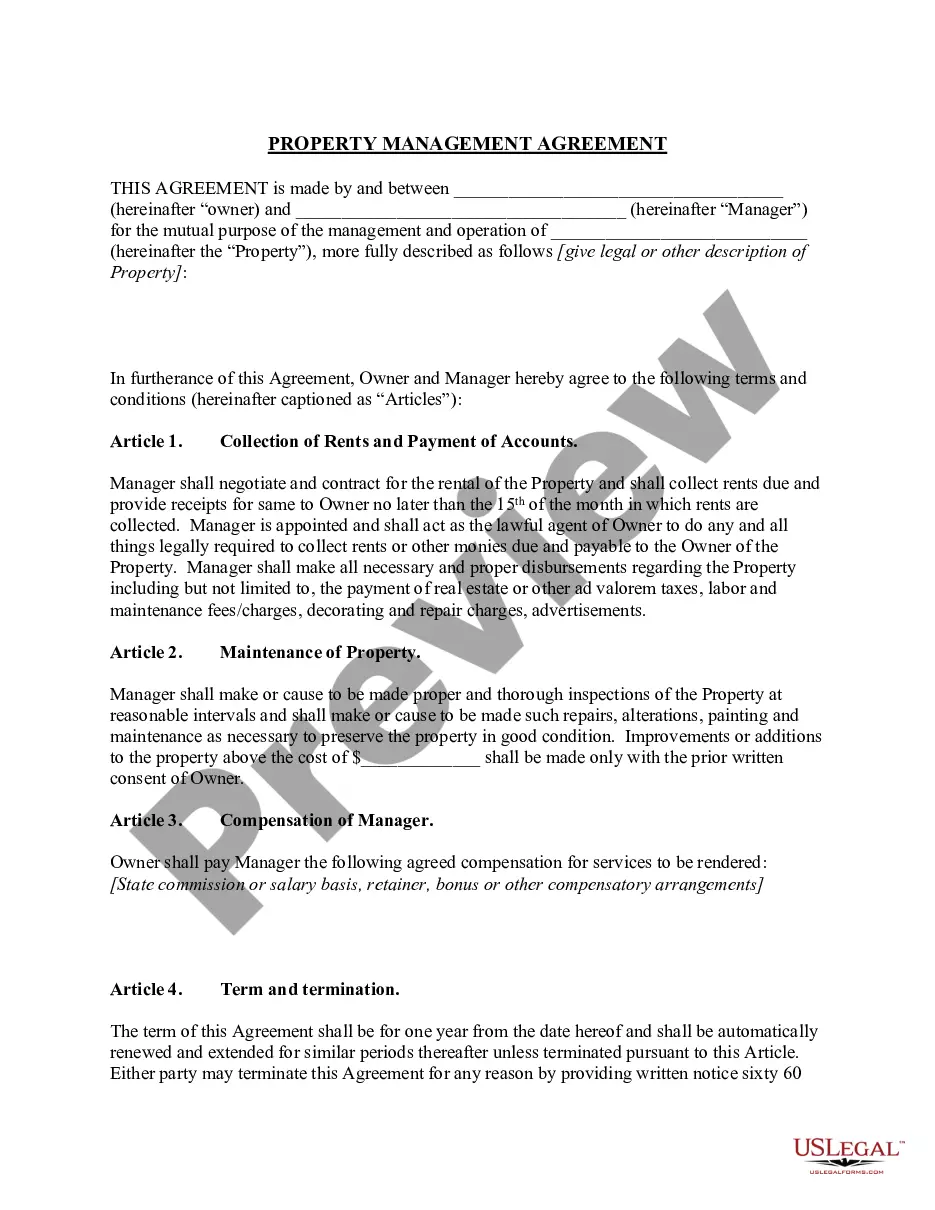

Massachusetts Property Manager Agreement

Description

How to fill out Massachusetts Property Manager Agreement?

Use US Legal Forms to get a printable Massachusetts Property Manager Agreement. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most comprehensive Forms catalogue online and offers reasonably priced and accurate samples for consumers and lawyers, and SMBs. The templates are grouped into state-based categories and a number of them might be previewed prior to being downloaded.

To download samples, users must have a subscription and to log in to their account. Press Download next to any template you need and find it in My Forms.

For individuals who don’t have a subscription, follow the tips below to quickly find and download Massachusetts Property Manager Agreement:

- Check out to make sure you have the proper template in relation to the state it is needed in.

- Review the document by looking through the description and by using the Preview feature.

- Click Buy Now if it’s the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to find another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Massachusetts Property Manager Agreement. More than three million users have utilized our platform successfully. Select your subscription plan and obtain high-quality documents in a few clicks.

Form popularity

FAQ

As The Landlord: As an investor or property owner signing a property management agreement is a legal document that allows you to enter into a business relationship with a property management company that allows you to have your property managed for a monthly or agreed upon fee.

Most property managers are required to hold a property management license or a real estate broker's license in order to conduct real estate transactions, which includes those related to managing and leasing rental properties. Only a couple of states do not have this requirement.

Property management isn't worth the money to some investors.One important note, even if you choose to manage your own properties it pays to have a backup plan in case you're no longer able to handle them. For others investing in real estate, there's no way they'd choose to manage their own rental properties.

The percentage collected will vary, but is traditionally between 8% and 12% of the gross monthly rent. Managers will often charge a lower percentage, between 4% and 7%, for properties with 10 units or more or for commercial properties, and a higher percentage, 10% or more, for smaller or residential properties.

Increase the rent. Manage multiple rental properties. Leverage technology. Offer additional services. Cut down expenses. Get a real estate agent license. Add value to rental properties. Market effectively- both to tenants and to clients.

A property manager costs approximately 7-10% of your total rental income, however the services and expertise offered by a good property manager is worth much much more than this fee, plus in many cases the agents service fee is tax deductable.

Property Management Laws in Massachusetts NO. Although renting and leasing activities are considered real estate activities undertaken by a real estate broker, if those activities are incidental to his or her involvement as a property manager, a real estate broker license is not required.

Are property managers regulated? From 1 October 2014 anyone who is engaged in property management work became legally required to belong to one of the following government approved redress schemes.

The property manager can provide full leasing services. They effectively negotiate leases with tenants and prepare those leases for signature. They make suggestions regarding the tenant mix and prospective tenants.