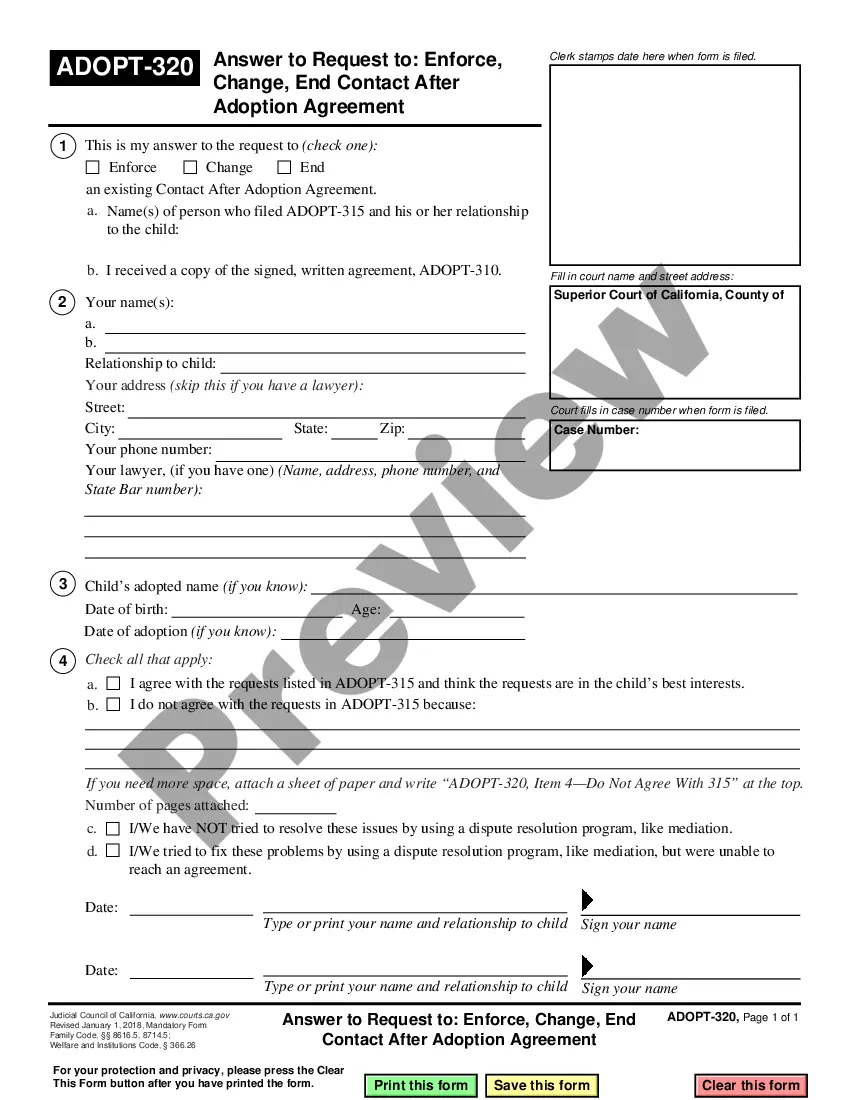

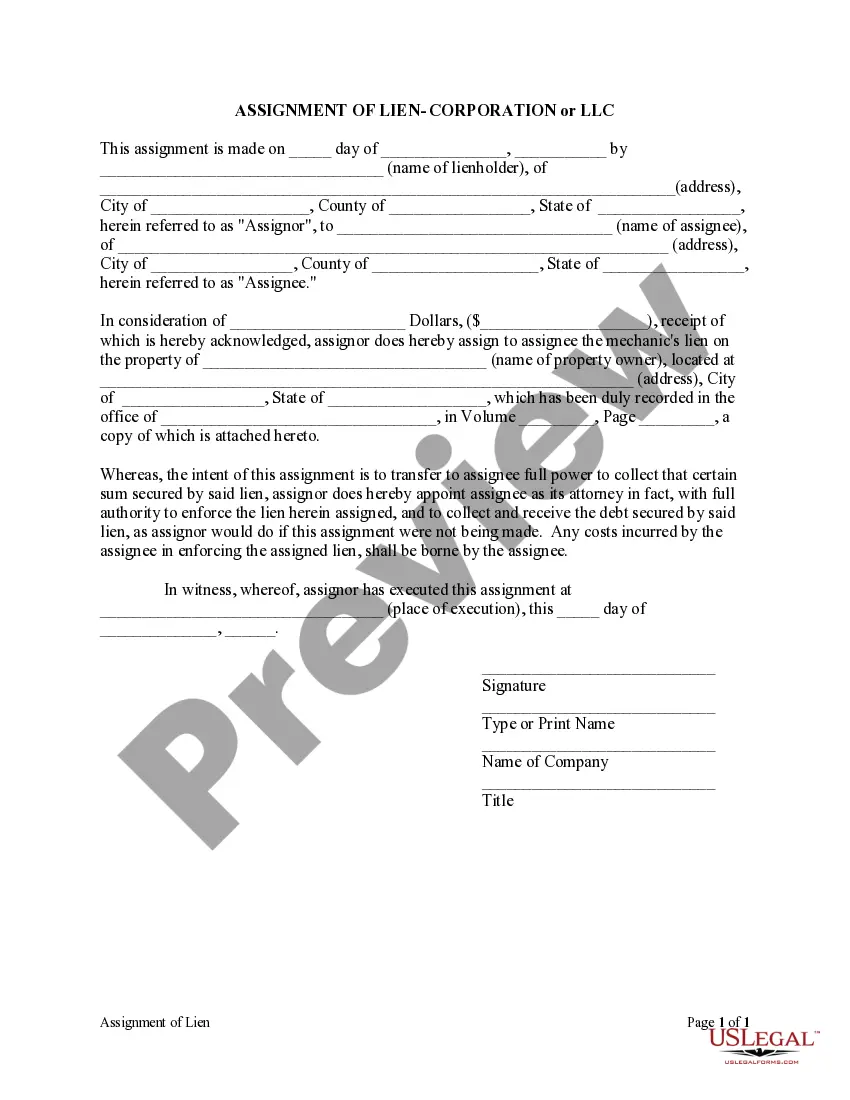

- See a lot more content with the Preview feature.

- If the sample matches all of your needs, click Buy Now.

- To make an account, choose a pricing plan.

- Use a credit card or PayPal account to join.

- Download the template in the format you require (Word or PDF).

- Print out the file and fill it out with your/your business’s information.

As soon as you’ve filled out the Declaration of Trust Under the Massachusetts Uniform Custodial Trust Code, give it to your attorney for confirmation. It’s an extra step but a necessary one for making confident you’re totally covered. Join US Legal Forms now and access thousands of reusable samples.

Form popularity

FAQ

A declaration of trust is something you'll come across when you're planning to buy a property with someone else, or with the support of another person. It's a legal document, also referred to as a deed of trust, which records the financial arrangements between everyone who has a financial interest in the property.

Just for your information, a trust is not a public record, so it's impossible to retrieve a trust document from a public office, agency or anyone who is not a beneficiary and doesn't have the rights to know about the details your trust.

Since the Schedule of Beneficiaries to a trust is not recorded with the Declaration of Trust at the Registry of Deeds, the identity of the Beneficiaries is not a matter of public record.There are two types of Trusts in Massachusetts.

Unlike a Will, which has to be filed with the court at the start of the probate process, a Revocable Living Trust generally does not have to be filed or recorded anywhere. Unless there's a lawsuit concerning your trust, it won't become a matter of public record.

Trusts in Massachusetts are governed by the Massachusetts Uniform Trust Code, codified at G.L.c. 203E.The trustee's certificate is recorded either immediately upon the trust's acquisition of real property, or when the trustee acts upon the title 1.

A declaration of trust under U.S. law is a document or an oral statement appointing a trustee to oversee assets being held for the benefit of one or more other individuals. These assets are held in a trust.The declaration of trust is sometimes referred to as a nominee declaration.

A trust is not required to be registered with any State or local agency and should be held by the parties involved, mainly, the Trustee. Although not legally required, having the document notarized could help prove authenticity should it be challenged.

Prior to enacting G.L.c. 184, §35, Massachusetts was among the few states requiring the full trust document for trusts containing real property to be recorded.The trustee's certificate is recorded either immediately upon the trust's acquisition of real property, or when the trustee acts upon the title 1.