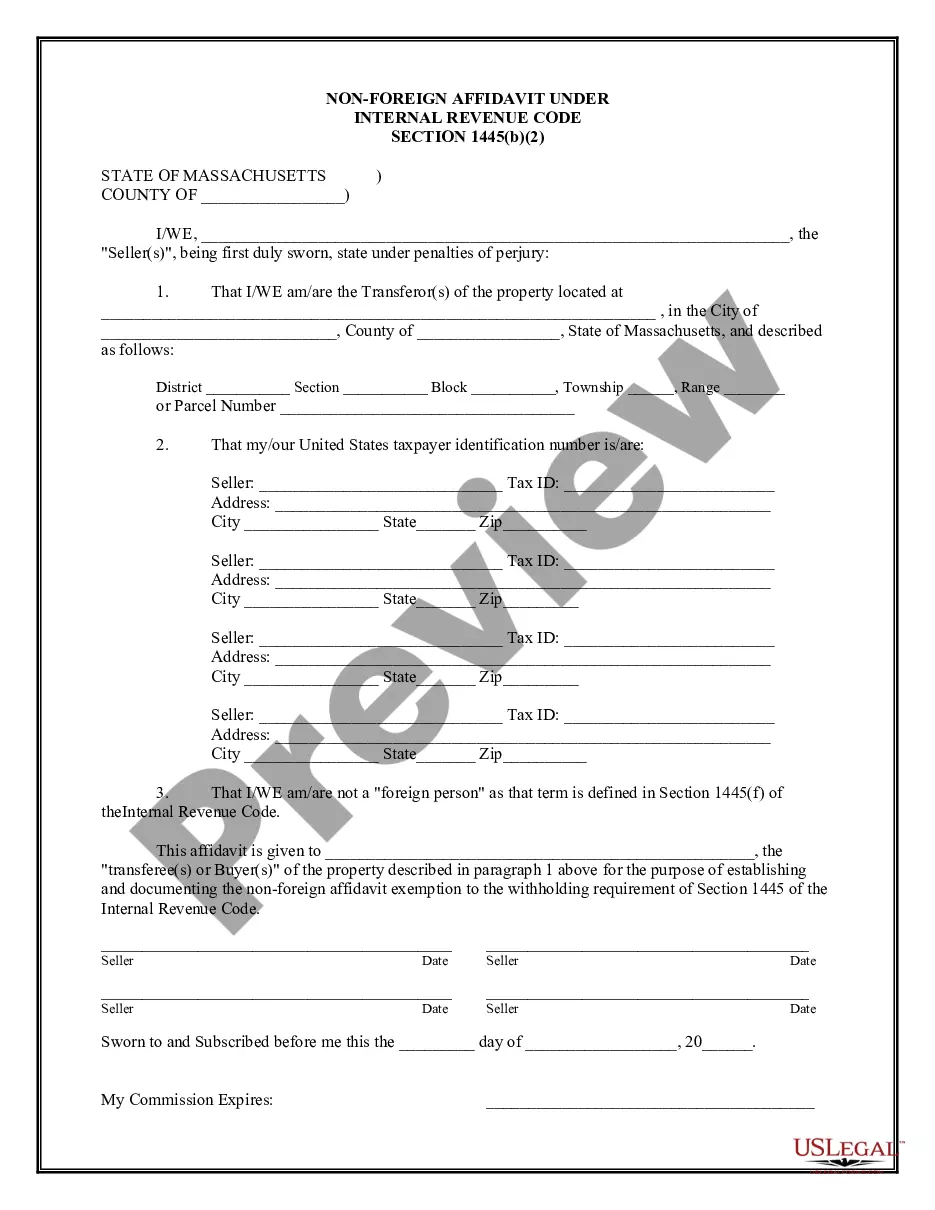

Massachusetts Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Massachusetts Non-Foreign Affidavit Under IRC 1445?

You are welcome to the most significant legal documents library, US Legal Forms. Right here you will find any template including Massachusetts Non-Foreign Affidavit Under IRC 1445 templates and save them (as many of them as you want/need). Make official papers in a several hours, instead of days or even weeks, without having to spend an arm and a leg with an attorney. Get your state-specific sample in clicks and be confident with the knowledge that it was drafted by our state-certified attorneys.

If you’re already a subscribed customer, just log in to your account and then click Download near the Massachusetts Non-Foreign Affidavit Under IRC 1445 you want. Due to the fact US Legal Forms is online solution, you’ll generally have access to your saved templates, regardless of the device you’re using. See them inside the My Forms tab.

If you don't have an account yet, what are you waiting for? Check out our guidelines below to get started:

- If this is a state-specific document, check its applicability in your state.

- Look at the description (if accessible) to learn if it’s the right template.

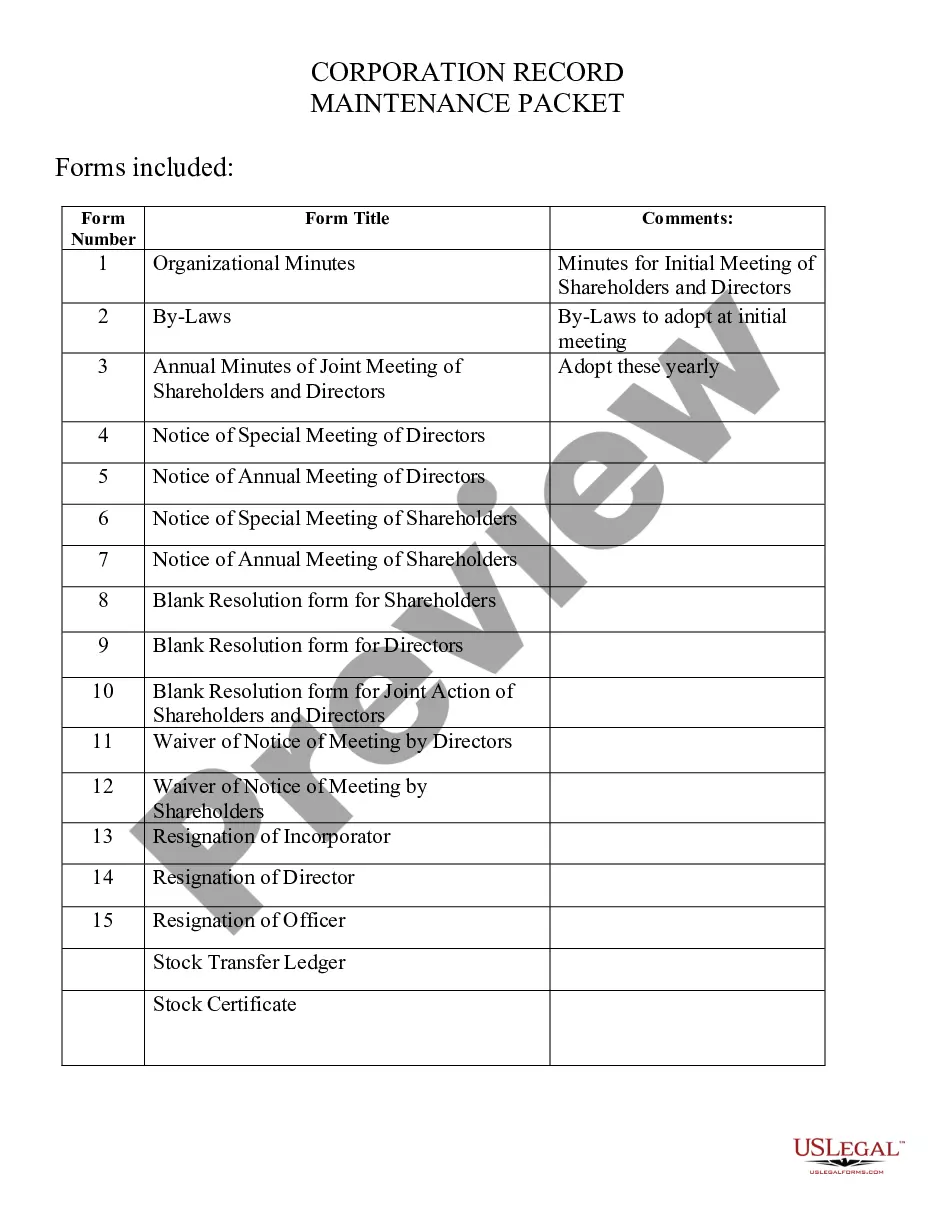

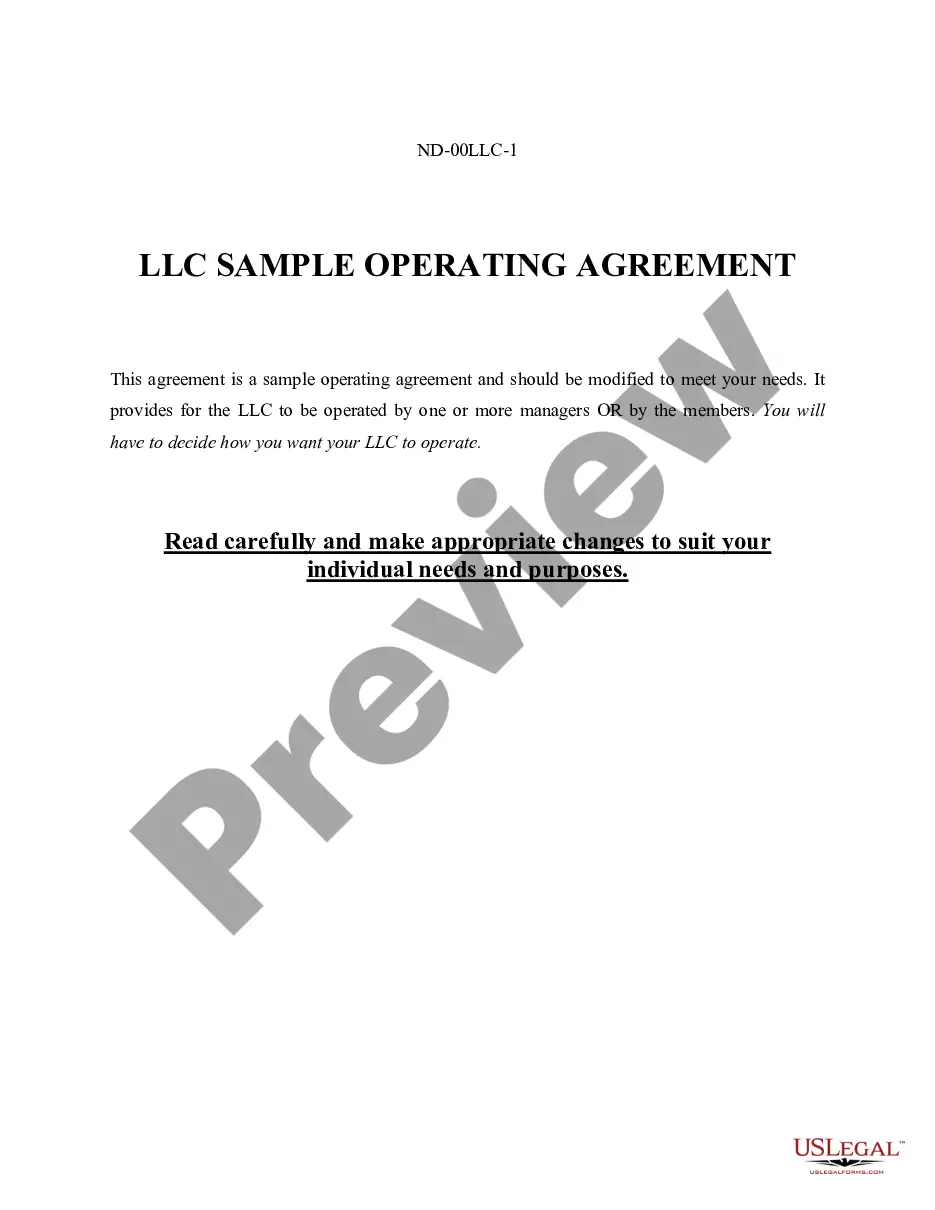

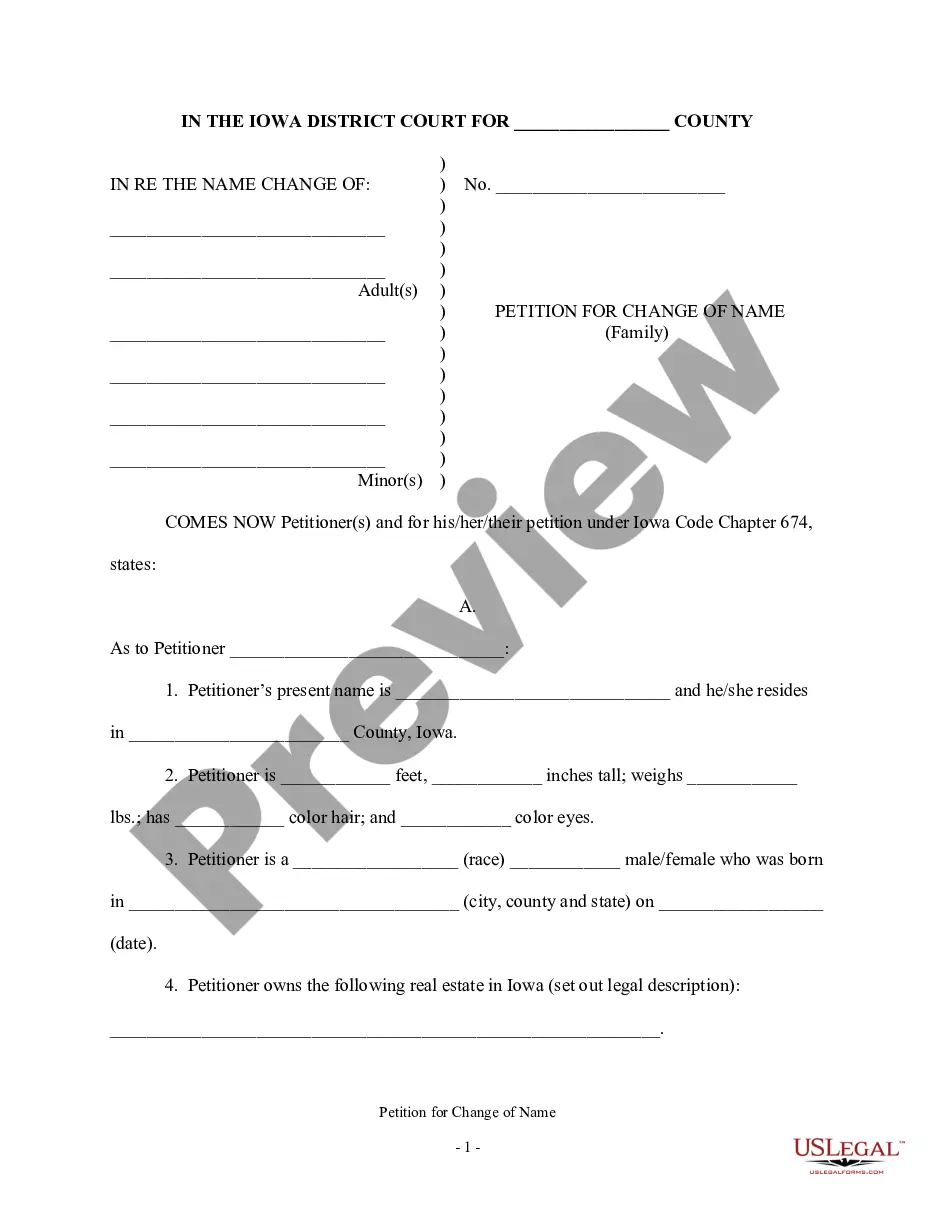

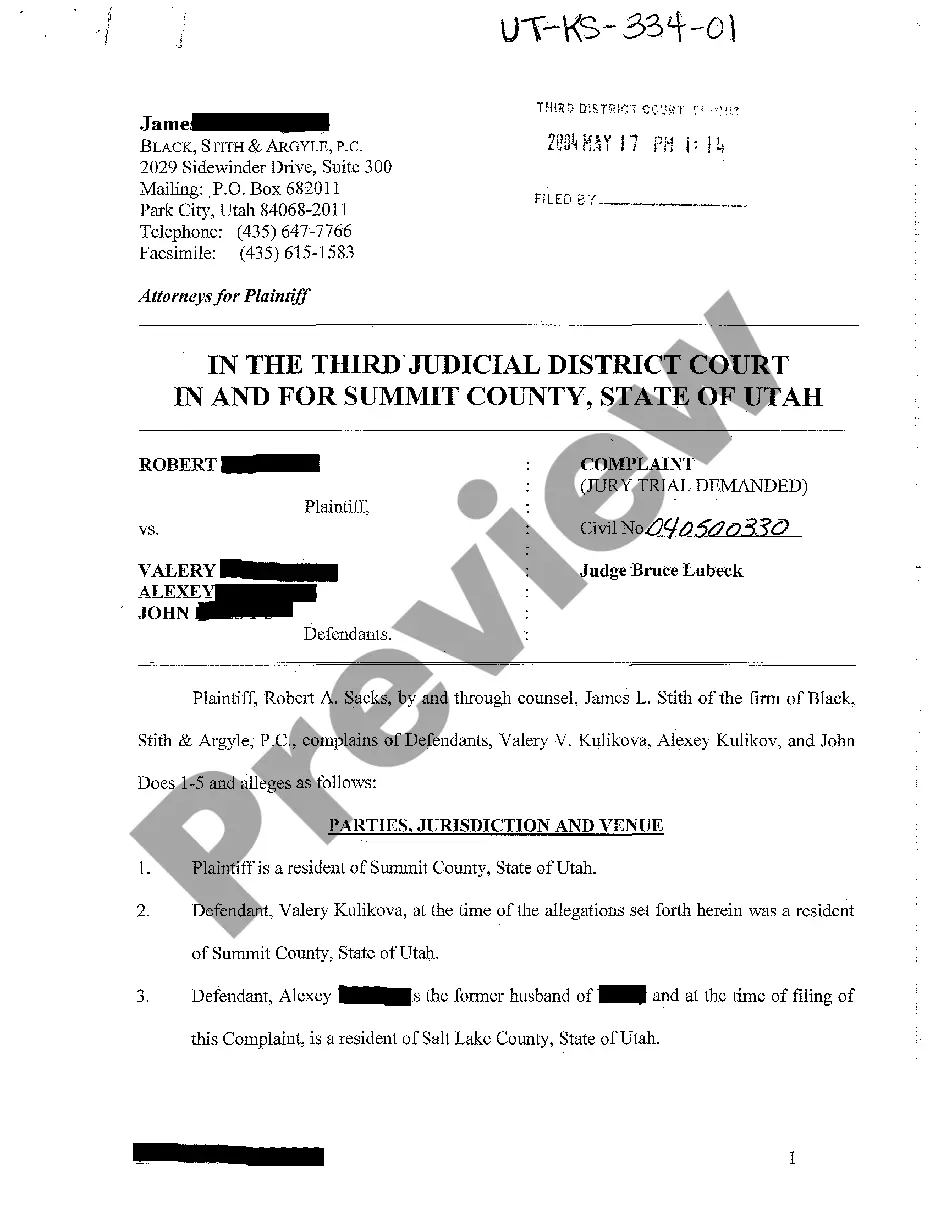

- See more content with the Preview feature.

- If the document matches all your needs, just click Buy Now.

- To make your account, pick a pricing plan.

- Use a credit card or PayPal account to subscribe.

- Save the file in the format you want (Word or PDF).

- Print the file and fill it out with your/your business’s details.

When you’ve completed the Massachusetts Non-Foreign Affidavit Under IRC 1445, give it to your attorney for verification. It’s an additional step but a necessary one for being confident you’re entirely covered. Join US Legal Forms now and get a large number of reusable examples.

Form popularity

FAQ

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445).Withholding is required on certain distributions and other transactions by domestic or foreign corporations, partnerships, trusts, and estates.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.