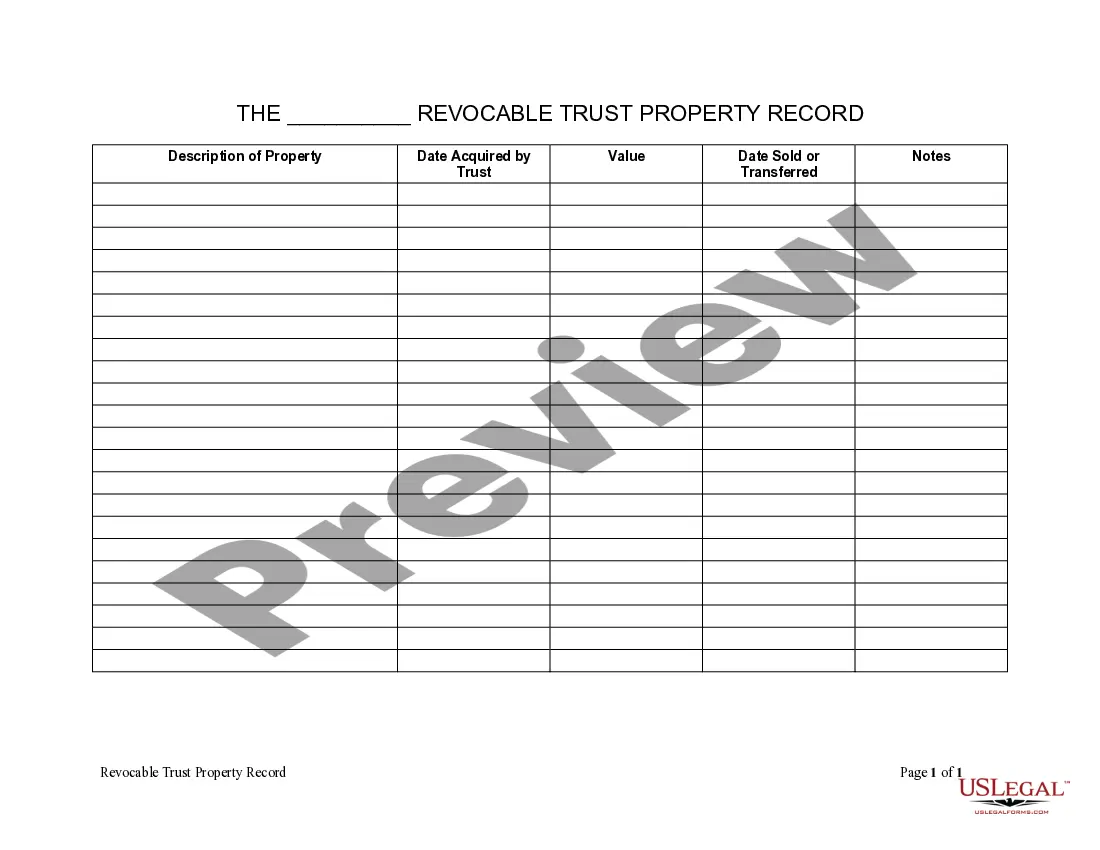

Massachusetts Living Trust Property Record

Description

How to fill out Massachusetts Living Trust Property Record?

Welcome to the most significant legal files library, US Legal Forms. Right here you can find any sample such as Massachusetts Living Trust Property Record forms and save them (as many of them as you want/need). Get ready official files in a few hours, instead of days or even weeks, without spending an arm and a leg on an legal professional. Get your state-specific example in a few clicks and feel confident knowing that it was drafted by our accredited attorneys.

If you’re already a subscribed customer, just log in to your account and then click Download next to the Massachusetts Living Trust Property Record you want. Because US Legal Forms is web-based, you’ll always get access to your downloaded forms, no matter the device you’re using. Find them within the My Forms tab.

If you don't have an account yet, just what are you awaiting? Check out our guidelines below to get started:

- If this is a state-specific document, check its applicability in the state where you live.

- See the description (if available) to learn if it’s the right example.

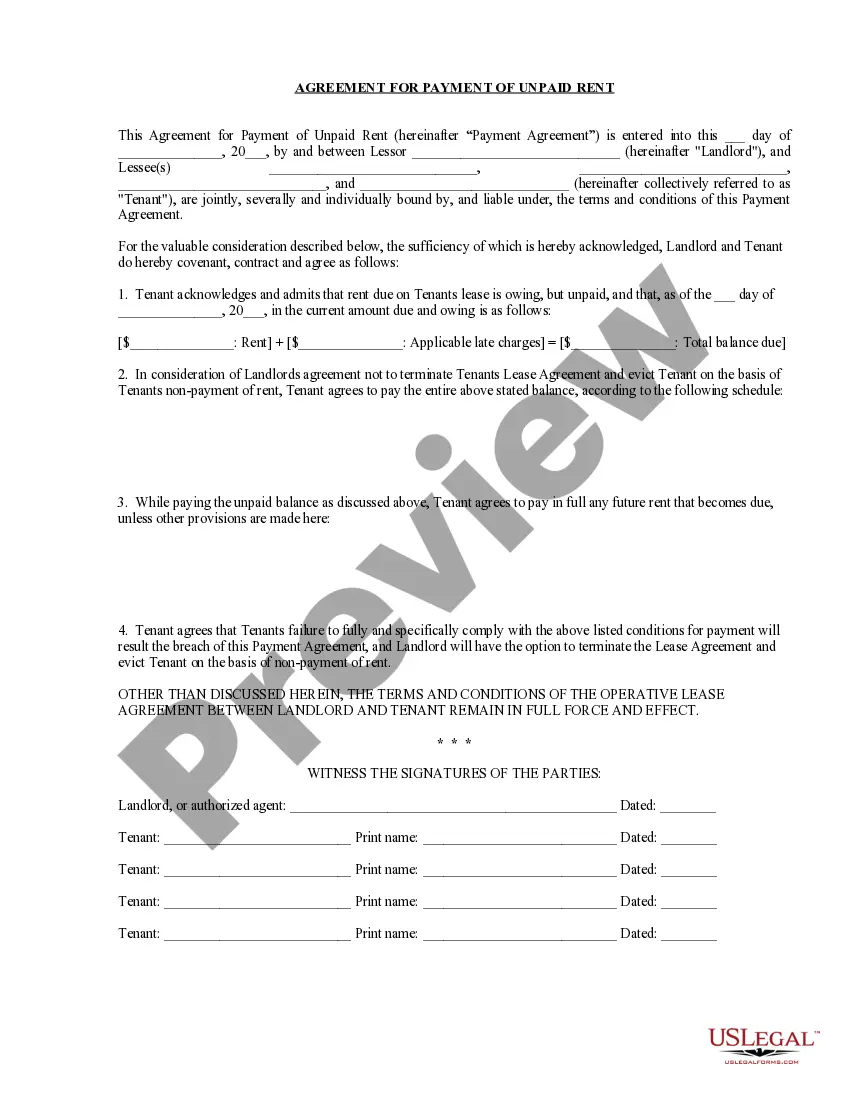

- See more content with the Preview feature.

- If the document fulfills all of your requirements, click Buy Now.

- To create your account, choose a pricing plan.

- Use a credit card or PayPal account to sign up.

- Save the file in the format you require (Word or PDF).

- Print out the document and fill it with your/your business’s information.

As soon as you’ve completed the Massachusetts Living Trust Property Record, send it to your legal professional for confirmation. It’s an extra step but a necessary one for being certain you’re completely covered. Sign up for US Legal Forms now and get a large number of reusable examples.

Form popularity

FAQ

Trusts in Massachusetts are governed by the Massachusetts Uniform Trust Code, codified at G.L.c. 203E.The trustee's certificate is recorded either immediately upon the trust's acquisition of real property, or when the trustee acts upon the title 1.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

Today clients who have living trusts normally keep the original copy. Having the attorney keep the original copy of the trust is not as important as keeping the original will used to be. At death, a copy of the trust generally suffices for all parties in place of the original.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

Since the Schedule of Beneficiaries to a trust is not recorded with the Declaration of Trust at the Registry of Deeds, the identity of the Beneficiaries is not a matter of public record.There are two types of Trusts in Massachusetts.

Trusts aren't public record, so they're not usually recorded anywhere. Instead, the trust attorney determines who is entitled to receive a copy of the document, even if state law doesn't require it.

Anyone can look up a particular parcel of real estate in the local land records office (often called the county recorder or registry of deeds, depending on where you live) and find out who owns it. (Often, other information is also available, such as the amount of property taxes paid each year.)

What happens if you have lost your Trust?If a Trust is lost, and the decedent has assets titled in the name of the Trust, the court will require that the heirs/Successor Trustees spend a significant amount of time and money searching for the Trust and documenting the search process.

Trusts created during your lifetime, known as living trusts, do not go into the public record after you die. With rare exceptions, trusts remain private regardless of whether you have an irrevocable or revocable trust at the time of your death.