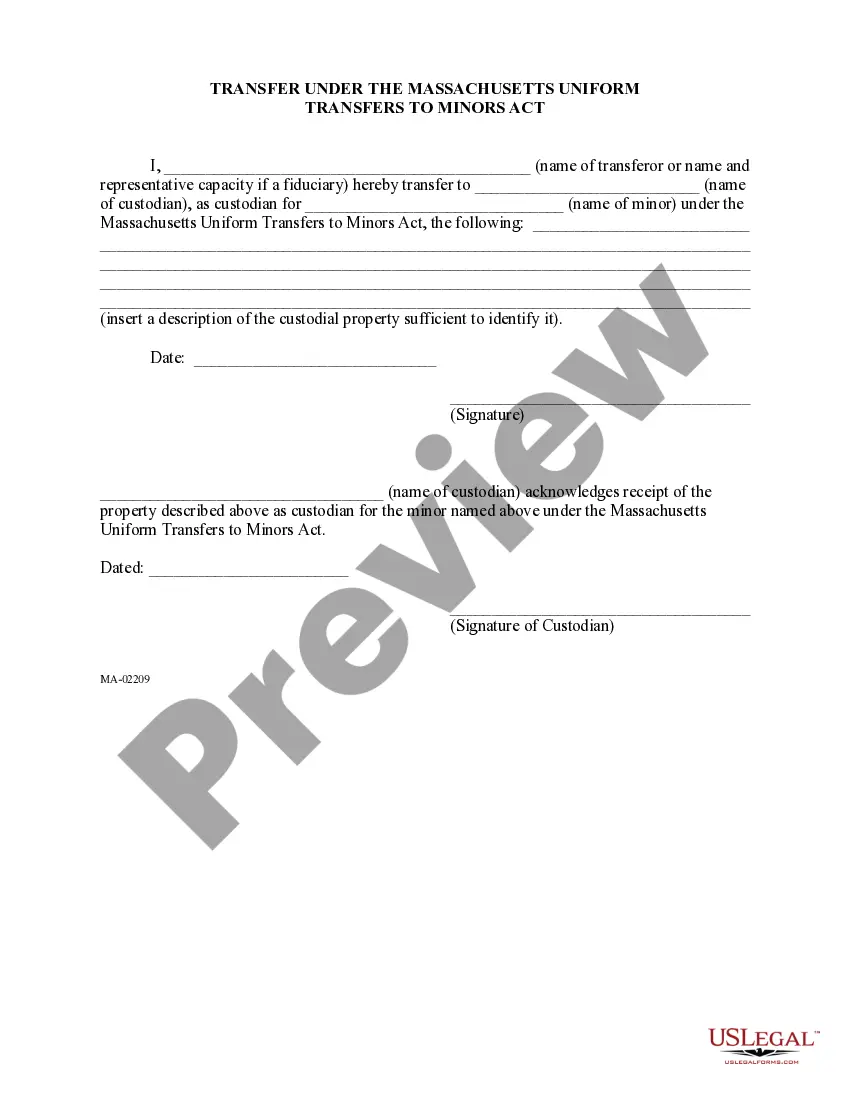

Transfer Under The Massachusetts Uniform Transfers to Minors Act

Description

How to fill out Transfer Under The Massachusetts Uniform Transfers To Minors Act?

You are welcome to the greatest legal documents library, US Legal Forms. Right here you can get any template including Transfer Under The Massachusetts Uniform Transfers to Minors Act forms and download them (as many of them as you wish/need to have). Prepare official papers in just a several hours, rather than days or weeks, without spending an arm and a leg with an attorney. Get the state-specific form in a couple of clicks and feel assured with the knowledge that it was drafted by our accredited lawyers.

If you’re already a subscribed customer, just log in to your account and then click Download next to the Transfer Under The Massachusetts Uniform Transfers to Minors Act you require. Due to the fact US Legal Forms is web-based, you’ll always have access to your downloaded forms, no matter the device you’re using. See them inside the My Forms tab.

If you don't have an account yet, just what are you waiting for? Check our instructions below to start:

- If this is a state-specific document, check its validity in the state where you live.

- View the description (if accessible) to understand if it’s the correct template.

- See a lot more content with the Preview feature.

- If the document matches all of your requirements, just click Buy Now.

- To create your account, choose a pricing plan.

- Use a card or PayPal account to sign up.

- Save the document in the format you need (Word or PDF).

- Print the file and fill it with your/your business’s information.

Once you’ve completed the Transfer Under The Massachusetts Uniform Transfers to Minors Act, send away it to your lawyer for verification. It’s an extra step but a necessary one for being sure you’re entirely covered. Sign up for US Legal Forms now and get a mass amount of reusable samples.

Form popularity

FAQ

The Uniform Gifts to Minors Act (UGMA) provides a way to transfer financial assets to a minor without the time-consuming and expensive establishment of a formal trust. A UGMA account is managed by an adult custodian until the minor beneficiary comes of age, at which point he assumes control of the account.

There is no ability to transfer a UGMA or UTMA account to another child or to change beneficiaries. You are not supposed to use a UTMA-529 or UGMA-529 account conversion to change the beneficiary either because that would equate to giving your child's money to someone else.

The Uniform Transfers to Minors Act (UTMA) allows a minor to receive gifts without the aid of a guardian or trustee.The donor can name a custodian who has the fiduciary duty to manage and invest the property on behalf of the minor until the minor becomes of legal age.

As the custodian of a UTMA/UGMA account, a parent can withdraw money whenever needed to benefit the child.

Generally, the UTMA account transfers to the beneficiary when he or she becomes a legal adult, which is usually 18 or 21. However, the age of adulthood may be defined differently for custodial accounts, like UTMAs or 529 plans, depending on your state.

There is no ability to transfer a UGMA or UTMA account to another child or to change beneficiaries. You are not supposed to use a UTMA-529 or UGMA-529 account conversion to change the beneficiary either because that would equate to giving your child's money to someone else.

Virtually all states have adopted some form of UTMA that allows you to make gifts to a minor to be held in the name of a custodian during the age of minority. On reaching the age of majority, usually 21 years, the minor is entitled to all assets held in the account.