Massachusetts Dissolution Package to Dissolve Corporation

Description Ma Dissolve Template

How to fill out Massachusetts Dissolution?

You are welcome to the greatest legal documents library, US Legal Forms. Right here you will find any example including Massachusetts Dissolution Package to Dissolve Corporation templates and save them (as many of them as you wish/need to have). Make official files within a few hours, instead of days or even weeks, without spending an arm and a leg on an attorney. Get your state-specific sample in a few clicks and feel confident with the knowledge that it was drafted by our accredited legal professionals.

If you’re already a subscribed user, just log in to your account and click Download near the Massachusetts Dissolution Package to Dissolve Corporation you want. Because US Legal Forms is web-based, you’ll always get access to your downloaded forms, no matter what device you’re using. See them in the My Forms tab.

If you don't have an account yet, what are you awaiting? Check out our guidelines below to begin:

- If this is a state-specific document, check out its validity in the state where you live.

- See the description (if readily available) to learn if it’s the right example.

- See much more content with the Preview function.

- If the example fulfills your requirements, just click Buy Now.

- To make your account, choose a pricing plan.

- Use a card or PayPal account to subscribe.

- Save the template in the format you need (Word or PDF).

- Print out the file and fill it out with your/your business’s information.

After you’ve filled out the Massachusetts Dissolution Package to Dissolve Corporation, send away it to your legal professional for confirmation. It’s an extra step but an essential one for making confident you’re entirely covered. Sign up for US Legal Forms now and access a mass amount of reusable examples.

Massachusetts Dissolution Dissolve Form popularity

Ma Dissolve Uslegal Other Form Names

Massachusetts Bundle Dissolve FAQ

In legal terms, when a company is dissolved, it ceases to exist. It cannot still be trading - although a person may trade (misleadingly) using its name.

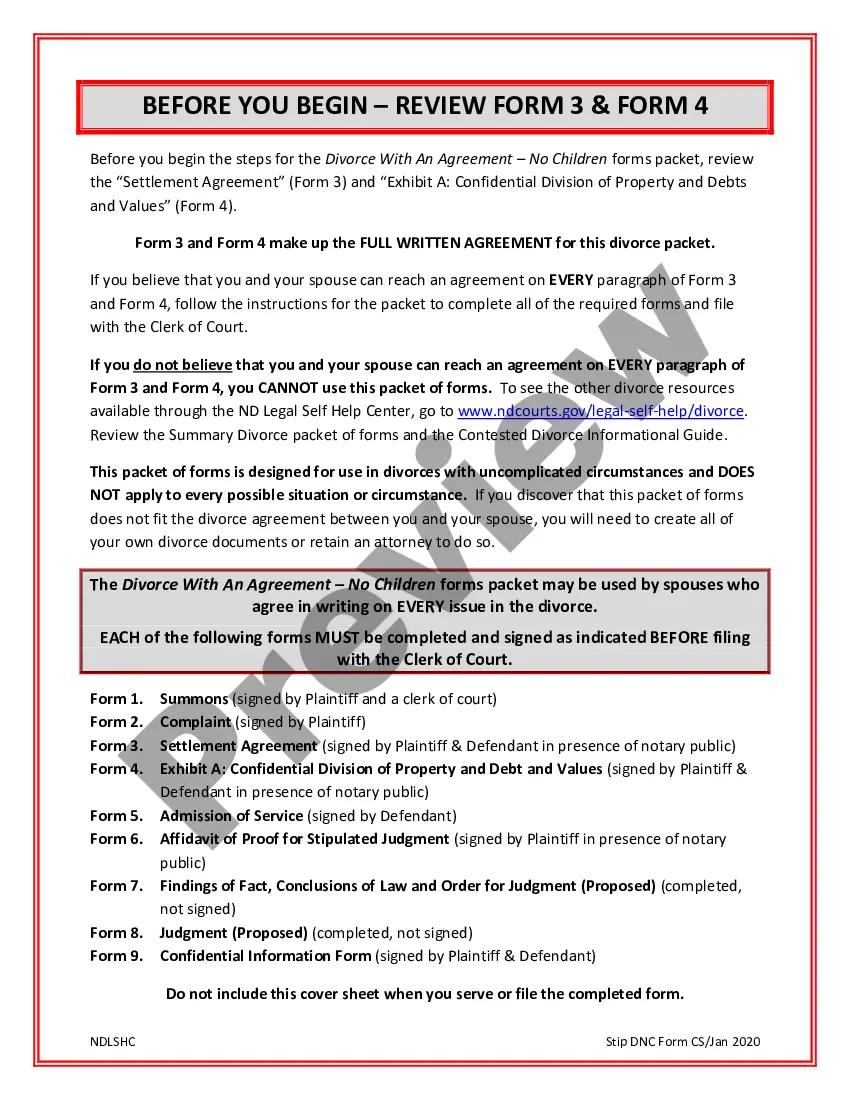

Call a Board Meeting. File a Certificate of Dissolution With the Secretary of State. Notify the Internal Revenue Service (IRS) Close Accounts and Credit Lines, Cancel Licenses, Etc.

Under the primary BCA procedure, your corporation is dissolved through action by your board of directors followed by a shareholder vote. More specifically, your board of directors must adopt and submit a proposal to dissolve to the shareholders. The shareholders must then vote on the proposal at a shareholder meeting.

If the company has ceased trading and is closed owing money and your debt is with that company then your liability ends with that company.

Dissolving the CorporationCalifornia's General Corporation Law (GCL) provides for voluntary dissolution if shareholders holding shares with at least 50 percent of the voting power vote for dissolution.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

After dissolution, you cannot use the funds remaining in your business bank account for new business. LLC members no longer have the authority to conduct business or do anything that would indicate that the LLC is still active. Your bank account can cover only essential winding up affairs.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets.Assets used as security for loans must be given to the bank or creditor that extended the loan, or you must pay off the loan before selling such assets.