Massachusetts Affidavit of Exemption for Certain Corporate Officers or Directors - Workers' Compensation

Description Form 153

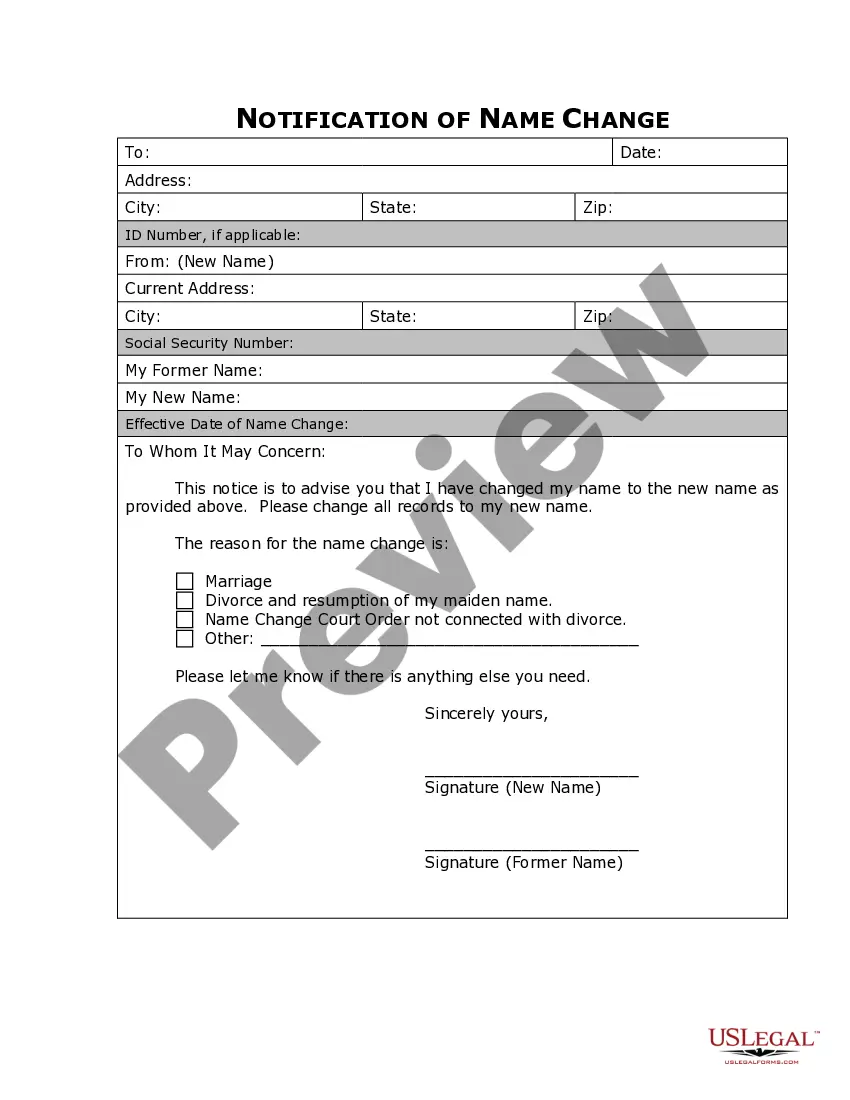

How to fill out Massachusetts Affidavit Of Exemption For Certain Corporate Officers Or Directors - Workers' Compensation?

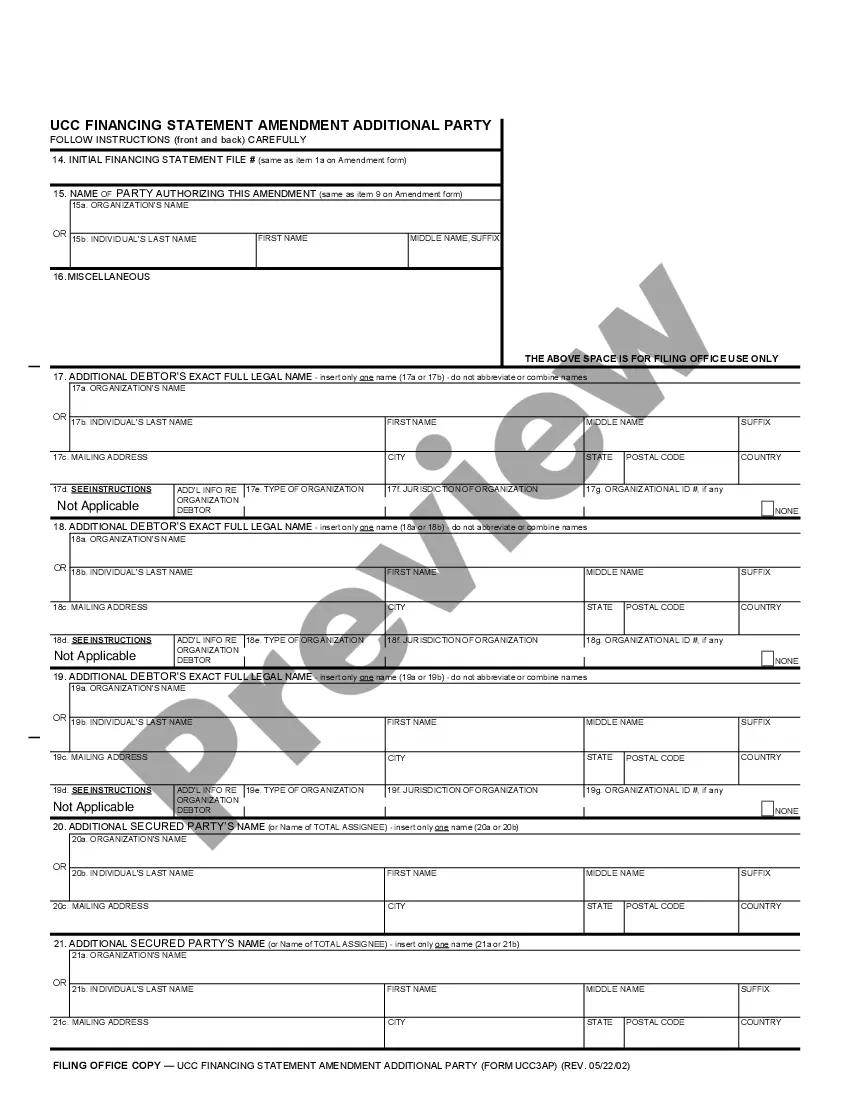

Use US Legal Forms to obtain a printable Massachusetts Affidavit of Exemption for Certain Corporate Officers or Directors - Workers' Compensation. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms catalogue online and provides reasonably priced and accurate samples for consumers and legal professionals, and SMBs. The documents are categorized into state-based categories and a number of them can be previewed prior to being downloaded.

To download samples, users need to have a subscription and to log in to their account. Hit Download next to any template you want and find it in My Forms.

For those who do not have a subscription, follow the following guidelines to easily find and download Massachusetts Affidavit of Exemption for Certain Corporate Officers or Directors - Workers' Compensation:

- Check to ensure that you have the right template in relation to the state it is needed in.

- Review the document by looking through the description and by using the Preview feature.

- Press Buy Now if it is the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it many times.

- Use the Search engine if you want to find another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including Massachusetts Affidavit of Exemption for Certain Corporate Officers or Directors - Workers' Compensation. More than three million users already have used our platform successfully. Choose your subscription plan and have high-quality documents within a few clicks.

Ma Workers Comp Affidavit Form popularity

Ma Workers Compensation Affidavit Other Form Names

FAQ

The California Labor Code requires that all employees be covered under a workers' compensation insurance policy.However, the Labor Code does allow workers' compensation insurance coverage for volunteers, including unpaid board members, but only if your board adopts a resolution specifically electing such coverage.

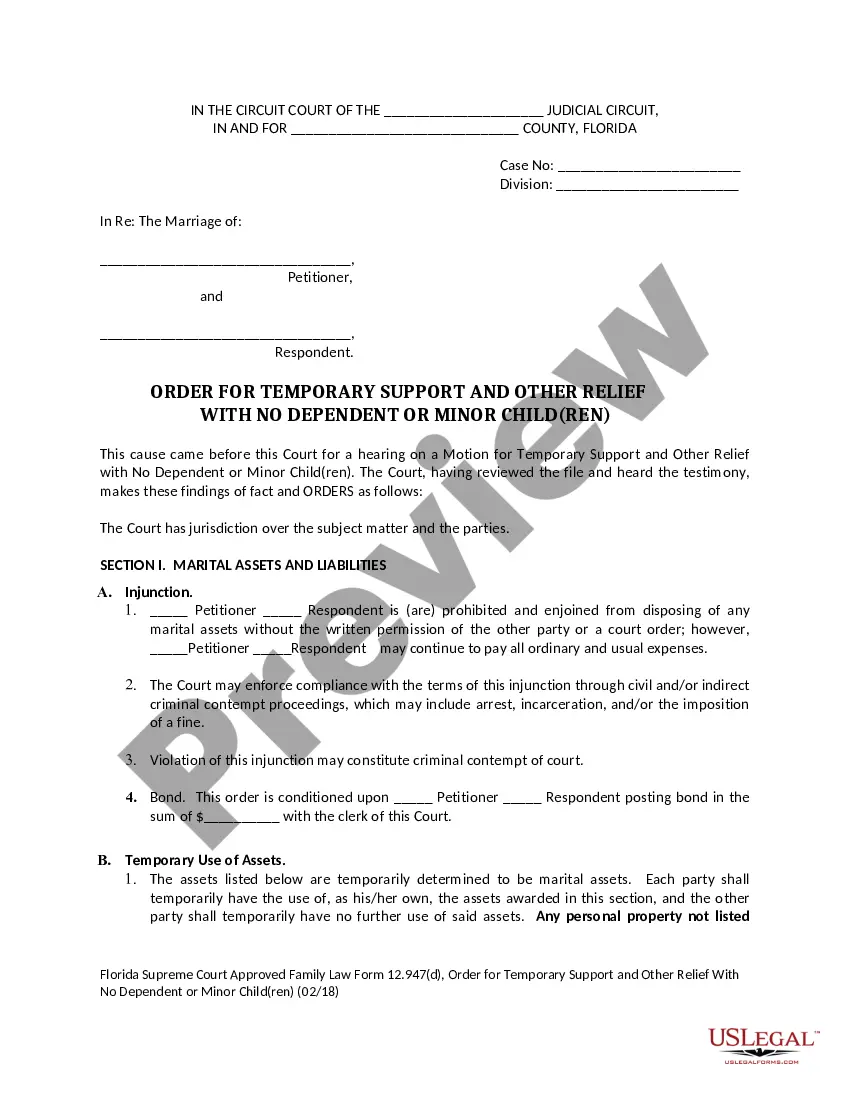

Generally, executive officers of a corporation are automatically included for coverage under each states' workers comp laws. Officers must file for exclusion from the policy. Partners and sole-proprietors are generally exempt from coverage, but they may elect to be included on the policy.

Is the Board of Directors covered under the Workers' Compensation policy? Generally, the Board of Directors as officers of the corporation will be specifically excluded.

As a sole proprietor you are not required to get workers' compensation insurance coverage. If you have employees, they must be covered. If you are a corporate officer that owns 25% or more of a company, you can file for an exemption so you will not be covered under a policy.

Owners and officers in higher risk industries often elect to be excluded from coverage in order to save money on their work comp premium.

The main categories of workers that are not covered by traditional workers' compensation are: business owners, volunteers, independent contractors, federal employees, railroad employees, and longshoremen.

In most states, executive officers are considered employees of the corporate entity. Like other employees, they are automatically covered by workers compensation laws.If the company employs other workers, all officers must be covered. Some states permit all officers to exempt themselves from coverage.

Corporate Officers are included in coverage, but may elect to be exempt up to four executive officers of a corporation Sole Proprietors, Partners and LLC Members are excluded from coverage but may elect to be included.

The main reason to exclude owners and officers is to save the company premium dollars. It is also often assumed that owners and officers would not need to file a workers' comp claim anyway.