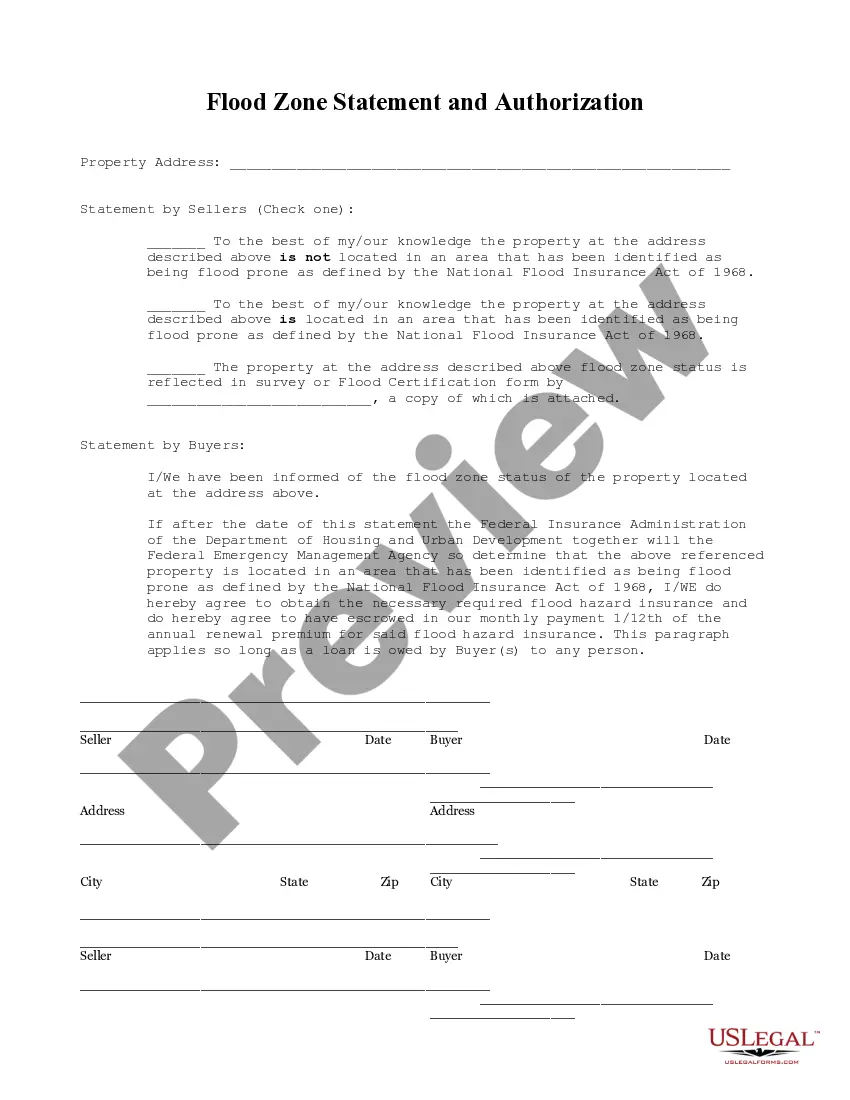

Massachusetts Flood Zone Statement and Authorization

Description

How to fill out Massachusetts Flood Zone Statement And Authorization?

You are welcome to the largest legal documents library, US Legal Forms. Right here you can find any template such as Massachusetts Flood Zone Statement and Authorization templates and save them (as many of them as you want/need to have). Prepare official documents with a few hours, rather than days or weeks, without having to spend an arm and a leg on an attorney. Get the state-specific example in a few clicks and feel confident knowing that it was drafted by our accredited attorneys.

If you’re already a subscribed user, just log in to your account and click Download next to the Massachusetts Flood Zone Statement and Authorization you require. Because US Legal Forms is online solution, you’ll always get access to your downloaded forms, regardless of the device you’re using. See them inside the My Forms tab.

If you don't have an account yet, what exactly are you awaiting? Check out our guidelines listed below to get started:

- If this is a state-specific document, check its validity in your state.

- See the description (if offered) to learn if it’s the right template.

- See far more content with the Preview feature.

- If the document fulfills all of your needs, just click Buy Now.

- To create your account, pick a pricing plan.

- Use a credit card or PayPal account to sign up.

- Save the document in the format you need (Word or PDF).

- Print out the file and fill it out with your/your business’s details.

As soon as you’ve completed the Massachusetts Flood Zone Statement and Authorization, send it to your lawyer for confirmation. It’s an extra step but a necessary one for making certain you’re fully covered. Sign up for US Legal Forms now and access a large number of reusable samples.

Form popularity

FAQ

If your home is in an area that's considered high risk of flooding, you'll probably need to provide your elevation certificate to your insurance agent to get a flood insurance quote. Remember, not every property needs an elevation certificate.

1Your local floodplain manager: Your local floodplain manager may already have a certificate on file.2The seller of your property: If you're buying a property, the sellers may already have the certificate, and you can ask them for it before purchasing.What Is An Elevation Certificate for Flood Insurance? - ValuePenguin\nwww.valuepenguin.com > elevation-certificate-flood-insurance

Zone A. Zone A is the flood insurance rate zone that corresponds to the I-percent annual chance floodplains that are determined in the Flood Insurance Study by approximate methods of analysis.

Evidence of flood insurance Completed and executed NFIP Flood Insurance Application PLUS a copy of the Borrower's premium check or agent's paid receipt.

The CLOMR does not revise an effective FIRM; rather, it indicates whether the project, if completed as proposed, would be eligible for a LOMR.The letter also includes instructions detailing how to follow up with a LOMR request after the proposed project has been completed.

Use the Comments area of Section D, on the back of the certificate, to provide datum, elevation, or other relevant information not specified on the front. Complete Section E if the building is located in Zone AO or Zone A (without BFE). Otherwise, complete Section C instead.

A flood elevation certificate documents your home's elevation, relative to the base flood elevation of the area you live in.Typically, the higher your home's elevation above the base flood elevation, the less risk you'll have of flooding and therefore, the lower your flood insurance premium.

An elevation certificate is a document that measures your property's susceptibility to flood damage and is one component used by your insurance agent to calculate your flood insurance premium.Location and flood zone: The NFIP has different zones designating your property's level of flood risk.

How long does it take to get an elevation certificate? The amount of time varies with each surveyor. If you work with a licensed surveyor, and he or she is able to fit you in and knows your area well, you should expect a completed elevation certificate within five business days.