Massachusetts Living Trust for Husband and Wife with No Children

Description

How to fill out Massachusetts Living Trust For Husband And Wife With No Children?

You are welcome to the largest legal documents library, US Legal Forms. Right here you can get any sample including Massachusetts Living Trust for Husband and Wife with No Children forms and download them (as many of them as you want/require). Make official files in just a couple of hours, rather than days or weeks, without having to spend an arm and a leg with an lawyer or attorney. Get the state-specific sample in a couple of clicks and be confident knowing that it was drafted by our state-certified legal professionals.

If you’re already a subscribed consumer, just log in to your account and then click Download near the Massachusetts Living Trust for Husband and Wife with No Children you want. Due to the fact US Legal Forms is web-based, you’ll always get access to your downloaded templates, no matter the device you’re using. Find them within the My Forms tab.

If you don't come with an account yet, what exactly are you awaiting? Check out our guidelines listed below to get started:

- If this is a state-specific sample, check its applicability in your state.

- See the description (if available) to learn if it’s the proper template.

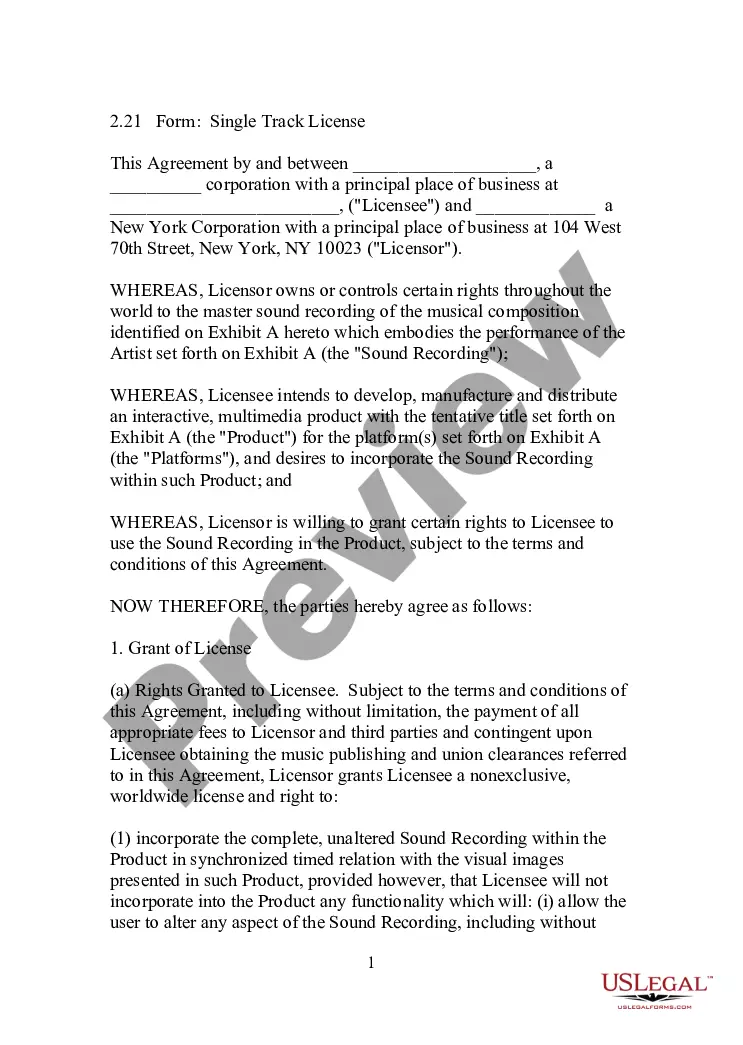

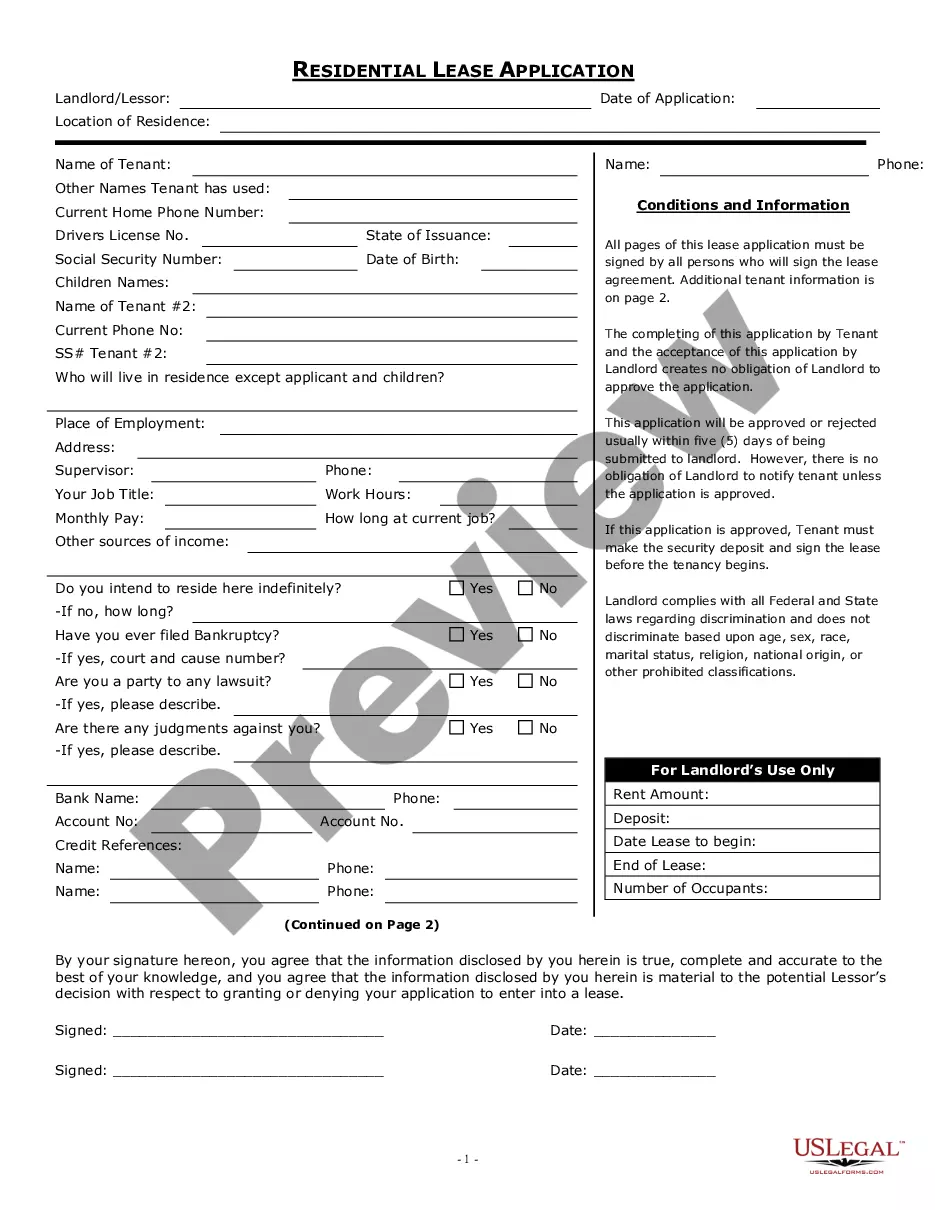

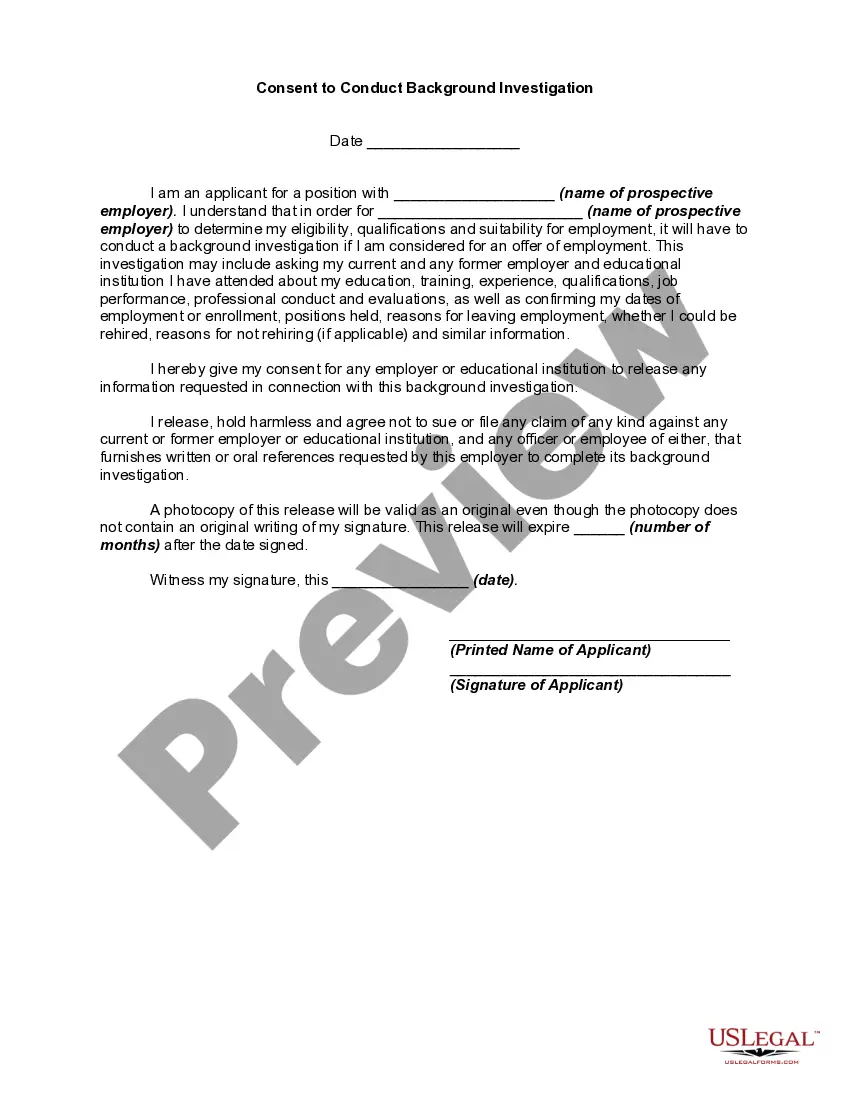

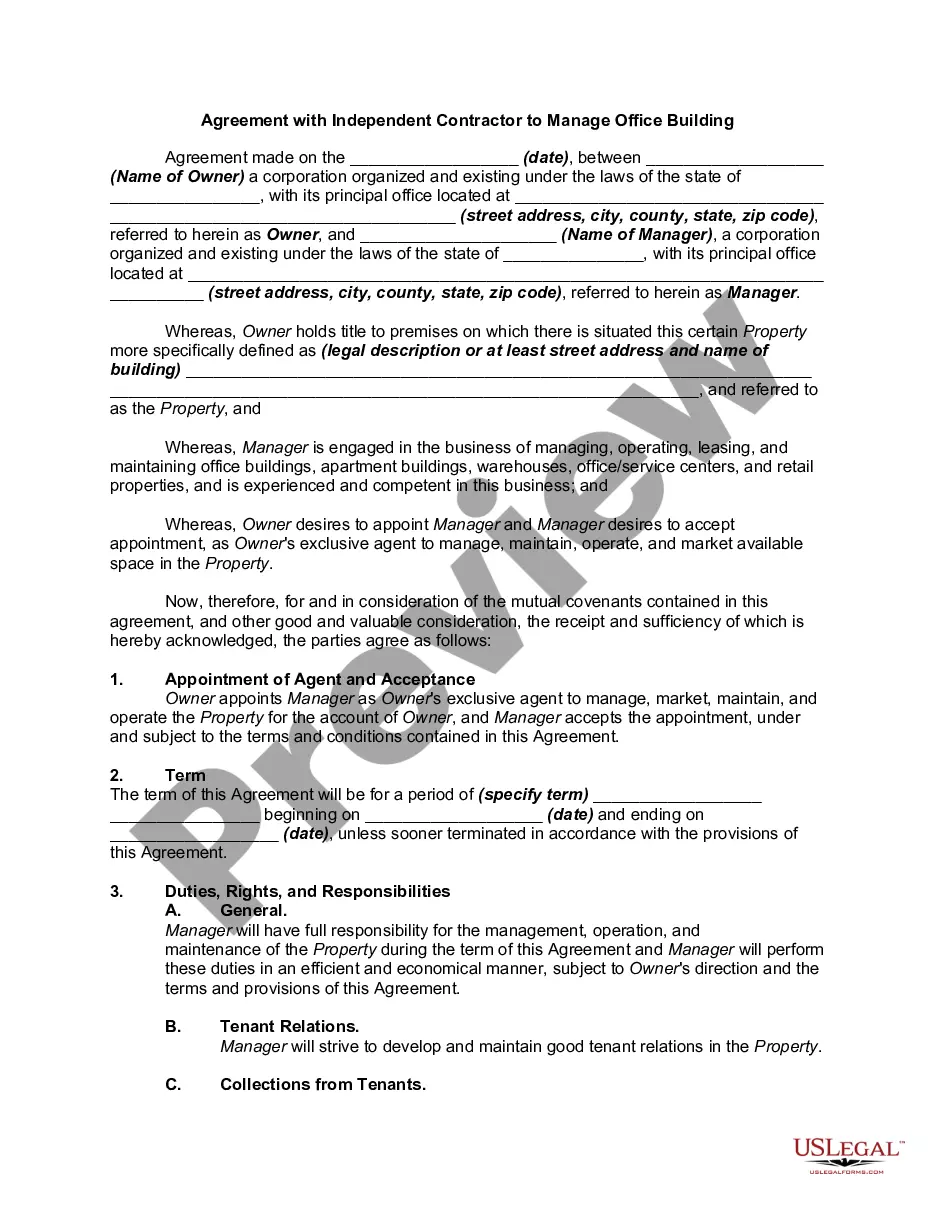

- See a lot more content with the Preview option.

- If the document fulfills your needs, just click Buy Now.

- To make an account, choose a pricing plan.

- Use a card or PayPal account to register.

- Download the document in the format you require (Word or PDF).

- Print the document and complete it with your/your business’s details.

When you’ve completed the Massachusetts Living Trust for Husband and Wife with No Children, send away it to your legal professional for verification. It’s an extra step but an essential one for making confident you’re completely covered. Become a member of US Legal Forms now and get access to thousands of reusable samples.

Form popularity

FAQ

If you die intestate, according to Massachusetts intestacy law, everything goes to your next of kin. Your next of kin are the people who have the closest relation to you. If you're married, then that's your spouse. If you're not married, your closest blood relations or equivalent, will inherit your property.

Separate trusts may offer better protection from creditors, if this is a concern. For example, at the death of the first spouse, the deceased spouse's trust becomes irrevocable, which makes it harder to access by creditors. And yet the surviving spouse can still access it for income and other needs.

In California, surviving spouses already receive all of the community property upon the death of their spouse.However, creating a joint will is still an option in California, and while it might help a couple save some time and money on their estate plan, it can also lead to some complex problems.

How Is Next of Kin Determined? To determine next of kin in California, go down the list until someone exists in the category listed.For example, if decedent had no surviving spouse or registered domestic partner, but was survived by adult children, then the adult children would be next of kin.

Typically, when a married couple utilizes a Revocable Living Trust based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

At the time of your death, the assets in your family trust are protected by the exemption, and the assets in your marital trust are protected by the marital deduction. No estate taxes are due.

Q: Can a person have more than one trust? A: Yes, it is not that uncommon for a person to be the beneficiary of multiple trusts. However, caution should be used. Trusts come in many shapes and sizes and can serve multiple purposes and can be established by you or by someone else for your benefit.

Joint trusts are easier to fund and maintain.In a joint trust, after the death of the first spouse, the surviving spouse has complete control of the assets. When separate trusts are used, the deceased spouses' trust becomes irrevocable and the surviving spouse has limited control over assets.